🕵️ Palantir: 'Otherworldly' Growth

AI euphoria meets business execution

Welcome to the Free edition of How They Make Money.

Over 240,000 subscribers turn to us for business and investment insights.

In case you missed it:

Apple plans to give Siri a new brain

The AI-powered Siri teased back in June 2024 still hasn’t made its debut.

According to Bloomberg’s Mark Gurman, Apple plans to pay Google ~$1 billion a year to use a custom version of Gemini to power next-gen Siri, handling tasks like summaries and planning. The new model would pack 1.2 trillion parameters, compared to roughly 150 billion for the current Apple Intelligence model.

$1 billion is a rounding error for these two Silicon Valley giants. The real story is who Apple chose. After testing models from Anthropic and OpenAI (including ChatGPT), it still went with Google.

Apple’s goal is to replace Gemini with its own model, eventually.

But don’t hold your breath.

Today at a glance:

🕵️ Palantir: Otherworldly Growth

↗️ AMD: Data Center Margins Miss

📱 AppLovin: AI Drives Record Profits

🛍️ Shopify: Growth & AI Costs Soar

🎧 Spotify: Ad Slump Continues

FROM OUR PARTNERS

Don’t let 2025 tax savings slip away

Range helps high-earners maximize their wealth with smart tax and investing strategies:

Max out your:

401(k) ($23,500, +$7,500 if 50+).

HSA ($4,300 individual/$8,550 family).

IRA ($7,000).

Leverage the $40,000 SALT cap, $15M estate tax exemption, or Roth conversions.

Gift $19,000/person tax-free, superfund 529s ($95,000), or harvest tax losses ($3,000 deduction).

Range’s real-time insights, flat fees, and expert guidance simplify it all.

