Welcome to the Free edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Every quarter, funds managing over $100 million must disclose their portfolios, offering a rare glimpse into the minds of elite investors.

But this time, context matters.

Trump’s ‘Liberation Day’ tariffs and the market turmoil that followed hit on April 2, just after Q1 closed. These filings don’t reflect the chaos… but they do reveal where top managers were placing their biggest bets before the storm.

Since then, many tariffs have been delayed or scaled back. The market rebounded, and we’re essentially back to where we started, making this Q1 snapshot more relevant than ever.

Let’s dive into the latest 13F filings and see what the smart money was buying.

Today at a glance:

Hedge funds’ strategies.

Top buys and top holdings in Q1.

Case studies.

Implications for individual investors.

FROM OUR PARTNERS

Still Haven’t Talked to a Financial Pro? Here’s Your Free Shot.

Think you're too early (or too late) to talk to a financial advisor? Think again.

Money Pickle gives you free access to a vetted financial pro who can answer all of your money questions like:

How do I navigate taxes?

What do I need to retire?

How should I be investing?

And much more – Just take this quick quiz, book your free consultation, and get matched.

Then you decide if you want to continue with them or not. No pressure. No commitment. Just smart, tailored advice.

👉 Take the quiz and claim your consult before spots fill up by clicking here.

Before we dive in, a quick reminder: blindly copying hedge fund trades is a terrible strategy.

Investing is like shooting 3-pointers. Even Steph Curry, the greatest shooter ever, misses more than half the time. There are no sure bets, even for the pros.

Your behavior matters more than your portfolio. As Peter Lynch said, “Know what you own and why you own it.”

Conviction is what helps you hold through volatility. And conviction comes from doing your own work, not borrowing someone else’s.

As Ian Cassel puts it:

“You can borrow someone else’s stock ideas but you can’t borrow their conviction. […] Do the work so you know when to sell. Do the work so you can hold. Do the work so you can stand alone.”

Some limitations of 13F filings:

Omit short positions and cash reserves.

Offer a partial view, leaving out smaller funds.

Exclude non-US equities, bonds, and commodities.

Can be dated, given their submission 45 days post-quarter.

With all this said, let’s see what top funds were buying and holding in Q1.

1. Hedge funds’ strategies

Hedge funds are financial powerhouses known for flexible, aggressive strategies designed to beat the market.

Here’s what typically shapes their moves:

Market conditions: Long in bull markets, defensive or short in bear markets.

Sector trends: Shifts in regulation or consumer behavior can steer capital.

Company fundamentals: Strong earnings, free cash flow, and leadership matter.

Macro factors: Rates, inflation, geopolitics—all influence positioning.

Quant models: Many funds lean on proprietary algorithms to find edge.

Risk management: Diversification, hedging, and position sizing are key.

Investor sentiment: Fear and greed can create mispriced opportunities.

Still, it doesn’t always work out.

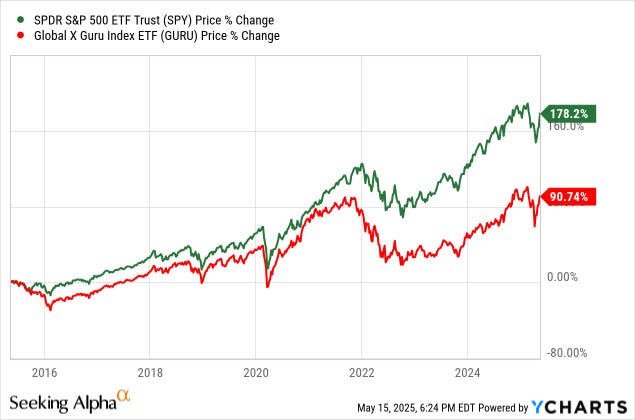

The Global X Guru ETF (GURU), built to track top hedge fund holdings, has underperformed the S&P 500 over the past decade, even before fees.

And those fees matter. The classic “2 and 20” model (2% of assets + 20% of gains) can seriously eat into returns. No wonder many individual investors are choosing simpler, lower-cost strategies.

