💡 How to Analyze an Income Statement

A guide to understanding a company's financial performance

Hello there! 👋

Greetings from San Francisco!

Welcome to the new members who have joined us this week!

Join the fast-growing How They Make Money community to receive weekly insights on business and investing.

Several community members have requested an explainer on basic financial terms.

So I’m starting a new recurring series called 💡 How To Analyze.

You can go back to these articles when you are unsure about specific financial concepts or want a refresher. Over time, I’ll cover more complex topics and explain them in plain English.

Welcome to the first part of our three-part mini-series on the three primary financial statements that every business owner or investor should know:

Income statement (Profit & Loss): shows a company's revenue and expenses over a specific period, resulting in a net profit or loss.

Balance sheet: shows a company's assets, liabilities, and equity at a specific point in time. It’s a snapshot at the end of a period.

Cash flow statement: shows how a company's activities have affected its cash position over a specific period.

These three documents are like the holy trinity of finance, and understanding them is crucial to making informed decisions about a company.

In this series, we'll be breaking down each financial statement and explaining what they're all about. We'll use examples and illustrations to ensure you don't fall asleep at the wheel.

You can find other articles in this series on our website:

Introduction to the income statement

First up, today we’ll talk about the income statement, also known as the profit & loss statement or P&L for short. This document shows a company's financial performance over a specific period, usually a year or a quarter. The P&L shows you how much money the company made, how much it spent, and how much it kept as profit.

We'll go over all the important stuff you need to know:

What’s included in a P&L: revenue, expenses, net income.

Key ratios: Margins and earnings per share (EPS).

Types of analysis: benchmarks, comparisons over time, and non-GAAP metrics.

So grab a cup of coffee (or whatever your drink of choice is), and let's get started!

If you prefer a video format, we just launched a new video series on the How They Make Money YouTube Channel! We’ll cover all financial statements from scratch.

Here’s the first one where we discuss Apple’s P&L.

Subscribe to make sure you don’t miss the next videos as they come out weekly.

A quick reminder—the monthly Earnings Visuals report just dropped!

If you happened to miss the release, you still have a chance to upgrade your subscription and gain full access to these earnings reports. They provide valuable insights into the recent financial performances of leading companies across various industries. Check out below to get full access. 👇

📊 Earnings Visuals (7/2023)

As a special perk for How They Make Money Premium subscribers, I share a monthly high-resolution report packed with visuals covering selected recent earnings. Here’s a sneak peek for all subscribers 👀

1) What’s included in a P&L

Here are the key aspects of the income statement that you should know:

Revenue: Think of revenue as money coming in the door.

Expenses: Think of expenses as money going out the door.

Net income/profit: The company's profits are calculated by subtracting expenses from revenue. This is the money left over after everything else has been paid for.

Simple, right? The P&L is a series of additions and substractions.