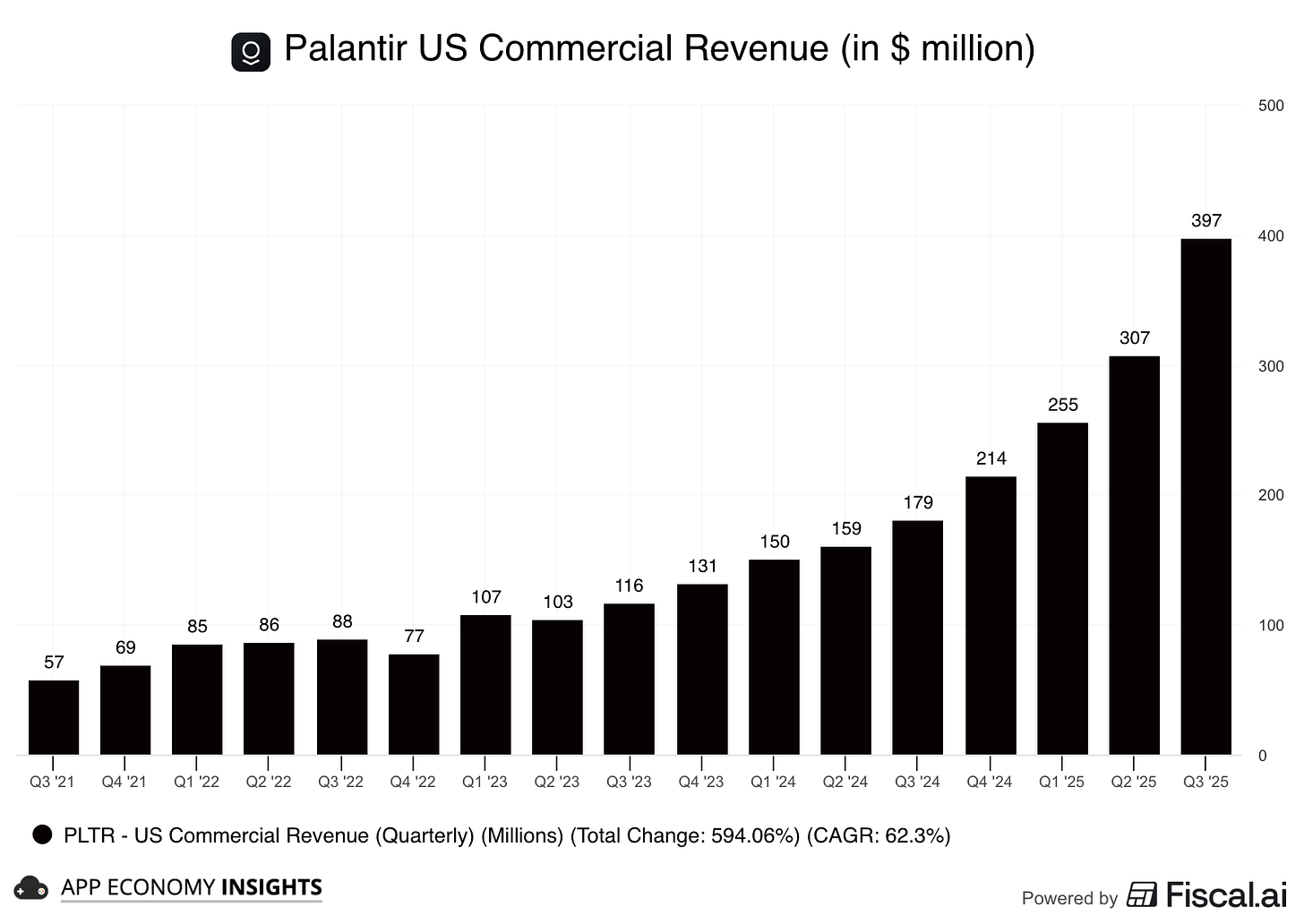

1. 🕵️ Palantir: ‘Otherworldly’ Growth

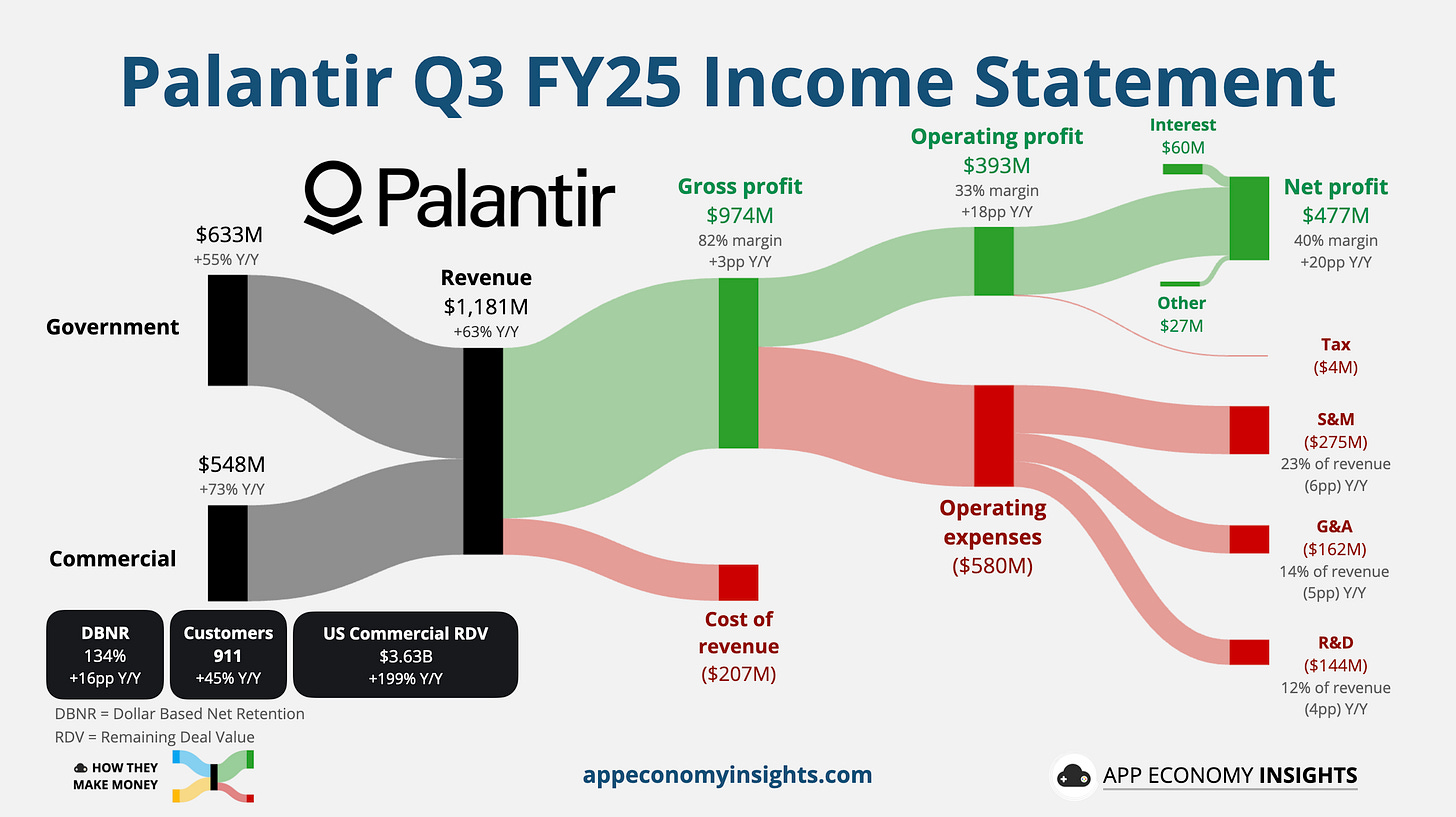

Palantir smashed expectations, with Q3 revenue jumping 63% Y/Y to $1.18 billion ($90 million beat) and non-GAAP EPS of $0.21 ($0.04 beat). The company’s dollar-based net retention reached a “best in class” 134%.

CEO Alex Karp called the growth “accelerating and otherworldly,” stating the results “make undeniable the transformational impact of using AIP to compound AI leverage.”

The real story: US commercial revenue soared 121% Y/Y to $397 million, while US government revenue climbed 52% to $486 million. US Commercial Total Contract Value rocketed 342% Y/Y to $1.3 billion, setting up a long runway of booked revenue ahead.

Management raised its FY25 guidance again, now targeting ~$4.40 billion in revenue ($150 million raise), including US commercial revenue expected to more than double to $1.43 billion ($131 million raise). Adjusted free cash flow is now projected at ~$2.0 billion ($100 million raise).

Palantir notched a record Rule of 40 score of 114% (up from 94% in Q2) and a record Total Contract Value (TCV) of $2.76 billion (+151% Y/Y). Its AI platform continues to win massive deals, with no signs of slowing down.

But here’s the twist: PLTR is an 11‑bagger (up 1,000%) since it entered our real-money portfolio in January 2024, a testament to the wild investor enthusiasm surrounding AI. Palantir is trading at the top end of the S&P 500’s valuation range. And despite stellar results, the stock fell 15% in the days after earnings, illustrating that much of the upside was already priced in.

Bottom line: Palantir’s growth is otherworldly, but so is its valuation. That requires stellar execution for the foreseeable future.

