🔎 Google: The Genie is Out

Self-funding a massive $185 billion CapEx ramp

Welcome to the Premium edition of How They Make Money.

Over 280,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members love our latest Earnings Visuals report!

Digest the performance of hundreds of companies in seconds.

📈 The $4 Trillion Reality Check

For the past year, Alphabet (GOOG) has been the quiet winner of the AI race. The stock doubled from its April lows, and the company recently crossed the $4 trillion valuation mark, edging past Apple for the first time since 2019.

The market is no longer asking if Google can build AI products. That assumption is already reflected in the soaring share price. Now we move to the execution phase.

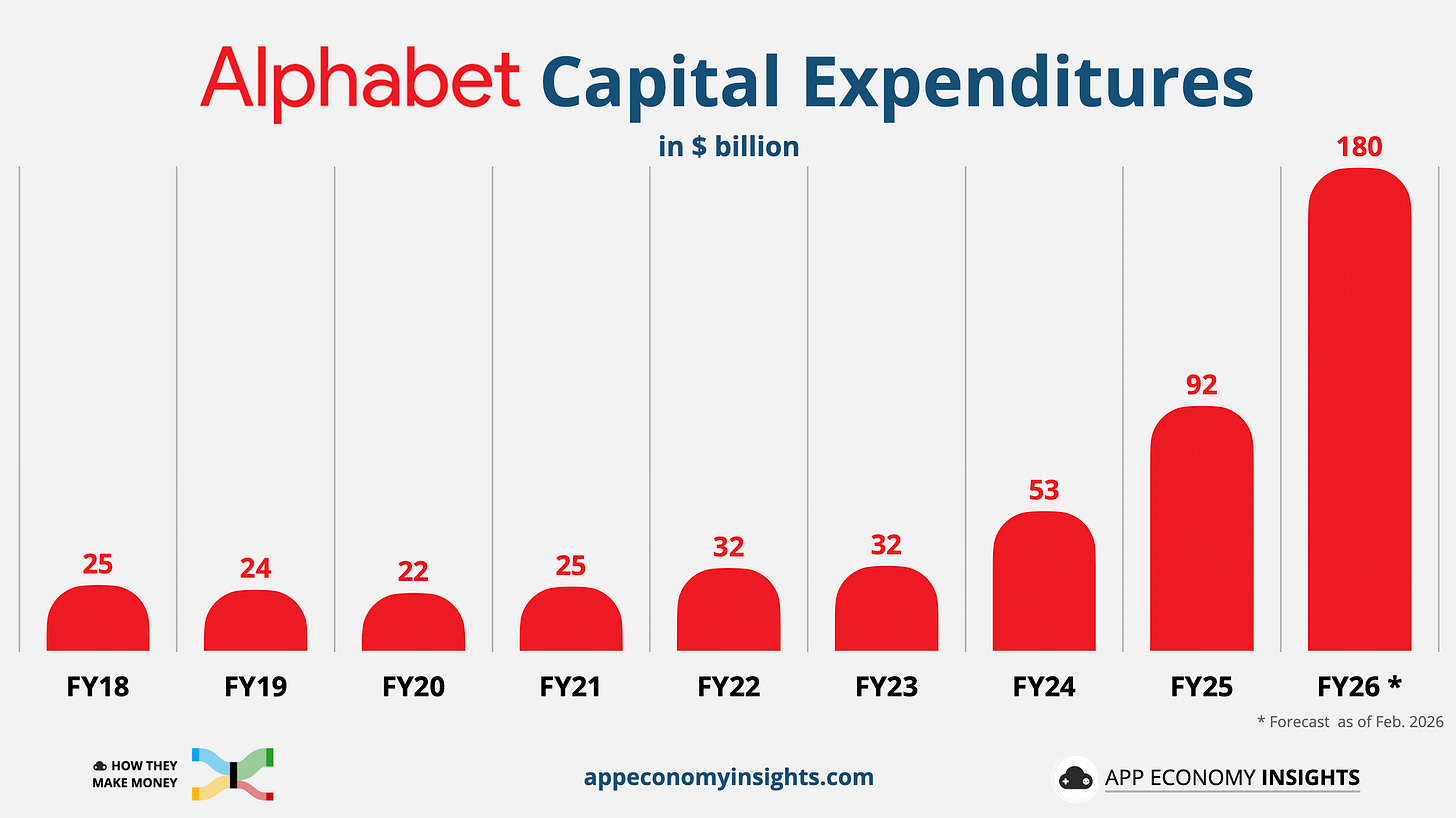

What matters right now

CapEx ramp: Alphabet plans to spend up to $185 billion in CapEx in FY26, effectively doubling its 2025 level. The company is plowing back nearly every dollar generated by its existing operations into the AI race. While OpenAI and Anthropic are perpetually one down-round or one failed capital raise away from a crisis, Alphabet is funding the most expensive infrastructure build-out in history entirely through its own cash flows.

