📊 PRO: This Week in Visuals

AVGO ZS FIG HPE LULU IOT DOCU NIO GTLB HQY PATH ASAN AI

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

📈 Broadcom: Upgraded AI Outlook

☁️ Zscaler: ARR Tops $3 Billion

🎨 Figma: Back To Reality

🖥️ HPE: Juniper Integration

🧘🏻 Lululemon: US Consumer Fatigue

🌐 Samsara: Enterprise Momentum

✍️ DocuSign: AI Drives a Rebound

⚡️ NIO: Volume Ramps

🛠️ GitLab: CFO Exit

🏥 HealthEquity: Record Margins

📝 Asana: AI Studio Momentum

🤖 UiPath: Execution Improves

🧠 C3.ai: Reset Underway

1. 📈 Broadcom: Upgraded AI Outlook

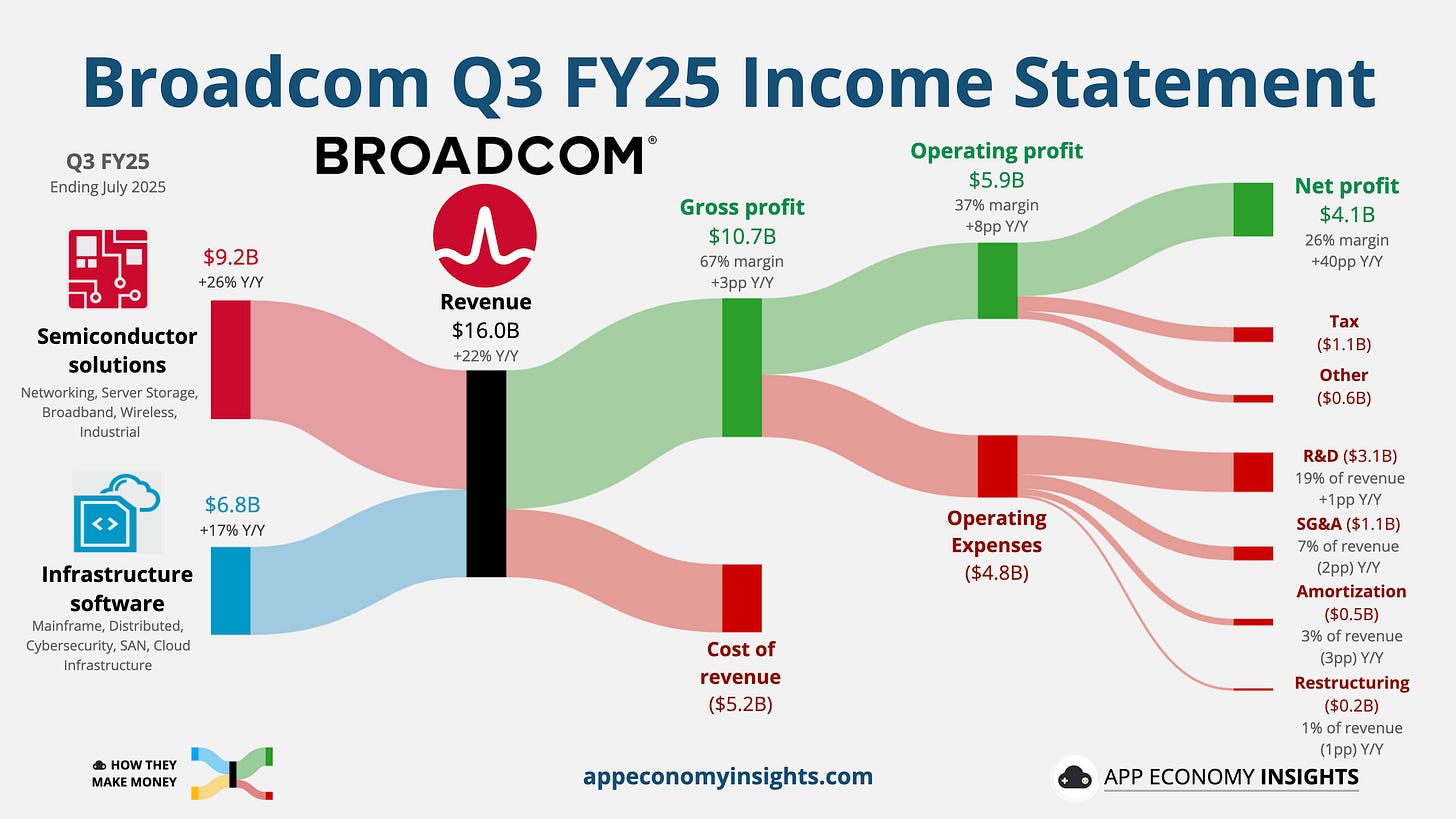

Broadcom’s Q3 revenue (July quarter) rose 22% Y/Y to $16.0 billion ($0.1 billion beat), and non-GAAP EPS was $1.69 ($0.03 beat).

The AI outlook got a major upgrade. AI-related revenue surged 63% Y/Y to $5.2 billion, beating estimates. More importantly, guidance for AI semiconductor revenue in Q4 is $6.2 billion, well ahead of the ~$5.8 billion consensus. Broadcom’s Q4 revenue guidance of $17.4 billion sailed past the ~$17.0 billion consensus. The biggest news came from CEO Hock Tan, who revealed a new major AI customer (reportedly OpenAI) with over $10 billion in orders, promising a "significant" acceleration in AI revenue for FY26.

Broadcom's efficiency remains best-in-class with a 37% operating margin and 44% of revenue converted into free cash flow, generating $7.0 billion in the quarter.

The VMware acquisition continues to deliver scale. Infrastructure software contributed $6.8 billion, accounting for over 42% of total revenue. This massive and stable software segment provides diversification and predictable cash flow, complementing the semiconductor business.

The narrative has shifted from steady delivery to significant acceleration. By securing a new, multi-billion-dollar AI customer, Broadcom reinforced its position as a critical enabler of AI infrastructure alongside NVIDIA. The stock has doubled in the past year, showing that the market sees a clear path for supercharged growth ahead.

2. ☁️ Zscaler: ARR Tops $3 Billion

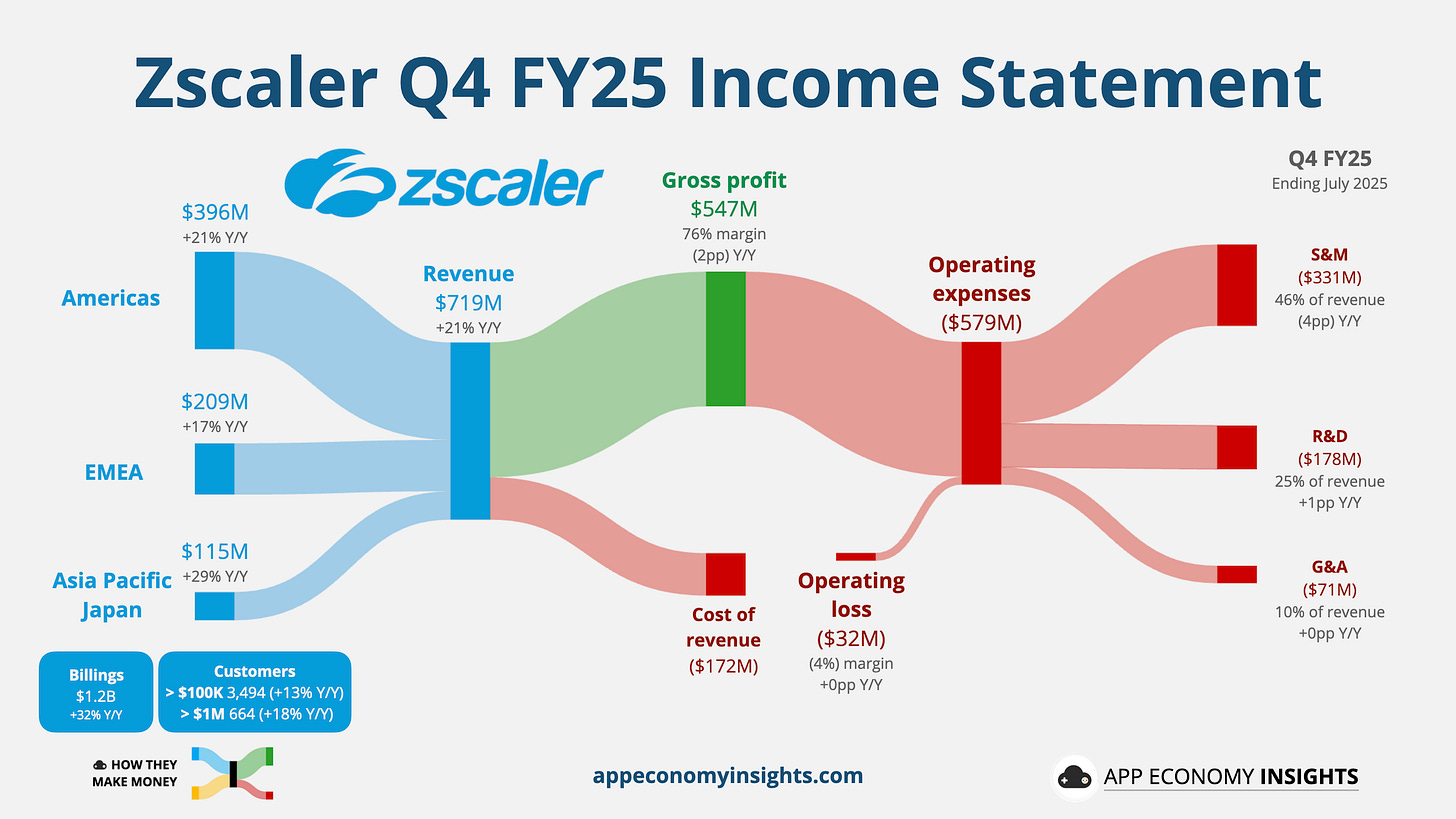

Zscaler’s Q4 revenue (July quarter) rose 21% Y/Y to $719 million ($12 million beat), and non-GAAP EPS was $0.89 ($0.09 beat).

Calculated billings saw a rapid acceleration from 25% Y/Y in Q3 to 32% Y/Y, and ARR grew 22% Y/Y to $3.0 billion. Management highlighted a record quarterly operating margin as Zero Trust and AI security demand stayed strong.

For FY26, Zscaler guided for accelerating revenue growth of 22% Y/Y to ~$3.27 billion (above the $3.2 billion consensus) and non-GAAP EPS to ~$3.66 (in line). The company also introduced ARR guidance of 22% Y/Y to $3.69 billion. AI Guardrails and broader AI security offerings are gaining traction, and the Red Canary acquisition (completed in August) expands MDR capabilities. Product momentum remains solid, supporting high growth and improving margins.

3. 🎨 Figma: Back To Reality

Figma’s first post-IPO quarter showed healthy execution, but the stock collapsed by more than 20%, so let’s review why.