🚖 Tesla: Promises Under Pressure

Autonomy and Optimus enter the ‘show me’ phase

Welcome to the Premium edition of How They Make Money.

Over 280,000 subscribers turn to us for business and investment insights.

In case you missed it:

Tesla is officially retiring its history to clear space for its future.

On the Q4 earnings call, Elon Musk gave the Model S and X an “honorable discharge,” announcing that production of the flagship vehicles that built the brand will end next quarter. Their Fremont assembly lines will be converted into a massive production hub for the humanoid robot Optimus, with a target of 1 million units per year.

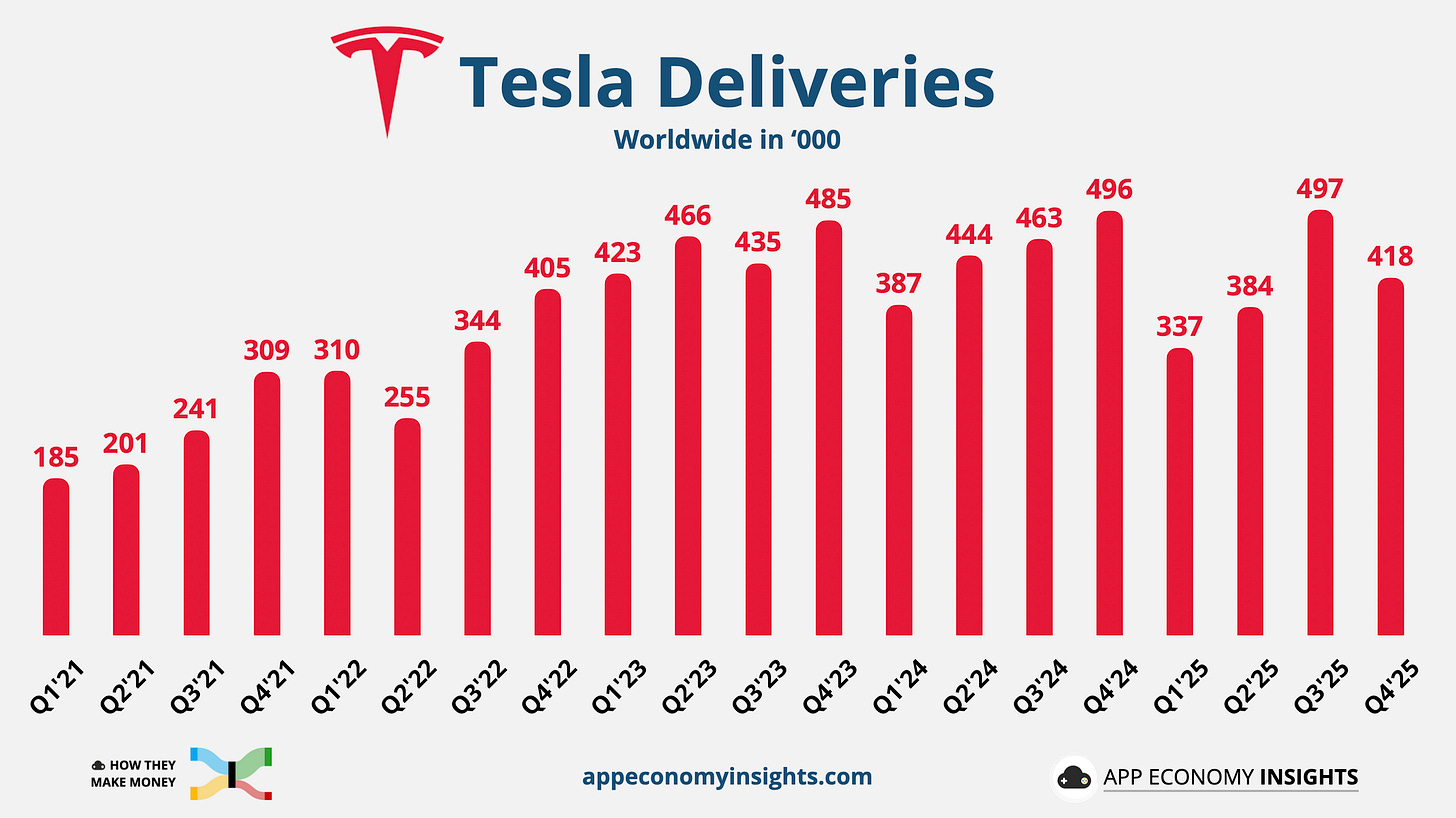

The numbers explain the urgency. Tesla delivered 418K vehicles in Q4, a sharp 16% decline from Q3 as we expected in our previous write-up. For the first time in its history as a public company, Tesla reported a full-year revenue decline, with 2025 revenue falling 3% to ~$95 billion.

Today’s auto business is cooling just as tomorrow’s initiatives need to heat up. Tesla officially leaned into this transition by announcing a $2 billion investment in xAI, further blurring the lines between manufacturing and the broader Musk AI ecosystem.

Declining market share and early signs of brand erosion have yet to show up in the stock. Instead, investor attention remains firmly anchored on autonomy and robots.

That focus makes sense once you consider Tesla’s $1.5 trillion valuation.

The core auto business supports a ~$0.4 trillion valuation, based on roughly 20× EBITDA applied to Tesla’s 2022 peak profitability.

The remaining $1.1 trillion is where expectations do the heavy lifting. While the precise breakdown is fluid, the market is effectively underwriting three buckets:

Autonomy/FSD ~$0.6 trillion.

Humanoid robots (Optimus) ~$0.3 trillion.

Energy, services, and other segments ~$0.3 trillion.

In other words, over two-thirds of Tesla’s valuation rests on businesses that are early, unproven at scale, or not yet meaningful revenue drivers.

The Q4 update is therefore less about deliveries today and more about promises that justify the valuation tomorrow. As manufacturing growth stalls, the burden of proof shifts entirely to the software and robotics timelines.

Today at a glance:

Tesla Q4 FY25.

Robotaxi promises.

Earnings call key quotes.

What to expect for Optimus.