🪙 How Bullish Makes Money

The "institutional Coinbase" just had a red-hot IPO

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

🪙 The “institutional Coinbase” has investors intrigued

The recent IPO Bullish (BLSH) has been one of the most requested breakdowns from readers. And for good reason. Bullish is building the rails for digital assets, and it just proved the point by taking its IPO proceeds in stablecoins.

The company pairs an exchange with indices, data, and media, which is a different playbook than most crypto venues. Most exchanges sell trades. Bullish also sells the information that powers funds and products.

The Peter Thiel–backed exchange also drew interest from ARK Invest's Cathie Wood, who bought into the IPO.

The debut was wild. Starting from an IPO price of $37, the stock more than tripled to $118 and has since settled near $65.

I have held Bitcoin and Ethereum for nearly a decade and invested in Coinbase in 2022, rode the roller coaster, and learned a lot about how this category trades across cycles.

Bullish, which also owns CoinDesk, is not a simple exchange story. Its accounting is unusual, with market swings that can move earnings sharply.

I went through the 300+ pages of Bullish’s F-1 so you don’t have to.

Today at a glance:

Overview

Business Model

Financial highlights

Risks & Challenges

Management

Use of Proceeds

Future Outlook

Personal Take

1. Overview

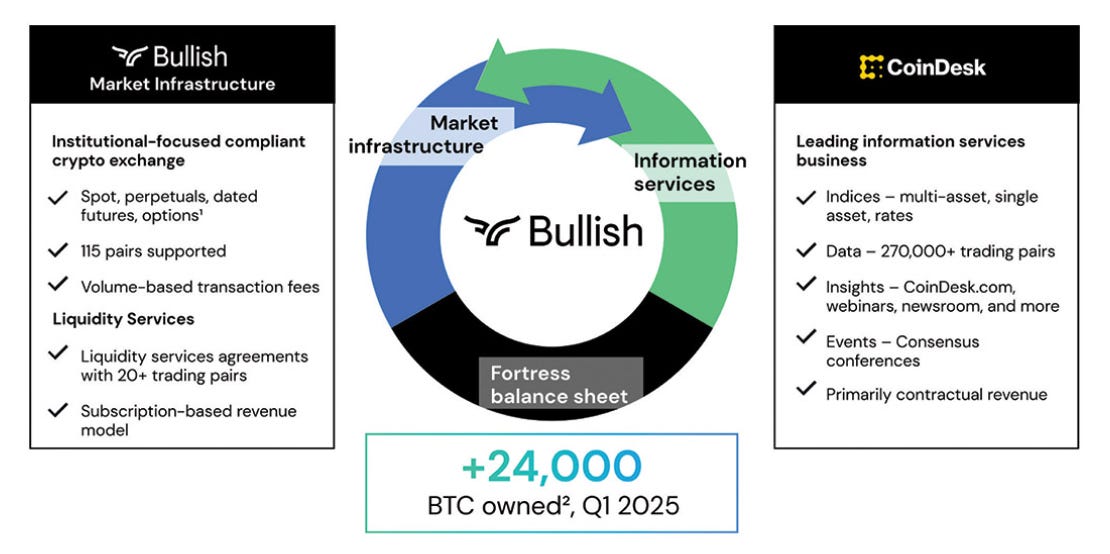

Bullish builds market infrastructure and information services for digital assets. It bundles execution, data and indices, and media and events under one roof.

The company listed on August 13, 2025, at $37 per share. It sold 30 million shares and raised about $1.1 billion.

The company is led by CEO Tom Farley, a former president of the New York Stock Exchange.

Legal headquarters are in the Cayman Islands, and major operations are in Hong Kong, Germany, Gibraltar, and the United States.

What Bullish actually does

Exchange (Bullish): An institution-focused trading venue for spot, margin, and derivatives. Its matching engine pairs a traditional central-limit order book with a regulated automated market maker (AMM) that programmatically posts thousands of bids. The exchange aims at deep, predictable liquidity and tight spreads. The company’s core differentiators include a single global order book, capital-efficient unified/cross-collateralized margin, and optional subscription-based liquidity & stablecoin services for clients.

