📊 PRO: This Week in Visuals

AAPL META SAMSUNG ASML V MA LVMH UNH SAP LRCX IBM AXP KLAC BA GEV TXN T VZ NOW LMT SBUX UPS GM SNDK SOFI LUV AAL APPF

Welcome to the Saturday PRO edition of How They Make Money.

Over 280,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO members get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

📱Apple: The Supercycle Arrives

🕶️ Meta: The AI Bet Pays Off

📱 Samsung: Memory Supercycle

🔬 ASML: €13 Billion Surprise

💳 Visa: Services Power the Beat

💳 Mastercard: The Services Moat

✨ LVMH: Stabilizing Signs

💼 UnitedHealth: The Hard Reset

☁️ SAP: Backlog Shock

🧠 Lam Research: The $135B Supercycle

🌐 IBM: Big Blue Momentum

💳 Amex: The Cost of Premium

🔬 KLA: Supply Constraints

🛩️ Boeing: Production Pivot

⚡ GE Vernova: The Grid Supercycle

⚙️ Texas Instruments: Catching the Upswing

📞 AT&T: The Convergence Payoff

📱 Verizon: The Schulman Turnaround

🧑💻 ServiceNow: The AI Paradox

🛰️ Lockheed Martin: The Missile Boom

☕️ Starbucks: Ahead of Schedule

📦 UPS: Trading Volume for Value

🚗 GM: The Great ICE Pivot

💾 Sandisk: AI Supercycle

🏦 SoFi: The Billion-Dollar Breakout

🛩️ Southwest: Cleared for Ascent

🦅 American Airlines: Turbulence & Tailwinds

🏡 Appfolio: Agentic AI Lift

FROM OUR PARTNERS

Investors Are Following Washington’s $7B Play

America is dedicating $7B to boost the domestic supply of precious metals. The real winner could be a US startup preparing for commercial lithium production right now, and investors are taking advantage.

EnergyX has been at the forefront of the $204B energy storage market for years, with patented tech that can recover up to 3X more lithium than conventional methods.

In fact, a recent independent study says EnergyX’s Chilean resource alone could generate $1.1B annually at projected market prices once fully operational. No wonder over 40,000+ people have already invested.

Invest before EnergyX’s share price increases after 2/26.

See important partner disclosure below.

