📊 PRO: This Week in Visuals

AAPL META LLY V MA SAMSUNG ABBV UNH MRK NOW BA BKNG VZ KLA MELI CDNS COIN RBLX MDLZ NET UPS FI PYPL CMG TEAM RDDT ADIDAS HSY SOFI KHC CFLT ETSY APPF

Welcome to the Saturday PRO edition of How They Make Money.

Over 240,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

📱Apple: Blockbuster Holiday Forecast

🕶️ Meta: Revenue Soars Alongside Spending

💊 Eli Lilly: GLP-1s Defy Headwinds

💳 Visa: Global Spending Stays Strong

💳 Mastercard: Differentiated Services

📱 Samsung: Chip Profit Soars

💊 AbbVie: Immunology Booms

💼 UnitedHealth: Reset in Motion

🦠 Merck: Growth Drivers Sputter

🧑💻 ServiceNow: AI Fuels Blowout

🛩️ Boeing: 777X Slips Again

🏝️ Booking: Momentum Improves

📱 Verizon: Broadband Still the Engine

🔬 KLA: China Rules Bite

🤝 Mercado Libre: Brazil Squeezes Margins

💡 Cadence: AI Drives Beat

📈 Coinbase: Derivatives Surge

👾 Roblox: Losses Overshadow Bookings

🍪 Mondelez: Peak Cocoa Costs

☁️ Cloudflare: Net Retention Rebounds

📦 UPS: Cost Cuts Stoke a Turnaround

💳 Fiserv: Massive Miss Triggers Reset

💳 PayPal: Agentic Commerce Boost

🌯 Chipotle: Consumer Pullback

☁️ Atlassian: AI & Cloud Migration Boost

👽 Reddit: Profitability Surges

👟 Adidas: Brand Heat Overcomes Tariffs

🍫 Hershey: Cocoa Pressures Ease

🏦 SoFi: Records Keep Falling

🌭 Kraft Heinz: Guidance Cut Again

📊 Confluent: Flink Takes Off

📦 Etsy: Changing Guard

🏡 Appfolio: Margins Pinched

1. 📱Apple: Blockbuster Holiday Forecast

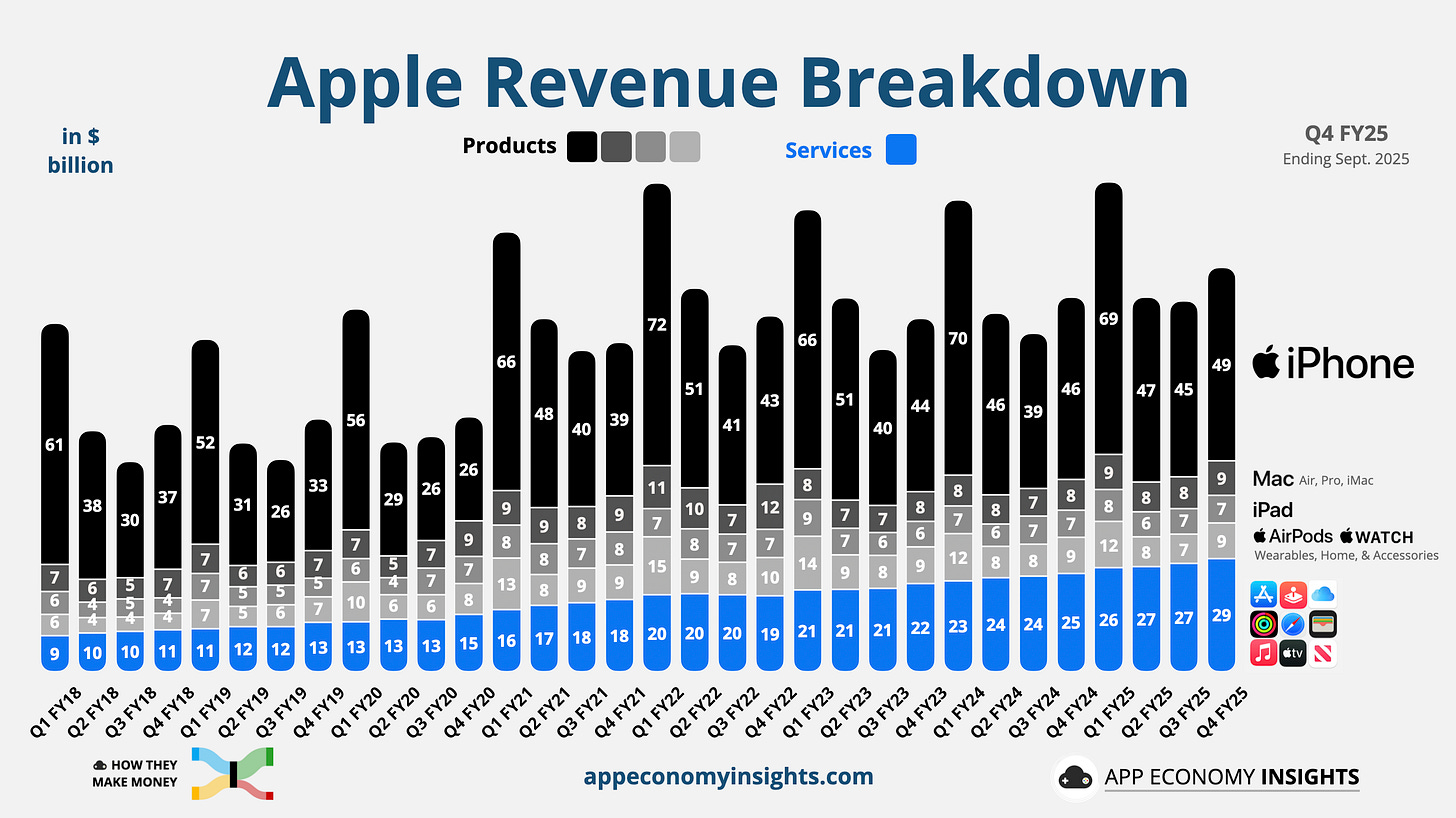

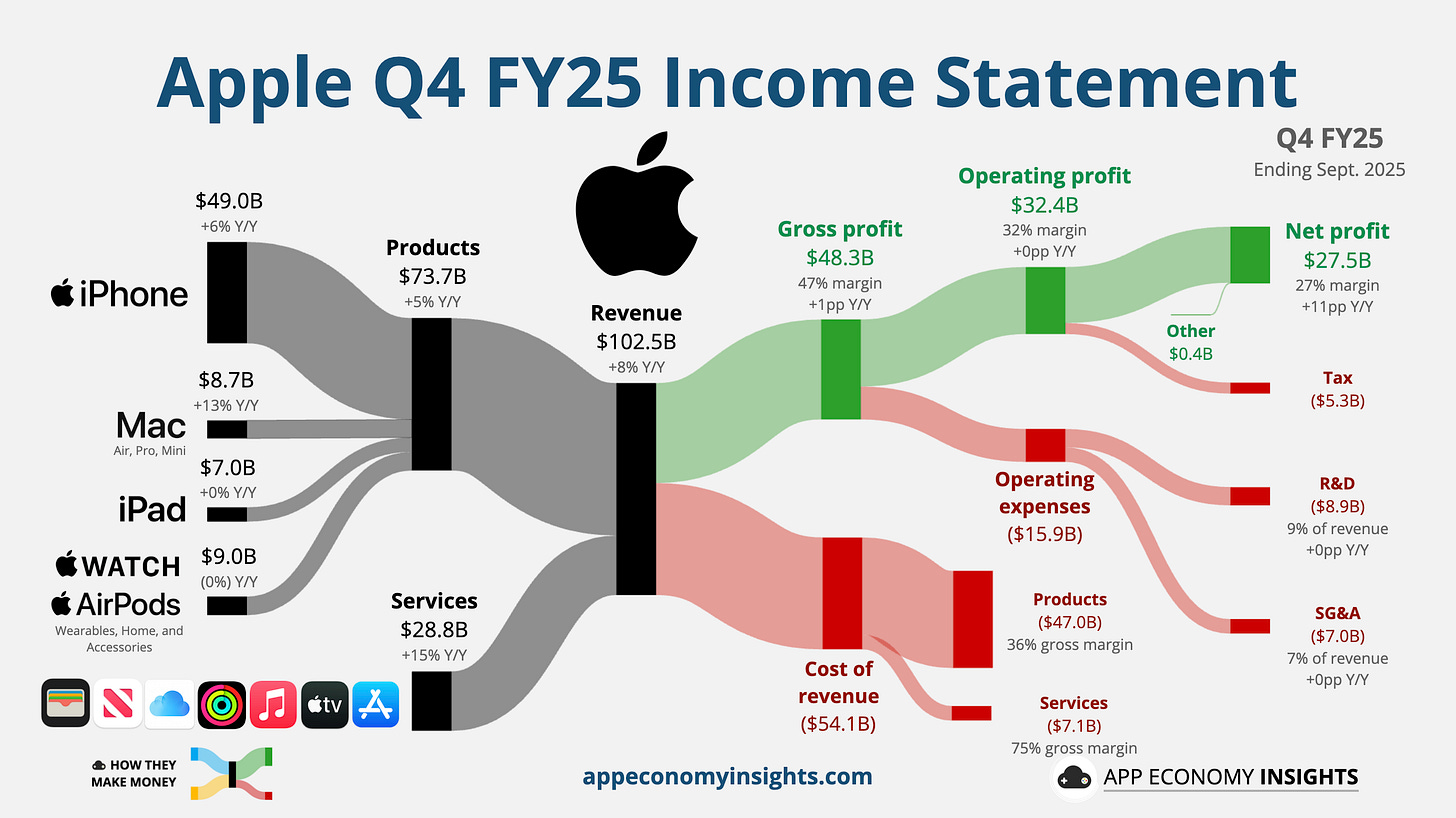

Apple’s September quarter (fiscal Q4 FY25) revenue rose 8% Y/Y to $102.5 billion ($220 million beat) with EPS of $1.85 ($0.08 beat). Results were driven by a record Services quarter, though iPhone sales were slightly below consensus.

📱 iPhone sales grew 6% Y/Y to $49.0 billion ($1.0 billion miss). While this reflects Q3’s pull-forward we previously discussed, management cited supply constraints on new iPhone 17 models as the primary limiting factor amid “very strong demand.”

💻 Mac sales were also a bright spot, rising 13% Y/Y to $8.7 billion.

💳 Services grew 15% Y/Y to a record $28.8 billion ($600 million+ beat), crossing the $100 billion annual revenue mark for the first time and continuing to boost Apple’s margin profile.

Despite a $1.1 billion tariff hit on costs (in line with guidance), Gross margin improved slightly at 47%, aided by the revenue mix.

