🚧 Wall Street Hits a Speed Bump

The Fed fight and a 10% rate cap cloud the outlook

Welcome to the Premium edition of How They Make Money.

Over 270,000 subscribers turn to us for business and investment insights.

In case you missed it:

A new earnings season is here!

As always, it starts with the big banks. 🏦

The banking sector’s final report card of 2025 has been largely overshadowed by the unprecedented clash in Washington. The DOJ launched a criminal investigation into Fed Chair Jerome Powell over headquarters renovation costs. This move is widely seen as a pretext to force aggressive rate cuts. Powell didn’t blink, issuing a defiant defense of central bank independence just months before his term expires.

But wait, there’s more! President Trump doubled down on his demand for a 10% cap on credit card rates by January 20. The proposal triggered an immediate sell-off in bank stocks, with lenders warning the move would force them to slash credit lines and eliminate rewards programs to stay profitable.

Against this chaotic backdrop, the latest earnings signaled that while the economic engine is humming, the gears are grinding. The much-anticipated explosion in dealmaking hit an air pocket as tariff anxieties pushed mergers into 2026, while rising costs and the sudden regulatory fears are weighing on valuations even as profits remain robust.

Let’s break down the results.

Today at a glance:

JPMorganChase: Apple Card Takeover

Bank of America: Equities Surge

Wells Fargo: Growing Pains

Citigroup: Transformation Takes Shape

The Big Picture

As a reminder, banks make money through two main revenue streams:

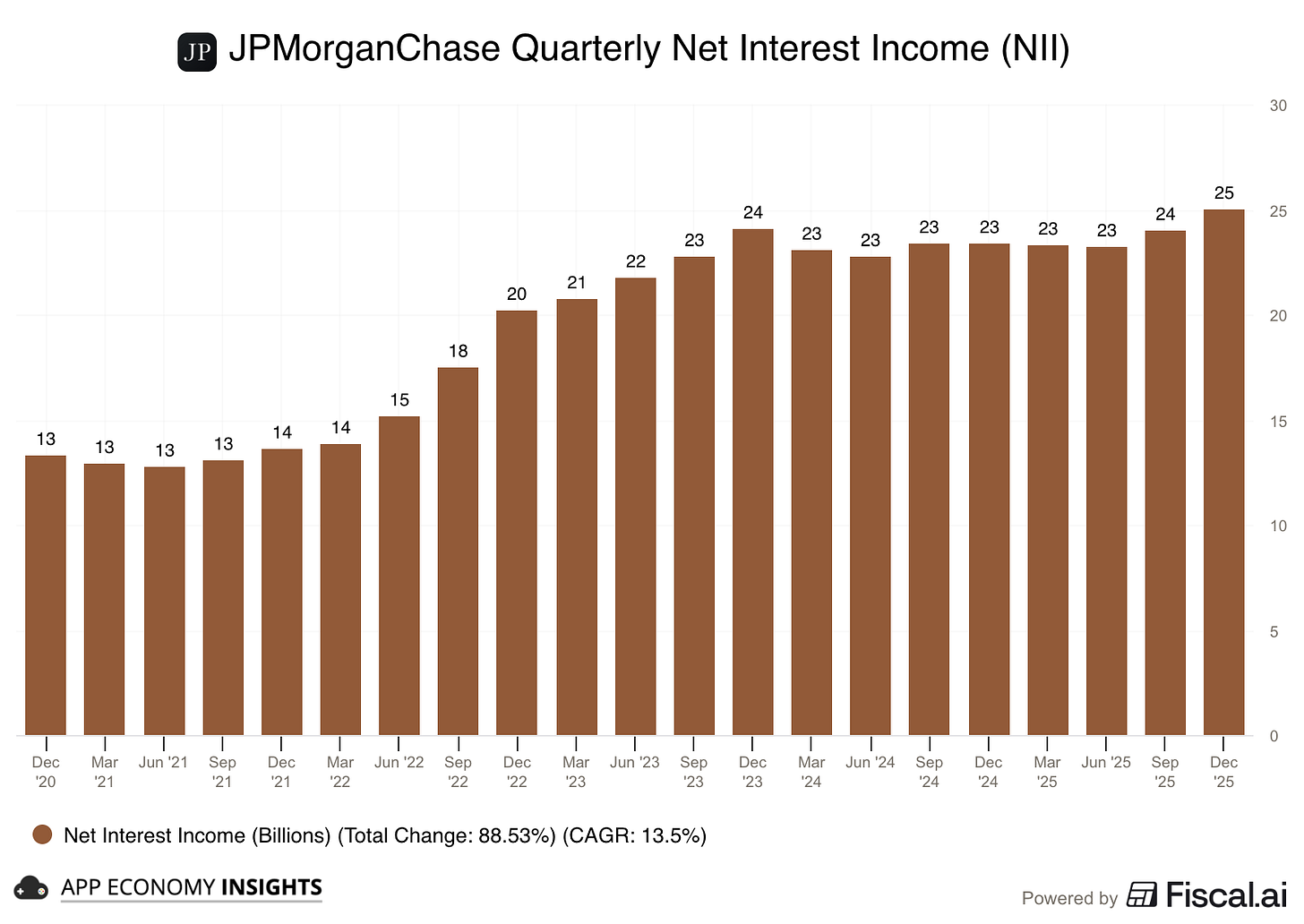

💵 Net Interest Income (NII): The difference between interest earned on loans (like mortgages) and interest paid to depositors (like savings accounts). It’s the primary source of income for many banks and depends on interest rates.

👔 Noninterest Income: The revenue from services unrelated to interest. It includes fees (like ATM charges), advisory services, and trading revenue. Banks relying more on noninterest income are less affected by interest rate changes.

Here are the significant developments shaping Q4 FY25:

📉 Dealmaking is lumpy: The animal spirits recovery is proving uneven. While JPMorgan and Bank of America saw advisory fee activity stall amid market volatility, Citigroup defied the trend, posting an 84% surge in advisory fees. The M&A rebound is real, but it’s going to be lumpy.

🎢 Equity traders save the day: Volatility was a headache for dealmakers but a goldmine for traders. JPMorgan (+40%) and Bank of America (+23%) posted massive jumps in equity trading revenue, helping offset weakness elsewhere. However, those reliant on Fixed Income (like Citi) saw less upside.

🏛️ The “Trump Trade” cuts both ways: The post-election optimism has curdled into regulatory anxiety. While banks expected a deregulatory bonanza, the proposed 10% credit card interest cap triggered a unified warning. From JPMorgan’s “everything is on the table” defense to Citi’s blunt “we could not support it,” the industry is bracing for a fight.

💸 Expense strategies diverge: The sector is splitting on costs. JPMorgan stunned Wall Street with a massive $105 billion spending plan to widen its moat. In contrast, Citi and Wells Fargo are still in “cutting mode,” shedding thousands of jobs and taking severance charges to protect margins.

💳 Soft landing still in play: Despite fears of a softening labor market, the data remains solid. Card spending is up across the board, and delinquencies are stable or even improving. The recession ghost story continues to be pushed out, providing a sturdy floor for the sector.

🔑 Takeaway: The straight line up narrative is over. Banks are navigating a complex mix of booming trading floors, uneven deal flow, and divergent cost strategies, all while keeping one eye on a hostile transition of power at the Federal Reserve.

Let’s visualize them one by one and highlight the key points.