Cloud backlog surge: With a record $240 billion backlog (up 55% sequentially), how fast is GCP converting these contracts into recognized revenue? There’s also the TPU and Anthropic upside, which now includes processing 10 billion tokens per minute for API customers.

Agentic shift: Chrome’s new Auto Browse moves from Search to Action. With the Gemini app already hitting 750 million monthly active users, we look at the high-stakes business model shift from advertising to subscription.

Gaming flash-crash: Why did Genie 3 trigger a nearly $50 billion wipeout for gaming stocks like Unity and Roblox, and is the market reaction warranted?

Here’s what stood out this quarter.

Today at a glance:

Alphabet Q4 FY25.

Agents & virtual worlds.

Key insights from the call.

Chrome, Atlas, and antirust update.

1. Alphabet Q4 FY25

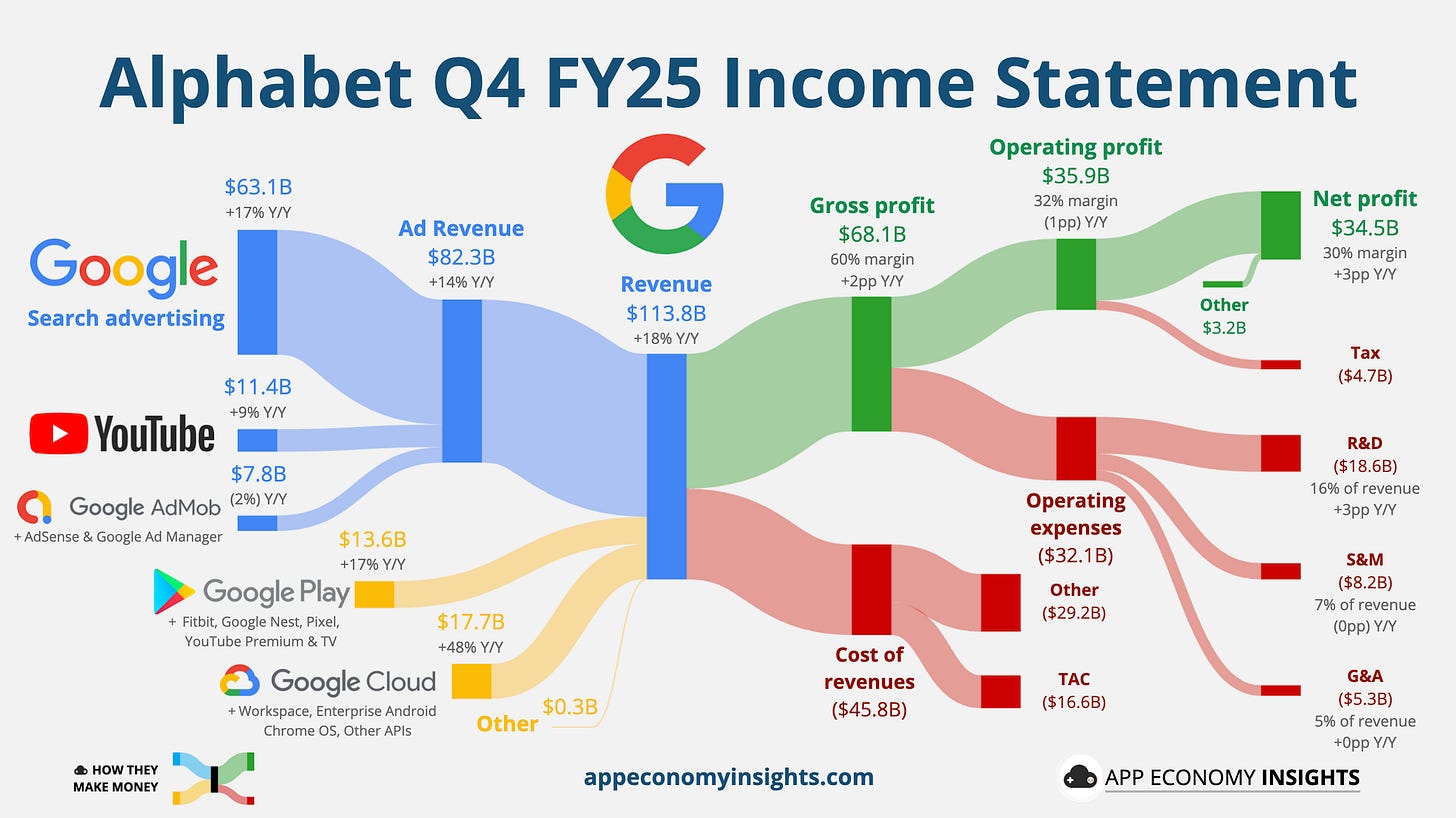

Income statement:

Revenue grew +18% Y/Y to $113.8 billion ($2.3 billion beat).

🔎 Advertising: $82.3 billion (+14%).

Search: $63.1 billion (+17%).

YouTube ads: $11.4 billion (+9%).

Network: $7.8 billion (-2%).

📱 Subscriptions, platforms, and devices: $13.6 billion (+17%).

