📊 PRO: This Week in Visuals

BABA HD ADI WDAY DELL ZS ZM HPQ ADSK NTNX NIO BBY

Welcome to the Saturday PRO edition of How They Make Money.

Over 250,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO members get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🇨🇳 Alibaba: Cloud Pops While Profit Drops

👷 Home Depot: Macro Slowdown

⚙️ Analog Devices: Cyclical Recovery

👔 Workday: AI ARR Accelerates

💻 Dell: AI Server Orders Hit Record

☁️ Zscaler: AI Security Explodes

🖥️ Zoom: AI Platform Transition

🖨️ HP: Job Cuts & Soft Guidance

🏗️ Autodesk: AECO Dominance

☁️ Nutanix: Revenue Timing Slips

⚡️ NIO: Margin Rebound

🛒 Best Buy: Marketplace Accelerates

FROM OUR PARTNERS

Don’t miss Fiscal.ai at 30% off!

Fiscal.ai is my favorite place to research new stock ideas from scratch.

Unlimited data on 100k companies.

Compare companies head-to-head.

Manage watchlists and dashboards.

Largest segment & KPI database in the world (2,300+ stocks).

They only run two sales per year, so you won’t want to miss this!

Fiscal.ai is our data partner, so our readers already get 15% off their paid plans. And this Cyber Week, you get an even larger discount of 30% off all their paid plans!

But don’t wait! The discount is only valid until Monday.

The 30% discount will be automatically applied at checkout.

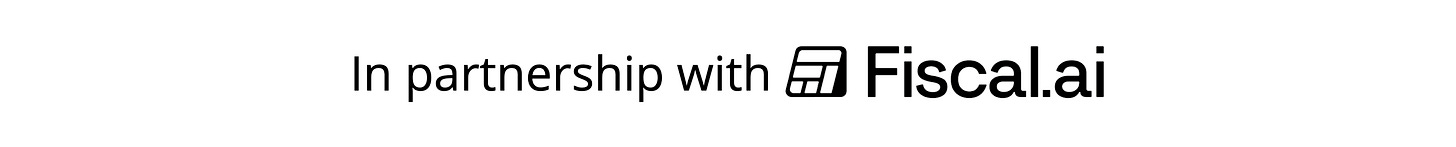

1. 🇨🇳 Alibaba: Cloud Pops While Profit Drops

Alibaba’s Q2 revenue rose 5% Y/Y to $34.8 billion ($570 million beat). Excluding disposed businesses, like-for-like revenue growth was 15% Y/Y. However, the company missed earnings estimates, and non-GAAP net income fell 71% Y/Y. This plunge was driven by aggressive spending on quick commerce subsidies and user experience. Sales & marketing expenses rose from 14% to 27% of revenue.

The core story is now divided into two accelerating segments:

Cloud Intelligence Group: Revenue grew 34% Y/Y (accelerating from 26% in Q1). AI-related product revenue posted its ninth consecutive quarter of triple-digit growth and now represents over 20% of external cloud revenue.

China e-commerce: Revenue grew 16% Y/Y. Customer Management Revenue (CMR) grew 10%, supported by improving unit economics in the quick commerce business, which saw its loss per order reduced by 50% sequentially.

Management stated it has entered an “investment phase” to build long-term value in AI and consumption platforms, noting that current AI infrastructure demand is outstripping supply (sounds familiar?). The quick commerce investment is expected to have peaked in the September quarter, and the company will continue to sacrifice short-term profits for long-term strategic growth. Alibaba’s Qwen AI app also gained over 10 million users in its first week of public beta, an encouraging move into consumer AI.