2. ↗️ AMD: Data Center Margins Miss

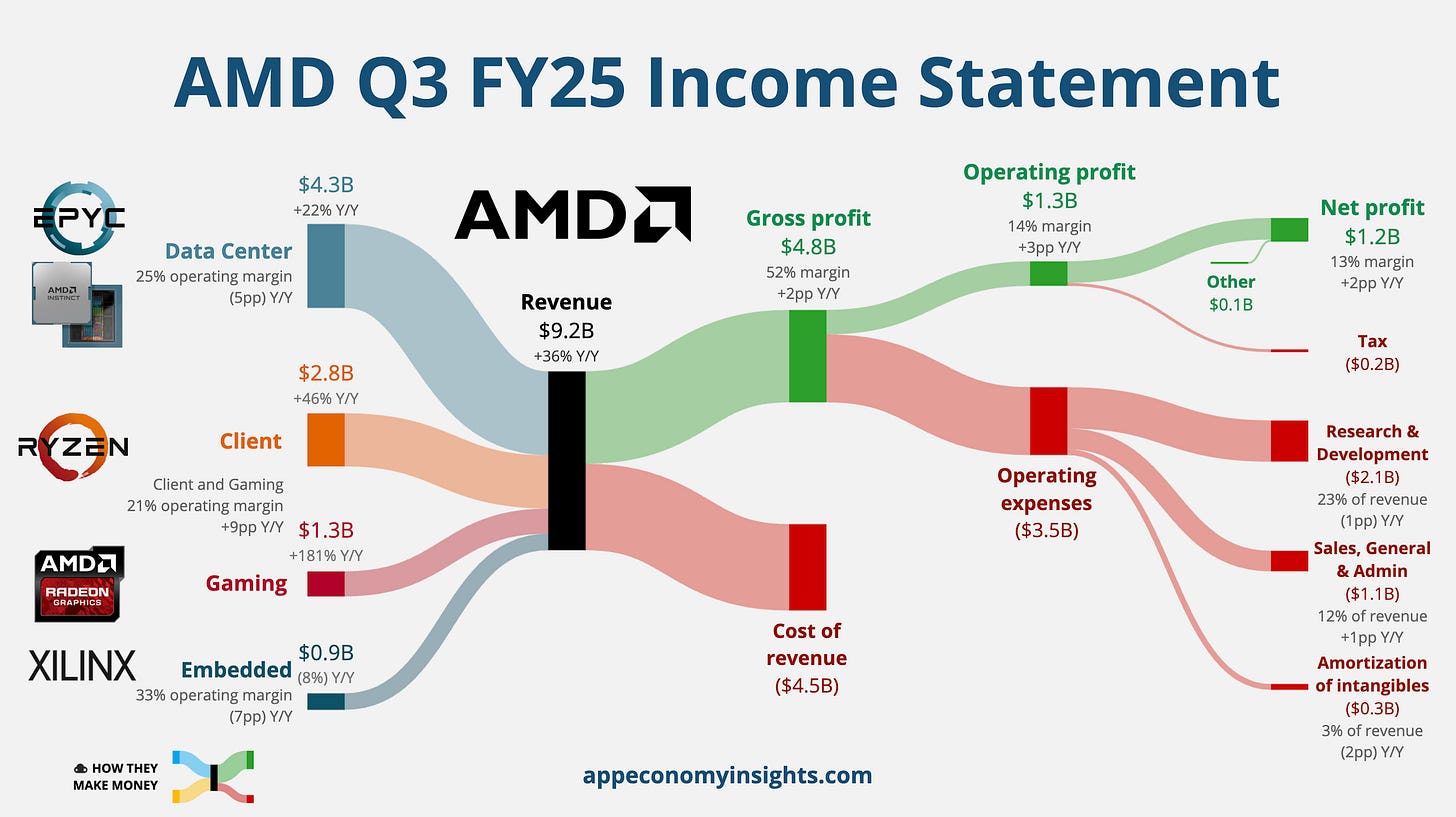

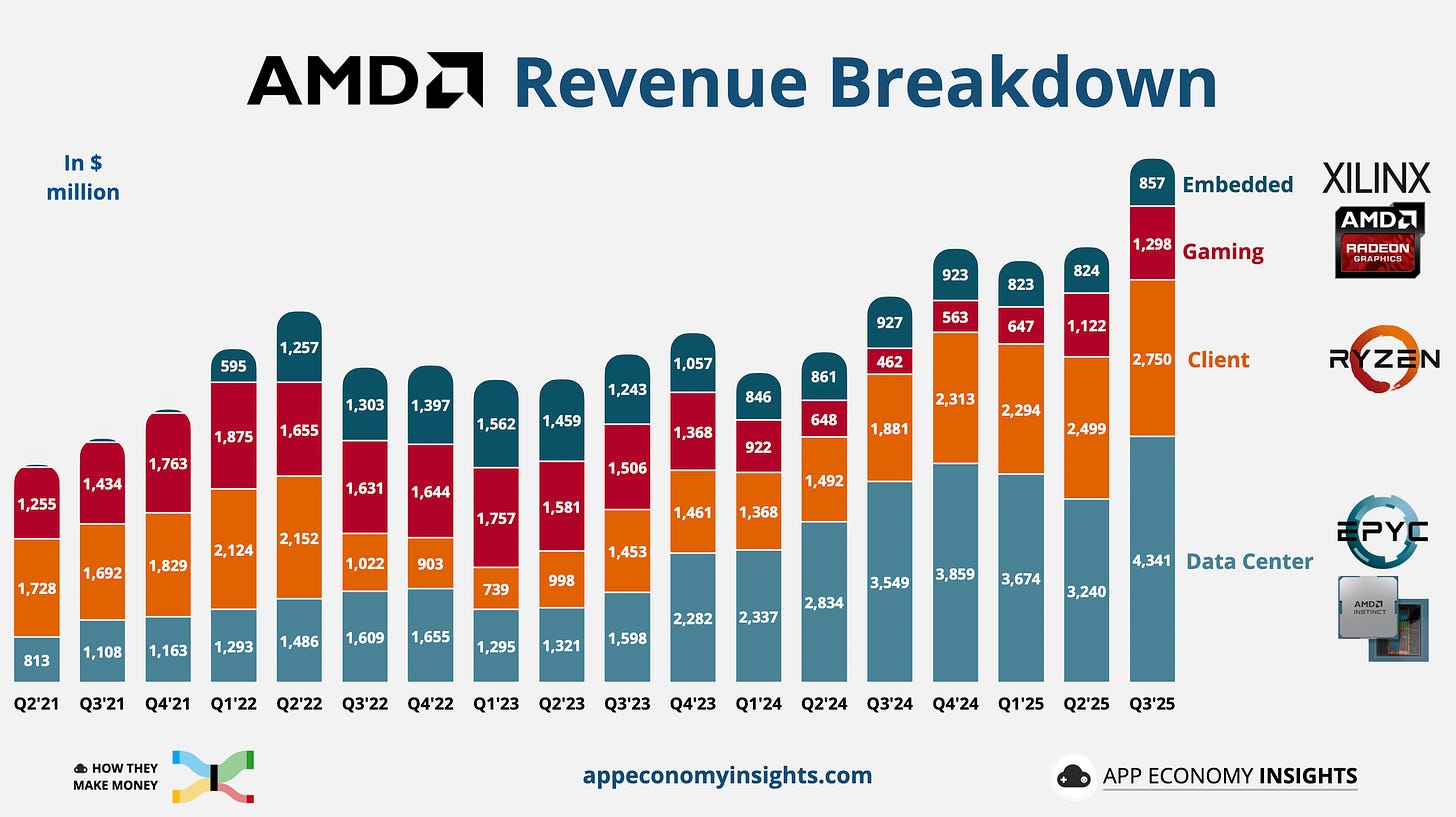

AMD’s Q3 revenue surged 36% Y/Y to a record $9.2 billion ($500 million beat), while adjusted EPS of $1.20 also beat estimates ($0.03 beat). The results were driven by broad-based demand for EPYC processors, Ryzen CPUs, and Instinct AI accelerators.

↗️ Data Center revenue rose 22% Y/Y to $4.3 billion ($200 million beat), driven by strong demand for 5th Gen EPYC processors and the MI350 AI accelerator ramp. However, the segment’s operating income of $1.1 billion missed expectations, with operating margins falling to 25% (from 29% a year prior).

💻 Client and Gaming revenue was the standout, soaring 73% Y/Y to $4.0 billion. Client revenue hit a record $2.8 billion (+46% Y/Y), fueled by record Ryzen processor sales. Gaming revenue exploded 181% Y/Y to $1.3 billion, driven by higher semi-custom console revenue and strong Radeon GPU demand.

📉 Embedded revenue declined 8% Y/Y to $0.9 billion.

The Q4 outlook beat expectations. AMD guided revenue to ~$9.6 billion (midpoint), roughly $400 million above consensus, with gross margin expected to expand to 54.5%. Notably, this forecast still excludes expected revenue from MI308 shipments to China.

CEO Lisa Su called it an “outstanding quarter” and a “clear step up in our growth trajectory.” Despite the strong top-line and improved guidance, the stock fell as investors likely focused on the data center margin miss and an AI growth trajectory that, while strong, has not yet met the market’s high expectations.

