🍿 Netflix + Warner Bros. Breakdown

A seismic $83B deal that rewrites the entertainment landscape

Welcome to the Premium edition of How They Make Money.

Over 250,000 subscribers turn to us for business and investment insights.

In case you missed it:

Netflix has entered a definitive agreement to acquire the studio and streaming assets of Warner Bros. Discovery for an enterprise value of $83 billion.

The deal covers massive intellectual property. But more importantly, the acquisition transforms Netflix from primarily a streaming-only company into a true entertainment conglomerate, expanding its risk profile and strategic direction.

But it is far from a done deal. An FTC review is inevitable. President Trump has already weighed in, stating the acquisition “could be a problem.” Adding to the chaos, Paramount just launched a hostile takeover.

In a world where Microsoft can buy Activision Blizzard, the vertical nature of the Netflix-Warner merger could be a critical edge. Remember, HBO Max captures only ~1% of US TV time, making it the 9th largest streamer on TV, according to Nielsen. But it brings theatrical distribution and licensing muscles in which Netflix historically plays a small part.

Warner Bros. is actively for sale. Regulators may have a hard time arguing that a Netflix acquisition is worse for the industry than a Paramount or Comcast deal. In fact, those would be horizontal mergers between direct competitors (studio and networks), arguably more problematic.

Let’s unpack the deal, the drama, and the data.

Today at a glance:

What Netflix is buying

Netflix embraces leverage

The end of Build vs. Buy

The real value beyond IPs

Antitrust and execution risks

Who wins & who loses

FROM OUR PARTNERS

You’re not “rich enough” to waste $40,000 a year on fees

Most firms quietly take 1–2% AUM forever. On a $2 million portfolio, that’s $20k–$40k+ gone every single year — enough to fund a luxury car, a dream vacation, or an extra decade of retirement.

Range doesn’t play that game.

No AUM fees. Just one flat, transparent annual membership fee for unlimited access to a team of human financial advisors + 24/7 access to RAI, your AI wealth advisor. You get institutional-grade tools once reserved for billionaires: direct indexing, real-time tax-loss harvesting, daily rebalancing, and a single dashboard that unites your crypto, real estate, RSUs, and 401(k)s.

Built exclusively for high-earning households.

Your money compounds. Legacy fees don’t.

Disclosure: Not investment advice. Brokerage fees, transaction charges, and other applicable platform fees imposed by our custodian are not included in your membership and will be passed through to you as the Member. Visit www.range.com for details.

1. What Netflix is buying

The deal involves two steps for current Warner Bros. Discovery (WBD) shareholders expected in the next 12 to 18 months.

Step 1: The spin-off

Before the Netflix acquisition closes, WBD will spin off its linear networks business into a new, publicly traded independent company dubbed Discovery Global.

What it holds: The legacy cable portfolio (CNN, TNT, TBS, Discovery Channel, HGTV, Food Network) and digital assets like Bleacher Report.

For WBD shareholders: If you own WBD stock, you will receive a pro-rata distribution of shares in this new company. You effectively keep the linear business as a standalone investment.

Step 2: Netflix acquires the rest

Netflix will acquire the remaining entity:

What it holds: Warner Bros. Pictures, Warner Bros. Television, DC Studios, HBO, and the HBO Max streaming platform. That includes coveted IPs like Harry Potter, Batman, Superman, Wonder Woman, Game of Thrones, The Lord of the Rings, Monsterverse (Godzilla/Kong), The Matrix, Looney Tunes, and an avalanche of prestige TV shows.

For WBD shareholders: Netflix purchases this streamlined company for $27.75 per share ($23.25 in cash + $4.50 in Netflix stock).

In short, Netflix buys the IP engine without inheriting the dying cable bundle.

Note that Paramount’s hostile takeover is at $30/share in cash for the entire company. With the value of the Networks segment estimated at ~$5/share, this is still short of Netlfix’s bid.