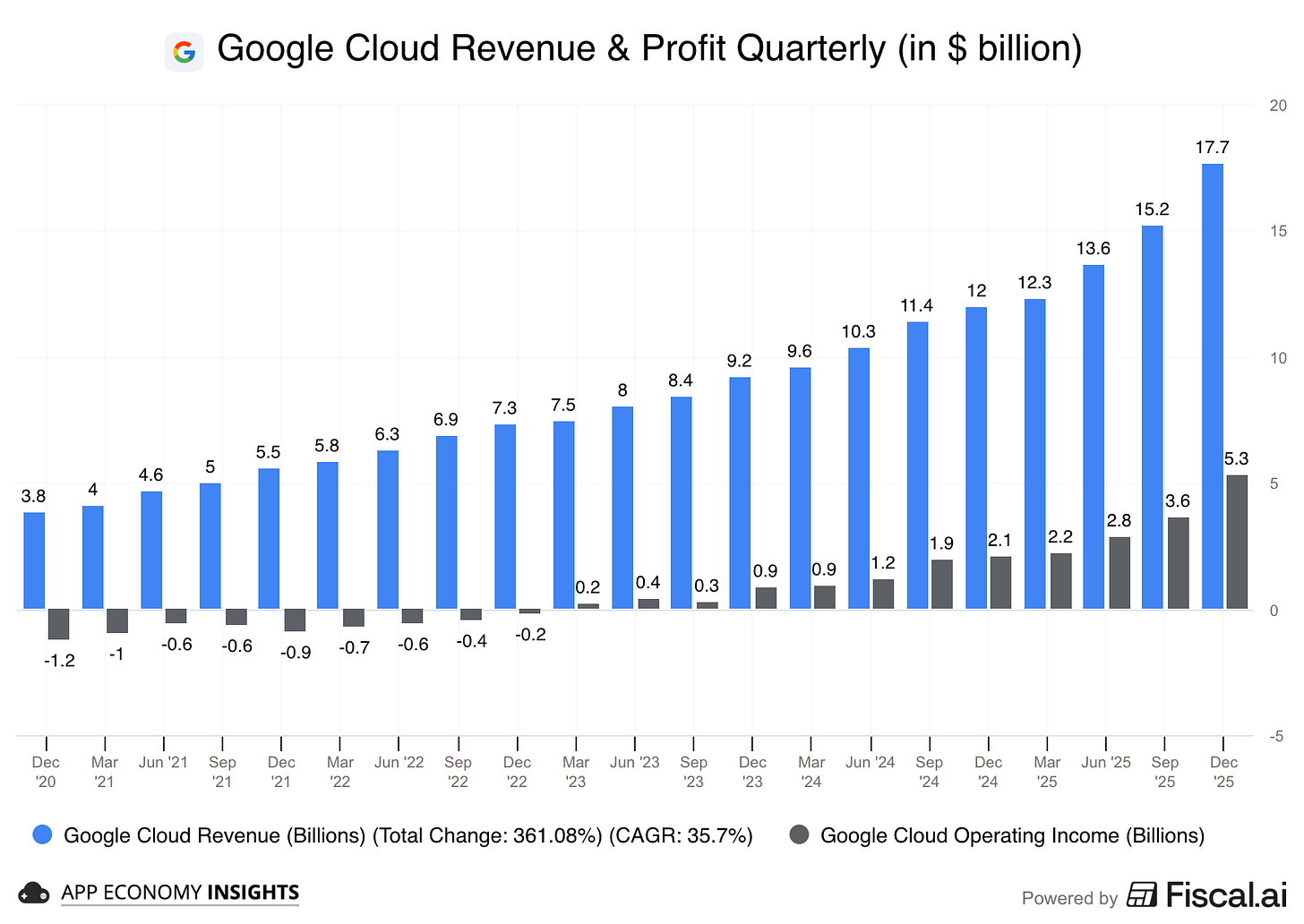

☁️ Cloud: $17.7 billion (+48%).

Margin trends:

Gross margin: 60% (+2pp Y/Y).

Operating margin: 32% (-1pp Y/Y).

Services (Advertising & Other): 42% (+3pp Y/Y).

Cloud: 30% (+13pp Y/Y).

Earnings per share (EPS) grew 31% Y/Y to $2.82 ($0.18 beat).

Cash flow:

Operating cash flow was $52.4 billion (+34% Y/Y).

Free cash flow was $24.6 billion (-1% Y/Y).

Balance sheet:

Cash, cash equivalents, and marketable securities: $126.8 billion.

Long-term debt: $46.6 billion.

So, what to make of all this?

The $400 billion club: Alphabet officially surpassed $400 billion in annual revenue for the first time. In Q4, revenue growth accelerated from 16% in Q3 to 18% Y/Y in Q4. Net income surged 30% Y/Y to $34.5 billion. Note the $3.2 billion of “other income” primarily coming from unrealized gains from equity investments.

Search is an AI winner: Search accelerated 17% Y/Y to $63.1 billion. Sundar Pichai noted that Search usage is at an all-time high, with the launch of Gemini 3 driving an “expansionary moment” rather than the cannibalization that bears once feared. A good reminder that the market can be completely wrong for a long time.

YouTube’s $60 billion year: YouTube Ads grew only 9% Y/Y to $11.4 billion, partly impacted by a tough comp (US election year). While slower than Search, total YouTube revenue (including subscriptions) topped $60 billion for the full year, supported by a subscriber base that has now surpassed 325 million across all services.

Cloud is the primary engine: Cloud was the clear standout, growing 48% Y/Y to $17.7 billion (a massive acceleration from 34% Y/Y in Q3). The market expected Cloud to grow by 36%. The unit is now on a $70 billion annual run rate, and its operating income skyrocketed 154% Y/Y to $5.3 billion. This 30% segment margin demonstrates that AI infrastructure is a highly profitable business.

