📊 PRO: This Week in Visuals

HD BABA PDD CRWD DELL SNOW MRVL ADSK VEEV AFRM MDB OKTA BBY ESTC S

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

👷 Home Depot: Small Projects Strength

🇨🇳 Alibaba: Cloud Accelerates

📦 PDD: Stimulus Softens the Blow

🦅 Crowdstrike: ARR Rebound

💻 Dell: AI Server Strength

📶 Marvell: Guidance Disappoints

❄️ Snowflake: AI Tailwind Accelerates

🏗️ Autodesk: Raise on AECO Strength

🧑⚕️ Veeva: Still Beating and Raising

🌈 Affirm: Turning Profitable

🌱 MongoDB: Atlas Accelerates

🔐 Okta: Long-Term Deals Shine

🛒 Best Buy: Sales Rebound

🔍 Elastic: Raising the Low Bar

👁️ SentinelOne: ARR Hits One Billion

1.👷 Home Depot: Small Projects Strength

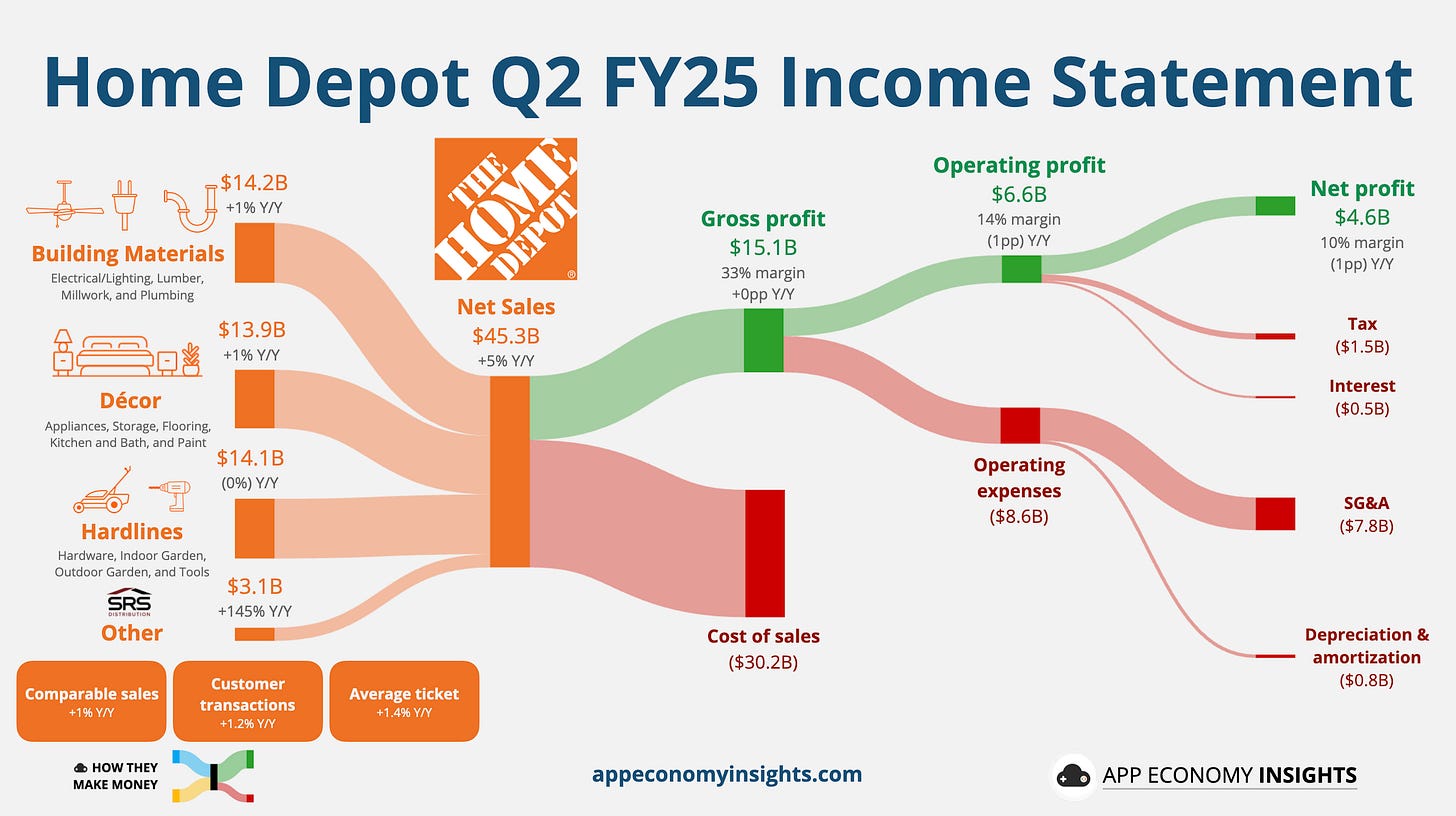

Home Depot’s Q2 revenue rose 5% Y/Y to $45.3 billion (in-line), while adjusted EPS was $4.68 ($0.01 miss). Most of the growth came from the “Other” segment following the SRS acquisition last year.

Comparable sales grew 1.0% (below expectations), with US comps up 1.4% and strength in smaller projects like lighting, gardening, and everyday repairs. Transactions declined 0.4% but the average ticket increased 1.4%. Online sales climbed about 12%, and 12 of 16 merchandising departments posted positive comps. Both DIY and Pro spending improved, July US comps ran above 3%, and management said customers are deferring—not canceling—large projects.