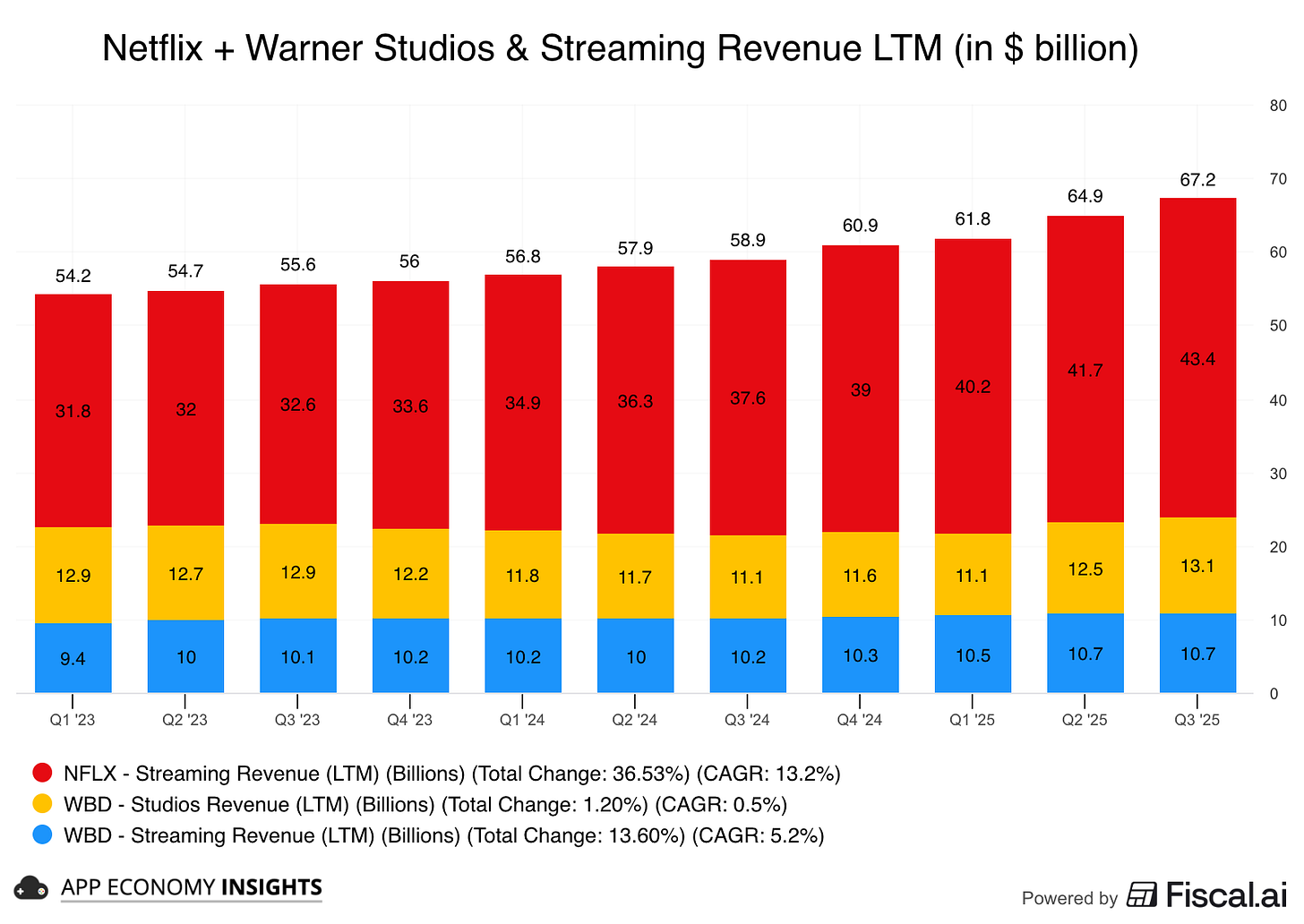

Here’s how the combined revenue would look:

Netflix made ~$43 billion in the last 12 months, still growing in the mid-teens.

Warner’s Studios and Streaming segments reached ~$24 billion over the same period, mostly flat in the past two years. The majority of revenue is coming from Studios, including theatrical, licensing, and gaming.

That puts the combined entity at ~$67 billion of annual revenue. Just barely ahead of YouTube, which has an estimated ~$60 billion annual run rate (ads + subscription).