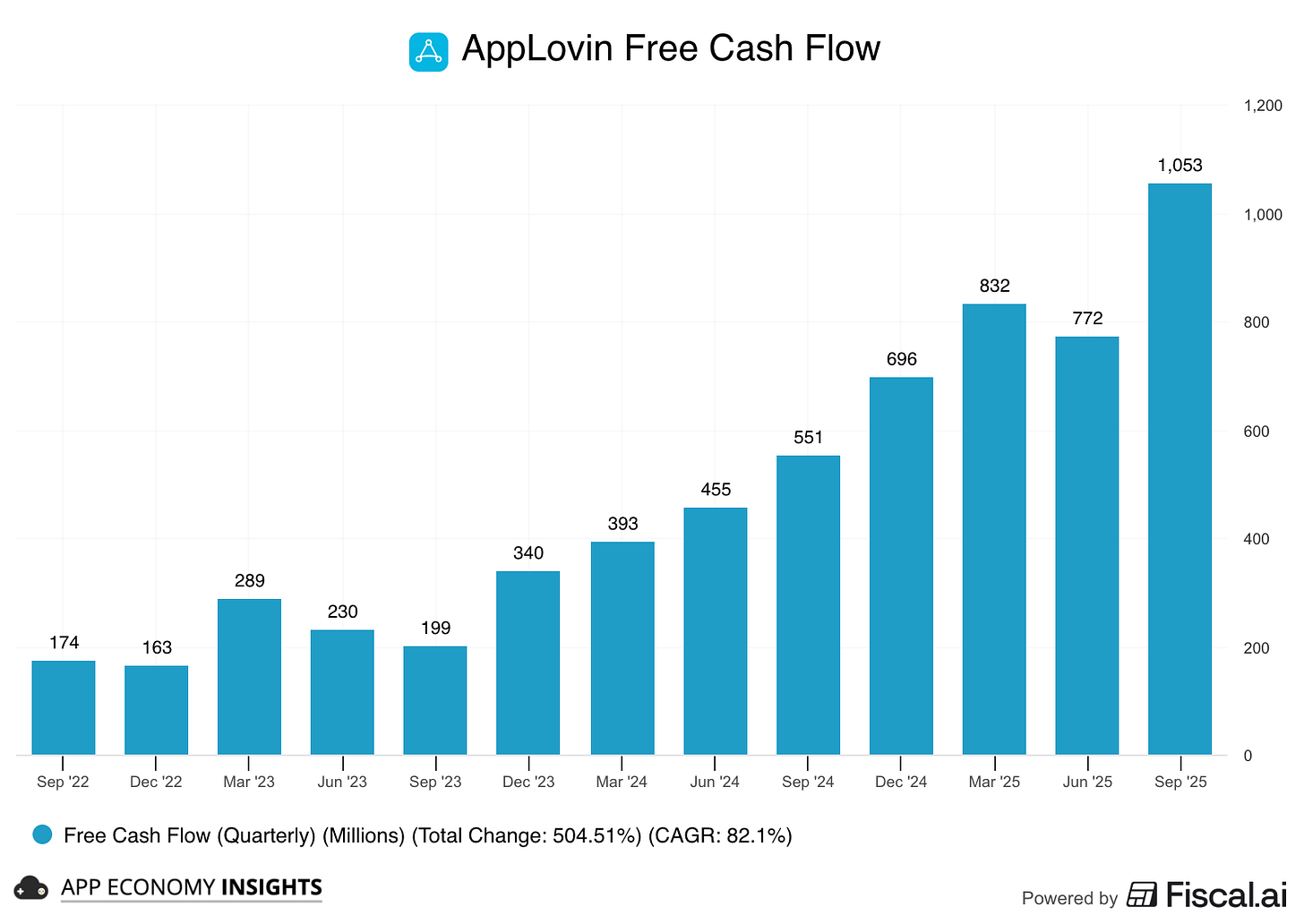

3. 📱 AppLovin: AI Drives Record Profits

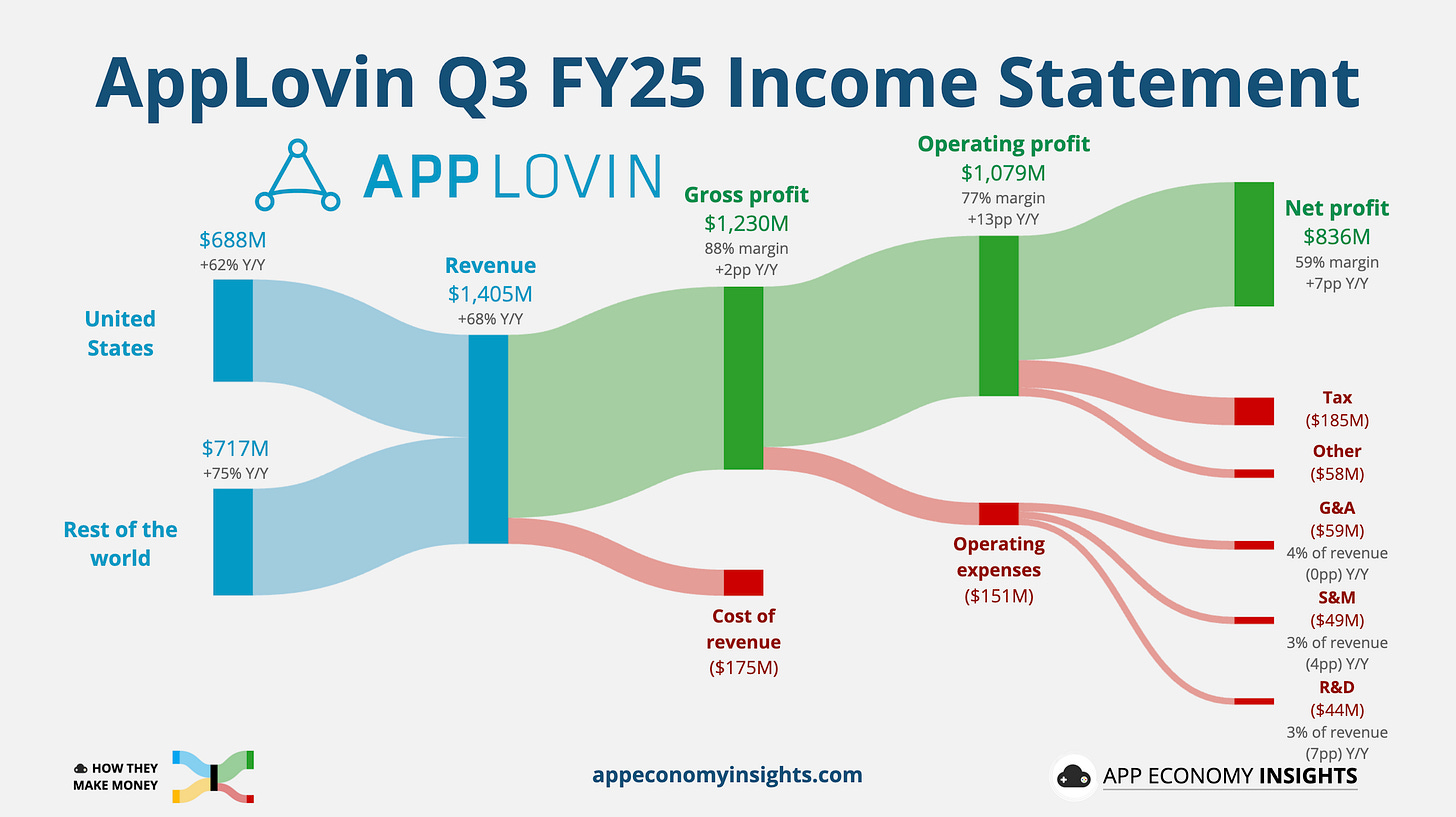

AppLovin is now operating as a pure-play ad-tech company following its app business divestiture.

Q3 revenue surged 68% Y/Y to $1.41 billion ($70 million beat), with the adjusted EBITDA margin reaching an impressive 82%. Even NVIDIA and Visa don’t hit such a high number. GAAP EPS was $2.45 ($0.06 beat), and free cash flow jumped 92% Y/Y to $1.05 billion.

AppLovin’s core ad tech business continued to fire on all cylinders, leading to its recent inclusion in the S&P 500. The AXON self-serve platform launched on October 1st, and management reported very strong early signals, with spend from new advertisers growing ~50% week-over-week.

Management guided for a strong Q4, with revenue of $1.57–$1.60 billion (well ahead of the $1.55 billion consensus) and a stable adjusted EBITDA margin of 82-83%.

The company also announced a new $3.2 billion share buyback authorization. While rumors of regulatory investigations (SEC, state AGs) regarding data practices have created an overhang, the company’s impressive execution, record profitability, and the promising initial ramp of its self-serve platform show accelerating momentum in its core AI-driven ad-tech business.

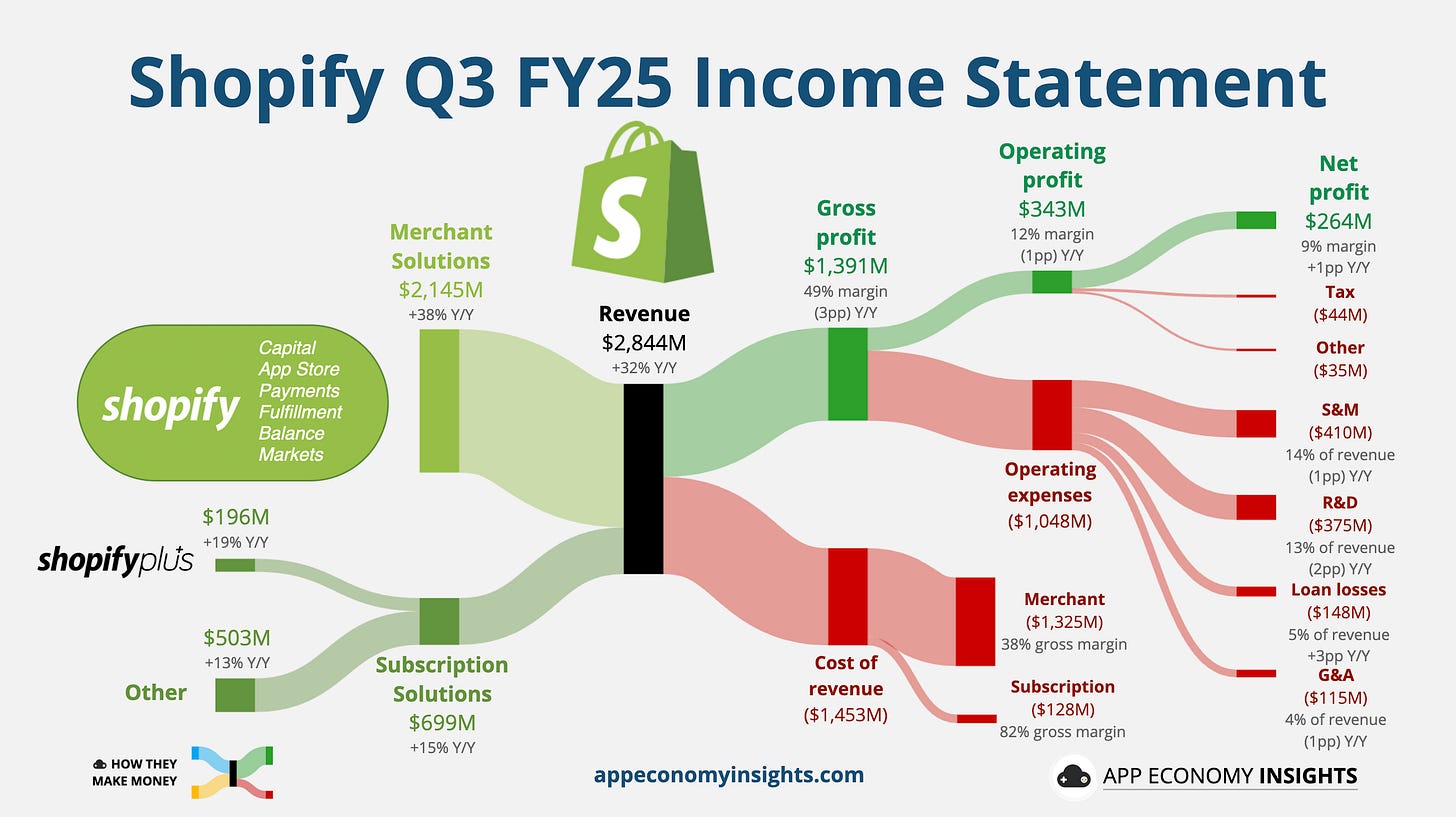

4. 🛍️ Shopify: Growth & AI Costs Soar

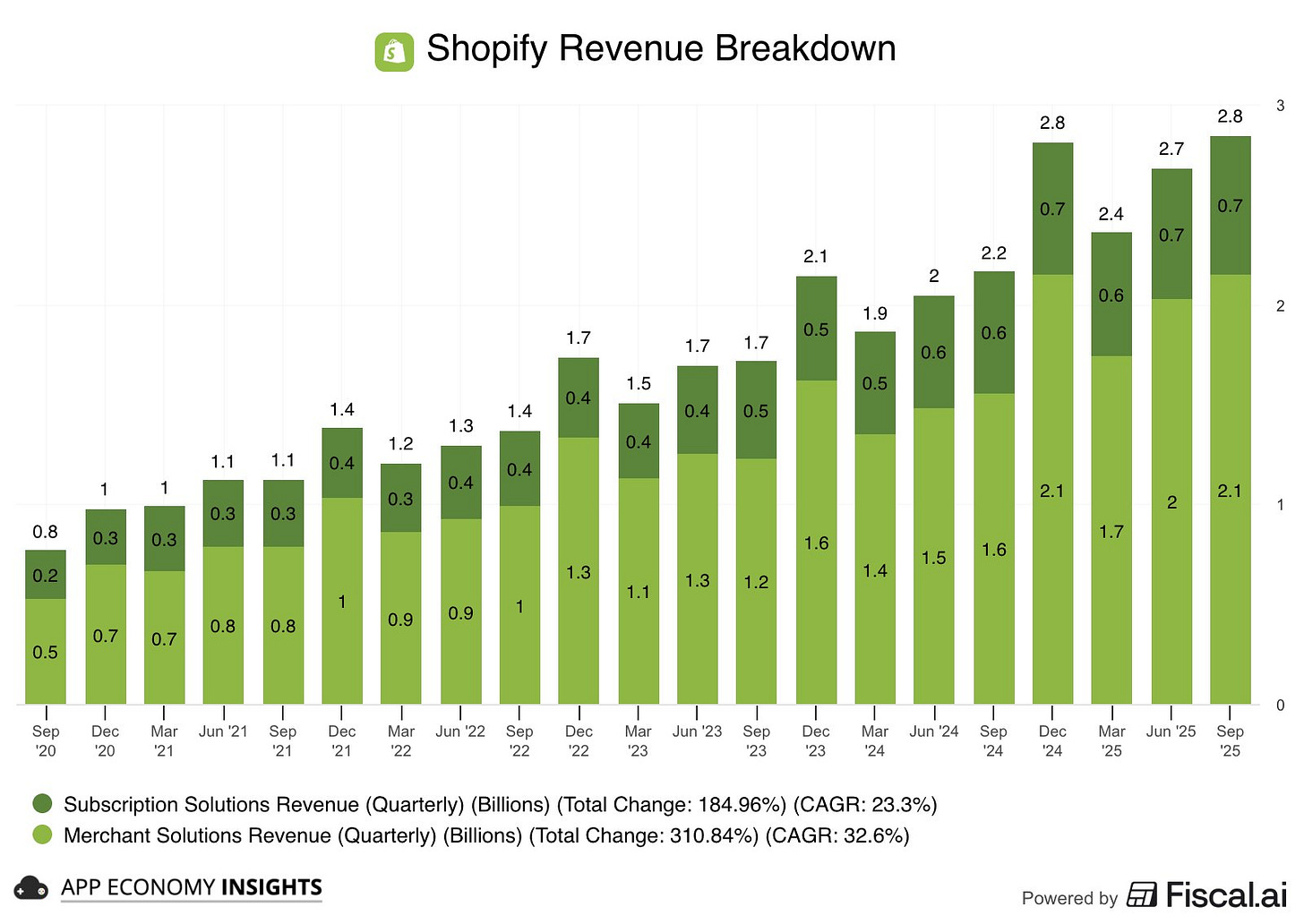

Shopify’s Q3 revenue jumped 32% Y/Y to $2.84 billion ($80 million beat), and Gross Merchandise Volume (GMV) also surged 32% to $92 billion ($3 billion beat). Growth was strong in North America and internationally, with Merchant Solutions revenue rising 38% Y/Y to $2.15 billion, while Subscription Solutions grew 15% Y/Y to $699 million.

Adjusted EPS was $0.34 (in line with consensus), while GAAP net income fell to $264 million from $828 million a year ago (due to a large one-time gain on equity investments last year). Gross margin compressed to 49% (from 52% a year ago), pressured by higher R&D, marketing, and increased spending on AI infrastructure to support new tools like the “Sidekick” assistant. You could argue that gross margin compression is actually a bullish sign because it shows that merchants are actually using Shopify’s AI tools.

