🚚 How Motive Makes Money

This Google-backed company is going public

Welcome to the Premium edition of How They Make Money.

Over 270,000 subscribers turn to us for business and investment insights.

In case you missed it:

Motive (MTVE) is going public

The physical economy includes trucking, construction, and oil and gas. For decades, it has run on paper logs, phone calls, and manual processes.

Motive wants to be the operating system for this physical world.

Fresh off its S-1 filing on December 23, 2025, Motive is set to be one of the first major IPOs of 2026. It’s backed by heavyweight investors, including Google Ventures.

If you follow this space, you’re likely familiar with Samsara (IOT), a close peer that went public in 2021 and a holding in App Economy Portfolio. The two companies sell similar products and target the same fleet-heavy customers. But Motive enters the public markets with a very different financial profile.

Motive is smaller, growing more slowly, burning cash, and carrying meaningful debt.

Is Motive a way to play the digitization of the physical economy, or a runner-up trap in a winner-takes-most market?

I went through the nearly 300 pages of Motive’s S-1 so you don’t have to.

Today at a glance:

Overview

Business Model

Financial highlights

Risks & Challenges

Management

Use of Proceeds

Future Outlook

Personal Take

1. Overview

Motive is an Integrated Operations Platform for the physical economy.

Founded in 2013 by CEO Shoaib Makani as KeepTruckin, the company started with a simple wedge: a free app to help truck drivers log their hours on a smartphone.

The timing mattered. The ELD (Electronic Logging Device) mandate created a rare moment when software adoption became mandatory. When the rule became federal law in 2017, most commercial trucking fleets were pushed to digitize compliance. Motive positioned itself ahead of that shift, landing customers before compliance became mandatory.

Today, they have expanded far beyond compliance logs into a full ecosystem:

Driver Safety: AI dashcams that detect distracted driving, including phone usage and smoking.

Fleet Tracking: GPS tracking for vehicles and heavy equipment.

Spend Management: The Motive Card, a corporate card for fuel and fleet-related expenses that integrates directly with the platform.

Motive’s AI pitch is all about measurable outcomes. The company estimates that its platform has helped prevent more than 170,000 collisions since 2023, underscoring why safety and compliance budgets are often non-discretionary for fleet operators.

Key numbers

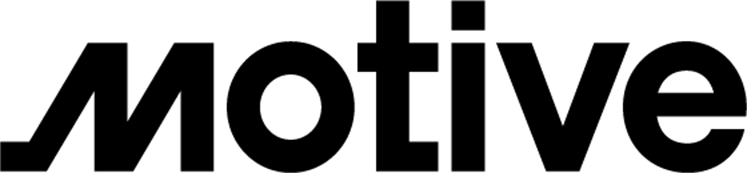

$501 million ARR (+27% Y/Y, accelerating).

100,000+ customers (mostly small trucking fleets).

4,500+ employees (heavy R&D presence in Pakistan).

For context, when Samsara went public in 2021, it did so with an ARR of $493 million (comparable to Motive) but was growing at nearly 70% Y/Y.

2. Business Model

Motive operates a classic Hardware-Enabled SaaS model.

In short: Hardware is not the margin driver. It’s the lock-in.

Motive’s cameras, sensors, and in-vehicle devices aren’t optimized for margin. They exist to create continuous first-party operational data tied directly to physical activity. Once installed, that hardware makes Motive the system of record for safety and compliance, raises switching costs, and enables multi-year software expansion on top of the same data stream.

The wedge (hardware): Motive sells physical devices, including Vehicle Gateways (ELDs), AI dashcams, and Asset Gateways. These act as the “eyes and ears” of the fleet, continuously capturing data from drivers, vehicles, and equipment. Like Samsara, the hardware is often sold at or near cost to secure the long-term software relationship.

The subscription model (SaaS): Customers pay a per-vehicle, per-month subscription to access Motive’s cloud dashboard. Once installed, removing Motive hardware requires physical replacement across the fleet, making churn operationally painful. This creates high switching costs and predictable recurring revenue.

The fintech layer (transaction revenue): Motive’s newer growth lever is the Motive Card, which earns interchange revenue when drivers pay for fuel or repairs. By tying spend directly to fleet activity, Motive gains visibility into where money is spent, reduces fraud, and adds a transactional revenue stream on top of subscriptions.

The flywheel looks like this: Capture Data (IoT devices) > AI Insights (safety, efficiency) > Financial Services (Motive Card) > More Data.