2. Top holdings and top buys in Q1

Back in early 2020, just before the COVID market turmoil, I curated a list of 20 top-performing hedge funds using TipRanks data. The selection focused on alpha relative to the S&P 500, and I also included a few funds frequently featured in my social feeds and podcast rotation. It’s not perfect, but it remains a solid directional filter.

Top 5 holdings end of March 2025:

The nine stocks below represent nearly half of the top holdings listed:

🤖 AI tech stack: META, NVDA, AMD, TSM.

☁️ Hyperscalers: AMZN, GOOG, MSFT.

💳 Payments: MELI, V.

Now for the more actionable insight:

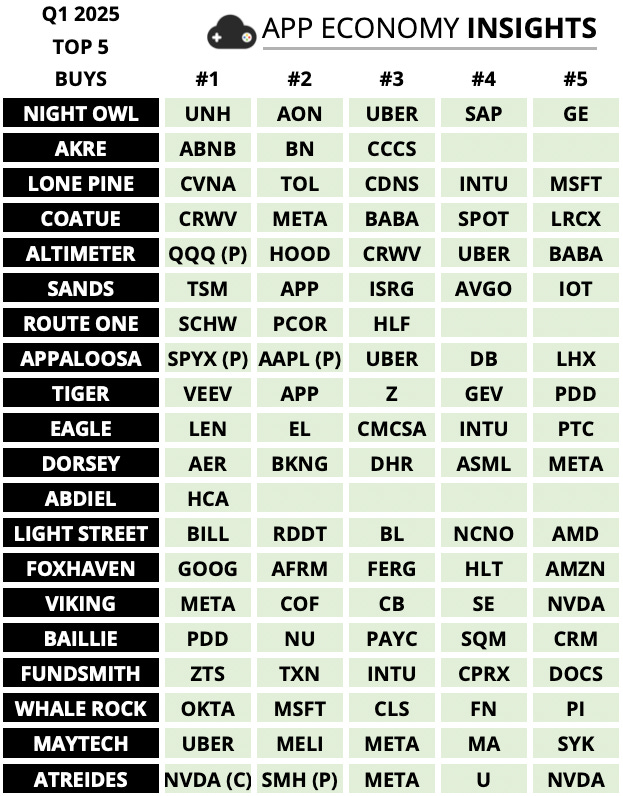

Top 5 buys in Q1:

Here are some of the recurring themes:

🌏 Global commerce: BABA, MELI, PDD.

🤖 AI tech stack: META, NVDA, TSM.

💻 Enterprise software: APP, INTU.

☁️ Hyperscalers: CRWV, MSFT.

📱 Marketplaces: UBER, ABNB.

Two call-outs:

💬 Meta is hot again: After disappearing from last quarter’s top buys, Meta returned with a bang, making the top 5 buys for Coatue, Dorsey, Viking, Maytech, and Atreides. Why? DeepSeek’s breakthrough in AI inference efficiency showed Meta’s infrastructure bets could pay off handsomely, potentially boosting margins over time.

🚖 Uber gets some love: Not a usual headliner, UBER was a top buy at Night Owl, Altimeter, Appaloosa, and Maytech. We just visualized Uber’s Q1 FY25 last week. There was plenty to like: Engagement rising, margins expanding, and Waymo robotaxis accounting for 20% of Uber rides in Austin. Uber’s asset-light approach to autonomy may be starting to click.

🧠 A quick note on top sells: I typically skip them — not because they aren’t interesting, but because they can be misleading. Hedge funds often trim high-conviction positions to manage risk or rebalance. So a “top sell” doesn’t always mean a bearish turn.

Outside the core list

Bill Ackman (Pershing Square)

New $2.3 billion Uber investment (now his top holding at 18%).

Also increased Brookfield (BN), which is now a close second.

Stanley Druckenmiller (Duquesne)

Opened new positions: DOCU, TWLO, ROKU.

Added to existing ones: TEVA, CPNG, FLUT.

