📊 PRO: This Week in Visuals

AMD PLTR UBER LLY ABBV NVS MRK NVO AMGN PFE NTDOY PEP MDLZ FTNT CMG YUM PYPL RBLX TTWO HSY RDDT TEAM AFRM SNAP NYT ALGN MTCH PTON

Welcome to the Saturday PRO edition of How They Make Money.

Over 280,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO members get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

↗️ AMD: Data Center Acceleration

🕵️ Palantir: 'N of 1' Growth Story

🚖 Uber: 200 Million Users Strong

💊 Eli Lilly: Trading Price for Volume

⏳ AbbVie: Humira’s Last Stand?

🧬 Novartis: The Patent Cliff Arrives

🦠 Merck: The Cost of the Bridge

🇩🇰 Novo Nordisk: Growth Era Ends

🧬 Amgen: Volume Over Value

💉 Pfizer: Transition Year

🍄 Nintendo: Switch 2’s Big Problem

🥤 PepsiCo: The Price Reset

🍪 Mondelez: The Cocoa Hangover

🔒 Fortinet: SASE Acceleration

🌯 Chipotle: Traffic Turns Negative

🌮 Yum! Brands: The Tale of Two Chains

💳 PayPal: Execution Stumbles & CEO Exit

👾 Roblox: Wild Rollercoaster

🎮 Take-Two: GTA VI Confidence Restored

🍫 Hershey: The Sweetest Outlook

👽 Reddit: Buyback Surprise

☁️ Atlassian: Billion-Dollar Cloud Quarter

🌈 Affirm: Card Compounding

👻 Snap: The Profit Pivot

🗞️ NYT: Ad Boom But Cost Gloom

🦷 Align: The Volume Recovery

🔥 Match Group: Project Aurora Sparks Hope

🚲 Peloton: The Turnaround Stalls

1. ↗️ AMD: Data Center Acceleration

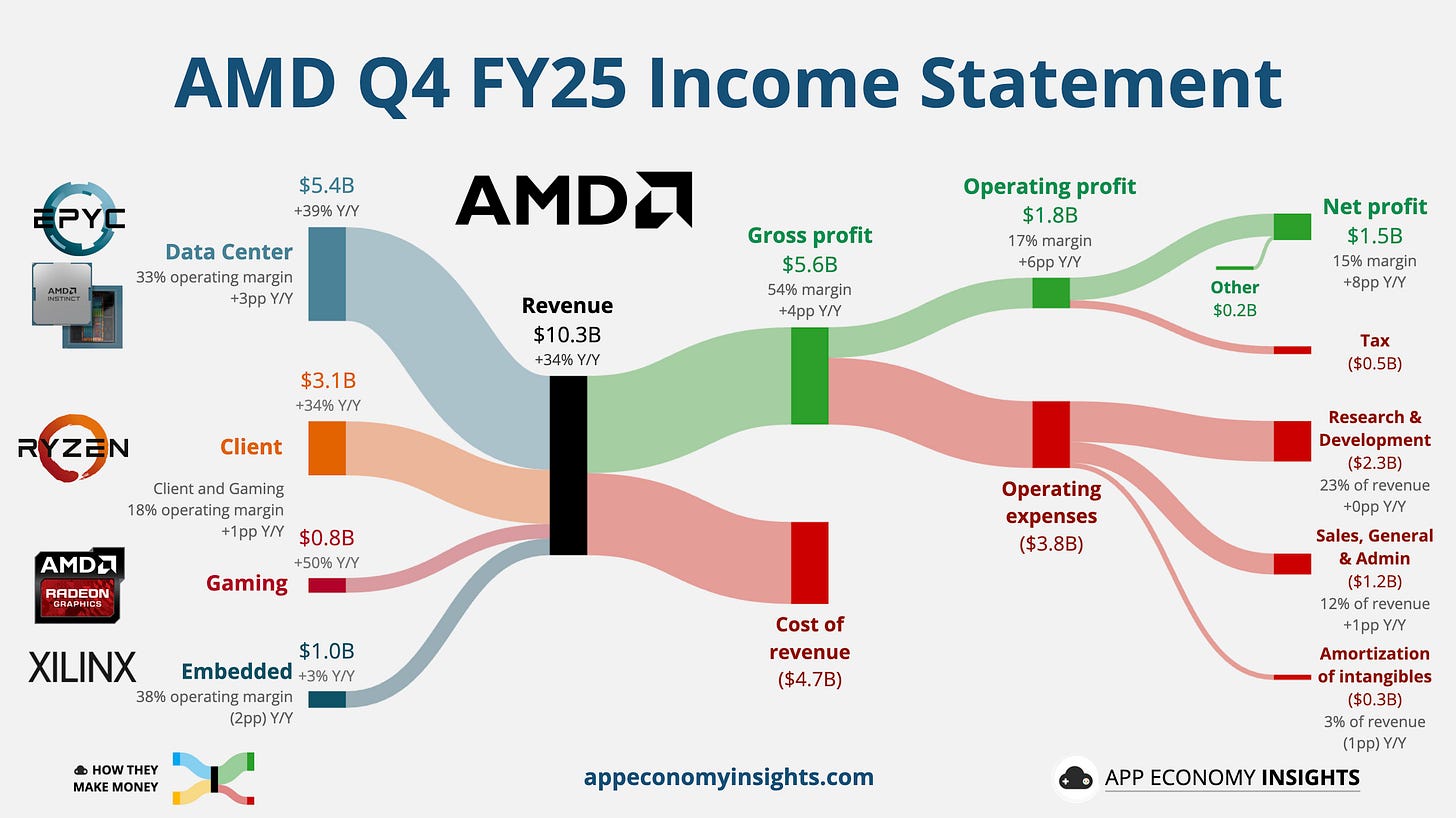

AMD delivered Q4 revenue growth of 34% Y/Y to $10.3 billion ($630 million beat) and adjusted EPS of $1.53 ($0.21 beat).