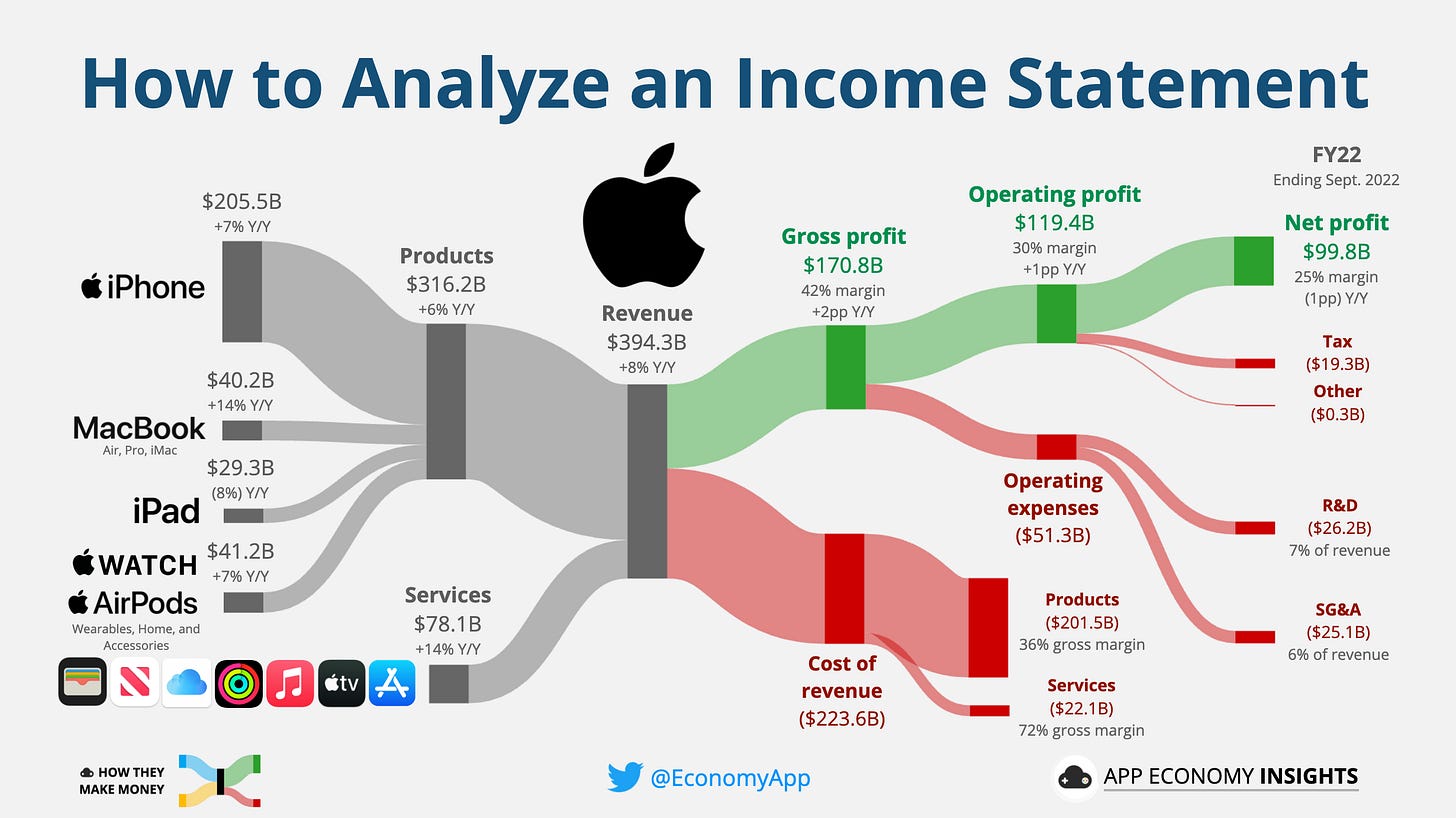

I love using visuals to help us digest financial statements. So as an example, let’s use the largest company in the world, Apple (AAPL), using their performance for the 12 months ending in September 2022, which was their fiscal year 2022 or “FY22.”

Revenue: In grey, I’m showing the money earned from selling products (iPhone, Macbooks, iPad, Watches, Airpods) or services (digital subscriptions, app store revenue, transaction fees, and more).

Expenses: In red, I’m showing the costs incurred to generate its revenue. We’ll cover them in detail in a second.

Profit/Income: In green, I’m showing whatever is left after deducting the expenses. Not all P&Ls look the same. Some provide more detail, and some provide less. In addition, some industries report their numbers differently (such as banks or insurance companies). Apple’s P&L is the most common format.

Here is the structure of a standard P&L:

Because of how a P&L is structured, analysts often refer to revenue as the “top line” and net income as the “bottom line.” It’s based on where they appear in the income statement.

Now that we've introduced the basics, let's dive deeper into how to read an income statement. It's not as scary as it sounds, I promise.

Revenue

Revenue is the lifeblood of any business. Without revenue, there's no way for a company to make money and survive.

There are a few different ways that companies can earn revenue, including:

Sales of goods: When a company sells a physical product to a customer (such as iPhones for Apple or coffee for Starbucks).

Sales of services: When a company provides a service to a customer, such as consulting or repair work.

Royalties: When a company earns a fee for allowing someone else to use its intellectual property, such as a patent or trademark.

Understanding the nature of revenue is critical:

Is it recurring revenue (for example, a subscription service like Netflix)?

Is the company starting from scratch every year to generate revenue (for example, a retailer like Target or an airline like Delta Air Lines)?

Revenue growth over time is a critical aspect to consider. Many legendary investors like Peter Lynch or Ray Dalio emphasize how they are looking for consistent and sustainable revenue growth over many years.

A period is always affected by temporary factors:

When positive, these factors are called “tailwinds.”

When negative, these factors are called “headwinds.”

In short, it’s easier to accelerate with the wind behind your back.

Overall, investors need to understand a company's revenue streams and how they are performing. Strong revenue growth is usually a good sign, while declining revenue can be a cause for concern. However, it is paramount to understand short- and long-term implications and put it all in context.

Expenses

Expenses are the costs that a company incurs to generate its revenue. In other words, they're the money a company spends to make money. Expenses can include everything from employee salaries to rent.