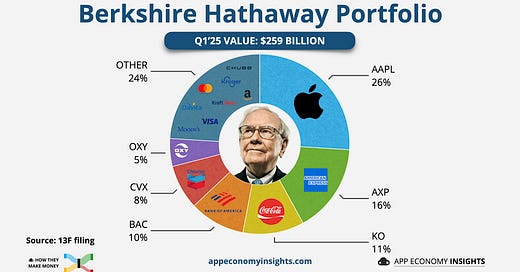

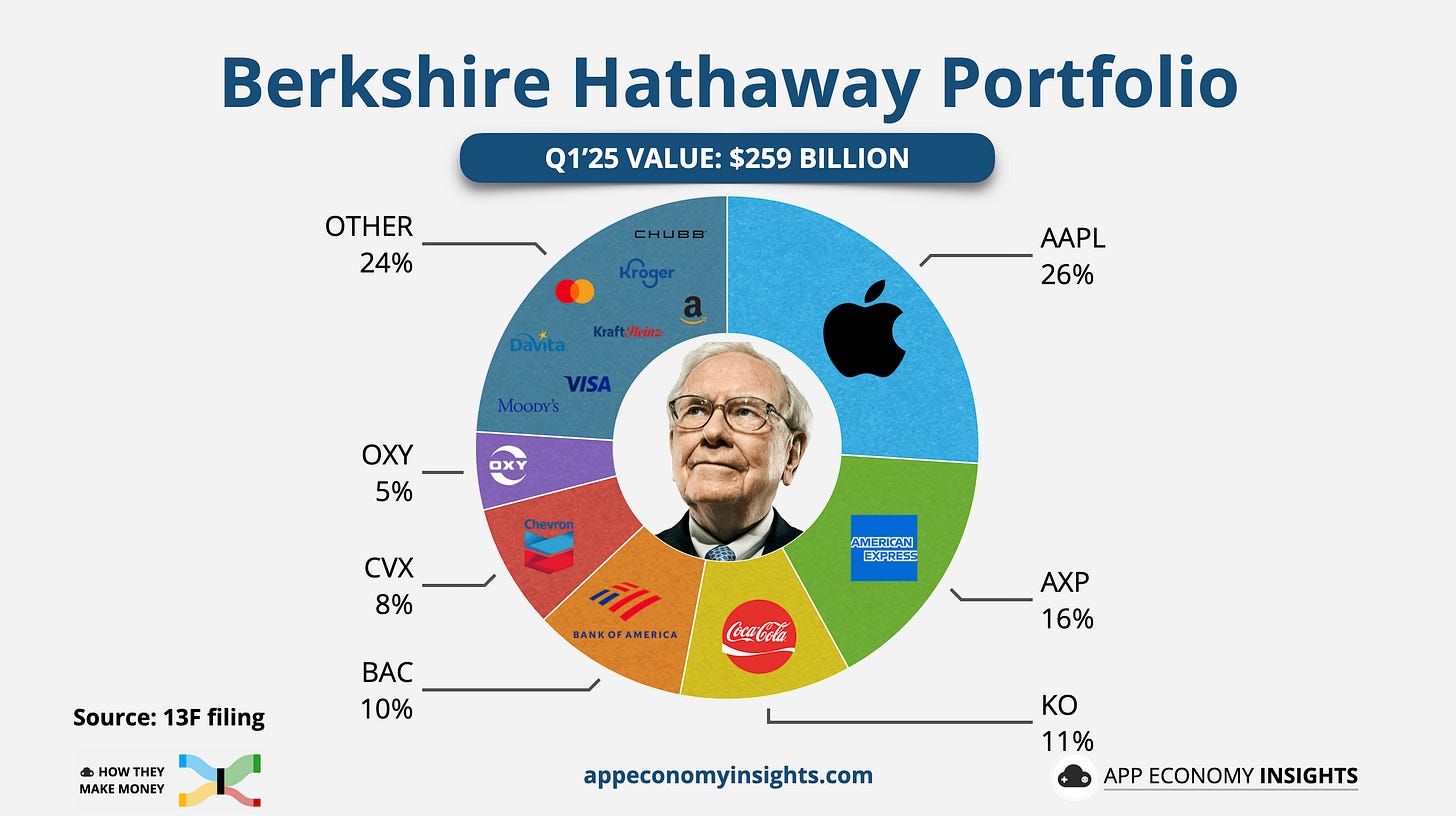

Warren Buffett (Berkshire Hathaway)

Apple gets a break from the chopping block. After heavy cuts in 2024, Buffett held steady for another quarter. AAPL remains the top holding (26% of the portfolio).

