💳 Klarna: Growth Now Profit Later

How the BNPL giant's hot IPO compares to Affirm

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Klarna is going public this week.

If you’re feeling a sense of déjà vu, you’re not alone.

Six months ago, we tore down the 300-page F-1 filing as the BNPL giant geared up for its highly anticipated IPO. The company then hit pause following the Liberation Day chaos, citing market volatility from tariffs and shifting trade policies, leaving the market waiting.

Well, the wait is over.

Shares will start trading on Wednesday under the ticker KLAR.

We have six months of new data, including results from the first half of FY25.

As one of Europe's largest fintechs and a bellwether for the 'Buy Now, Pay Later' category, Klarna's public debut is one of the most significant of the year.

Has the investment case gotten stronger or weaker?

Let's find out.

Today at a glance:

The Klarna Thesis

What the New Data Reveals

IPO Facts and Valuation

Klarna vs. Affirm vs. Block

What to Watch Next

FROM OUR PARTNERS

Former Zillow exec opens door to $1.3T market

Austin Allison sold his first company for $120M. He later served as an executive for Zillow. But both companies reached massive valuations before regular people could invest.

“I always wished everyday investors could have shared in their early success,” Allison later said. So he built Pacaso differently.

Pacaso brings co-ownership to the $1.3T vacation home market, earning $110M+ in gross profit in under 5 years. No wonder the same early investors who backed Uber, Venmo, and eBay already invested in Pacaso.

They even reserved the Nasdaq ticker PCSO. Now, after adding 10 new international destinations, Pacaso is hitting their stride.

And unlike his previous stops, you can invest in Pacaso as a private company. But you don’t have time to waste.

Invest before Pacaso’s opportunity ends on September 18th.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

1. The Klarna Thesis

If you missed our original F-1 teardown on Klarna, I strongly recommend it to get the key facts and understand how they make money.

To understand Klarna's IPO, you have to understand the two powerful narratives that surround the company. One is of a fintech giant with accelerating momentum. The other is of an unprofitable business whose fundamentals are becoming more complex.

📈 Bull Case: A Global Growth Engine

The argument for Klarna is rooted in undeniable momentum and strategic progress:

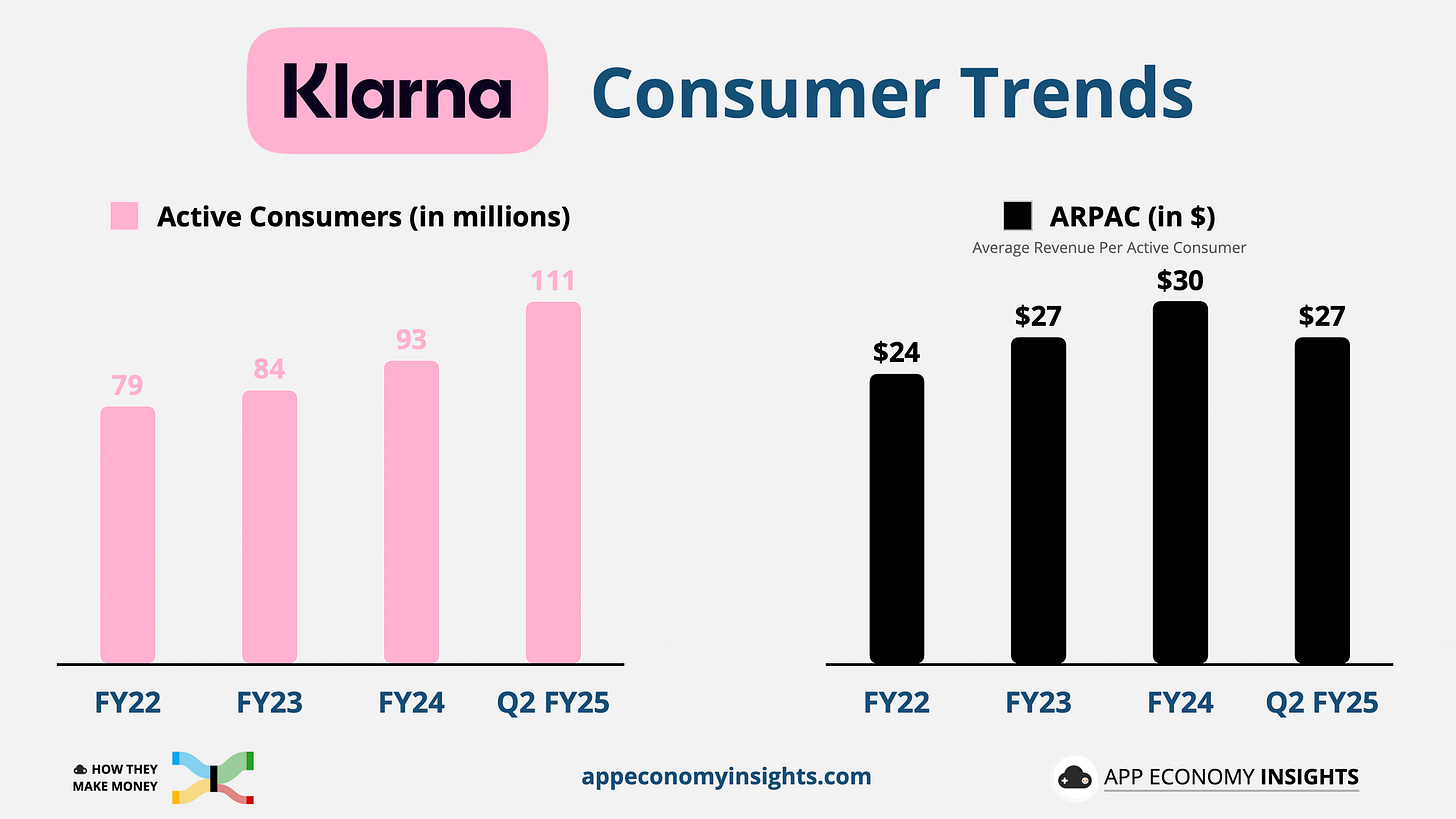

Explosive scale: Klarna's network effect is its greatest asset. Its active consumer base has swelled to 111 million as of Q2 2025, a massive 31% jump from Q2 2024. This growth is supercharged by partnerships with retail giants like eBay and Walmart later this year, and a merchant network that has expanded 34% Y/Y to 790,000.

Accelerating growth: Q2 revenue climbed 20% Y/Y to $823 million (up from 15% Y/Y in Q1), with Gross Merchandise Volume (GMV) up 19% Y/Y to $31 billion (up from 13% Y/Y in Q1). This acceleration is particularly strong in the crucial US market, its largest by revenue and fastest-growing.

