💰 Stock-Based Compensation Explained

A comprehensive guide to SBC and its impact on companies, employees and investors

Greetings from San Francisco! 👋

Welcome to the new members who have joined us this week.

Join the 32,000+ How They Make Money subscribers receiving insights on business and investing every week.

Today, we’ll cover the following:

What is stock-based compensation (SBC)?

How does SBC affect investors?

The different types of SBC.

The benefits of SBC.

The drawbacks of SBC.

How can investors assess the impact of SBC?

SBC trends and developments.

This article is brought to you by App Economy Portfolio, my real-money portfolio service. Joining App Economy Portfolio gives you access to:

📊 Earnings Reports: Compelling earnings visuals & thesis updates for 70+ stocks, plus a steady flow of research on disruptive tech.

🎯 Actionable Ideas: New stocks on the first of the month, best buys mid-month, and live trade alerts twice a month.

🔐 Live Trade Alerts and Portfolio Tracker: Access to my real-money portfolio, practical spreadsheets, and templates.

👥 Active Community: A network of investors that regularly shares updates, company earnings, innovative ideas, and engaging discussions.

Want to advertise in How They Make Money? Book here.

“Show me the incentive and I will show you the outcome.”

Charlie Munger's famous quote highlights the essence of stock-based compensation (SBC), a critical aspect of modern corporate finance.

With over 50% of S&P 500 companies using SBC, according to a recent Equilar study, it has sparked heated debates among investors. The divide between fervent supporters and staunch opponents begs the question: What makes this financial instrument so polarizing?

Stock-based compensation is an employee remuneration strategy that awards equity in a company, aligning the interests of employees and investors. Its increasing popularity stems from companies aiming to attract and retain top talent. However, SBC's complexities often leave many wondering about its nature, workings, and investment potential.

This article demystifies stock-based compensation, exploring its mechanics, benefits, and controversies to empower you with the insights needed for informed decision-making, irrespective of your investing experience.

1. What is stock-based compensation (SBC)?

SBC is a remuneration strategy where companies reward employees with equity interests, such as stock options, instead of cash. This approach aligns employees' financial interests with shareholders', incentivizing them to contribute to the company's long-term success.

The primary aim of SBC is to motivate employees to work toward the company's growth and profitability. By tying their financial well-being to the company's performance, employees are encouraged to make decisions that enhance shareholder value. This incentive structure attracts top talent, retains key employees, and fosters a performance-driven culture.

SBC is also a vital consideration for investors. Comprehending the various types of stock-based compensation and their implications enables investors to make informed decisions when assessing a company's performance and prospects.

2. How does SBC affect investors?

SBC significantly affects investors in various ways, both positively and negatively. Investors should consider the following:

Dilution of Ownership

SBC issuance can dilute existing shareholders' ownership. As more shares are issued, each existing share's percentage ownership decreases. Think of it like a birthday cake (the company) being shared among party guests. If new guests arrive, the same cake must be divided into thinner slices for everyone. This dilution can potentially affect share price and earnings per share (EPS), lowering the company's valuation on a price-to-earnings basis. We defined EPS in our explainer on how to analyze an income statement.

Alignment of Interests

SBC fosters alignment between employees and investors, encouraging better decision-making and long-term value creation. As a result, companies offering SBC can attract and retain skilled employees, driving innovation, improving operational efficiency, and enhancing shareholder value.

Company Performance

A potential relationship exists between SBC and company performance. Well-designed compensation plans can incentivize employees to pursue success, impacting growth and profitability. Case studies (1) show that companies with effective SBC plans can outperform peers in financial performance and shareholder returns.

Financial Statement Analysis

First, let’s discuss where you can find SBC in a company’s financial statements.

SBC is part of employee compensation, so it’s included in the cost of revenue and operating expenses on the income statement, affecting critical financial metrics like gross profit, operating income, and net income. Some companies provide an exact breakdown, as shown in Airbnb's Q4 FY22 Shareholder Letter (see chart). Airbnb’s income statement included $254 million of Stock-based compensation in Q4 FY22, spread across all operating expenses. For example, the SBC of a sales representative would be in Sales & Marketing (S&M) expenses.

Since SBC is a non-cash expense, it reduces net income in the income statement but is added back when calculating operating cash flow. As a result, it can artificially inflate the cash flow margin of the business.