There are a few different types of expenses that you'll see on an income statement, including:

Cost of goods sold (COGS): The direct cost of producing a product or providing a service. For example, if you're a car manufacturer like Tesla (TSLA), your COGS might include the cost of raw materials, labor, and delivery. These are variable costs that increase in direct proportion to revenue.

Operating expenses (OPEX): These are the indirect costs associated with a company's day-to-day business activities, such as salaries, rent, utilities, and supplies, including:

Selling and marketing (S&M): Sales and marketing teams, advertising costs, events, conferences, etc.

Research and development (R&D): Engineering and technical teams responsible for developing new products or improving existing ones.

General and administrative (G&A): Costs incurred to run the business, such as rent, utilities, finance, and human resources personnel.

Depreciation and amortization (D&A): These are non-cash expenses that a company incurs from using long-term assets, such as buildings or equipment.

Depreciation: It’s a method of allocating the cost of a tangible asset over its useful life. For example, if a company buys a $50,000 machine expected to last for 5 years, it would record a depreciation expense of $10,000 per year for 5 years.

Amortization: It’s a method of allocating the cost of an intangible asset over its useful life. For example, if a company buys a patent for $50,000 expected to last for 5 years, it would record an amortization expense of $10,000 per year for 5 years.

Depreciation and amortization are called non-cash expenses because the cash was spent for the initial purchase ($50,000 in the examples above). The cost is spread over the useful life of the asset instead of all at once when the payment is made.

In specific cases, depreciation and amortization costs are included in COGS based on their nature (for example, if the asset depreciated is required to produce the products sold).

Investors need to pay close attention to a company's expenses. We want to see a track record of controlling expenses and maintaining a lean cost structure.

Net income

Net income is the amount of money a company has left over after all of its expenses have been subtracted from its revenue. In other words, it's the profit that a company makes. However, it can be a net loss when expenses exceed revenue.

Net income is a good indicator of how much money the company will have left over to pay dividends to shareholders or re-invest in the business.

There are two ways that a company can increase its net income:

Increasing its revenue: This can be done by launching new products or services, selling more of the existing ones, or raising prices.

Decreasing its expenses: This can be done by finding ways to save money, such as by cutting unnecessary costs or negotiating better deals with suppliers.

Looking at the net income for a specific period can be highly misguiding, so it’s critical to zoom out:

Was there any non-recurring expense that made profitability look worse?

Is management re-investing aggressively in future growth initiatives?

Is the company mature and optimized for profitability or still in its infancy?

The income statement has a trove of information, but it cannot be analyzed without proper context. So we are going to review how to gain more insights.

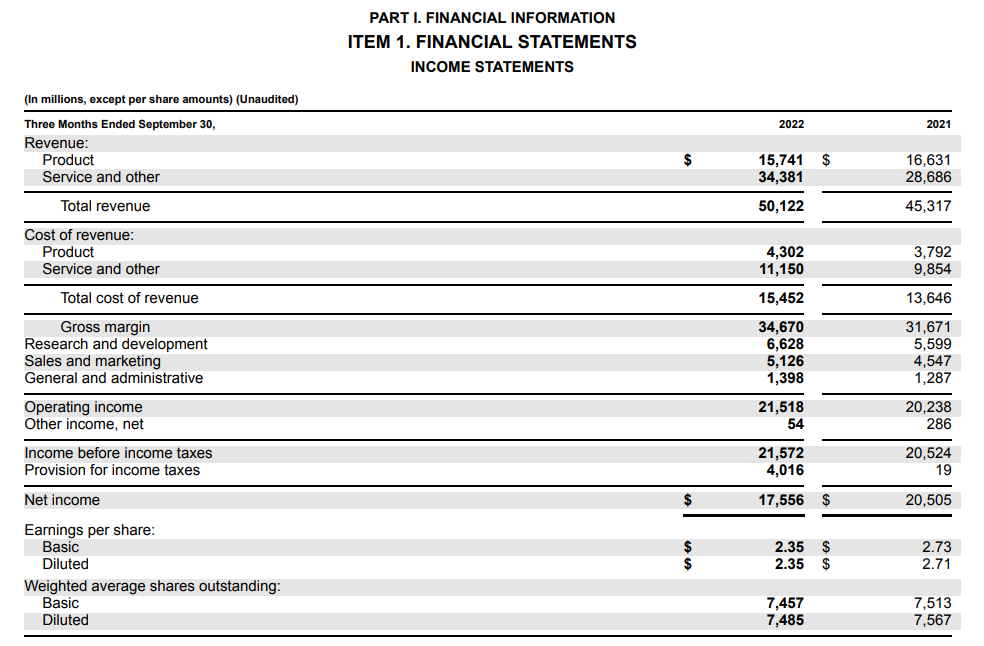

To wrap up this section, here is an example of what an income statement looks like when you open an annual (10-K) or quarterly report (10-Q). This is Microsoft’s quarter ending in September 2022. It also shows the quarter ending in September 2021 as a comparison.

