⚖️ Google Saved by ChatGPT?

What the latest antitrust verdict means for Big Tech

Welcome to the Free edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Alphabet dodged a bullet this week

After a landmark antitrust trial that threatened to reshape Silicon Valley, a federal judge rejected the most drastic of the government’s proposals, which was a forced sale of Chrome or possibly Android.

But the sigh of relief wasn't just felt in Mountain View. Apple also had reason to celebrate, as the judge declined to ban the estimated $20+ billion in annual payments it receives to keep Google as the default search engine on Safari.

The verdict's real surprise? The judge pointed to the rise of AI competitors such as ChatGPT as a key reason why drastic measures weren't needed—for now. This created a great irony: the very existence of a new threat to Google's dominance was used as the primary legal justification for not punishing its past monopolistic behavior.

Today at a glance:

⚖️ Google's Judgment Day

☁️ Salesforce's AI Story: Hype vs. Reality

⚖️ Google's Judgment Day

Federal Judge Amit Mehta ruled that Google did break antitrust law, but he didn’t swing the breakup hammer. Instead of corporate surgery, he prescribed a series of targeted changes.

What Judge Mehta ordered

It was less about dethroning Google and more about preventing it from locking the gates to its kingdom.

No more golden handcuffs: Google can no longer sign exclusive deals that make it the only default search engine. Think of this as the "you can't pay to keep everyone else out" rule. They can still pay partners like Mozilla to be the preferred default, but those partners are now free to promote rivals.

Sharing search data: This is the big one. Alphabet must share some user search and interaction data with rivals. The goal isn't to give away the secret sauce, but to provide competitors with the raw ingredients they need to train their own AI models and refine their products. It’s a major step toward leveling the playing field.

What he didn’t order

The most significant news was what didn't happen. For shareholders, no news was good news.

No breakup: The doomsday scenario—selling off Chrome or parts of Android—is officially off the table. This was the market's biggest fear, and its removal sent a wave of relief through Alphabet’s stock.

The power of default remains: The court did not order "choice screens," which would force phones to ask users "Which search engine do you want?" upon setup. This is a massive win for Alphabet, as some experts during the trial suggested ~90% of users stick with the default.

The $20+ billion handshake survives

Then came the ruling on Traffic Acquisition Costs (TAC)—the mountain of cash Alphabet pays Apple ($20+ billion a year!) to be the default search on Safari.

The payments can continue. While the court put some new guardrails in place, the core of this critical partnership remains intact. This deal is the single most important distribution channel for the search giant, and keeping it preserves the company's search moat. The news is also significant for Apple's high-margin Services revenue, of which the Alphabet payment represents ~20%. So it’s no surprise that both GOOG and AAPL surged on the news.

TAC is part of Alphabet’s cost of revenues and reached $14.7 billion in Q2 alone, as visualized in our latest earnings review.

So what's next on the docket?

This saga isn't over.

Appeals are coming: Expect both sides to appeal this ruling, a process that could end up at the Supreme Court. While the data-sharing order may set a powerful new precedent for future antitrust cases against Apple and Meta, the judge's strong reluctance to break up Alphabet signals that this option is likely off the table for other tech giants.

The other lawsuit: Don't forget, Alphabet is still facing a completely separate antitrust case focused on its ad-tech business. That trial is another beast entirely, and divestitures are still very much on the table there.

The bottom line: Alphabet won a major battle by avoiding a breakup, but the regulatory war on Big Tech is far from over, and AI challengers are waiting to rush in.

☁️ Salesforce's AI Story: Hype vs. Reality

Salesforce (CRM) just posted another solid quarter, with expanding margins across the board. But beneath the surface, a crucial question looms:

Can AI re-accelerate revenue growth and defend the moat?

Let's break it down.

A solid beat driven by discipline

Current RPO (next-12-month backlog) grew 11% Y/Y to $29.4 billion.