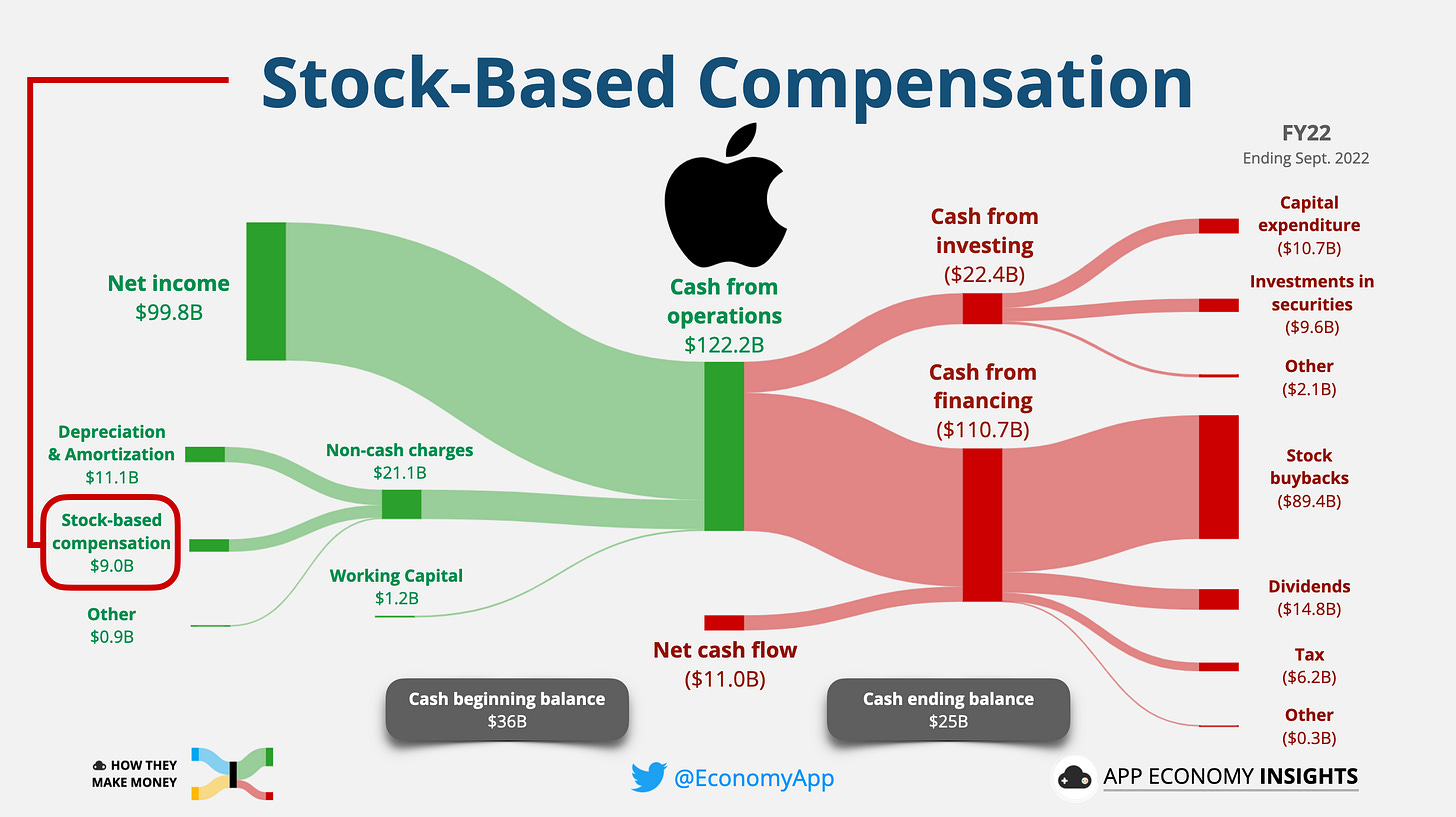

For example, let’s look at the financials of Apple (AAPL), the largest company in the world. If you go to the company’s investor relations website and look at the quarterly reports, you’ll find SBC in the cash flow statement as one of the items added to the net income to calculate the operating cash flow. Below is Apple’s FY22 cash flow statement with SBC highlighted.

If you subscribe to How They Make Money, you know I love to put everything in a diagram to make it easy to digest. So here is what Apple’s FY22 cash flow statement looks like in a diagram format, with the SBC included on the left as part of the non-cash charges added to the net income to calculate the cash from operations.

When analyzing a company's valuation, using a cash-flow multiple can be misleading if the company aggressively uses SBC. To alleviate this, account for the free cash flow net of SBC to obtain a multiple more aligned with the underlying business performance. For more on the definition of free cash flow and other metrics, you can refer to our article on how to analyze a cash flow statement.

GAAP (generally accepted accounting principles) is a set of accounting standards companies use to prepare their financial statements. GAAP metrics include the impact of SBC in the income statement, which is an appropriate representation of a company’s performance.