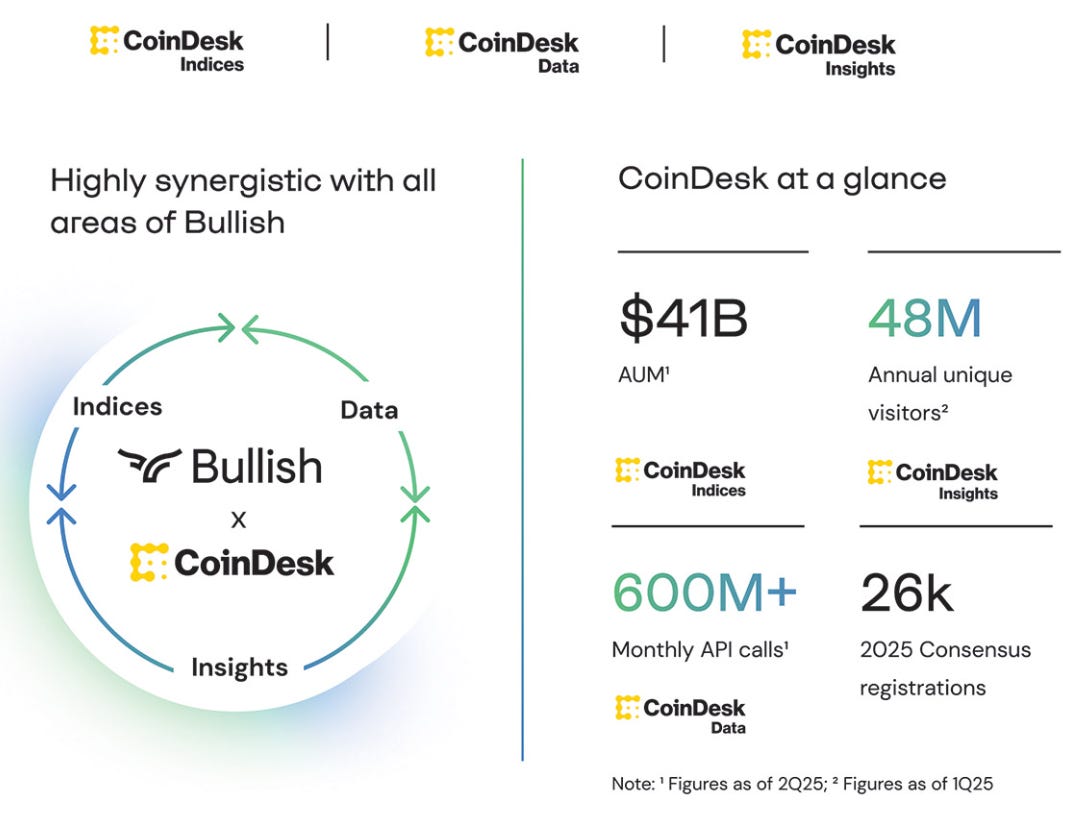

Data and Indices (CoinDesk). CoinDesk supplies the official prices funds use for NAVs and settlements, the rule-based baskets that issuers use to launch ETFs and other products, and the data feeds investors use to backtest and rebalance strategies.

Media & Events (CoinDesk / Consensus). Global newsroom and conferences used by policymakers, builders, and investors.

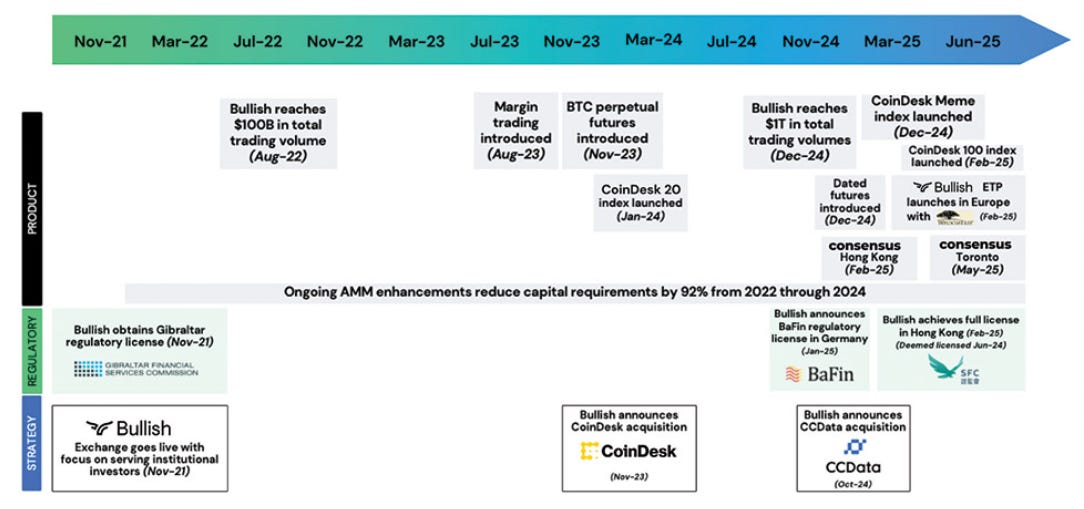

Milestones at a glance (Nov 2021–Jun 2025)

From launch to today, Bullish has built an institutional exchange, then layered on margin, perpetuals, and dated futures while winning key licenses and cutting AMM capital needs by 92%. Along the way, it acquired CoinDesk and CCData, adding media, indices, and market data that feed the trading business.