Shopify provided a strong Q4 revenue growth outlook in the “mid-to-high-twenties” percentage range (unchanged), ahead of consensus.

Despite the top-line beat, shares fell slightly post-earnings. Investors are likely focused on the rising AI spending. While the company’s AI tools are driving merchant adoption, investors are now weighing the high costs of the AI pivot against the platform’s resilient, share-gaining growth. AI tailwinds are clear, but now the ROI also comes into question.

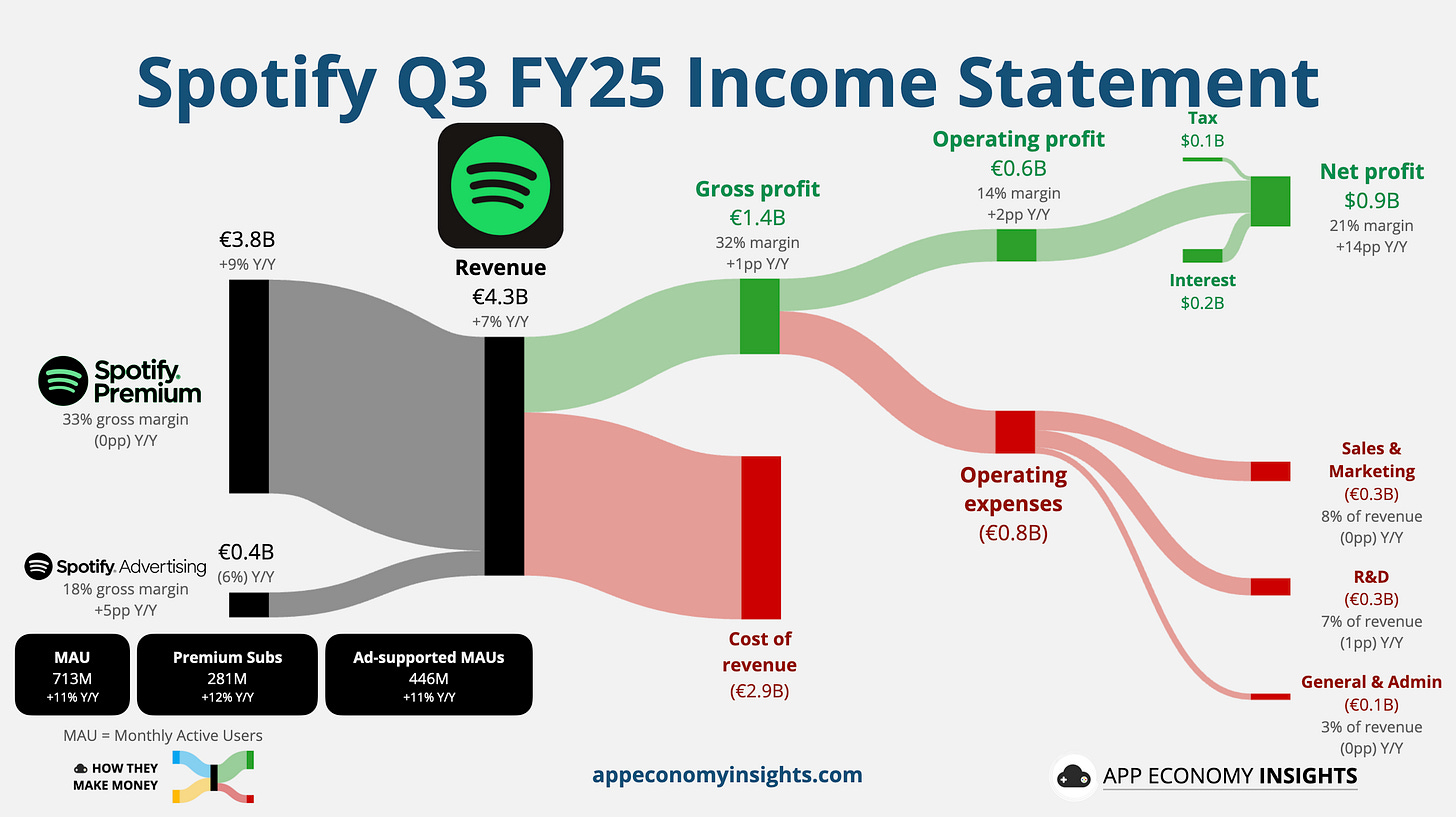

5. 🎧 Spotify: Ad Slump Continues

Spotify’s Q3 revenue rose 7% Y/Y to €4.3 billion (€40 million beat). The company posted a strong net profit of €0.9 billion, or €3.28 per share (€1.32 beat), a significant turnaround from last quarter’s stock-based-comp-driven loss.