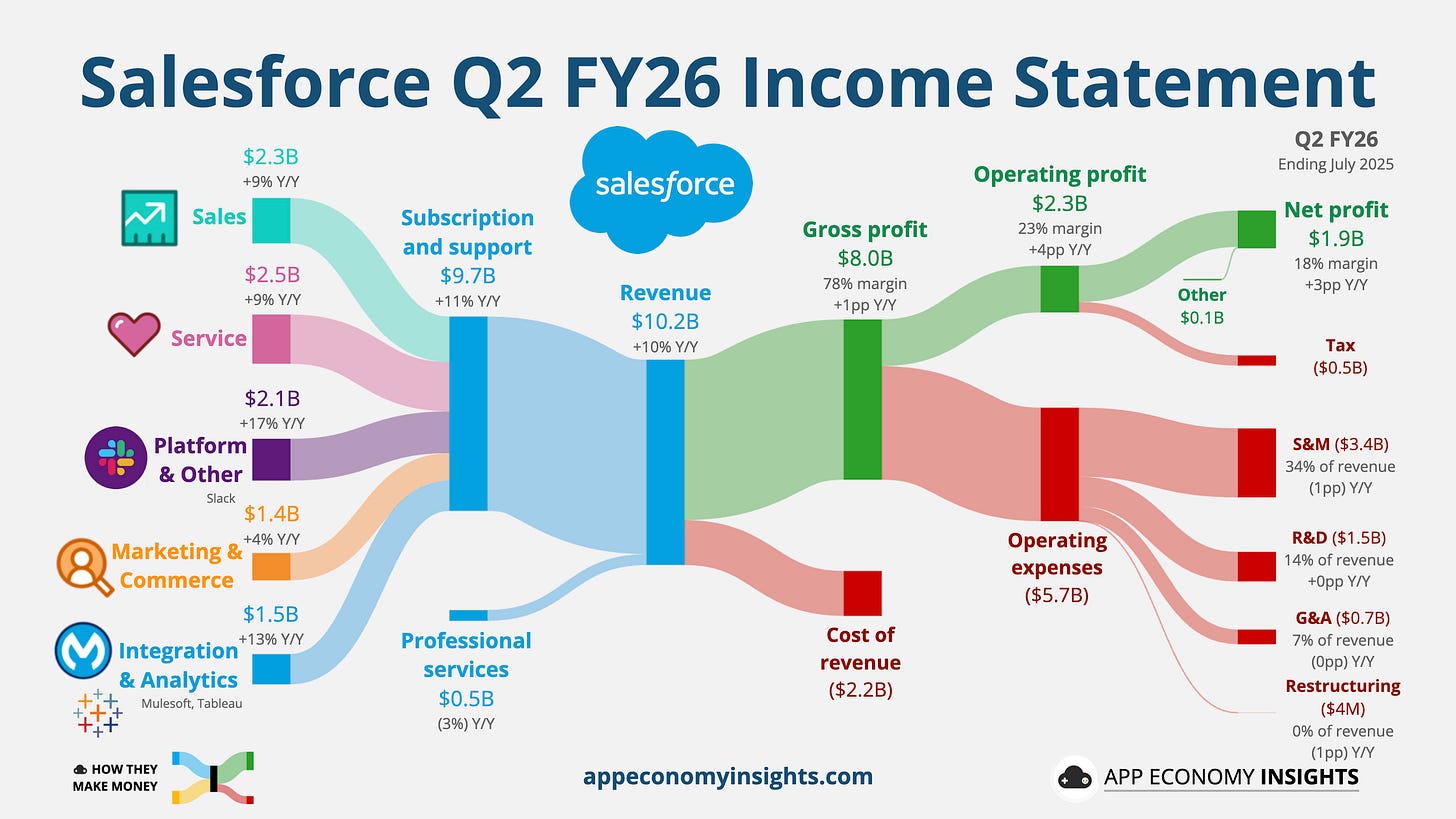

Revenue rose 10% Y/Y to $10.2 billion ($100 million beat).

Operating profit: $2.3 billion at 23% margin (+4pp Y/Y).

Non-GAAP EPS: $2.91 ($0.13 beat).

FY26 Guidance (mid-range): +9% Y/Y to $41.2 billion ($50 million raise).

Capital returns: Buyback authorization was lifted by $20 billion to $50 billion.

The July quarter cleared expectations on revenue, margins, backlog, and EPS. But it wasn’t quite enough to impress the market, with a mostly unchanged FY26 outlook, and the cRPO cadence didn’t scream re-acceleration. Analysts wanted a cleaner inflection in new business.