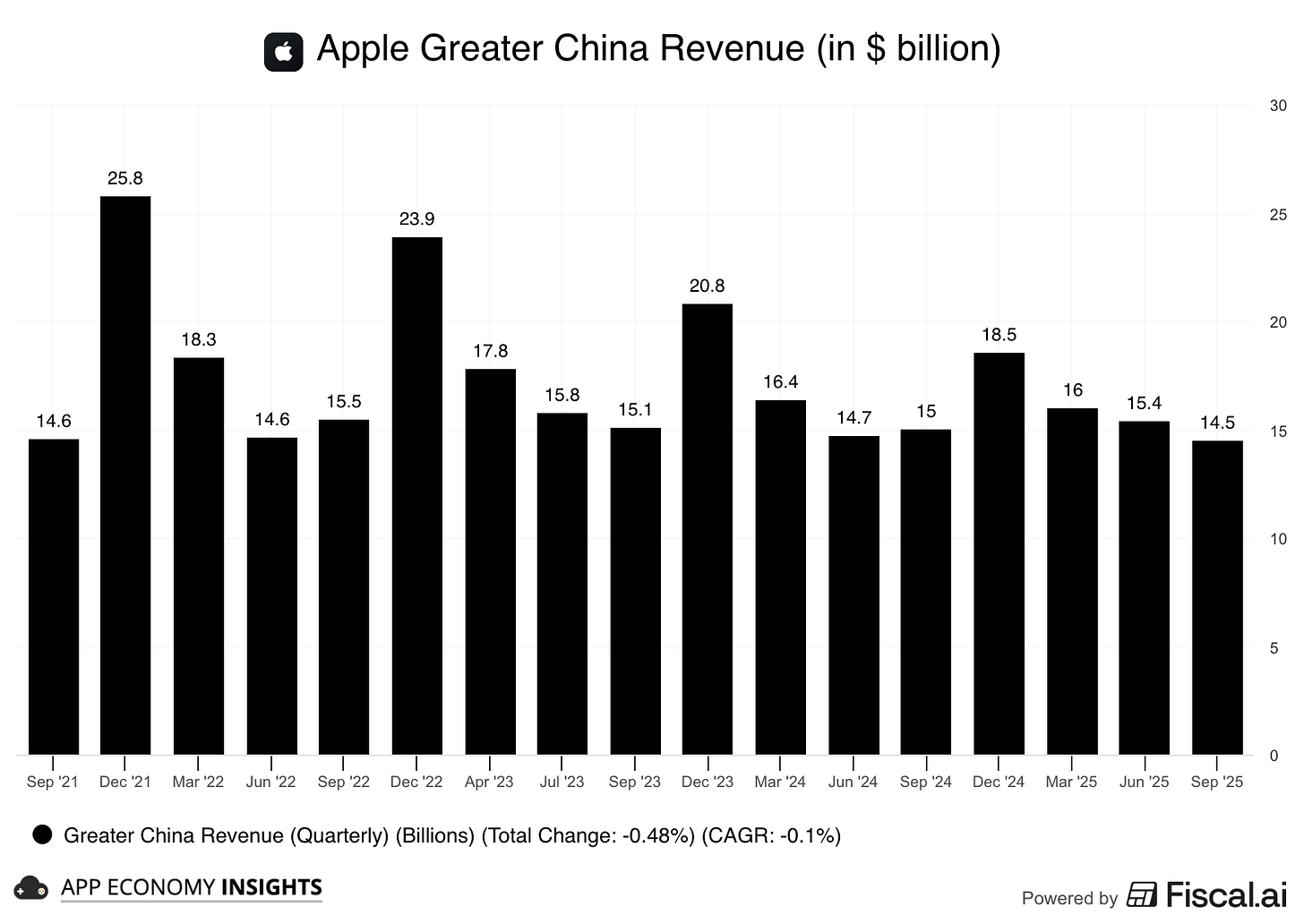

Geographically, China was a weak spot, down 4% Y/Y, though other regions set records.

The muted Q4 was completely overshadowed by Apple’s blockbuster Q1 guidance:

Total Revenue: 10%-12% Y/Y growth (far above consensus).

iPhone Revenue: Double-digit Y/Y growth.

China: Expected to return to growth.

Tariff Costs: Expected to rise to $1.4 billion.

Management highlighted that the strong outlook is supported by heavy R&D investment in AI and Apple Intelligence, which is now driving higher operating expenses. The record Q1 forecast signals powerful demand for the new product cycle, calming any fears of a slowdown.

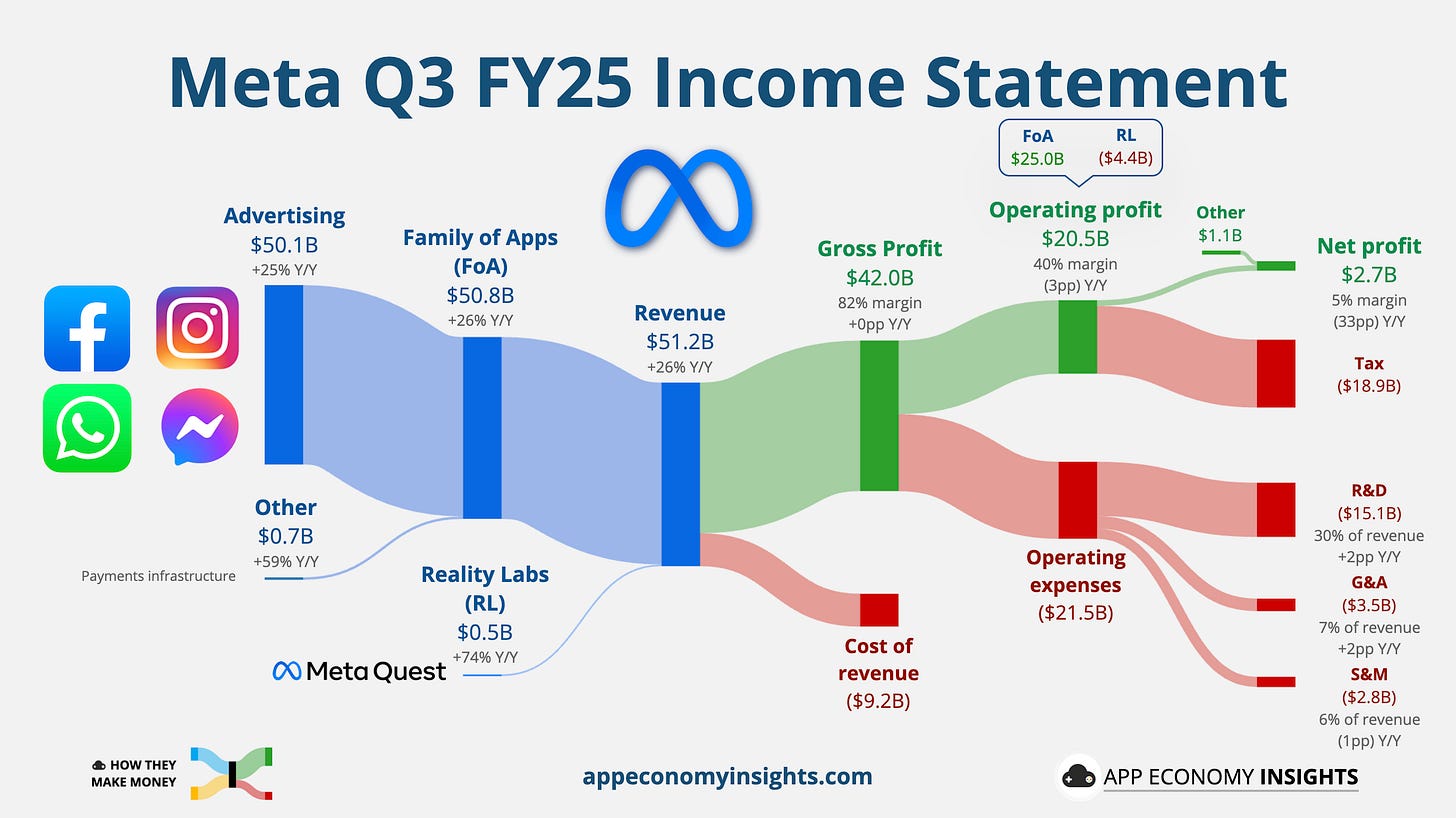

2. 🕶️ Meta: Revenue Soars Alongside Spending

Meta posted another blowout quarter on the top line, with Q3 revenue surging 26% Y/Y to $51.2 billion ($1.8 billion beat). However, GAAP EPS plummeted to $1.05, massively missing estimates due to a one-time, non-cash $15.9 billion income tax charge related to a new US tax law. Excluding the charge, EPS would have been $7.25, easily beating consensus.

Ad strength remained exceptional, with impressions up 14% Y/Y and average price per ad climbing 10%. Daily active people across the Family of Apps rose 8% Y/Y to 3.54 billion. The core business is firing on all cylinders, funding Meta’s accelerating AI ambitions.

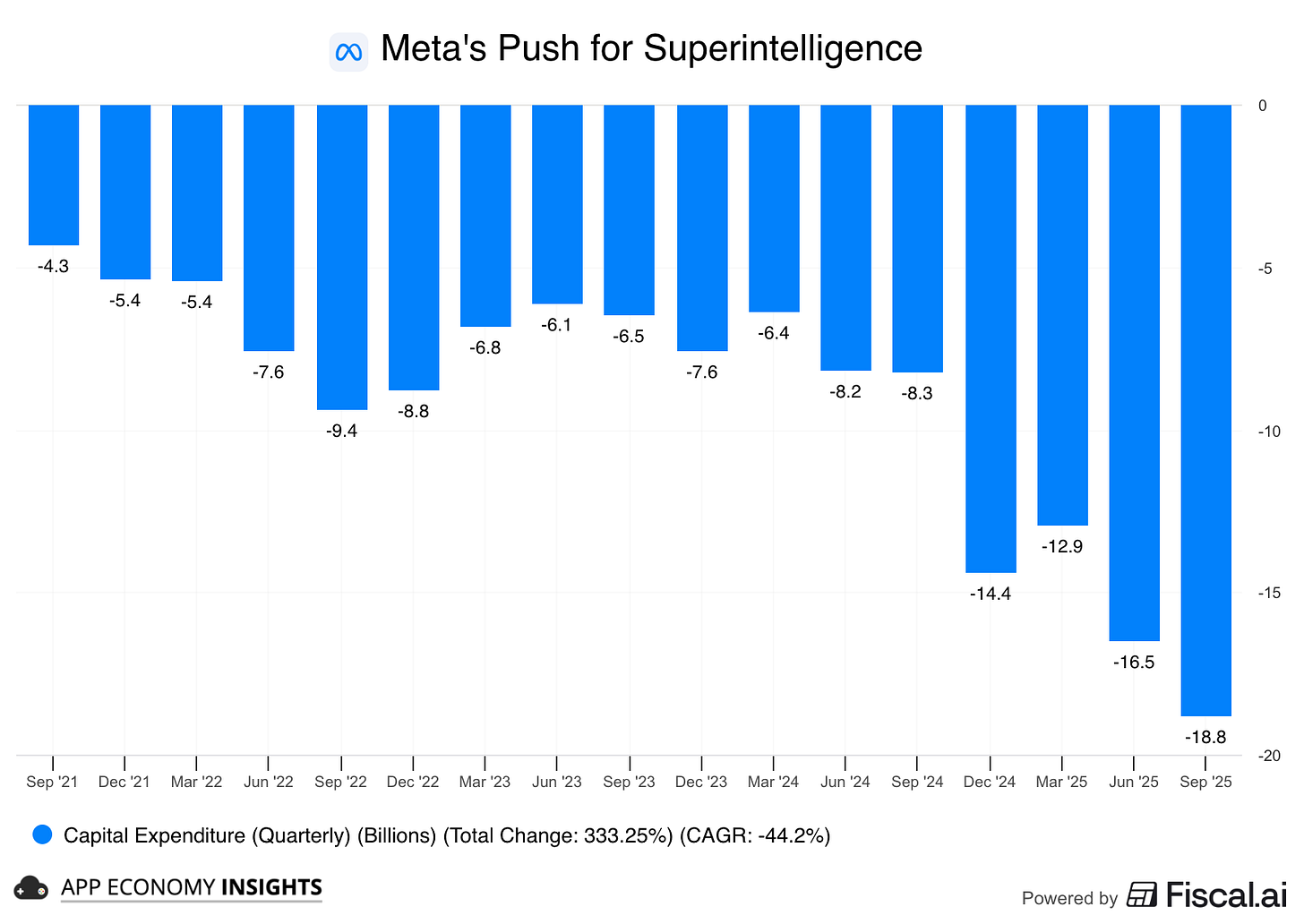

But Wall Street didn’t cheer. The stock slid as AI ambition met cold, hard spending math. Management raised its 2025 CapEx outlook slightly to $70-$72 billion (tightening the bottom end from $66 billion). The real sticker shock came from guidance beyond that: 2026 CapEx will be “notably larger” and total expenses will grow at a “significantly faster percentage rate.”

Zuck doubled down on “aggressively” front-loading AI infrastructure investments to pursue Superintelligence, shaking investor confidence about near-term returns. While Q4 revenue guidance ($56-$59 billion) was strong (+22% Y/Y on the high-end), the open-ended commitment to accelerating AI spending overshadowed the impressive core business performance.

If you’re feeling déjà vu, you’re not alone. Meta faced the same skepticism when it poured billions into the Metaverse. The stock took a hit back then, too — until strong execution turned sentiment around.