The $240 billion backlog: The Cloud backlog surged 55% quarter-over-quarter to $240 billion. Management emphasized “wide customer breadth.” This growth is a structural shift as enterprise customers move from experimenting with Gemini to signing billion-dollar, multi-year infrastructure deals. Anthropic is also likely a major contributor to the massive $85 billion sequential jump.

Other Bets cleanup: Other Bets revenue fell 7% to $370 million, with a widened operating loss of $3.6 billion. This included a one-time $2.1 billion charge related to Waymo employee compensation (more on Waymo in a minute).

CapEx shock: While 2025 spending hit the guided $91.5 billion, Alphabet stunned the market by guiding $175–$185 billion in CapEx for 2026. This is nearly double the 2025 level and well above the $120 billion analysts expected. Free Cash Flow for the quarter held steady at $24.6 billion, but the market is now anticipating most of it to go toward AI investments in FY26.

💡 Key takeaway: Alphabet is no longer playing catch up in AI. With Gemini models processing 10 billion tokens per minute via API and the Gemini app reaching 750 million monthly users, the tech is scaling at a pace that justifies the massive infrastructure spend. The company is trading short-term cash flow for a dominant, vertically integrated position in the AI era.

2. Agents & virtual worlds

Alphabet is aggressively expanding the capabilities of its software and infrastructure.

Chrome’s agentic pivot

In late January, Chrome launched its direct counter-offensive to OpenAI’s Atlas as we correctly predicted. Just as Meta has been piggybacking on innovations from other social platforms (from Stories to Reels), Google has been able to match features released from other AI labs.

Auto Browse (available for AI Pro and Ultra subscribers) transforms Chrome from a window into the web into an active participant within it.