Trimmed Bank of America by ~7%, pushing it to #4 behind AXP and KO

Increased Constellation Brands (STZ) to 0.9% of the portfolio

3. Case studies

Let's zoom in on two names from Q1’s top buys.

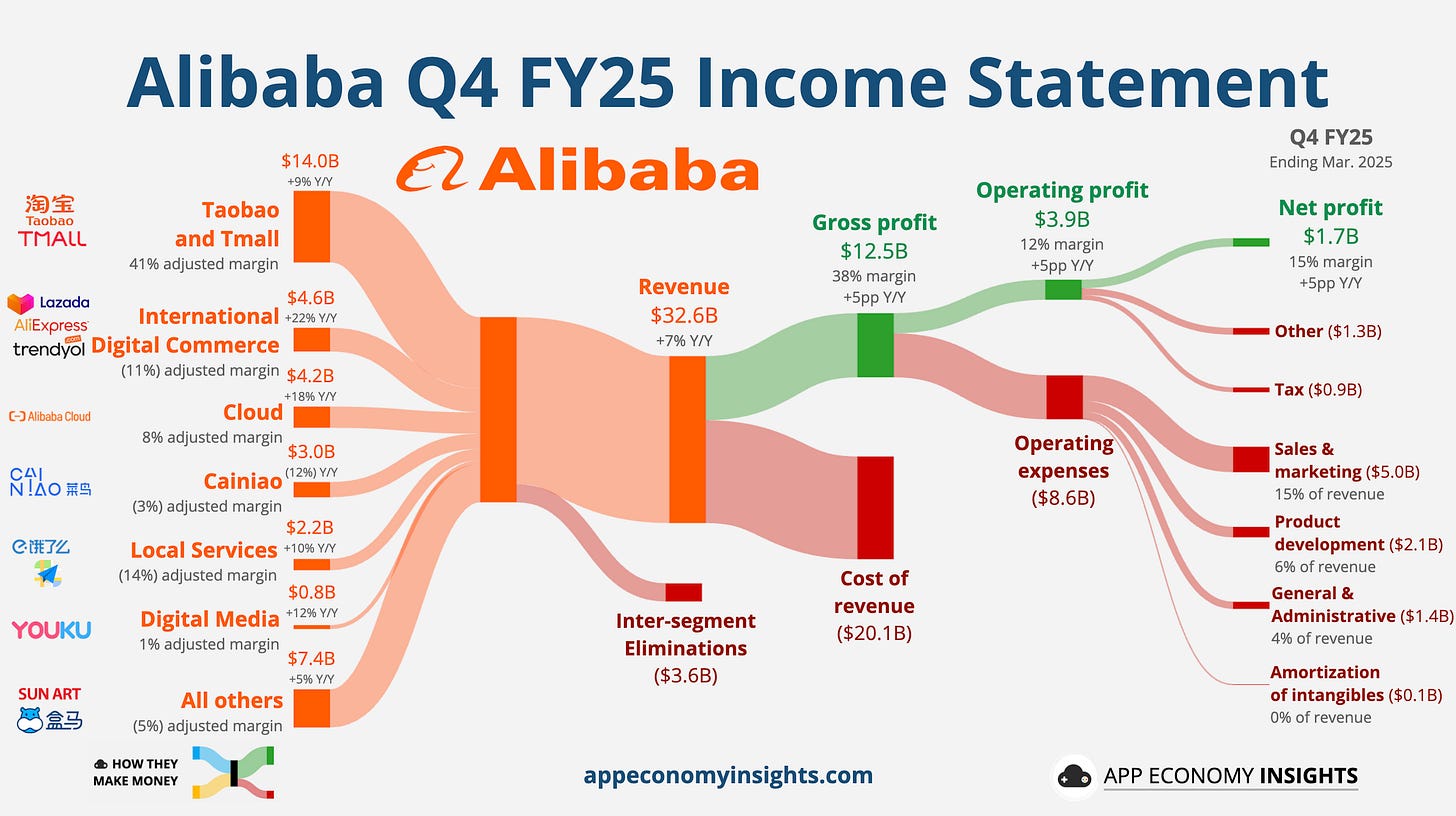

📦 Alibaba: Double Miss Despite AI

Alibaba’s Q4 (March quarter) revenue rose 7% Y/Y to $32.6 billion ($740 million miss), while EPS was $1.73 ($0.05 miss). Despite the double miss, Cloud accelerated to 18% Y/Y, driven by a seventh consecutive quarter of triple-digit AI growth. The company continues to prioritize AGI, launching Qwen 3 and expanding its AI assistant Quark amid intensifying competition from Tencent, Baidu, and DeepSeek.

Core commerce remained resilient: Taobao and Tmall revenue rose 9%, with customer management revenue up 12% and improved take rates. Alibaba is leaning into “instant commerce,” offering one-hour delivery and deepening its Xiaohongshu partnership to boost engagement. International commerce grew 22%, slightly slowing from last quarter.

Profit nearly quadrupled off a low base, but free cash flow fell 76% due to heavy AI infrastructure investment. Amid a cooling economy and ongoing tariff uncertainty, Alibaba’s bet on AI and logistics aims to fend off PDD, JD, and ByteDance—though monetization remains the key challenge ahead.