2) Key ratios

Okay, let’s move on to the key ratios to review when you analyze a P&L.

First, there are three margins you should know: gross, operating, and net margin. They are all expressed in percentage of revenue.

Gross margin

Gross margin is an excellent way to measure a company's earnings potential. It represents the percentage of each dollar of revenue the company retains as profit before accounting for other expenses such as selling, general, and administrative (SG&A) expenses.

Here's the formula for calculating gross margin:

Gross margin = (Revenue - COGS) / Revenue

For example, let's say that a company has a revenue of $100 and COGS of $50. The gross margin for this company would be:

Gross margin = ($100 - $50) / $100 = 50%

This means that the company is making a profit of 50% on each sale.

Apple had a 42% gross margin in FY22:

Products (hardware like iPhones or Airpods) have a 36% gross margin.

Services (software like digital subscriptions) have a 72% gross margin.

So Apple generates twice as much gross profit for every dollar spent on its services compared to its hardware lineup. The products are a gateway to its digital ecosystem, where margins are far superior.

In the book Warren Buffett and the Interpretation of Financial Statements, we learn that Uncle Warren looks for businesses with at least a 40% gross margin profile. Why? Because you can’t offset bad unit economics with volume. If the gross margin is low, there is no room for error. As a result, the sustainability of the business is at risk, and it shows a potential lack of pricing power or competitive advantage.

A high gross margin is usually a good sign, as it means that the company has some flexibility to absorb other costs. However, it's essential to remember that different industries have different average gross margins, so we want to compare a company's gross margin to its peers.

Operating margin

Operating margin is a financial metric that shows a company’s profitability after accounting for all of its expenses, except for taxes, interests, and extraordinary items that are not part of normal business operations. It's like the "real" profit a company makes from its operations after all the bills have been paid.

Here's the formula for calculating the operating margin:

Operating margin = Operating income / Revenue

For example, let's say that a company has an operating income of $20 and a revenue of $100. The operating margin for this company would be:

Operating margin = $20 / $100 = 20%

This means that the company is making a profit of 20% on each sale after accounting for all of its operating expenses.

A high operating margin indicates a company's ability to generate profits and withstand competition. It can give investors insight into a company's profitability and efficiency. It’s the most critical margin since it factors all business operations.

Net margin

Net margin, also known as "net profit margin," is a financial metric showing how much profit a company makes after accounting for all of its expenses, including taxes, interest, and extraordinary items. It's like the cherry on top of a company's profit sundae - the final profit a company gets to keep.

Here's the formula for calculating the net margin:

Net margin = Net income / Revenue

For example, let's say that a company has a net income of $15 and a revenue of $100. The net margin for this company would be:

Net margin = $15 / $100 = 15%

This means that the company is making a profit of 15% on each sale after accounting for all of its expenses and taxes.

Net margin is a great way to measure how much money a company keeps in its pockets after everything is said and done. However, I tend to focus on operating margin. Why? The net margin includes the impact of non-recurring items that can be misguiding. For example, if there were a legal dispute or a favorable interest income, it would affect the net margin but doesn’t say much about the long-term viability of the business or its actual long-term margin profile.

Earnings per share (EPS)

Earnings per share, also known as EPS, is a financial metric that shows how much profit a company makes for each share. It's calculated by dividing a company's net income by the number of shares outstanding.

Here's the formula for calculating EPS:

EPS = Net income / Number of shares outstanding

For example, let's say that a company has a net income of $20 million and 5 million outstanding shares. The EPS for this company would be:

EPS = $20 million / 5 million = $4 per share.

The EPS can grow faster or slower than net income, depending on the number of shares outstanding at the end of a period.

If management issued more shares to raise debt or pay employees, the EPS would grow slower than net income.

If management buys back company shares with its cash, the number of outstanding shares goes down. As a result, the EPS would grow faster than the net income. Think of it like a cake that needs to be cut into fewer slices. As a result, each slice becomes slightly bigger.

Watching the EPS over time is critical because that’s ultimately what’s moving the stock price. Investors pay for the earnings power of a company moving forward and how much money can be returned to shareholders.

3) Types of analysis

When analyzing a company's financial performance, it's essential to look at its current numbers and compare them to industry benchmarks and the company's performance in prior periods. This can give investors a better understanding of how the company is doing relative to its peers and how it has been performing over time.