1. 📱Apple: The Supercycle Arrives

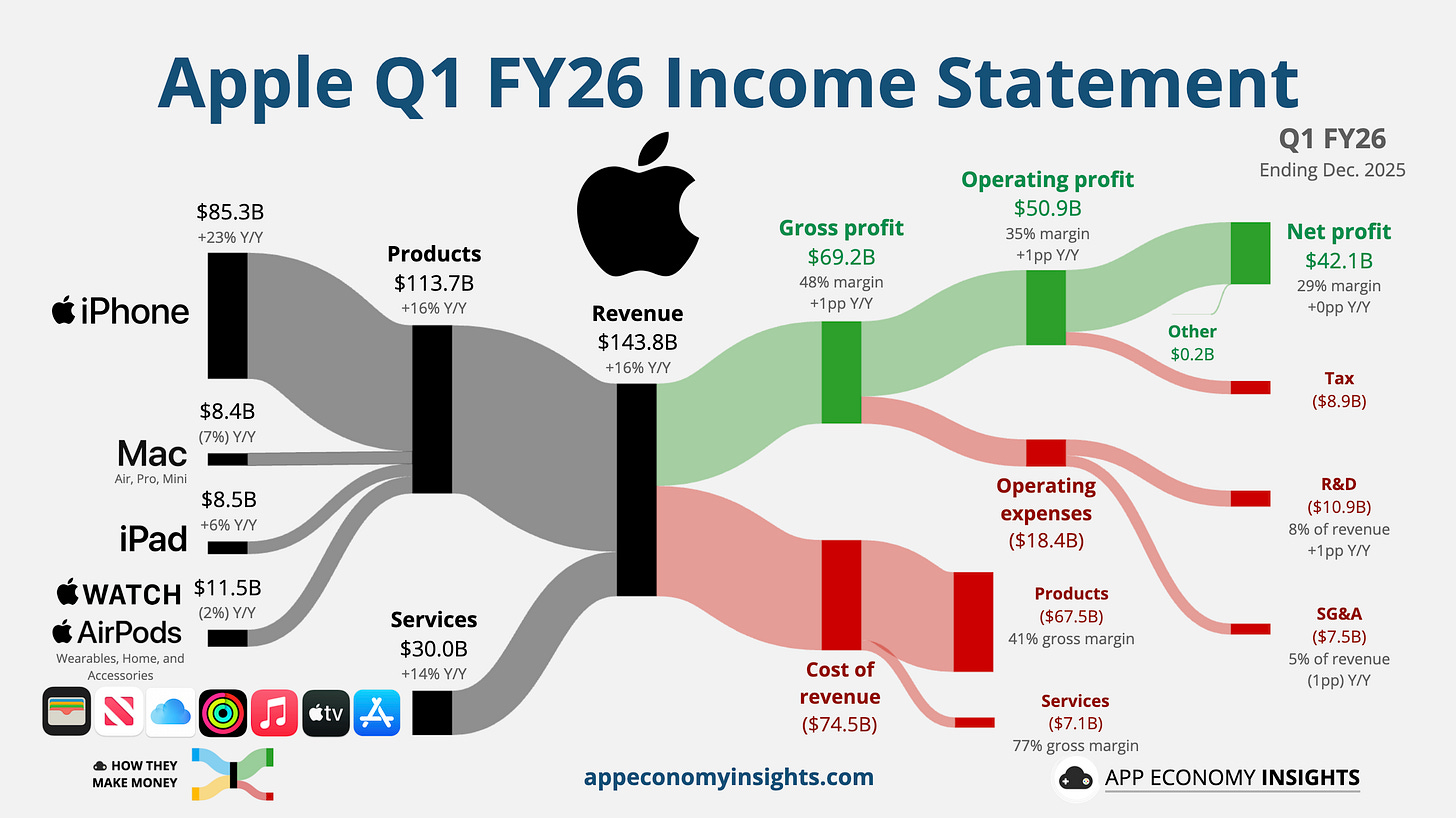

Apple delivered the blockbuster quarter it promised and then some, reporting revenue growth of 16% Y/Y to $143.8 billion ($5.2 billion beat) and record EPS of $2.84 ($0.17 beat).