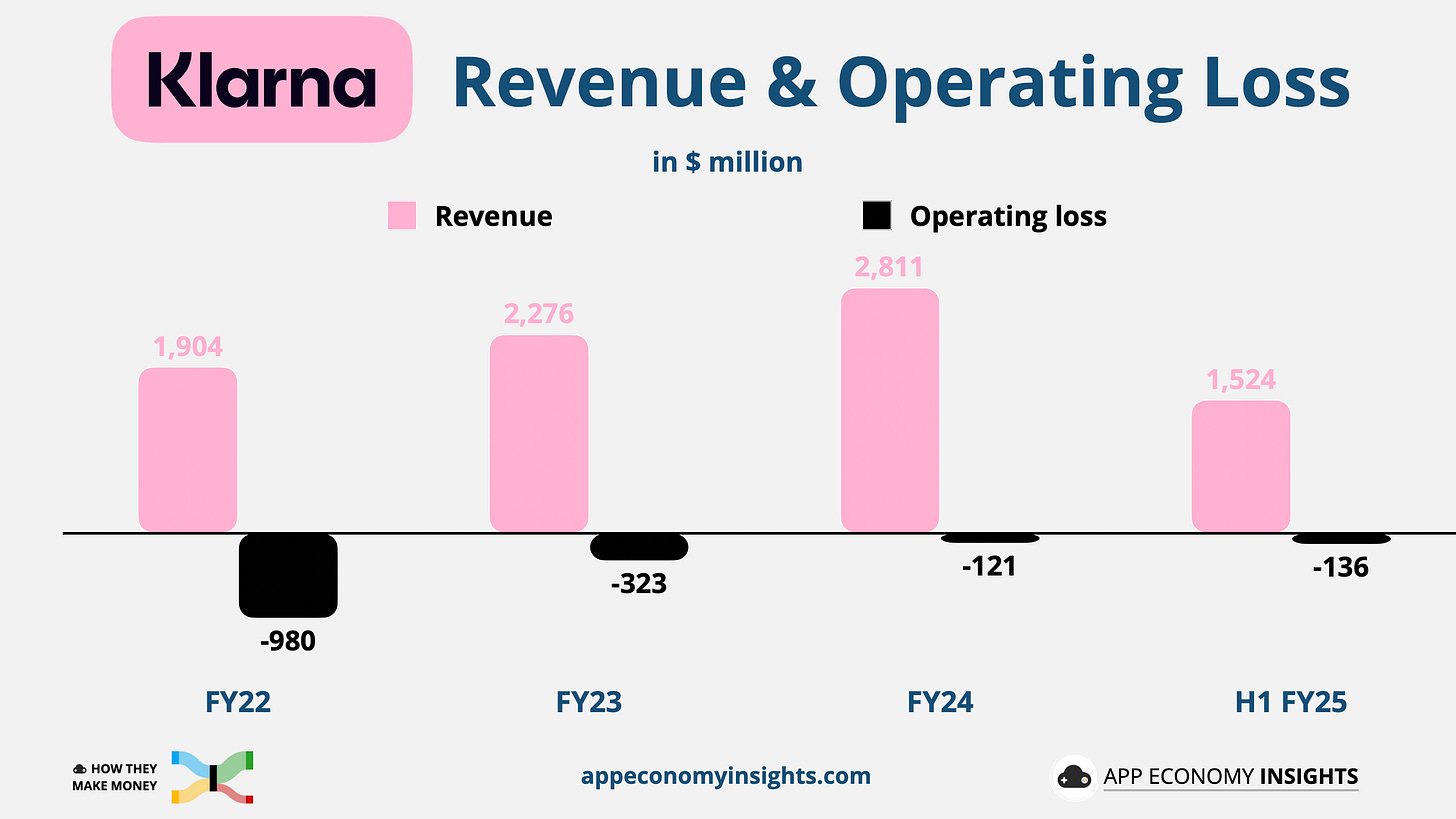

The path to "profitability": While P&L is still in the red, management is pointing to a crucial milestone: its fifth consecutive quarter of adjusted operating profit, which hit $29 million in Q2. This signals, in their view, that the underlying business model is efficient and scaling effectively.

📉 Bear Case: A Race to the Bottom

Despite the impressive top-line growth, the risks are becoming more pronounced:

The "profit" illusion: The focus on "adjusted" profit masks a harsher reality. If we include stock-based compensation, Klarna's operating loss expanded to $46 million in Q2 2025 from $4 million a year prior. For the first half of the year, the operating loss ballooned to $136 million, a significant deterioration from the $32 million loss in H1 2024.

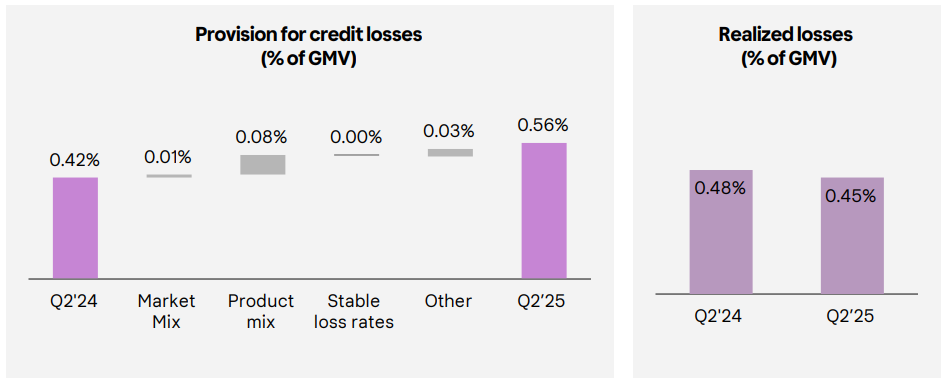

Rising Provisions for Losses: As Klarna pushes more into longer-term loans (higher-value items paid over 6-12 months), its "provision for credit losses" is increasing, rising to 0.56% of GMV (up from 0.42% in Q2 FY24). On the bright side, the realized losses actually declined from 0.48% to 0.45% of GMV, showing that the higher provisions are the result of accounting rules, as opposed to a sign of rising defaults. It still creates a drag on near-term profitability that complicates the financial picture.

Brutal Competition: The landscape remains a battlefield. Klarna is in a constant fight for merchant partnerships and consumer attention against well-capitalized and profitable rivals like Affirm, Afterpay (Block), and PayPal.

2. What the New Data Reveals

It's critical to focus on "Like-for-Like" (LfL) metrics, as they provide the clearest view of the core business's health.

Klarna uses it to adjust for two significant elements:

Sale of Klarna Checkout (KCO): Klarna sold KCO, its online checkout solution, to a consortium of investors on October 1, 2024. This has negatively impacted Q4 FY24’s revenue growth rate, and it will impact the first three quarters of FY25 as well.

Foreign currency (FX) fluctuations: These can create temporary tailwinds or headwinds, so it’s best to exclude them.

But we also have to dig deeper into the impact of the Fair Financing product.