In addition to their GAAP metrics, many companies provide additional data on an “adjusted” basis (also called a “non-GAAP” basis for US companies). When they do, they tend to exclude SBC. This exclusion is unwarranted since SBC is a required cost to attract and retain talent. While excluding non-recurring items like restructuring costs or impairment provisions makes sense to compare apples to apples, SBC is a requirement for the day-to-day business. Without the employees running the show, the business would not sustain its performance. Therefore, it's essential to ensure accurate comparisons between companies or historical performance by focusing on the performance including SBC. This allows investors to make informed decisions based on a company's true financial health.

Focusing on the performance including SBC is essential to ensure accurate comparisons between companies or historical performance. In addition, this enables investors to make informed decisions based on a company's true financial health, considering the implications of stock-based compensation on their investments.

3. The different types of SBC.

Stock-based compensation can take many forms, each with its own characteristics and implications for employees and investors. Here, we'll explore the most common types of equity awards companies offer their employees.

Stock Options: Stock options grant employees the right to buy a specific number of shares at a predetermined price (the "strike price") within a specified period. Options typically vest over time, allowing employees to exercise them gradually. Non-qualified stock options (NSOs) and incentive stock options (ISOs) differ primarily in tax treatment upon exercise.

Restricted Stock Units (RSUs): RSUs promise to award a certain number of shares or their cash equivalent once vesting conditions are met. Unlike stock options, employees don't need to pay a strike price to receive shares. As a result, RSUs offer more predictable value but may be less tax-efficient than stock options.

Performance Shares: Performance shares grant company stock contingent upon meeting specific performance goals or metrics, incentivizing employees to focus on achieving strategic objectives that benefit all shareholders. Tesla's compensation plan for Elon Musk is an example of performance shares at work, making him one of the wealthiest people in the world.

Employee Stock Purchase Plans (ESPPs): ESPPs enable employees to buy company stock through payroll deductions, usually at a discount. ESPPs encourage broad-based employee stock ownership and foster a sense of shared ownership, but may dilute existing shareholders' ownership interests.

Other Forms of Stock-Based Compensation: Less common forms of SBC include stock appreciation rights (SARs) and phantom stock. SARs allow employees to receive stock value appreciation without owning shares, while phantom stock promises a cash bonus equivalent to the value of a certain number of shares. Phantom stock aligns employees' interests with the company and shareholders without transferring actual shares.

Understanding the unique characteristics of each SBC form helps investors make informed decisions when analyzing companies.

4. The benefits of SBC.

Stock-based compensation offers a range of advantages for companies, employees, and investors. Understanding these benefits helps stakeholders appreciate the value SBC provides.

For Companies:

Cash Preservation: Offering stocks or options instead of cash allows companies to allocate resources to essential ventures, supporting growth and stability.

Tax Advantages: Reduced tax burdens as employees exercise options or stocks vest enables better financial planning and resource allocation, improving the bottom line.

Employee Attraction & Retention: Competitive SBC packages attract top talent and foster loyalty, reducing turnover costs, especially in competitive markets like the San Francisco Bay Area.

For Employees:

Wealth Creation: As employees own a portion of the company, their personal wealth increases with its success, providing a sense of ownership and accomplishment.

Diversification & Flexibility: SBC offers financial planning opportunities, allowing employees to diversify their investments or tailor their compensation structures to individual preferences.

For Investors:

Enhanced Company Performance: SBC incentivizes employees to drive growth and innovation, leading to better business outcomes and increased competitiveness.

Shareholder Value Creation: Flourishing companies create value for shareholders, resulting in growing investments and generating positive returns for investors.

Long-term Alignment: SBC ensures employees, management, and investors share the same long-term vision and goals, fostering collaboration and contributing to the company's success.

5. The drawbacks of SBC.

While SBC offers numerous benefits, it also has certain drawbacks that stakeholders should consider.

For Companies:

Dilution: Issuing new shares for stock-based compensation can dilute existing shareholders' ownership, potentially impacting share price and investor sentiment.

Complexity: Managing and implementing SBC programs can be administratively challenging and may require expert guidance as companies navigate complex regulations, accounting rules, and compliance requirements.

For Employees:

Vesting Requirements: Vesting periods or performance conditions may limit employees' access to the full value of their SBC, impacting their ability to benefit from equity awards as anticipated.

Tax Implications: Exercising options or selling stocks can trigger tax consequences, requiring employees to navigate complex tax rules and plan accordingly to avoid financial surprises.

For Investors:

Earnings Manipulation: Companies may use SBC to adjust earnings reports, potentially masking actual financial performance. Investors should scrutinize financial statements to clearly understand a company's financial health.