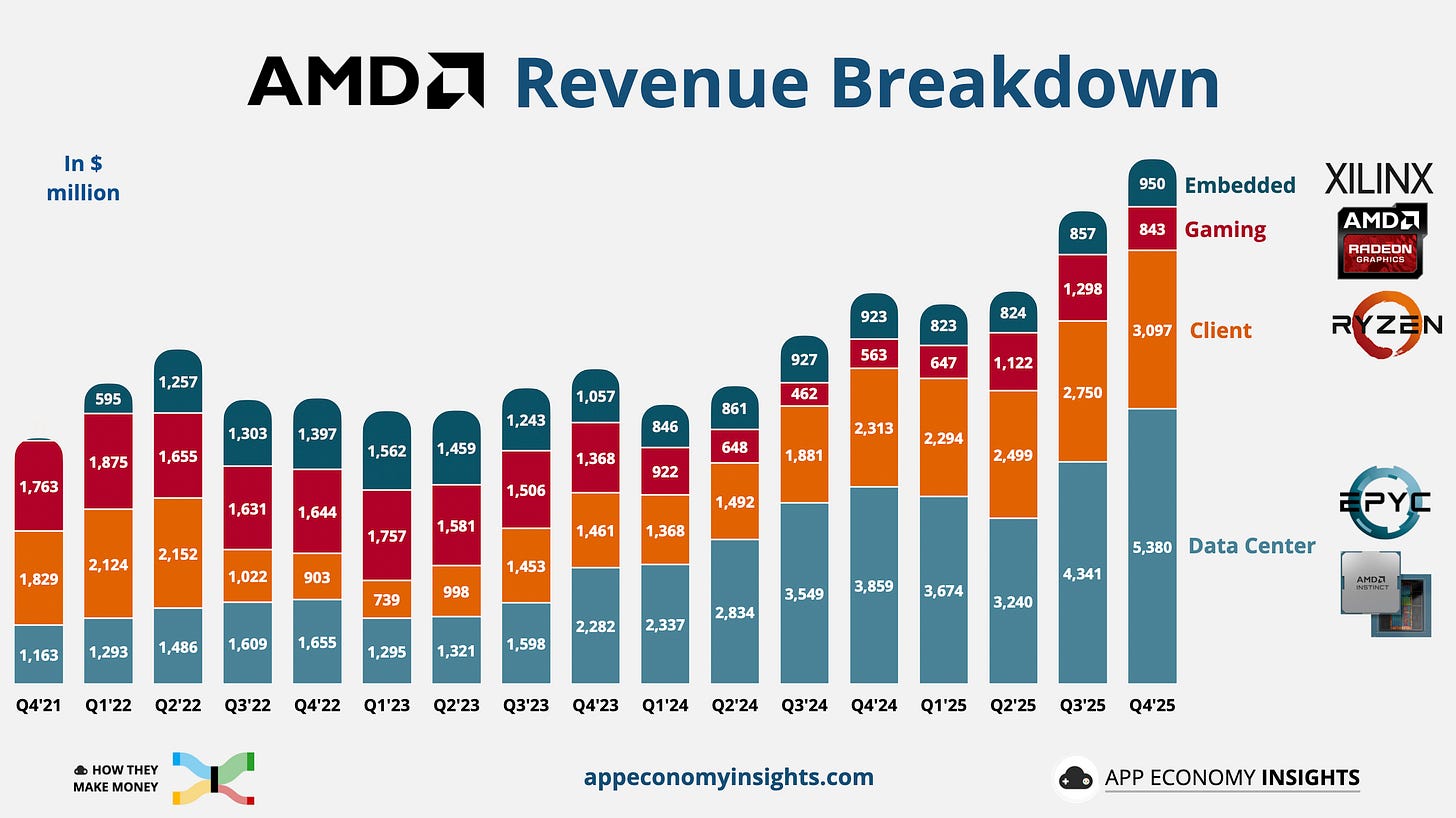

The growth engine is led by the Data Center segment, which surged 39% Y/Y to $5.4 billion ($0.4 billion beat) as adoption of the MI300 AI accelerator and EPYC processors continues to scale. Notably, AMD successfully navigated export controls to ship $390 million in legacy MI308 AI chips to China during the quarter.

Client and Gaming revenue also impressed, growing a combined 39% Y/Y to $3.9 billion. Client revenue rose 34% to $3.1 billion, while Gaming revenue saw a surprising 50% surge to $843 million, driven by renewed demand for Radeon GPUs.

Management issued strong Q1 guidance, projecting revenue of ~$9.8 billion (well above the $9.4 billion consensus) and gross margins of ~55%. This outlook includes an expected ~$100 million in further MI308 sales to China.

Despite the beat, shares dropped in after-hours trading, as investors may have priced in even higher AI upside or sought to rotate out of the extended semiconductor sector.