Comparison to industry benchmarks

For example, if a company is in the retail industry, it might be helpful to compare its gross margin to the average gross margin of other retail companies. In short, compare Walmart to Target and Costco, and don’t compare it to Google.

Too often, non-insiders judge a company harshly because they compare it to the wrong subset of peers. Unfortunately, it can lead to missed opportunities.

Here are a few examples of margin profiles that significantly differ:

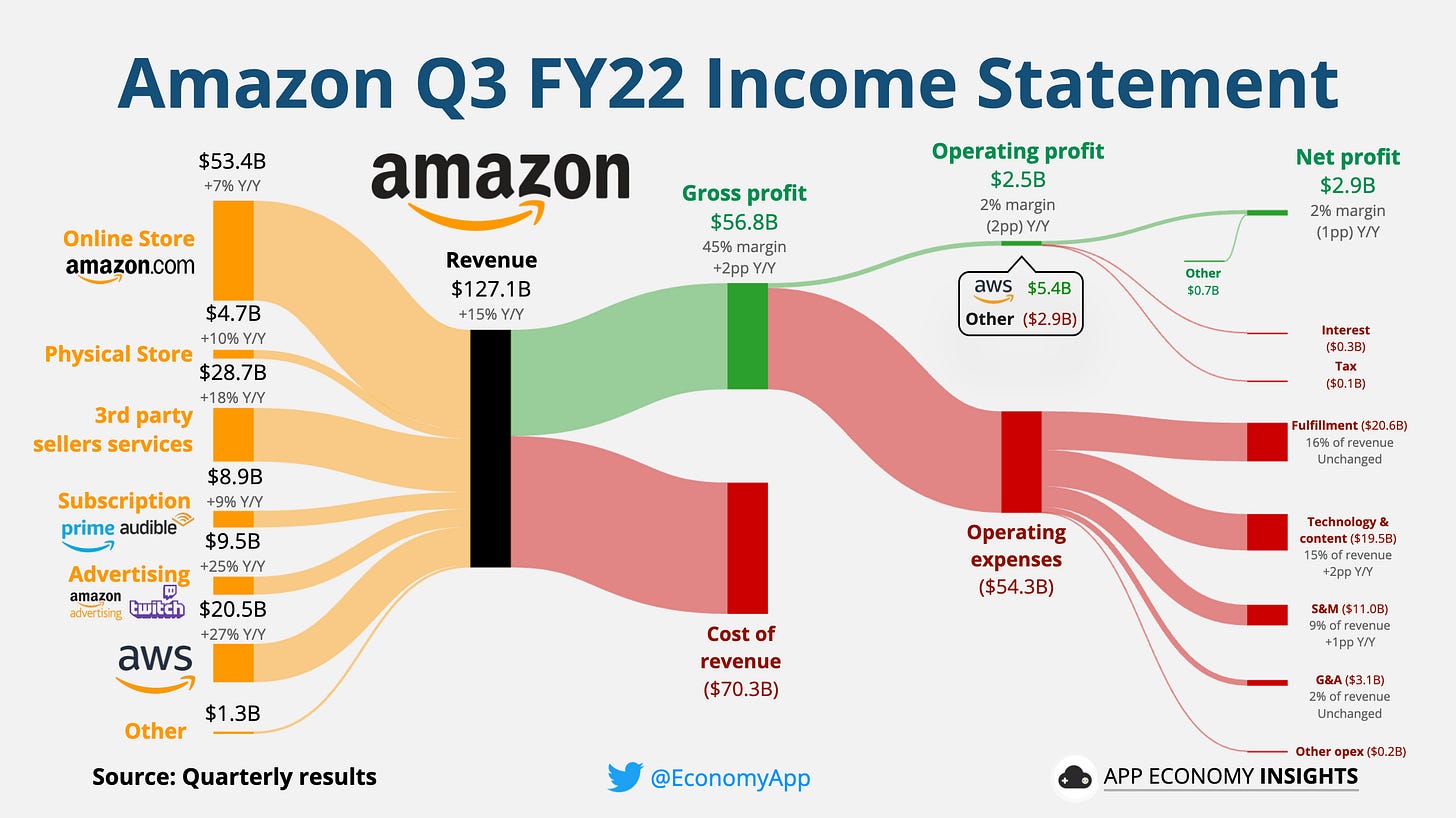

Amazon (AMZN): Amazon is known for its low margins, with an operating margin of around 2%. This is partly due to the online store’s focus on low prices and the high level of re-investment into new ventures.

Microsoft (MSFT): Microsoft has much higher margins than Amazon, with a gross margin of 69% and an operating margin of 43%. This is partly due to the nature of its revenue focused on software and services.