CoinDesk gives Bullish distribution and data. Its indices anchor about ~$41 billion of AUM (assets under management) (with ~$21 billion tied to XBX, its Bitcoin benchmark) and ~$15 billion of related trading volume. The site reaches about 48 million people a year, and its data handles more than 600 million API calls a month. Its flagship conference, Consensus, drew over 26,000 registrations in 2025 as the brand expands internationally.

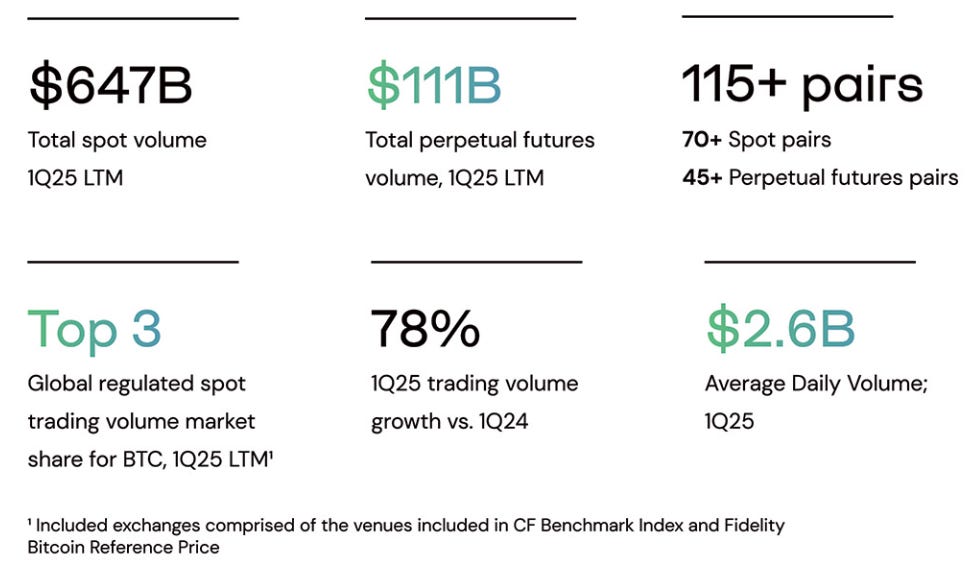

Proof points

Since launch, cumulative trading volume on Bullish exceeded $1.25 trillion by March 2025. Recent average daily trading volume has been ~$2.6 billion.

Within Bullish’s own peer set of comparable exchanges, 2024 spot volume reached about $285 billion in BTC and $145 billion in ETH, equal to about 35% and 44% share in that group.

Regulated footprint

Bullish operates within multiple regimes, notably in Hong Kong where its unit holds Type 1 (dealing in securities) and Type 7 (automated trading services) licenses and a VASP authorization. It also maintains permissions in Germany and Gibraltar as it expands across jurisdictions.

Why this IPO matters

Bullish combines execution, benchmarks and data, and media and events in one platform, which gives institutions a wider toolkit than a stand-alone exchange. They are also sending a strong signal to the market by taking the IPO proceeds in stablecoin.

2. Business Model

Bullish makes money in two big ways:

First, it runs an exchange where institutions pay trading fees.

Second, it sells information services that other financial firms use every day.

Trading economics

This is the core engine.

Spot trades: Clients buy or sell the actual asset at the market price. Bullish charges trading fees and earns a spread when its automated market maker helps fill the order book.

Margin and derivatives: Eligible clients post collateral and trade with leverage. Bullish charges trading and financing fees. Because the platform programmatically provides liquidity, gains and losses from those positions also flow through the income statement.

Liquidity and stablecoin services: Some clients pay a subscription so Bullish stands ready with inventory in a specific asset or stablecoin when they need it.

Unified margin account: Clients keep one pool of collateral that covers spot, margin, and futures. Cross-collateral means less idle capital and more trading, which is good for volumes and fees.

Who uses the exchange?

Fund managers, market makers, proprietary trading firms, and retail brokerages that route flow on behalf of their users. They connect by API, post collateral, and trade across a single global order book.

Information services

This is the second engine, and it is less tied to day-to-day market swings.

Indices: CoinDesk Indices licenses benchmarks like XBX and the CoinDesk 20 to ETF issuers and banks. License fees are usually linked to assets under management or to product usage.

Data: CoinDesk Data sells real-time and historical feeds, research, and APIs to investors and trading firms. Customers pay subscriptions or service fees.

Media and events: CoinDesk sells advertising and sponsorships and runs the Consensus conferences, which generate ticket and sponsorship revenue.

The Bullish Flywheel

Indices and data create the reference prices that issuers and traders rely on, which nudges activity back to the exchange.

News and events keep Bullish in front of decision-makers, which lowers the cost of customer acquisition.

Exchange listings and liquidity make the indices and data more useful. That supports more licensing and API demand.