2. 🕵️ Palantir: 'N of 1' Growth Story

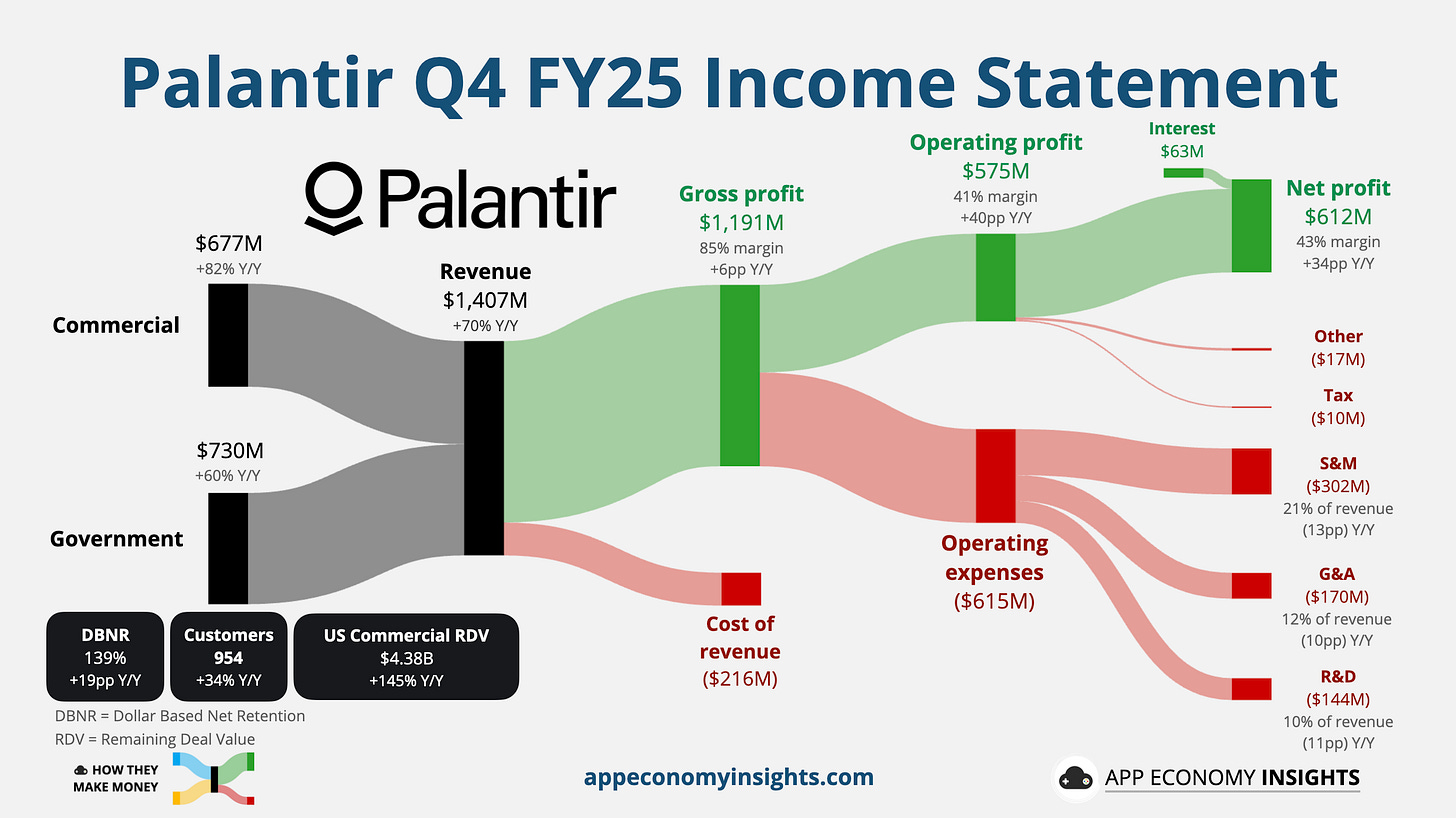

Palantir delivered a stunning Q4, with revenue accelerating to 70% Y/Y growth at $1.4 billion ($60 million beat) and non-GAAP EPS hitting $0.25 ($0.02 beat). The Rule of 40 score climbed to a record 127%, proving the company is scaling with elite efficiency.