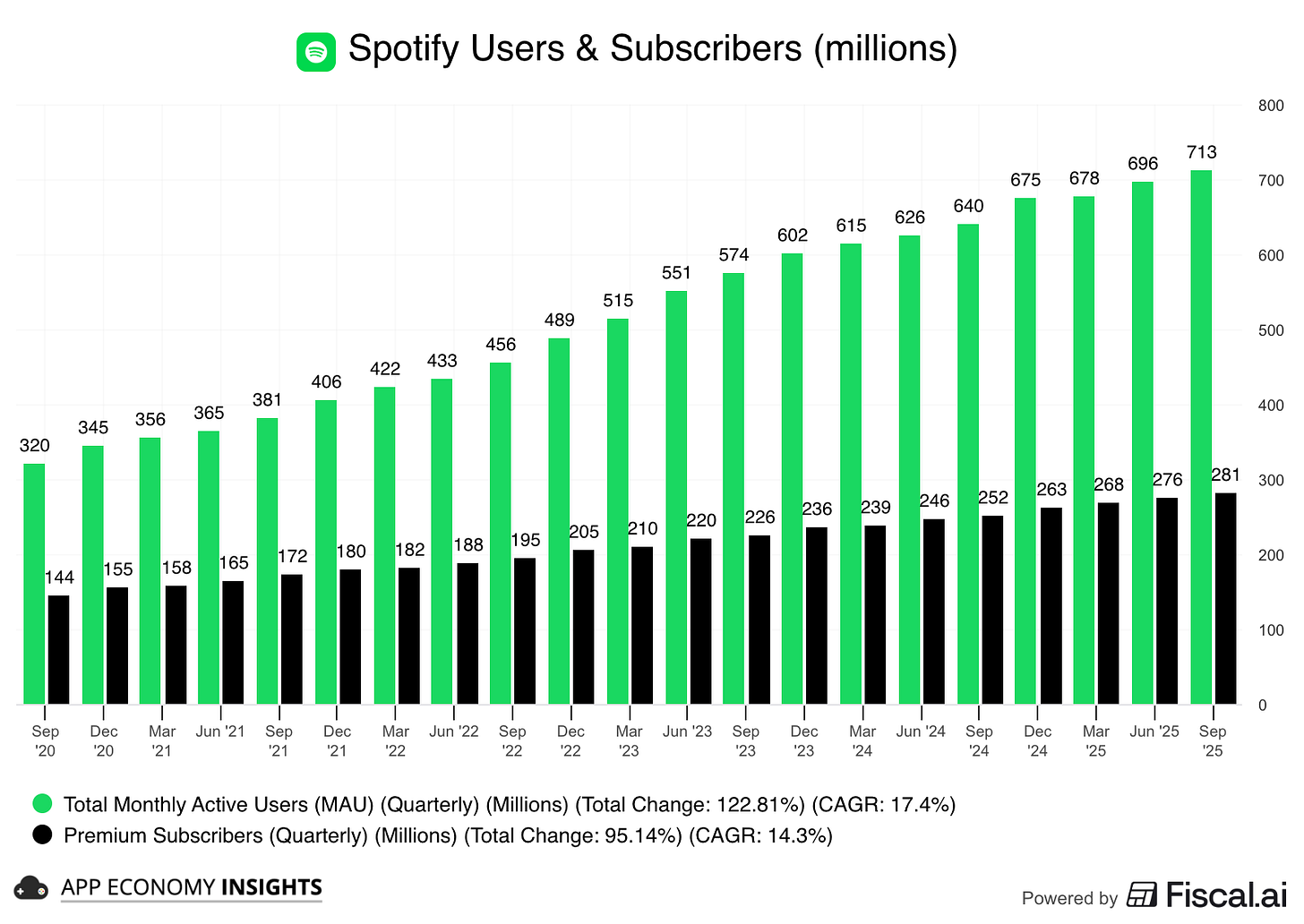

Monthly active users (MAUs) climbed 11% Y/Y to 713 million (3 million beat), and Premium subscribers rose 12% Y/Y to 281 million (in line with expectations).

Engagement is being driven by a major push into video podcasts, which now have 500,000 shows and have been streamed by 390 million users (up 54% Y/Y). Time spent with video content on the platform has more than doubled Y/Y, and a new “ubiquity” strategy—including a new partnership with Netflix—aims to syndicate content off-platform to drive awareness and incremental usage back to Spotify.

Guidance for Q4 was mixed. While MAU and operating income forecasts were ahead of consensus, the Q4 revenue forecast of €4.5 billion was slightly below analyst expectations.

The low-light of the quarter was the continued decline in advertising revenue, which fell 6% Y/Y due to pricing pressure. Management now views 2025 as a “transition year” for ads, with no growth improvement expected until the back half of 2026. The quarter also marks a leadership transition, with CEO Daniel Ek moving to executive chairman, handing the reins to co-CEOs Gustav Söderström and Alex Norström.

That’s it for today!

A massive PRO issue drops tomorrow with over 40 companies included. Berkshire’s cash pile, Robinhood’s crypto miss, the Duolingo meltdown, and much more.

Stay healthy and invest on.

Want to sponsor this newsletter? Get in touch here.

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Start an account for free and save 15% on paid plans with this link.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Disclosure: I own PLTR, AMD, SHOP, and ABNB in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.