JPMorganChase: Apple Card Takeover

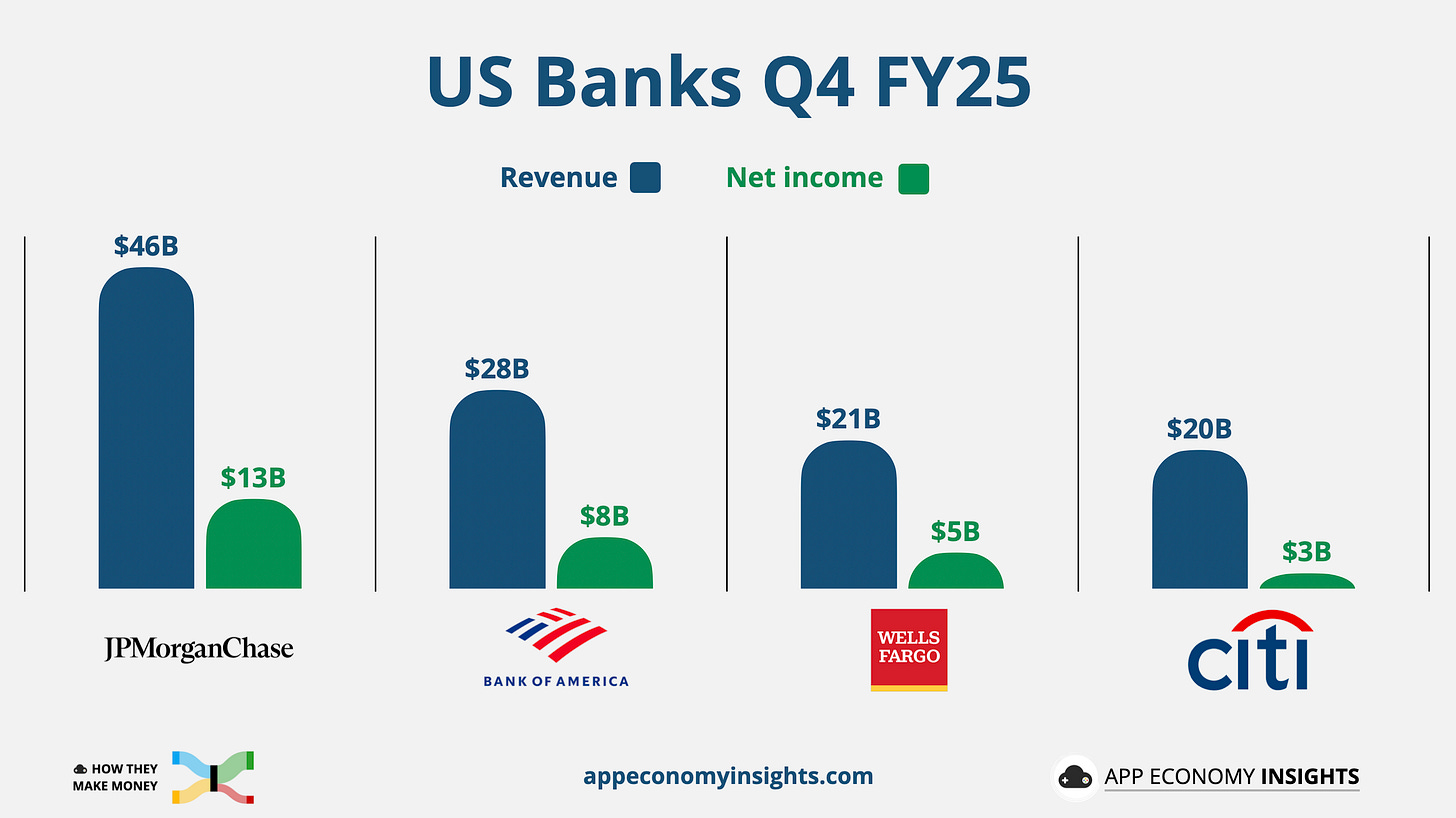

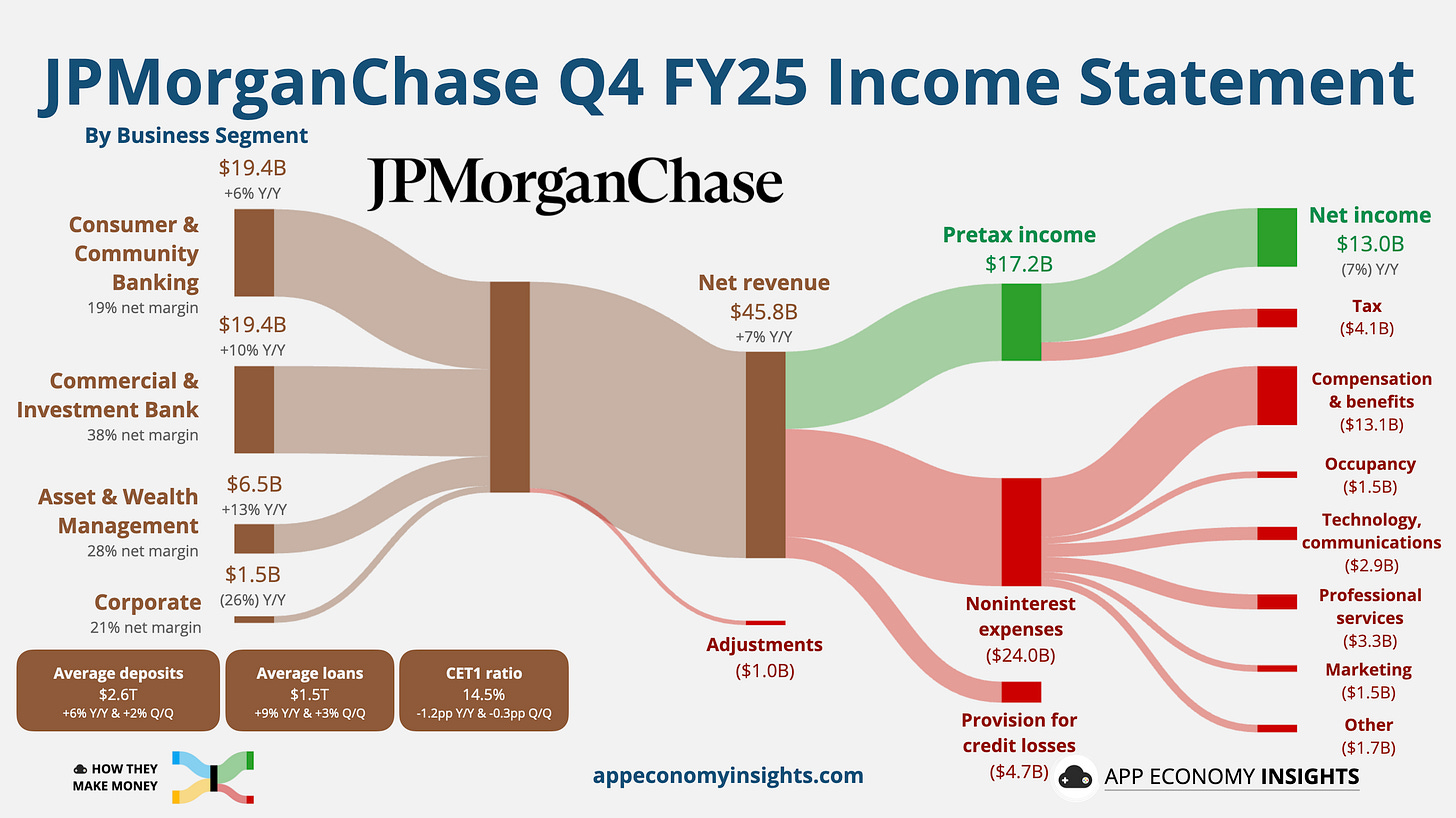

Net revenue grew 7% Y/Y to $45.8 billion ($0.5 billion beat):

Net interest income (NII): $25.0 billion (+7% Y/Y).

Noninterest income: $20.8 billion (+7% Y/Y).

Net income: $13.0 billion (-7% Y/Y).

Adjusted EPS: $5.23 ($0.37 beat).

Key developments:

📱 Apple Card impact: The bottom line took a heavy hit from a $2.2 billion credit reserve build tied to taking over the Apple Card program from Goldman Sachs. This strategic move dragged EPS down by $0.60, though management views the upfront pain as necessary for the 2-year integration process.

📊 Trading saves the quarter: While many peers struggled, JPMorgan's Markets revenue surged 17% to $9.7 billion, beating the highest analyst estimates. The beat was driven by a 40% jump in equities trading and strong fixed-income results, capitalizing on market volatility.

📉 Investment Banking miss: Contrary to guidance given just last month, Investment Banking fees fell 4% to $2.3 billion. The bank cited delayed deals and a surprise 2% decline in debt underwriting (analysts expected a 19% gain). CFO Jeremy Barnum noted, "Our performance was not what we would have liked."

💳 Consumers stay spending: Despite macro headlines, debit and credit card spending rose 7% Y/Y. Credit quality remains stable with delinquencies actually dropping slightly to 1.10% (vs 1.14% last year).

🌐 Economy resilient: The bank is positioning for a soft landing in which labor softens while spending continues. Jamie Dimon highlighted “huge” geopolitical risks.

🔑 Takeaways: A messy quarter. The core business is split: Trading is firing on all cylinders, but Investment Banking stumbled unexpectedly. The headline earnings miss was largely manufactured by the massive Apple Card.

Key quote:

CEO Jamie Dimon: “The US economy has remained resilient. While labor markets have softened, conditions do not appear to be worsening. Meanwhile, consumers continue to spend, and businesses generally remain healthy.”