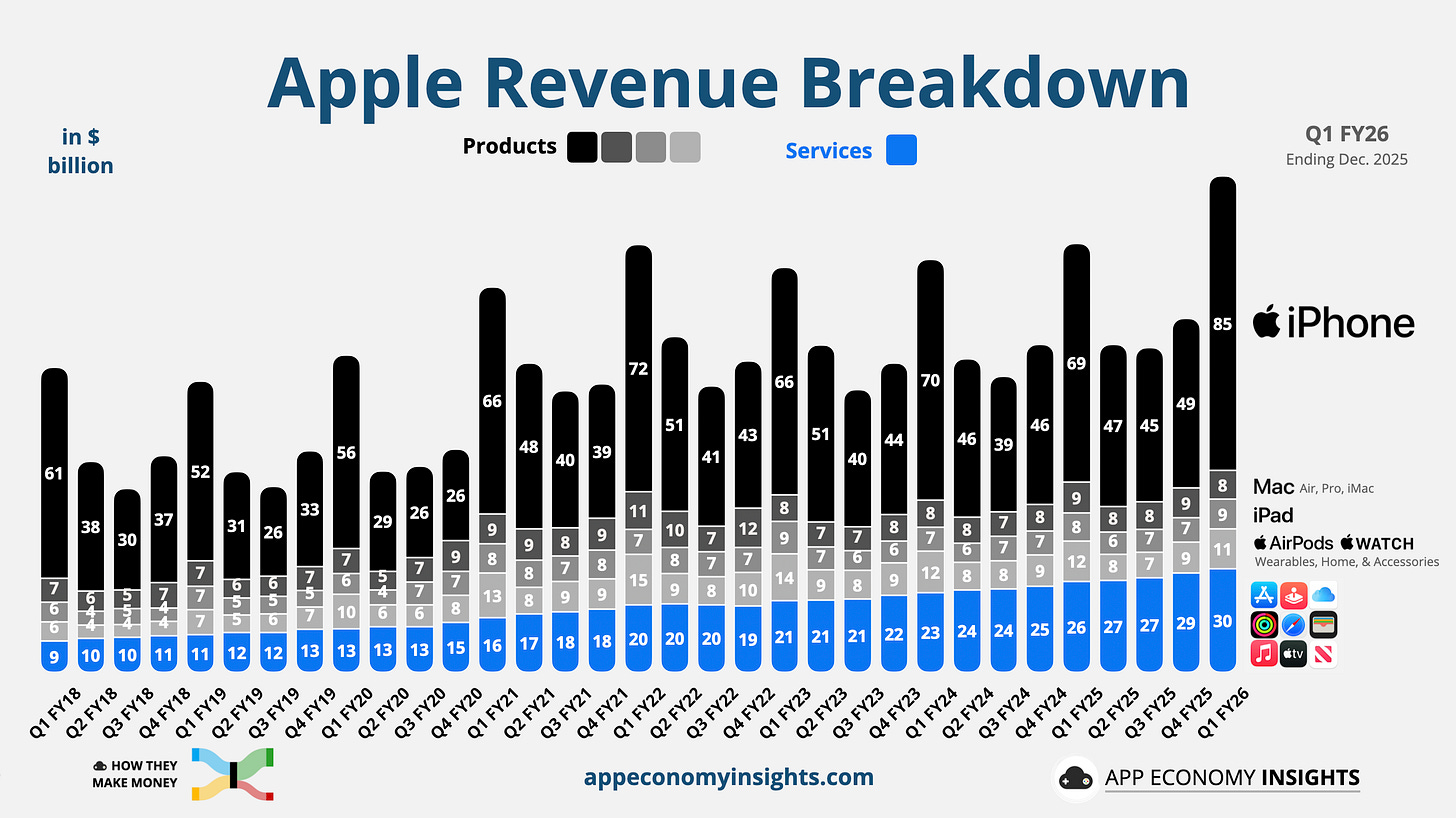

The results were powered by staggering demand for the iPhone 17 lineup, which drove iPhone revenue up 23% to $85 billion, crushing the $78 billion consensus. The installed base hit a new milestone of over 2.5 billion active devices.

Services also continued their steady ascent, hitting a record $30 billion (+14% Y/Y). While Mac and Wearables were softer, the core iPhone engine is firing on all cylinders, with premium Pro models accounting for 52% of US sales (up from 39% last year).