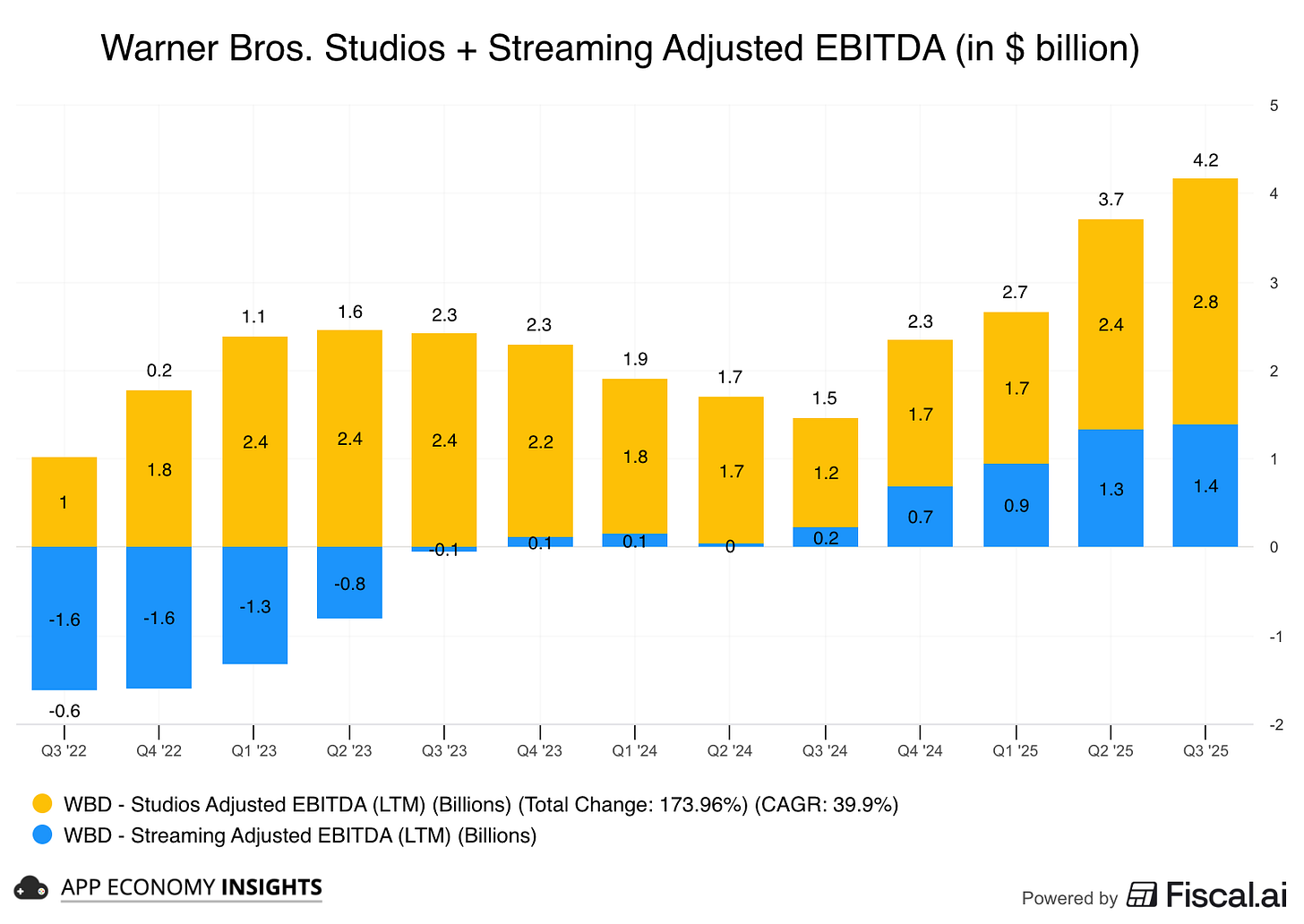

Turning to profitability, Warner’s Studios and Streaming segments achieved $4.2 billion in adjusted EBITDA in the past 12 months. Most noteworthy is the progress made in the Streaming segment as more cord-cutters switch to HBO Max (128 million subscribers globally in Q3). But the Studios segment can be hit or miss and depends on big new releases.

Valuation

At an enterprise value of ~$83 billion, Netflix is essentially paying ~20x EBITDA. It gets to 25x if we use Warner’s expected EBITDA of $3.3 billion for FY26. That’s a big premium for a no-growth business, as you would expect after a bidding war. For perspective, Disney is currently trading at ~12x EBITDA.

Critically, Netflix expects $2-to-3 billion in annual cost savings by year 3. If they can deliver on the high end of this goal, the valuation comes down to ~12x EBITDA and makes more sense.

In addition, there is a wide range of value that could be unlocked and not reflected in trailing financial metrics:

Netflix IPs get a publishing and distribution boost via vertical integration (potential theatrical releases, licensing, gaming).

Warner Bros. IPs get to reach over 300 million Netflix members, potentially unlocking a new fanbase for century-old franchises, fueling the rest of the flywheel (more on this in a minute).

A massive break-up fee

Netflix agreed to a massive $5.8 billion termination fee.

What this means: If regulators (DOJ/FTC) block the deal, Netflix must pay WBD $5.8 billion just for walking away.

The signal: This is one of the largest breakup fees in M&A history. Netflix is putting 8% of the deal’s equity value on the line (much higher than the typical 2% to 3% seen on other large deals), showing confidence they can get it done and convince regulators.

Meanwhile, if WBD shareholders vote down the deal or Warner takes a rival offer, there is a $2.8 billion reverse breakup fee. If Paramount makes another bid, it would be on the hook for that fee, making it less likely.