Short-term Focus Risk: Overemphasis on stock performance could encourage short-term decision-making at the expense of long-term success. Investors should assess whether a company's SBC plan promotes long-term growth and value creation or inadvertently prioritizes short-term gains.

6. How can investors assess the impact of SBC?

Here are some key details to consider when assessing the impact of SBC.

Key Metrics and Data Points:

Diluted EPS (Earnings Per Share): Diluted EPS accounts for the impact of stock-based compensation on outstanding shares. A lower diluted EPS may signal potential earnings dilution due to SBC, while a higher one indicates that the company's growth could offset dilution concerns.

Equity Overhang: Equity overhang measures the total outstanding stock-based compensation as a percentage of a company's outstanding shares. A high equity overhang can indicate dilution risk and reduced shareholder value, while a low overhang suggests a more shareholder-friendly approach.

Burn Rate: The burn rate reveals the pace at which a company grants stock-based compensation, calculated as a percentage of outstanding shares. A high burn rate might indicate aggressive SBC practices, whereas a low burn rate suggests a more conservative approach that better preserves shareholder value.

SBC-to-Revenue Ratio: This ratio can provide context on how aggressive a company is with SBC. Many young tech companies have a high SBC-to-revenue ratio. Monitoring how this ratio evolves over time and comparing it with peers can be a helpful way to gain context.

Evaluating the Effectiveness of a Company's Stock-Based Compensation Plan:

Performance Criteria: Examine the performance metrics linked to the company's SBC program. A strong alignment between performance goals and stock-based compensation suggests a well-designed plan that drives desired outcomes.

Vesting Schedules: Analyze the vesting schedules for awarded stocks or options. Longer vesting periods and performance-based vesting conditions can help ensure that employees remain focused on the company's long-term success, benefiting investors.

7. SBC trends and developments

Recent Trends in Stock-Based Compensation:

Performance-based awards: Companies increasingly link stock-based compensation to specific performance metrics, such as revenue growth, market share, or total shareholder return. This approach aims to better align employee incentives with company success and foster a more results-driven culture.

Clawback provisions: In response to corporate scandals and investor concerns, many companies incorporate clawback provisions into their SBC programs. These provisions enable the company to reclaim previously awarded stock-based compensation under certain conditions, such as financial restatements, misconduct, or performance failures.

Regulatory Changes and Updates Impacting Stock-Based Compensation:

Evolving accounting standards: Financial accounting standards for stock-based compensation are subject to change as regulatory bodies like the Financial Accounting Standards Board (FASB) regularly review and update rules. Companies must stay informed and adapt their SBC programs to comply with the latest standards.

Executive compensation disclosure: Regulatory agencies, such as the Securities and Exchange Commission (SEC), have introduced new disclosure requirements for executive compensation, including stock-based compensation. Companies are now required to provide transparent, detailed information about their SBC programs in annual proxy statements, helping shareholders make informed decisions.

Bottom line

Understanding SBC is crucial for investors, as it provides valuable insights into a company's financial health, employee motivation, and long-term growth potential. SBC programs can be a powerful tool to align the interests of employees, management, and shareholders, ultimately driving value creation and business success.

SBC is an expense and should not be excluded from a company’s performance evaluation. That’s why it's important to consider financial statements on a GAAP basis, with SBC included in the cost of revenue and operating expenses. All my diagrams present data on a GAAP basis for this reason. Investors evaluating a company’s performance on a cash flow basis need to be vigilant and consider the impact of SBC over time.

Throughout this guide, you’ve learned:

What SBC is.

How it affects investors.

The benefits and drawbacks.

The recent trends and development.

How to assess its impact as an investor.

Remember, a well-balanced approach that considers both the advantages and challenges of stock-based compensation can lead to more successful investment outcomes. So keep learning, stay curious, and continue to assess the impact of SBC on your investment journey!

That’s it for today!

Stay healthy and invest on!

Disclosure: I am long AAPL and ABNB in the App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members here.

Stay up to date and give us a follow on Twitter, LinkedIn, or Instagram.

(1) References:

Core, J., Guay, W., & Larcker, D. (2003). Executive Equity Compensation and Incentives: A Survey. Economic Policy Review, 9(1), 27-50.

McConnell, J. J., Servaes, H., & Lins, K. V. (2008). Changes in Insider Ownership and Changes in the Market Value of the Firm. Journal of Corporate Finance, 14(2), 92-106.

In the AAPL chart, the SBC cost is much less than the stock buyback Apple completed that quarter. While SBC are commonly FUTURE shares so it's less of, well, an apples to apples comparison, does a buyback rate exceeding the SBC issuance rate tend to nullify dilution risks? Or is a buyback not a sufficiently precise opposite to issuance to make that comparison?

Does there exist a better opposite to issuance than a buyback?

Great article