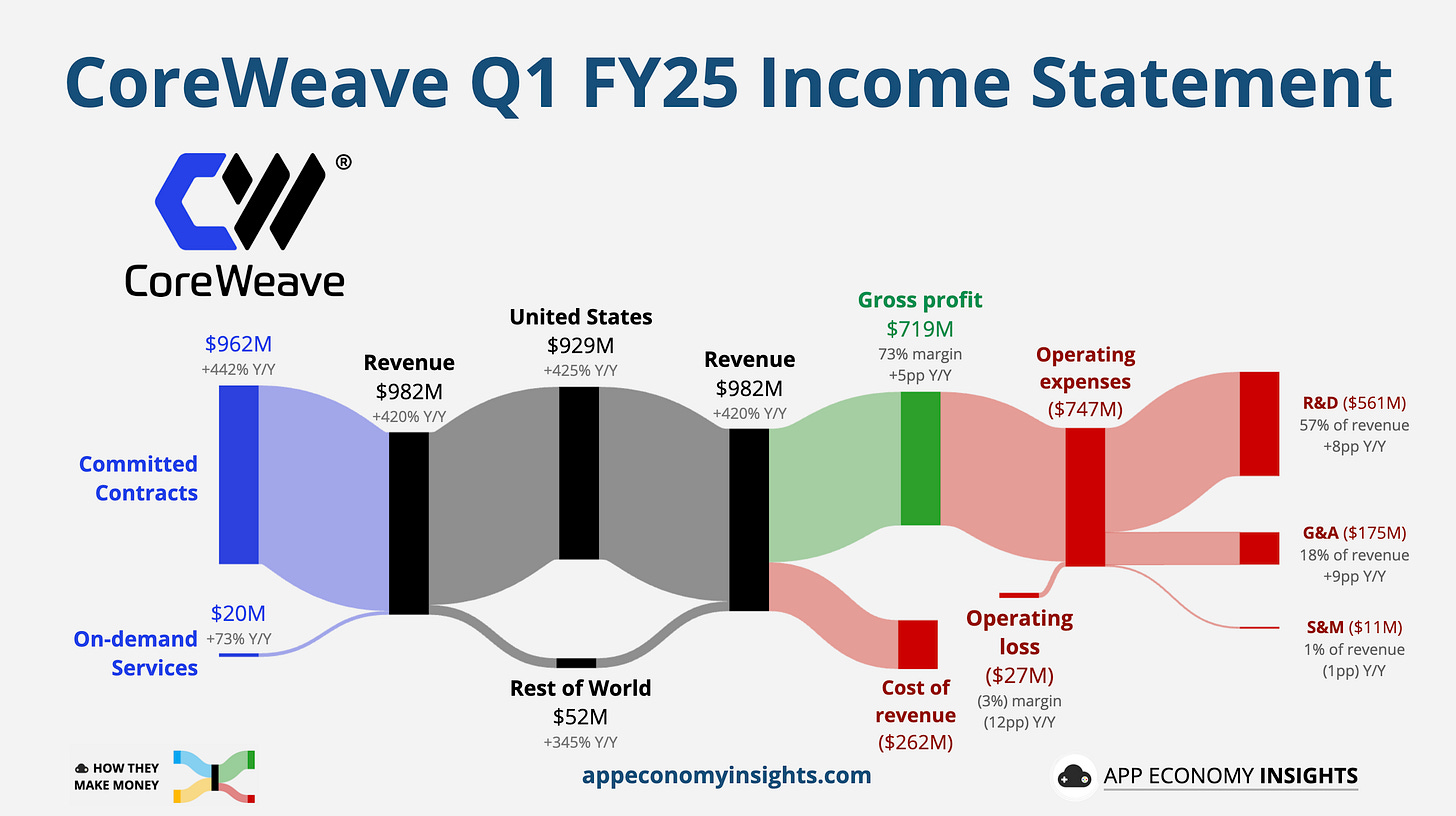

☁️ CoreWeave: $4B OpenAI Deal

CoreWeave posted a blockbuster first quarter as a public company, with revenue soaring 420% Y/Y to $982 million ($122 million beat), driven by surging demand for high-performance AI infrastructure. But losses widened to $1.49 per share, missing estimates by $1.27, as the company fast-tracked capex plans to meet growing demand. We covered CoreWeave’s business model previously.

A new $4 billion deal with OpenAI brought total backlog to $26 billion, underscoring CoreWeave’s strategic positioning in the AI supply chain. But guidance for Q2 operating income ($140–$170 million) missed expectations, and full-year capex is now expected to hit $20–$23 billion, sparking investor concerns about sustainability and capital intensity.

Still, bulls point to deep partnerships with OpenAI, Microsoft, and Nvidia, a growing list of hyperscaler clients, and projected 2025 revenue of $5 billion. As the GPU economy scales, CoreWeave is betting big to become the go-to AI infrastructure layer—fast growth now, profits later.

4. Implications for individual investors

Tracking hedge fund activity can be insightful, but it comes with caveats.

Here’s what to keep in mind:

Diversify: Hedge funds spread risk across sectors and regions. You should, too. Don’t hinge your portfolio on a single big idea.

Think long term: Top funds look years ahead. They don’t chase headlines — they bet on where the world is going, not where it’s been.