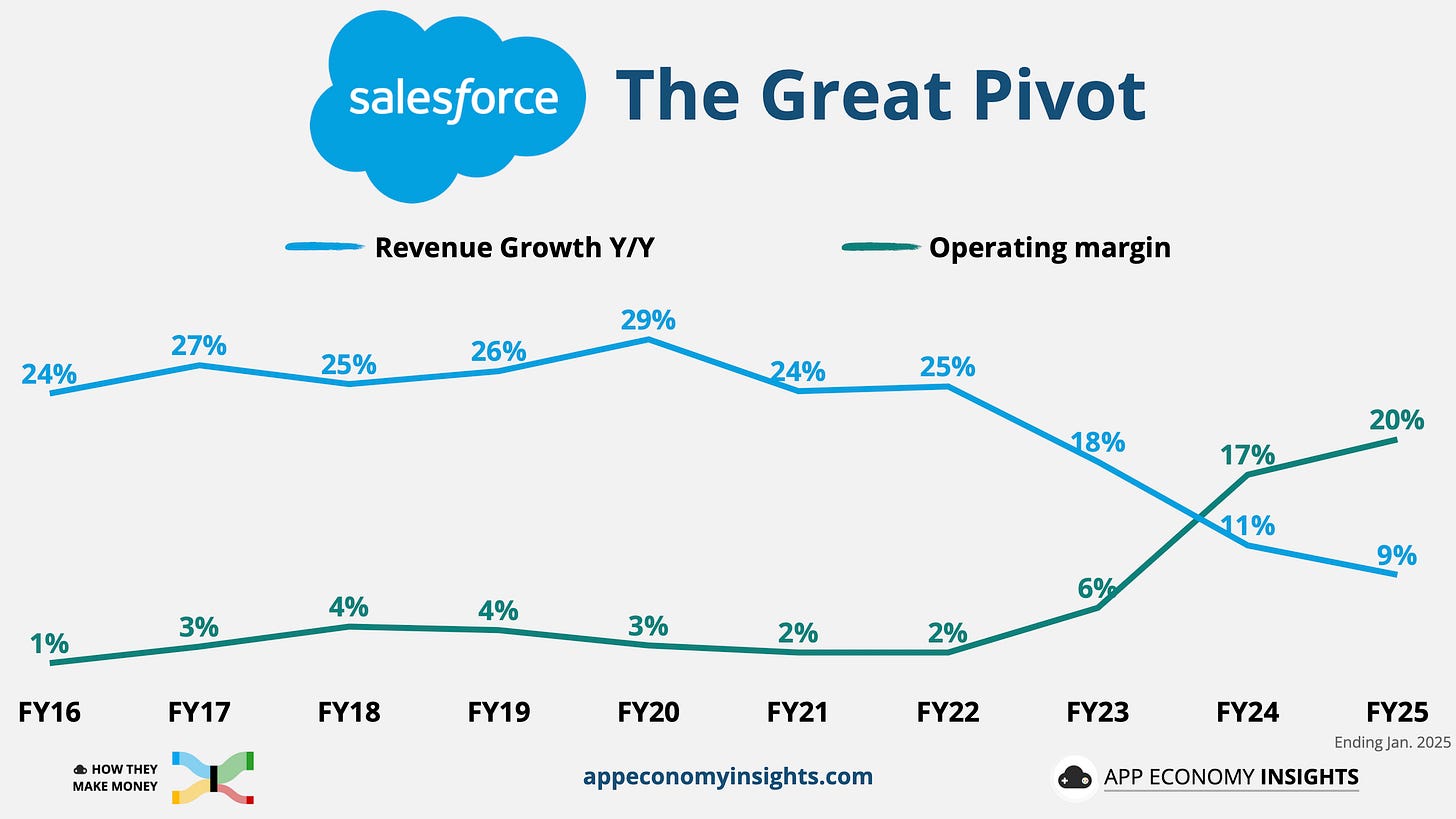

Salesforce’s operating margin has greatly improved in recent years, but it has come at a cost, with revenue growth dropping to only 9% Y/Y in the latest fiscal year.

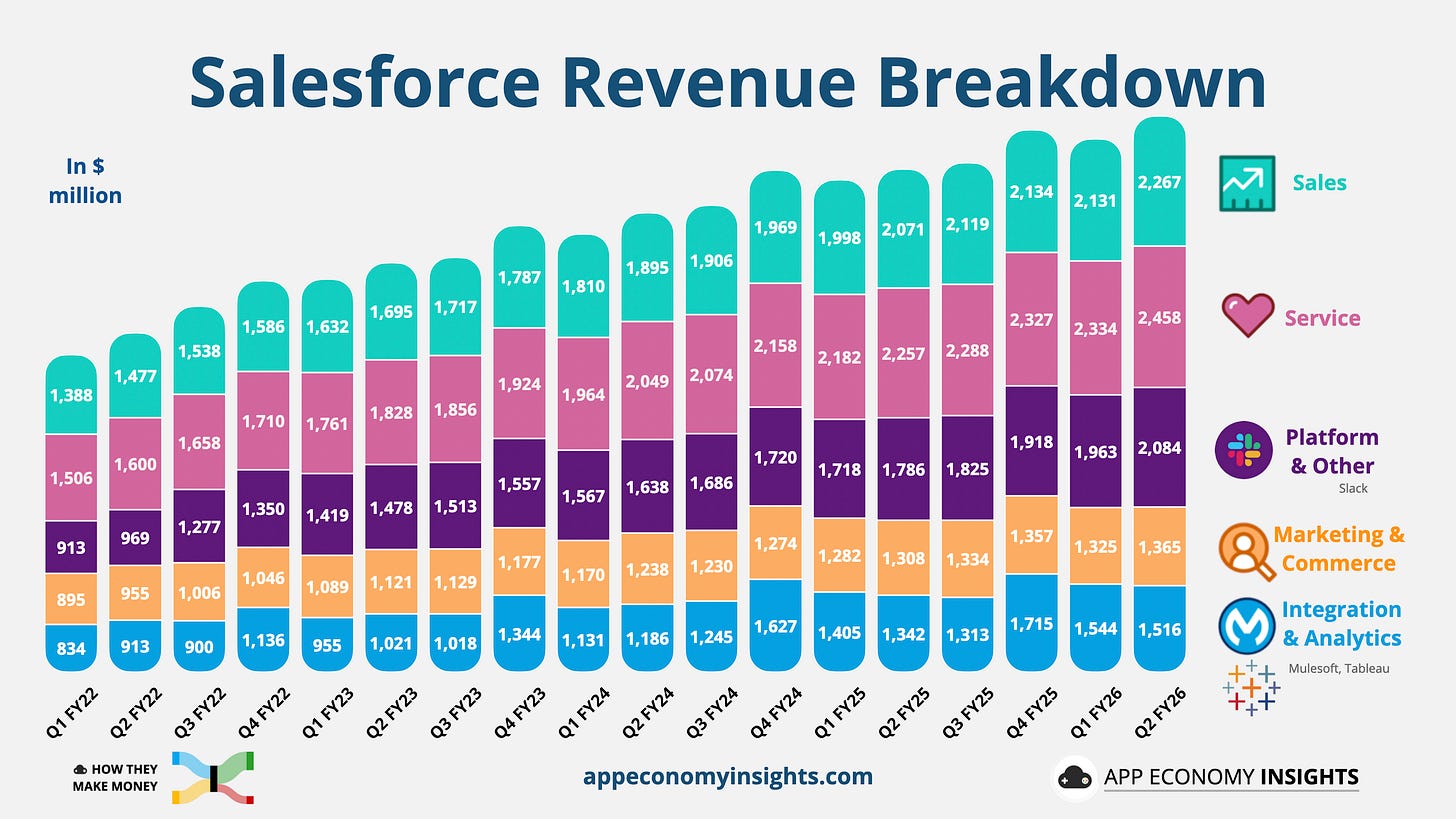

While Platform (including Slack) and Integration & Analytics (MuleSoft, Tableau) remain the fastest-growing segments, the more mature clouds have slowed to single-digit growth.

📈 Sales: $2.3 billion (+9% Y/Y).

💜 Service: $2.5 billion (+9% Y/Y).

🧩 Platform & Other: $2.1 billion (+17% Y/Y).

🛍️ Marketing & Commerce: $1.4 billion (+4% Y/Y).

🔗 Integration & Analytics: $1.5 billion (+13% Y/Y).

AI reality check

The Data and AI tailwind is real, but pacing and scale matter:

Data Cloud and AI ARR reached over $1.2 billion, up 120% Y/Y (no slowdown). It was up from “over $1 billion” in Q1 FY26.

Agentforce has reached over 12,500 total deals (up from 8,000 in Q1), of which over 6,000 are paid since launch (up from 4,000 in Q1), with strong pilot-to-production trends.

There was no fresh Agentforce ARR update beyond May’s ~$100 million figure, and management said adoption in large, regulated industries takes time. This is the crux of the debate. Customer adoption is accelerating, but the impact on paid contracts has been slower to materialize.

Management signaled deeper moves into the public sector as well as IT service management, which would bring more head-to-head competition with ServiceNow (NOW), something to monitor into 2026.

While Data Cloud and AI are growing fast, the $1.2 billion ARR figure is only 3% of Salesforce’s projected FY26 revenue.

SaaS defensibility in the agent era: Bears argue AI agents could compress per-seat SaaS over time. Management pushed back directly, explaining that customer workflows still live inside CRM, and AI is being embedded rather than replacing the suite.

All eyes on Dreamforce

The upcoming Dreamforce conference will be a key catalyst to get more insights on Agentforce (monetization, attach rates, and concrete customer wins). The company needs to prove that its new AI tools are not just features, but essential drivers that can re-accelerate growth across its entire portfolio.

With the blockbuster $8 billion acquisition of Informatica set to close later this year, Salesforce is making its biggest bet yet on helping customers consolidate messy data pipelines—a key bottleneck for AI adoption.

The big question at Dreamforce will be whether the AI story is compelling enough to convince customers to spend more. Without a stronger bookings uptick, AI won’t yet read as a significant top-line accelerant. For now, Salesforce’s story is one of rising profits and cash flow as AI builds its revenue runway.

That’s it for today!

Stay healthy and invest on.

Want to sponsor this newsletter? Get in touch here.

Disclosure: I own AAPL, CRM, GOOG, META, and NOW in App Economy Portfolio, our investing service, where we identify and accumulate shares of exceptional companies—from fast-growing disruptors to proven cash machines.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or the views of any other organization.