📊 PRO: This Week in Visuals

WMT PDD INTU PANW NTES VEEV TGT LENOVO AS KLAR ESTC GLBE BLSH

Welcome to the Saturday PRO edition of How They Make Money.

Over 250,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO members get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🛒 Walmart: E-Commerce Surges

📦 PDD: Headwinds Ahead

✅ Intuit: OpenAI Integration

🔒 Palo Alto: AI Brings Customer Wins

🎮 NetEase: Mixed Beyond Gaming

🧑⚕️ Veeva: AI Platform Deepens Moat

🎯 Target: Digital Push

💻 Lenovo: AI Demand Sets Records

⛷️ Amer Sports: Arc’teryx Re-accelerates

💳 Klarna: Fair Financing Drives GMV

🔍 Elastic: AI Drives Adoption

🛍️ Global-e: Profitable Scale

🪙 Bullish: Institutional Pivot

1. 🛒 Walmart: E-Commerce Surges

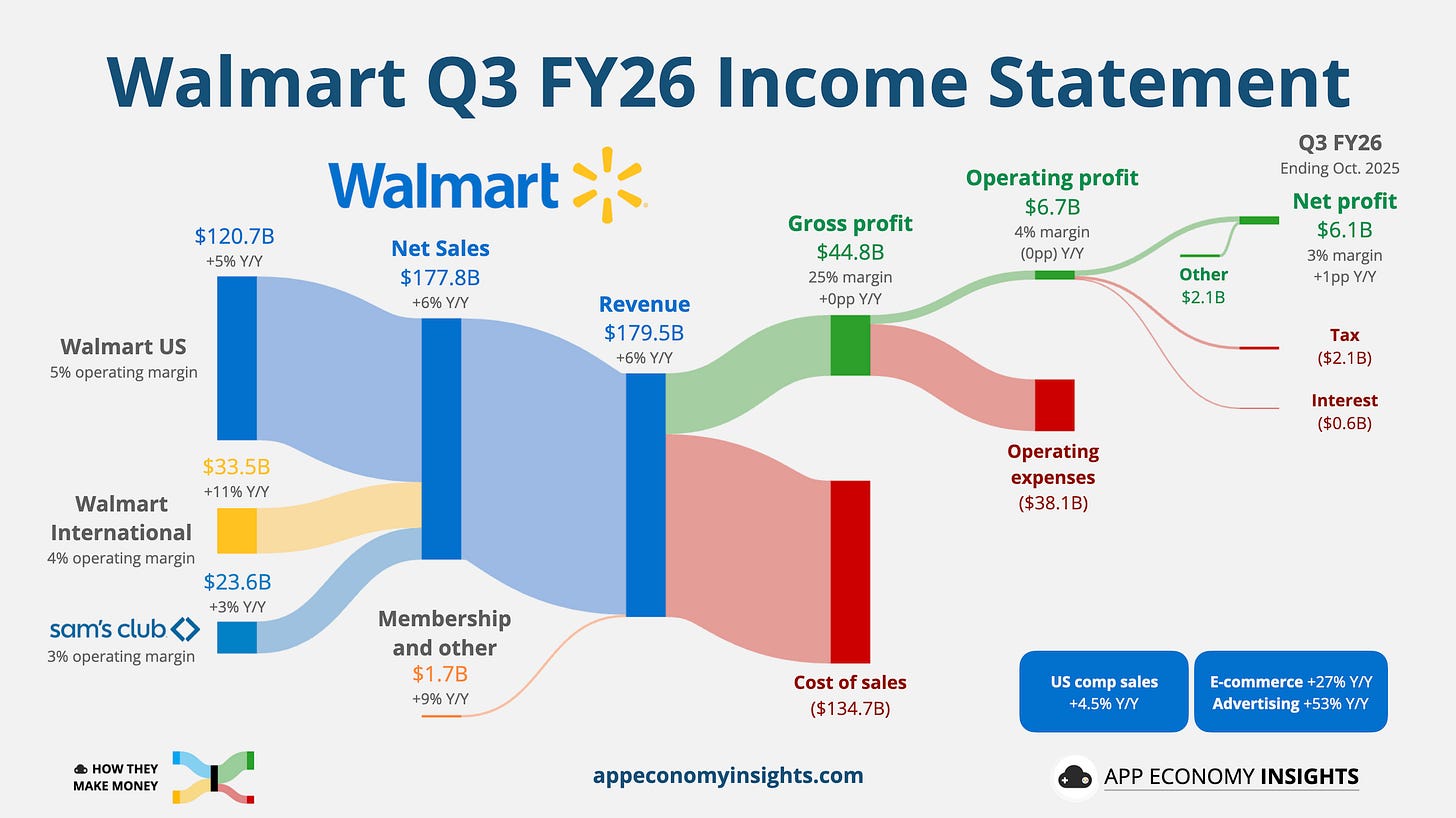

Walmart sales grew 6% Y/Y to $179.5 billion ($4.3 billion beat) and GAAP EPS of $0.62 ($0.02 beat) for its October quarter (Q3 FY26).