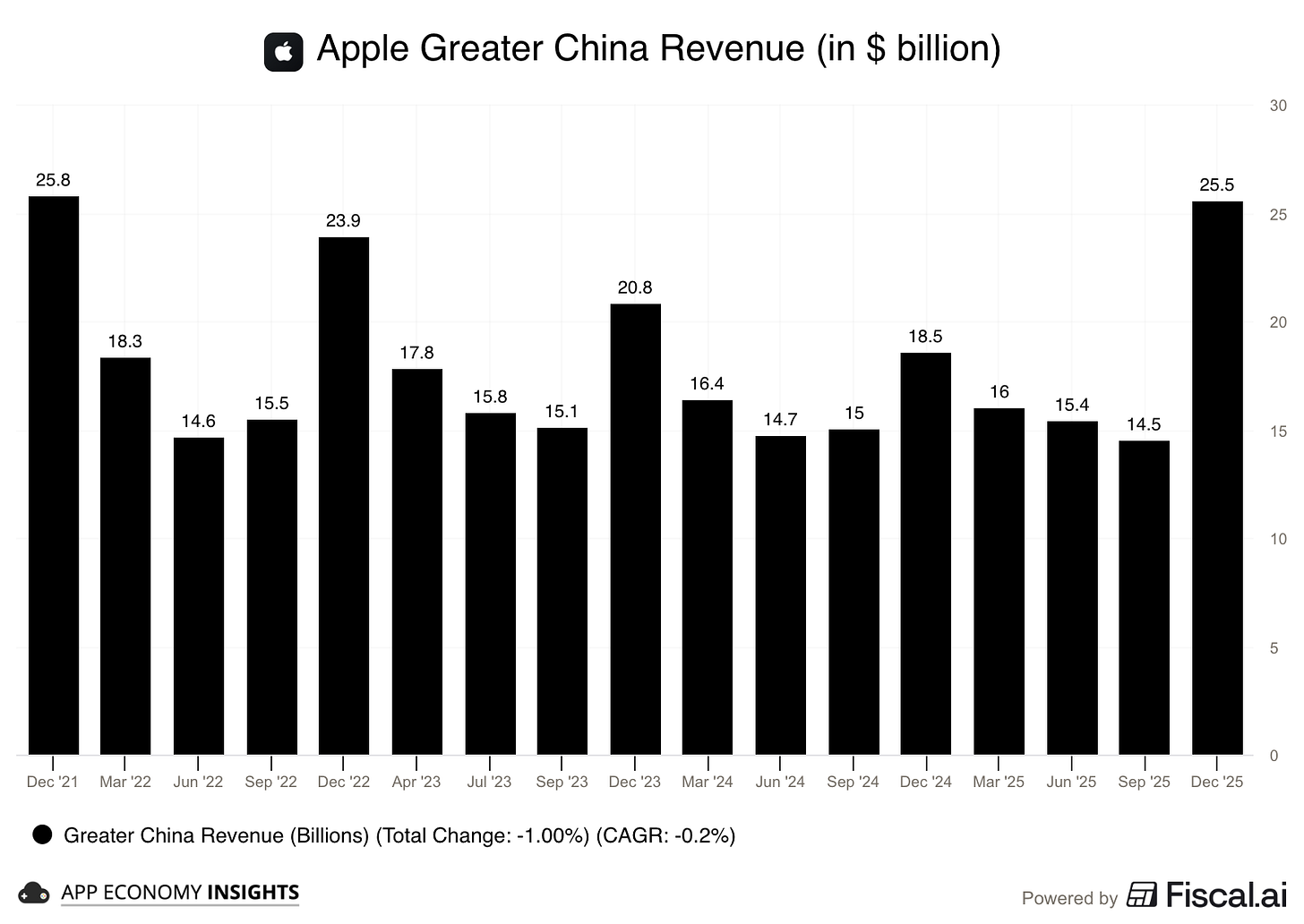

The biggest surprise was the massive resurgence in China, where revenue surged 38% Y/Y to $25.5 billion, completely reversing recent declines.

Looking ahead, management guided for Q2 revenue growth of 13%–16% Y/Y, well above the 10% Wall Street consensus. This bullish outlook comes despite ongoing supply constraints on 3-nanometer chips and rising memory prices, which CEO Tim Cook flagged as a growing margin headwind. To maintain momentum, Apple confirmed a partnership with Google to use Gemini for upcoming Siri enhancements and announced the acquisition of AI startup Q.ai.