Home Depot reaffirmed its full-year guidance for a full-year sales growth of nearly 3%, comparable sales growth of about 1%, and adjusted EPS down roughly 2%. Tariffs will trigger modest price increases in select categories later this year (about half of products are US-sourced), and Home Depot is accelerating supply-chain diversification.

The Pro ecosystem remains a priority as SRS integration drives revenue synergies, and the pending $4.3 billion GMS acquisition is expected to expand specialty building-products capabilities. Management sees potential upside if mortgage rates ease, but its outlook does not assume a near-term rebound in big, financed remodels.

2. 🇨🇳 Alibaba: Cloud Accelerates

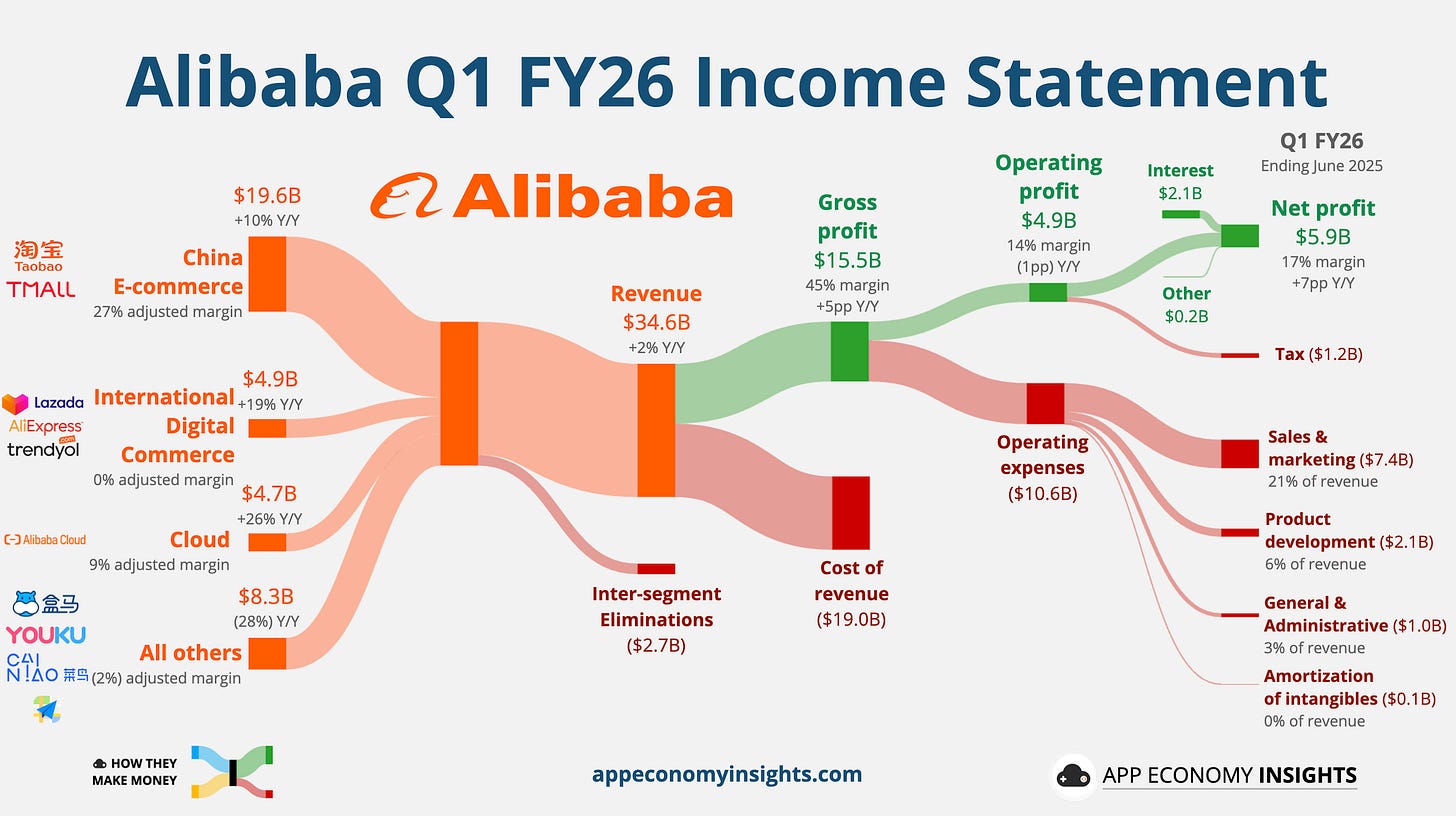

Alibaba’s June quarter revenue rose 2% Y/Y to $34.6 billion ($0.9 billion miss), while non-GAAP EPADS was $2.06 ($0.10 miss). On a like-for-like basis, excluding the Sun Art and Intime disposals, revenue would have grown about 10% Y/Y.

China e-commerce revenue increased 10%, and Cloud accelerated 26% Y/Y (from 18% Y/Y in the prior quarter), with AI-related product revenue posting an eighth straight quarter of triple-digit growth. Operating margin declined slightly to 14% and adjusted net income fell 18% amid heightened investment, even as reported net profit benefited from investment gains and a disposal.

Management leaned into two priorities: AI and instant/quick commerce. Cloud momentum is being driven by Qwen models and AI services, while rapid-commerce investments boosted user and order activity but pressured margins amid an industry price war with JD and Meituan. International commerce grew 19% Y/Y, helping diversify growth.

The setup is mixed near-term. AI and cloud are gaining share, but competition and deflationary pressures in local e-commerce weigh on profitability. It leaves execution on AI monetization and disciplined spending as the key catalysts ahead.