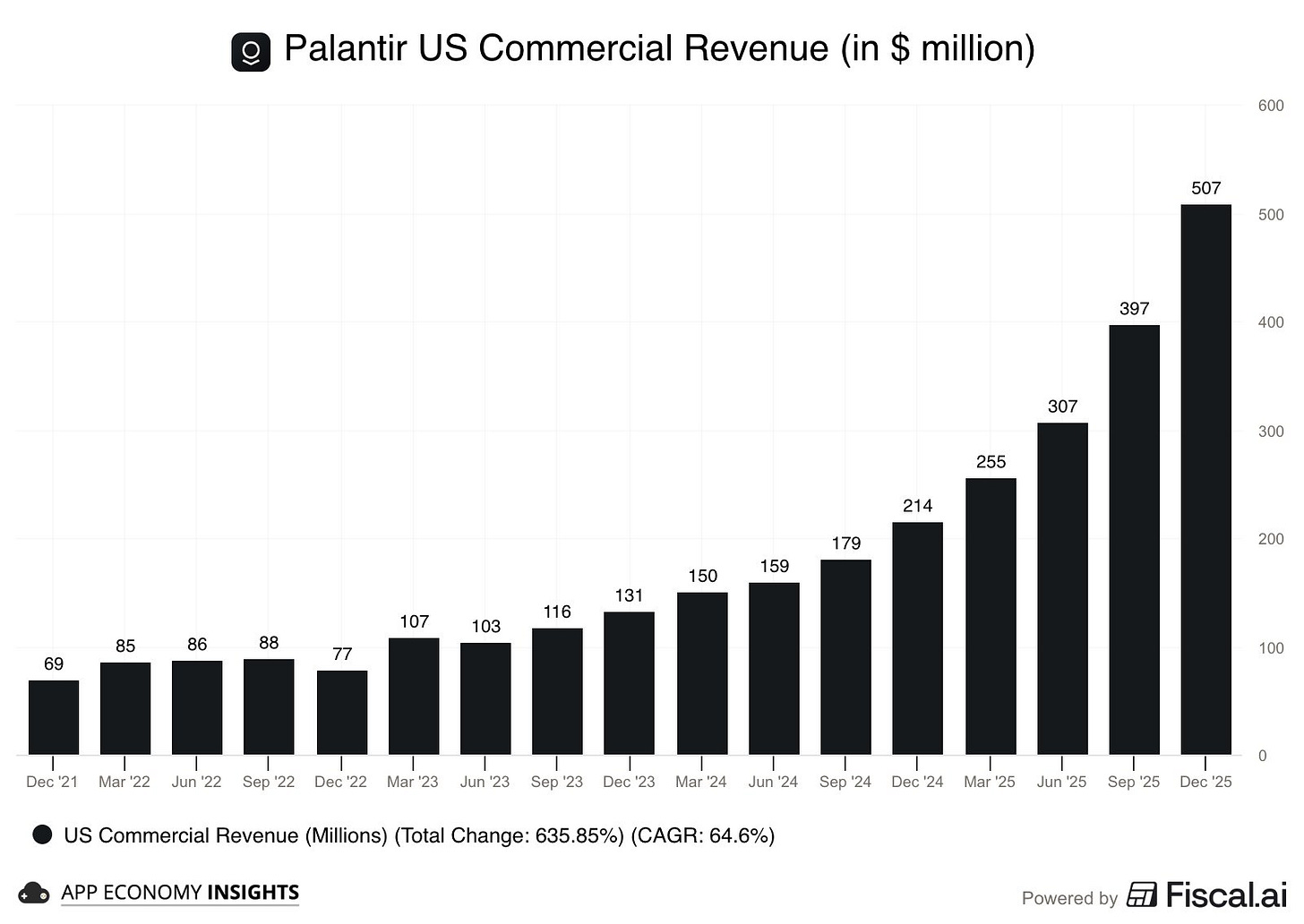

The ‘otherworldly’ growth story from Q3 somehow found another gear. US Commercial revenue exploded 137% Y/Y to $507 million (accelerating from +121% in Q3), driven by a frenzy of AI Platform (AIP) bootcamps converting to massive deals.

US Government revenue also re-accelerated, growing 66% Y/Y to $570 million (the Government segment grew 60% Y/Y globally). Total Contract Value (TCV) hit a record $4.26 billion for the quarter (+138% Y/Y), securing a massive backlog of future revenue.

Management issued a blowout outlook for FY26, guiding for revenue to grow 61% Y/Y to $7.2 billion ($0.9 billion beat). They expect US Commercial revenue alone to exceed $3.1 billion (+115% growth). CEO Alex Karp declared Palantir an “N of 1,” stating the company is in a league of its own in capitalizing on “commodity cognition” (ubiquitous AI models).

Palantir has delivered two consecutive flawless quarters, yet the stock has remained flat over the last six months. This signals a healthy period of valuation digestion. Trading at ~70x forward EBITDA, Palantir commands a massive premium, but with 60%+ growth expected in FY26, it’s one of the few software names growing fast enough to justify it. PLTR is up nearly 10x since it entered our real-money portfolio in January 2024. The fundamentals are finally catching up to the price.