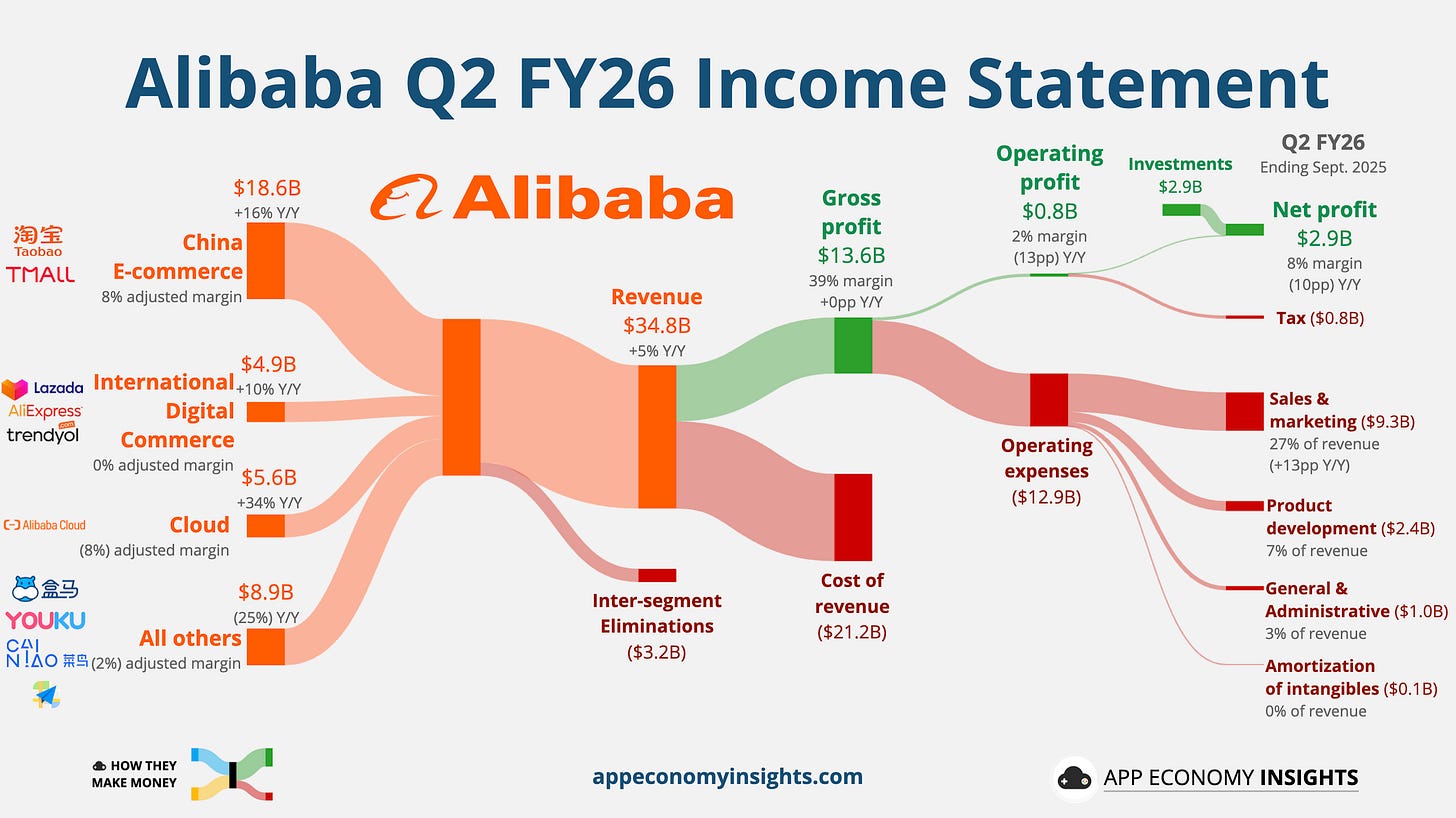

2.👷 Home Depot: Macro Slowdown

Home Depot just dropped its 10-Q earlier this week. Q3 revenue rose 3% Y/Y to $41.3 billion ($230 million beat), primarily due to the acquisition of GMS in October, contributing ~$0.9 billion in sales. Non-GAAP EPS was $3.74 (a $0.09 miss).

Comparable sales grew only 0.2% (missing the expected 1.4% growth), with US comps up a modest 0.1%. Transactions declined 1.6%, offset by a 1.8% rise in the average ticket.

The miss was attributed to two main factors: a lack of storm activity (which usually boosts certain repair categories) and continued weakness from consumer uncertainty and housing market pressure that is disproportionately impacting large, financed remodels.

Management cut its full-year FY25 adjusted EPS guidance (now expected to decline 5% Y/Y, worse than the prior 2% decline), while slightly raising the revenue target (now roughly $3% growth) due to the inclusion of the GMS sales. The outlook remains cautious, as the company sees no near-term catalyst for an acceleration in big-ticket demand, focusing instead on pro customer momentum and the long-term fundamentals.