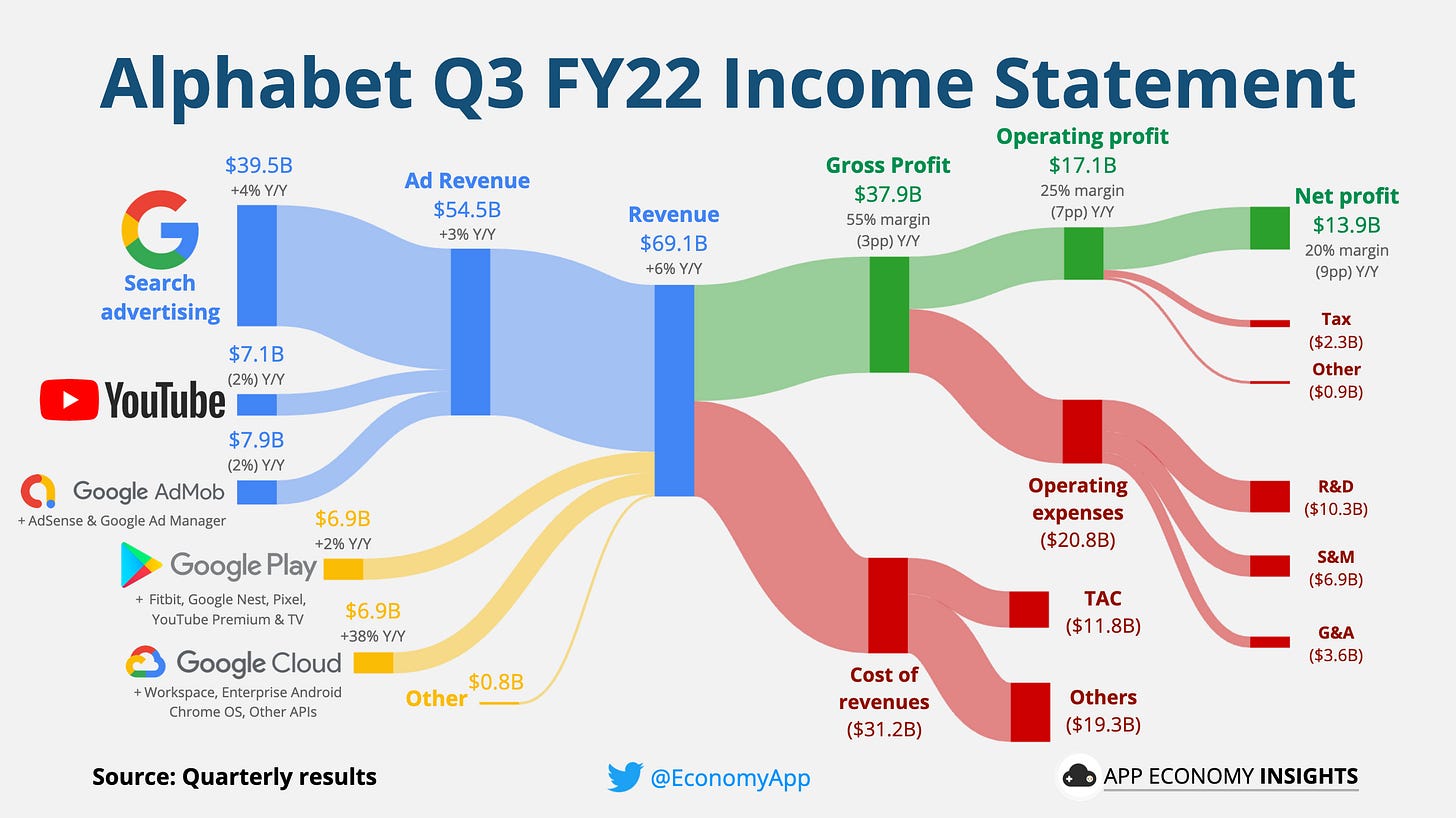

Google (GOOG): Google has relatively high margins, with a gross margin of around 55% and an operating margin of about 30%. This is partly due to the company's leading position in the digital advertising market.

Costco (COST): Costco has lower margins than the other companies listed here, with a gross margin of 12% and an operating margin of about 3%. This is partly due to the company's focus on low prices and its competition.

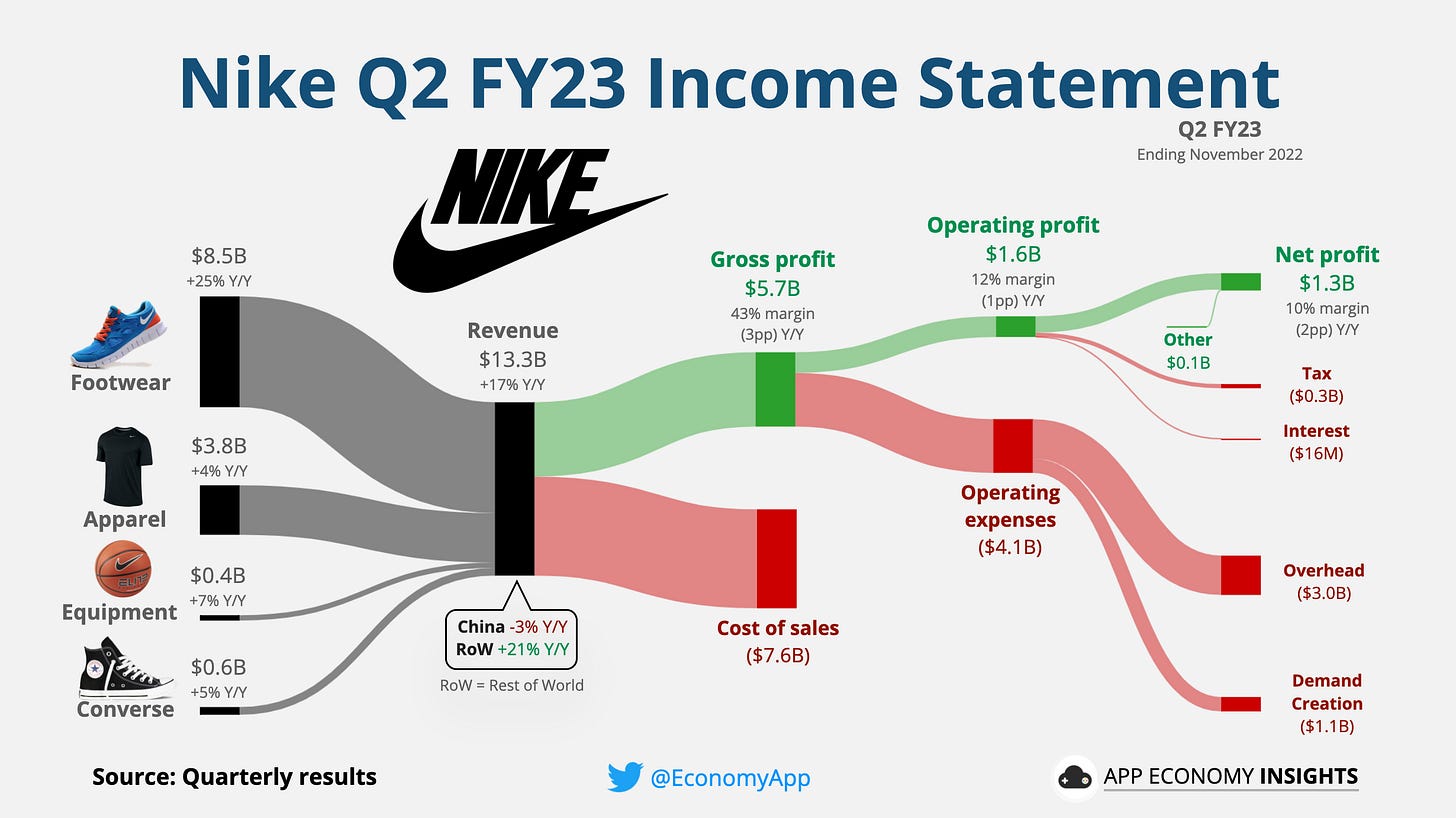

Nike (NKE): Nike has higher margins than Costco, with a gross margin of around 43% and an operating margin of about 12%. This is partly due to the strong demand for the company's products and its brand recognition.

Comparing to prior periods

My favorite way to evaluate the sustainability of a company’s competitive advantages is to look at the margins over time.

In my charts, you’ll see me compare the margin to the prior period. I compare them using percentage points (pp). For example, if a gross margin improved from 40% in FY21 to 45% in FY22, that’s a 5pp improvement.

Margin and growth are critical in an investment thesis.

Here are some traits to look for:

Improving market share: When a company grows revenue faster than its peers, it shows its business superiority.

Strong unit economics: When a company can maintain a high gross margin, it shows its long-term earnings potential.

Operating leverage: When a company's operating margin steadily improves over the years, it shows the business is becoming more efficient by growing revenue faster than operating expenses.

Scalability: For example, a business can spend less in sales and marketing in % of revenue over time without compromising demand.

Path to profitability: When a company is losing money but showing a steady improvement in its margins over time.

Below is an example of how I love looking at the margin profile of a company, using Netflix (NFLX) as an example. It shows quarterly metrics over a decade.

In the past 10 years, Netflix has steadily improved its gross margin (purple line) and operating margin (blue line) and has reduced its sales and marketing spending in % of revenue (orange line). It illustrates the success of its focus on original content to grow its subscription business.

GAAP vs. Non-GAAP

GAAP (generally accepted accounting principles) is a set of accounting standards developed by the Financial Accounting Standards Board (FASB) and used by companies to prepare their financial statements. These standards provide a common framework for companies to follow when reporting their financial performance.

Non-GAAP (adjusted) measures, on the other hand, are financial measures not calculated in accordance with GAAP. Companies often use these measures to provide additional information about their financial performance and present them alongside GAAP measures.

There are several reasons why companies might use non-GAAP measures, including:

To exclude one-time or unusual items from their financial statements.

To adjust for the impact of acquisitions or divestitures.

To present financial measures more closely aligned with the company's business model and offer a better representation of execution.

Here are examples of non-GAAP metrics:

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): This measure is often used to evaluate a company's profitability and performance, as it excludes certain non-cash expenses such as depreciation and amortization.

EBIT (Earnings Before Interest, Taxes): This measure is the same as EBITDA but includes the impact of depreciation and amortization.

Adjusted Earnings Per Share (EPS): This metric adjusts a company's earnings per share by excluding certain one-time or non-recurring items, such as restructuring charges (layoffs) or asset write-downs (when an asset is no longer worth as much as it was when a company bought it).

Pro Forma Revenue: This measure adjusts a company's revenue to exclude certain items, such as acquisitions or divestitures, to provide a more "normalized" view of the company's revenue performance.

It's important to note that non-GAAP measures are not necessarily more accurate or reliable than GAAP measures. The Securities and Exchange Commission (SEC) has issued guidelines stating that companies should not use non-GAAP measures to mislead investors or obscure poor financial performance.

The only metrics that matter over the long term are the GAAP metrics. In addition, GAAP metrics are necessary to compare several companies since we need to compare apples to apples.

Many tech companies exclude the impact of stock-based compensation (SBC) in their non-GAAP performance. This exclusion is unwarranted since SBC is a required cost to attract and retain talent. As a result, it’s a cost required for the company to run its operations. Note that SBC is part of employee compensation, so it’s reflected across all GAAP operating expenses based on the nature of the employee's work. I’ll cover SBC in a dedicated article later.

Non-GAAP metrics can help evaluate the progress made by a company over time. For example, excluding non-recurring items that may pollute the analysis can be helpful.

The numbers presented in my diagrams are always on a GAAP basis. I provide specific Non-GAAP metrics when appropriate if the data provides more insights into the business. For example, valuable metrics include customer retention or revenue per user.

Valuation method

Many methods to evaluate the valuation of a company are based on business metrics that can be found in the income statement.

The valuation of a company is its market capitalization, which is the value of a publicly traded company calculated by multiplying the stock price by the number of shares outstanding.

For example, Apple has a $2.1 trillion market capitalization and has 15.9 billion shares outstanding shares. So that’s about $128 per share.

Companies are often valued based on the following:

Price-to-sales (P/S ratio): Market capitalization / Revenue.

Price-to-earnings (P/E ratio): Market capitalization / Net Income.

We’ll provide more detail on valuations in another article!

Final word

Well, that's it! You've made it to the end of our income statement guide. We hope you've enjoyed learning about the income statement and how to read one like a pro.

The income statement shows a company's revenue, expenses, and profits over a specific period. Investors use it to evaluate a company's financial performance. Some critical aspects of the income statement to pay attention to include revenue growth, margin trends, and overall profitability.

Remember, it's also important to compare a company's financial performance to industry benchmarks and its own performance in prior periods. This can give you a better understanding of how the company is doing relative to its peers and how it has been performing over time.

We hope you've found this guide helpful and that it's given you a good foundation for understanding how to read an income statement. Check our article on how to analyze a balance sheet here 👇

Disclosure: I am long AAPL, AMZN, GOOG, and NFLX in the App Economy Portfolio. I share my ratings (BUY, SELL or HOLD) with App Economy Portfolio members here.

This is a really good introduction to this stuff.

One question/request - have you considered creating an animated version of these diagrams that show this data over time?

I think those would be very cool animations. And since so many of these metrics are best evaluated over time, I think they would be valuable.

Fantastic article. Have you considered writing article how to analyze REITs, since those are pretty different and internet lacks on such information. For example ARR?