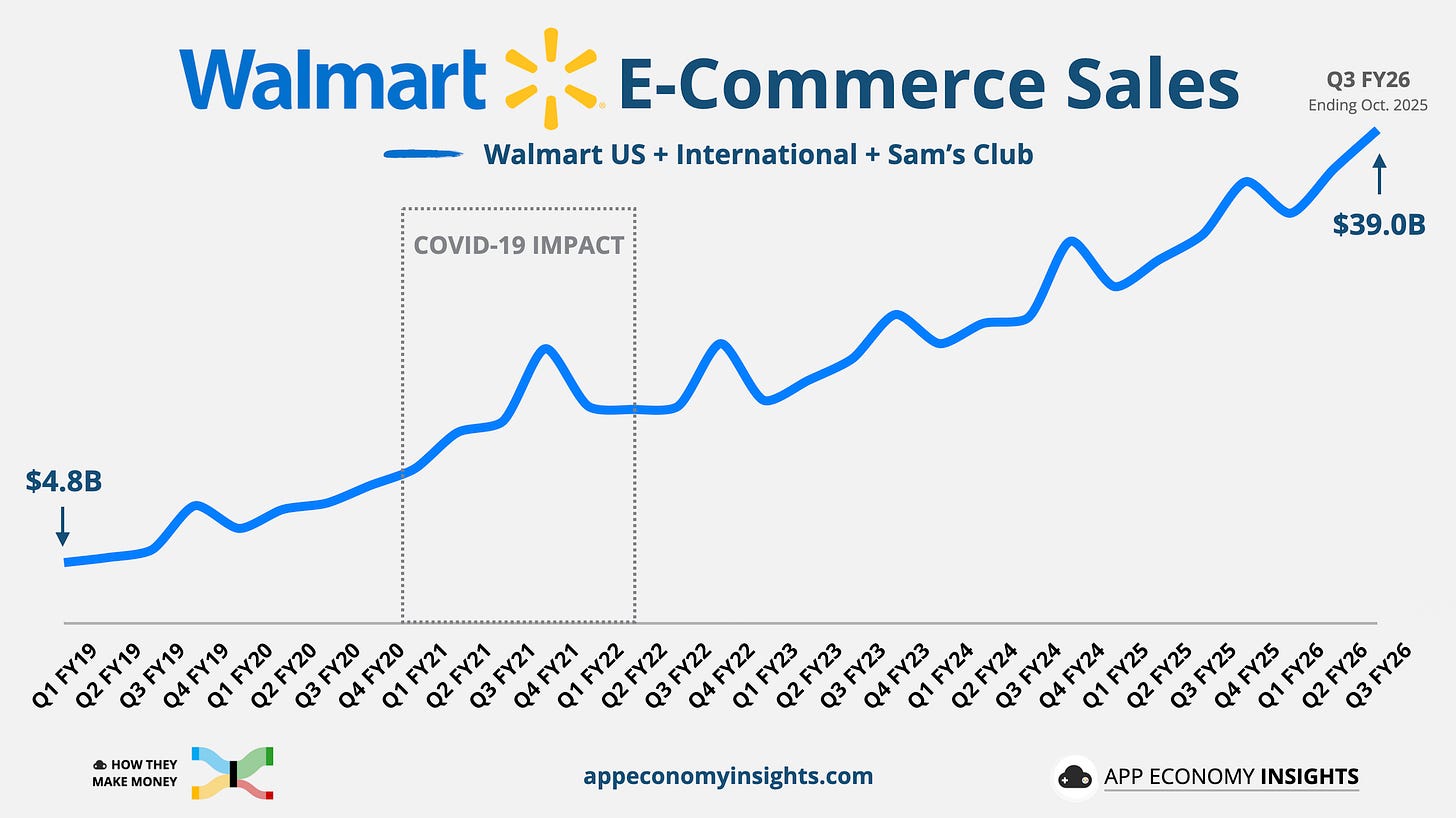

Walmart US comps rose 4.5%, and international sales were up 11% in constant currency. Once again, e-commerce took the cake, up 27% globally, with all online segments growing over 20%. Higher-income shoppers, strong grocery momentum, and improving general merchandise all contributed. E-commerce sales now represent nearly 22% of Walmart’s revenue.

Advertising surged 53% Y/Y globally (including Vizio), and membership revenue grew 9%, boosting gross margin.

Adjusted operating income rose 8% in constant currency, and year-to-date operating cash flow hit $27 billion. Walmart reiterated that disciplined inventory, lower shipping costs, and smarter assortment management helped offset tariff-related cost pressure.

Management raised full-year guidance, now expecting 4.8%–5.1% sales growth (up from 3.75%–4.75% previously), with FY26 EPS of $2.58–$2.63 (up from $2.52 to $2.62). The quarter also marked a major transition with US chief John Furner stepping in as CEO in February 2026, as CEO Doug McMillon entered his final quarter after transforming Walmart into a digital and AI-driven retailer.

While low-income consumers show mild moderation and category mix remains a margin headwind, Walmart continues to gain market share across income cohorts, integrate AI across operations, and expand its marketplace and delivery capabilities. The market approved with shares ticking up 5% post-earnings.

2. 📦 PDD: Headwinds Ahead

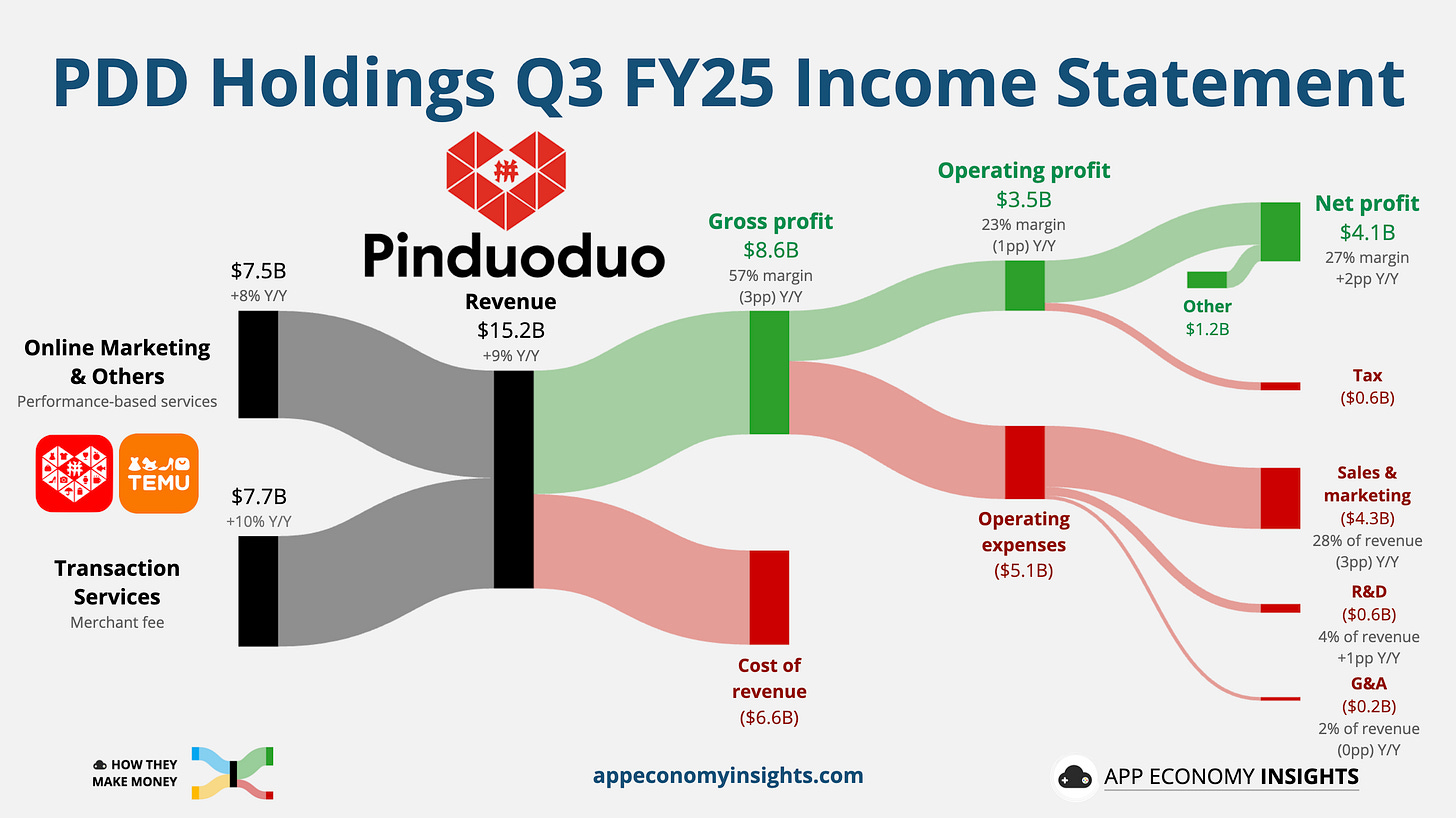

Temu’s parent, PDD Holdings, saw Q3 revenue rise 9% Y/Y to $15.2 billion ($90 million miss), continuing its slow pace amid a tough consumer environment in China. Looking at the growth by segment, Online Marketing Services (performance-based) grew 8% and Transaction Services (including merchant fees) rose 10%.

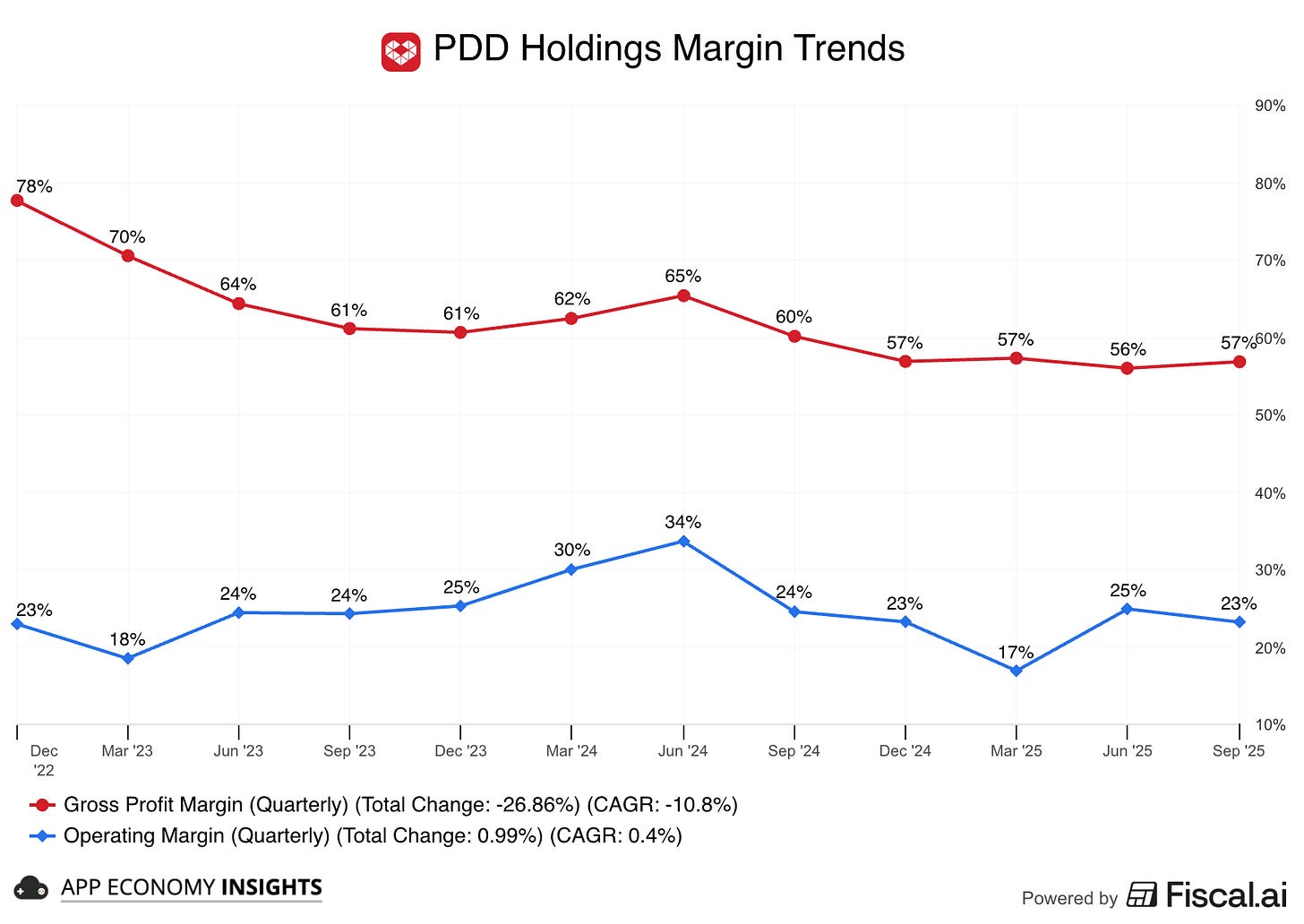

The group is aggressively investing in its ecosystem, deliberately sacrificing short-term profit. Higher fulfillment and processing costs continued to impact the gross margin. The operating margin compressed to 23% (from 24% a year ago). However, net profit still grew 17% to $4.1 billion, helped by lower marketing spend (28% of revenue, down from 31% a year ago).

PDD’s long-term investments continued with the “100 billion support program,” and R&D expenses surged 41%. Overseas, the Temu arm is stabilizing its US presence (monthly active users improved after a sharp Q2 plunge) but is now focused on expanding into Europe to offset the damage from the end of the US de minimis tax exemption.

Management reiterated that quarterly profitability will fluctuate and explicitly warned investors not to use Q3 results as guidance, emphasizing a strategic focus on building “intrinsic value” over short-term earnings. The balance sheet remains stellar, with cash and short-term investments reaching RMB 424 billion (~$60 billion), and barely any debt.