2. 🕶️ Meta: The AI Bet Pays Off

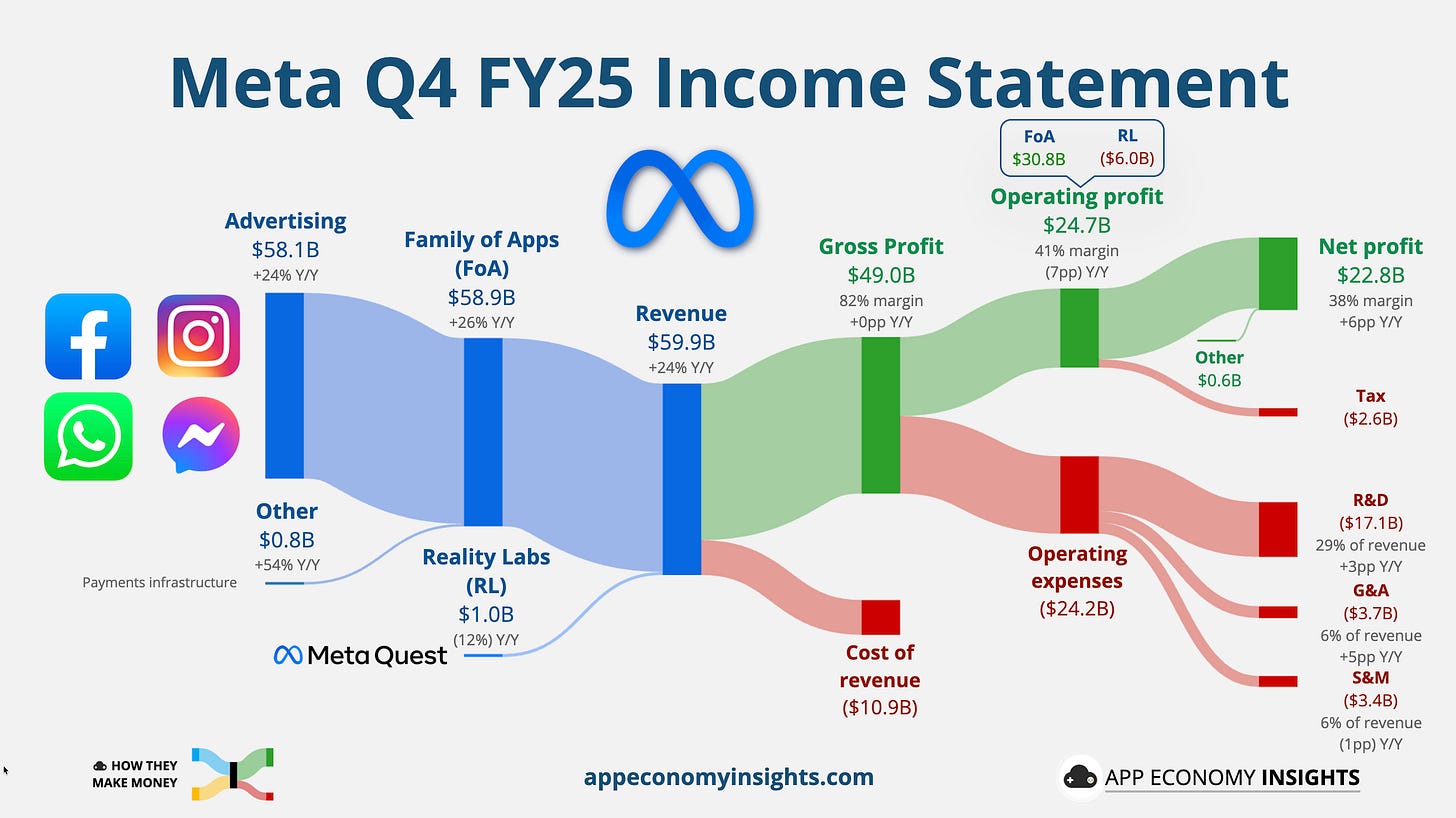

Meta delivered Q4 revenue growth of 24% Y/Y to $59.9 billion ($1.4 billion beat) and EPS of $8.88 ($0.66 beat). The core advertising engine is humming. Ad impressions jumped 18% Y/Y, and the average price per ad rose 6%, fueled by AI-driven improvements in targeting and content recommendations. Family Daily Active People (DAP) grew 7% to 3.58 billion.