Key metrics

Core Customers (ARR > $7.5K): 9,201 (+17% Y/Y)

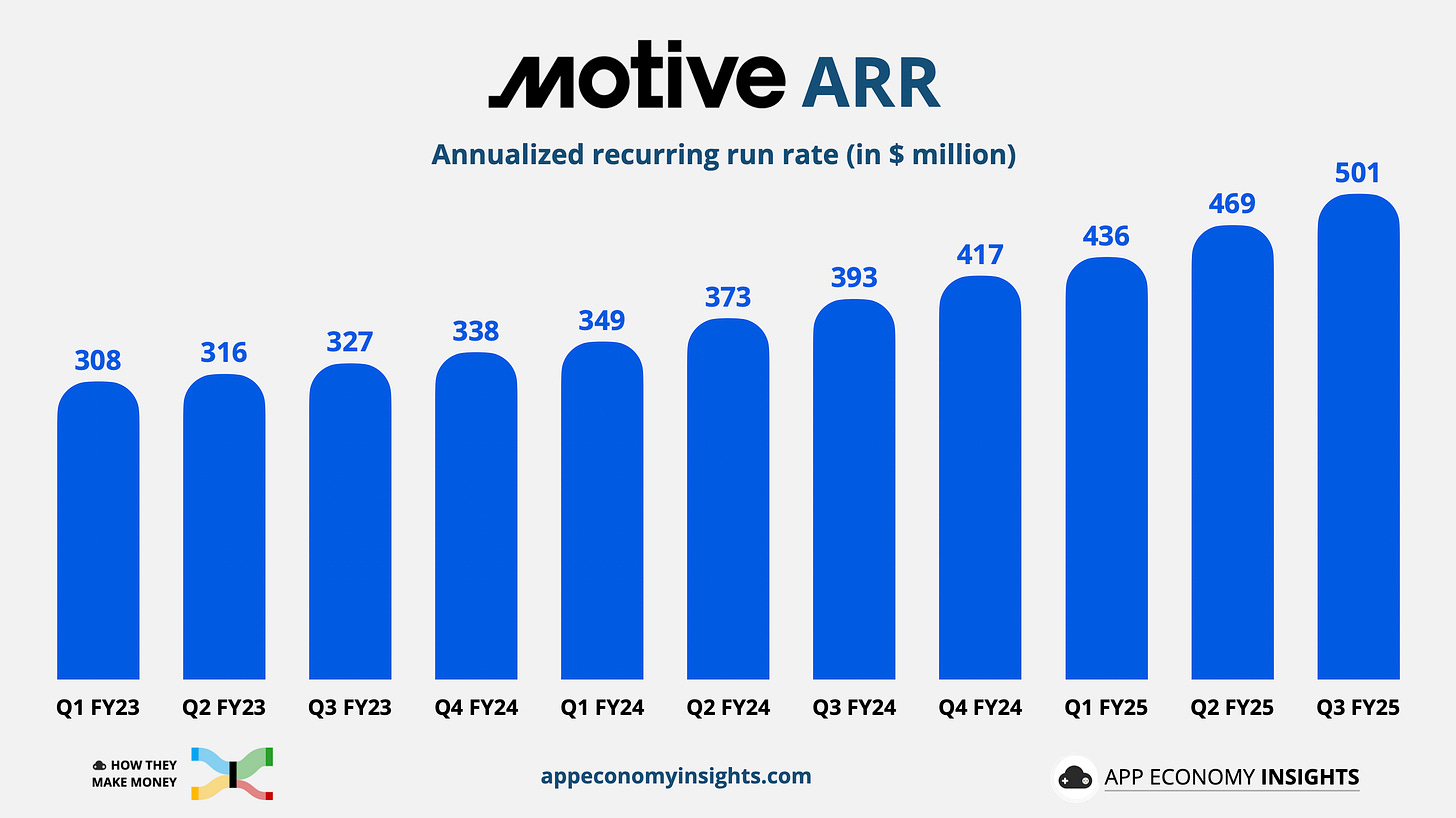

Large Customers (ARR > $100K): 494 (+58% Y/Y).

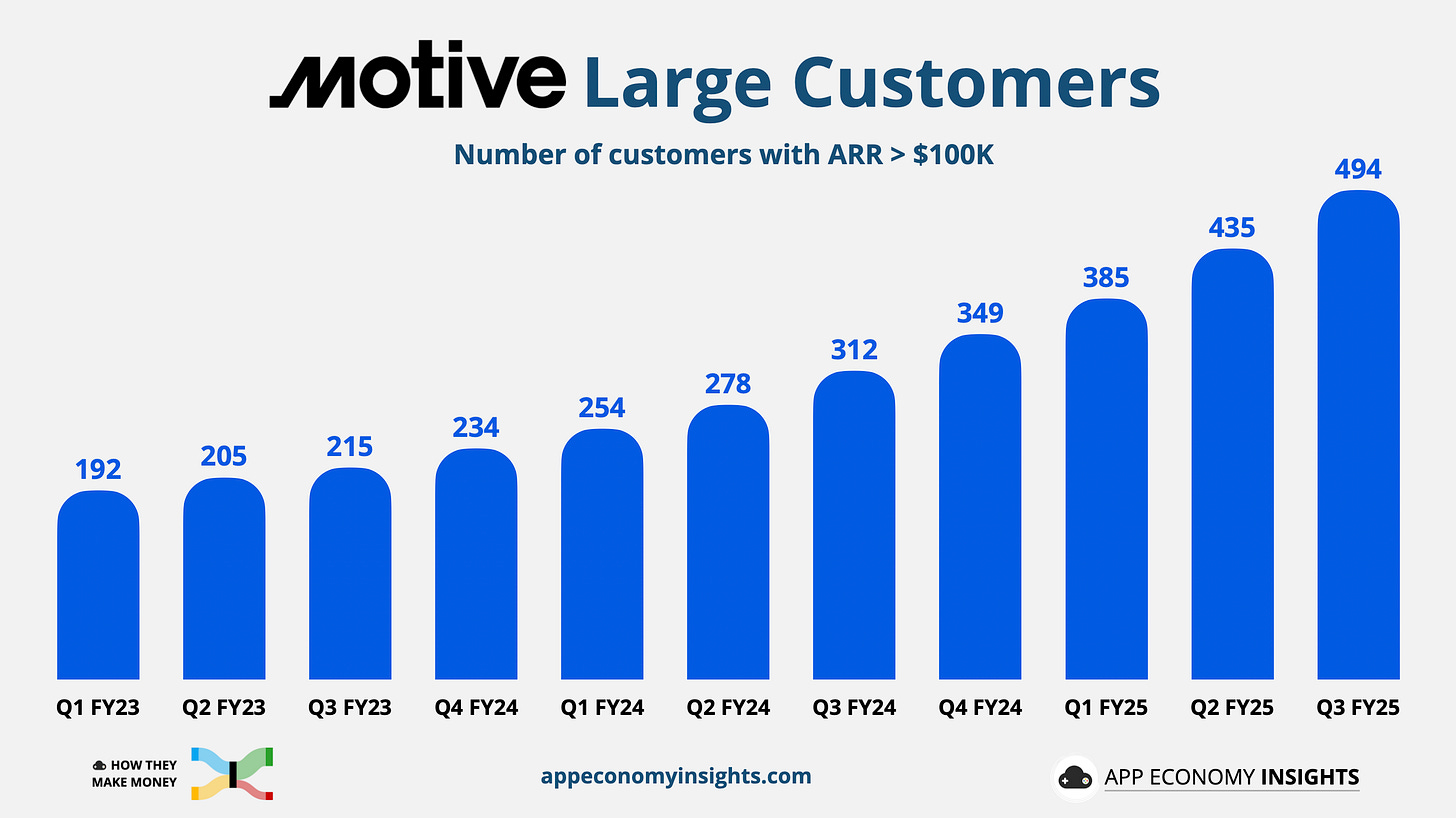

Net Dollar Retention (NDR): 110% for Core Customers (+1pp Y/Y), and 126% for Large Customers. This shows they are successfully upselling larger fleets (adding dashcams, cards, etc.).

Expansion at Motive is usage-driven, not contract-driven. Revenue scales automatically as fleets grow in vehicles, drivers, assets, and locations. Larger fleets generate more data, adopt more modules, and standardize on fewer systems as operational complexity rises. That dynamic shows up clearly in the numbers, with large customers expanding far faster than smaller ones. Multi-product adoption is steadily improving among Core Customers.

Customer mix

So why is Motive growing at a much slower pace than Samsara at the same ARR milestone? The growth gap stems from the go-to-market strategy. Motive built its business in the SMB segment, initially selling low-ACV (Annual Contract Value) compliance solutions to small fleets. That left it with a large customer base, but lower revenue per account.

Samsara targeted mid-market and enterprise customers earlier, driving larger deal sizes and faster ARR expansion at a similar scale.

3. Financial Highlights

Let’s turn to the financials and where the money flows. Motive is growing, but it is burning cash to do it. And that burn is not improving with scale.