Do your homework: Yes, hedge funds have research teams. But that doesn’t excuse you from digging in. Read. Analyze. Stay curious.

Watch the fees: Fees erode returns. As Jack Bogle said, “In investing, you get what you don’t pay for.” Know what you’re being charged.

Use 13Fs as a starting point: These filings are dated snapshots, not real-time signals. But they’re great for surfacing ideas and framing your research.

Watching hedge funds can be instructive, but your investment journey is personal. Make informed decisions that suit your goals and risk appetite.

Bottom line

Successful investing isn’t about copying the smart money. It’s about knowing why you’re invested in the first place, with your unique goals and risk profile.

While most of us won't have the vast resources of a hedge fund, we possess something just as potent—the ability to invest with patience and a long-term vision.

Investing isn't about blindly following the herd. It's about carving your own path, armed with knowledge, patience, and a relentless pursuit of growth and learning.

That’s it for today.

Stay healthy and keep investing!

Want to sponsor this newsletter? Get in touch here.

Disclosure: I own AAPL, ABNB, AMD, AMZN, APP, APPN, ASML, BABA, BAC, CRM, GLBE, GOOG, HUBS, INTU, JD, MELI, META, NET, NVDA, PCOR, SE, SHOP, SNOW, TSM, TWLO, U, UBER, V, and Z in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.