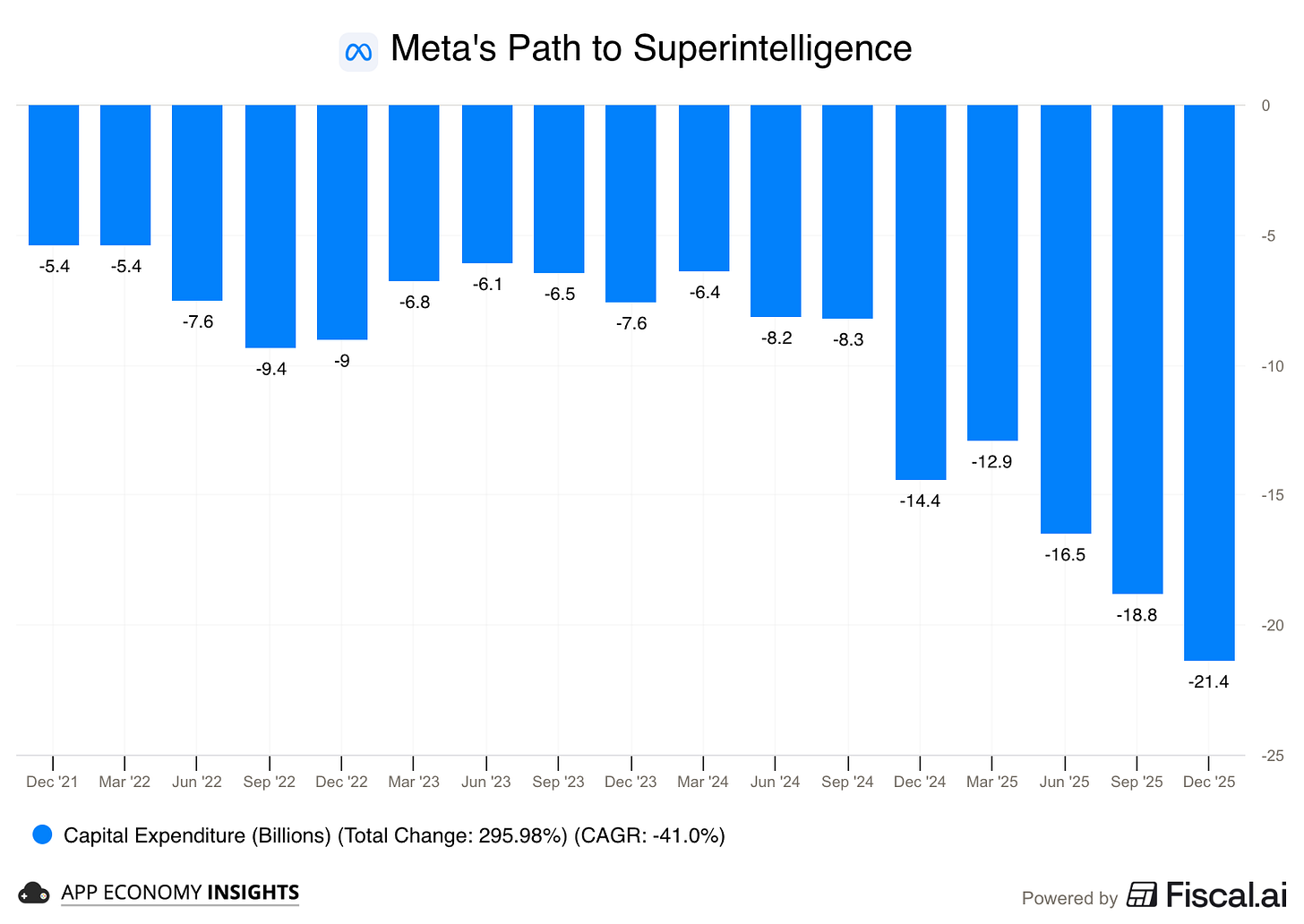

Crucially, Wall Street’s skepticism from Q3 has morphed into optimism. Investors cheered the results despite a massive hike in the 2026 CapEx outlook, now projected at $115–$135 billion (nearly double the ~$72 billion spent in 2025). This historic spending spree is targeted at building “tens of gigawatts” of data center capacity for the new Meta Compute initiative.

Zuck framed this as the path to Superintelligence, promising a “major AI acceleration” in 2026 with new announcements coming soon. While Reality Labs posted another significant operating loss (~$6 billion), losses are expected to peak this year as resources shift toward successful AI wearables like Ray-Ban Meta glasses.

The Q1 FY26 revenue forecast is $53.5–$56.5 billion (well ahead of the $51.4 billion consensus). With so much momentum and growth accelerating, the market now views Meta’s massive spending as an offensive weapon rather than a reckless gamble.