What to watch in the model

Mix: A higher share of derivatives and margin tends to lift fees per dollar traded.

Balance-sheet exposure: The platform supplies liquidity, so marks on inventory and derivatives can move reported profit even when volumes are strong.

Cross-sell: The long game is one customer using two or more products. A fund that trades on Bullish, licenses an index, and takes a data feed is far more valuable than a single-product relationship.

That’s Bullish in a nutshell. An exchange that monetizes trading and balance-sheet liquidity, paired with an information stack that monetizes benchmarks, data, and audience.

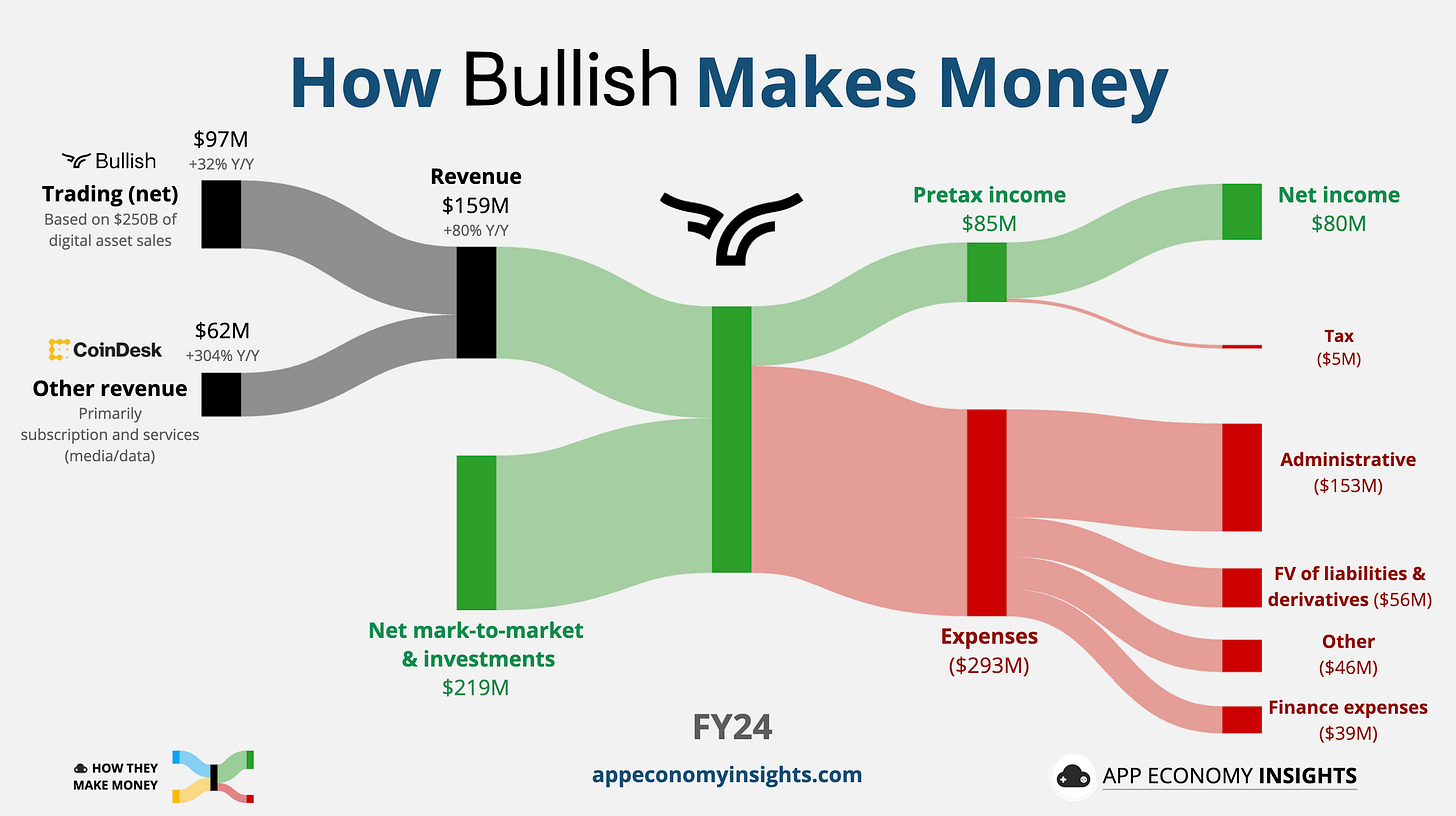

3. Financial Highlights

Bullish’s income statement does not look like a typical software P&L.

It mixes operating revenue with large mark-to-market gains and losses from digital assets and related instruments. That can make any single quarter noisy. Looking at the full year FY24 is a cleaner read to break down the business.

This P&L was very confusing to me at first, so let’s walk through it together.

Here are the most critical KPIs and what they actually mean: