💻 Microsoft + OpenAI's Wild Ride

Azure’s outlook brightens, but execution risk remains

Welcome to the Free edition of How They Make Money.

Over 240,000 subscribers turn to us for business and investment insights.

In case you missed it:

Microsoft’s September quarter contained a hidden bombshell: a $4.1 billion loss from its equity-method investment in OpenAI.

The implication? OpenAI’s losses are even wilder than you thought: roughly $15 billion in the latest quarter alone.

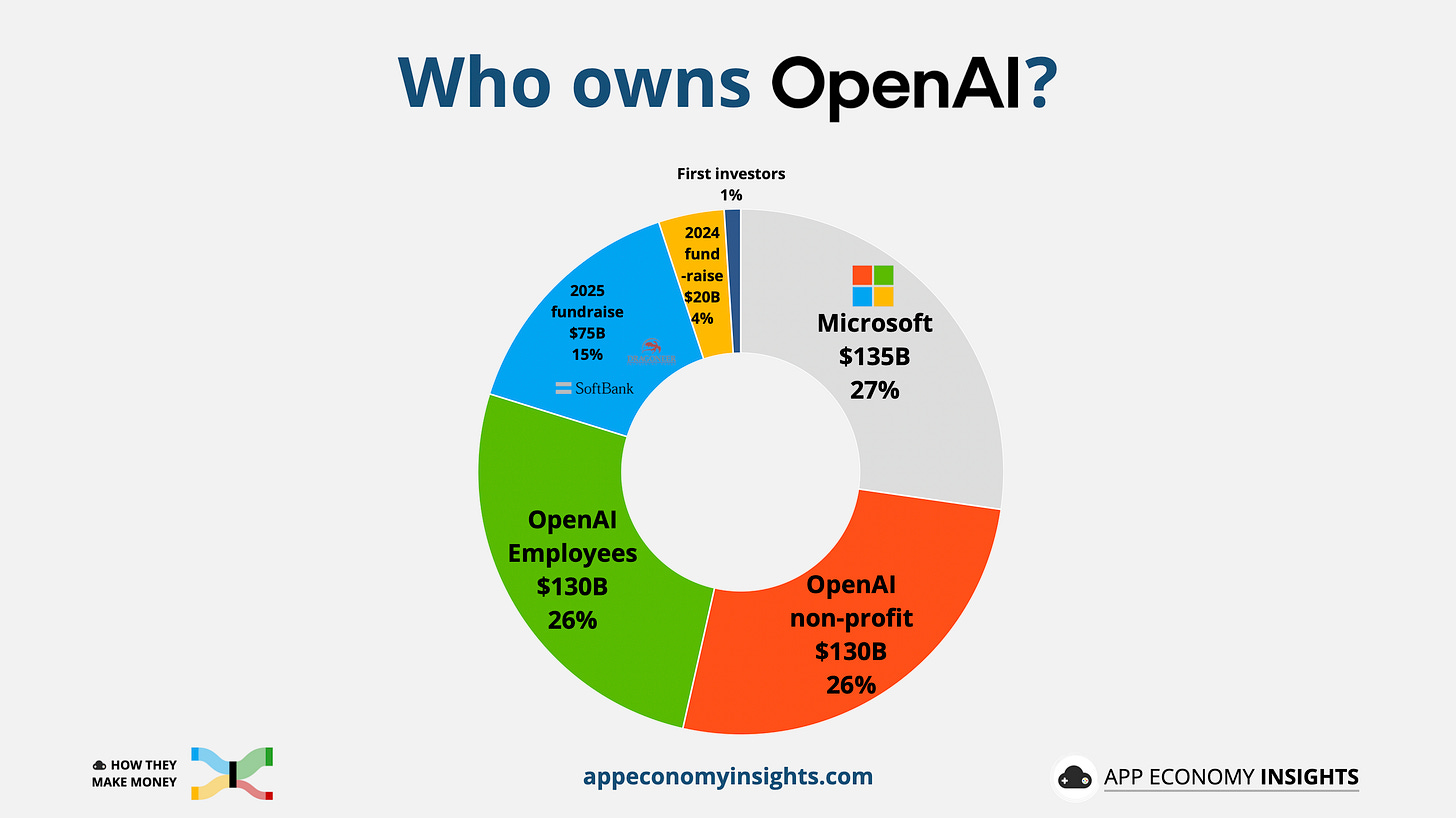

This staggering figure lands as Microsoft and OpenAI renegotiated their landmark partnership, turning OpenAI into a for-profit public benefit corporation (PBC). Microsoft now holds a 27% stake in the new entity and has locked in long-term rights to its models. OpenAI gets the freedom to scale on other clouds, but is committed to $250 billion in Azure spending.

To put that in perspective, OpenAI is projected to generate $13 billion in revenue for all of 2025.

If the AI boom ever cracks, it might start here. OpenAI’s CapEx appetite could eventually outpace its ability to fund it, pulling investors and vendors into the fallout. There’s no shortage of capital for now, but eventually, the bill will come due.

Here’s what stood out this quarter.

Today at a glance:

Microsoft’s Q1 FY26.

The new OpenAI agreement

Earnings call takeaways.

What moves the needle.

FROM OUR PARTNERS

Banish friction from your writing with Wispr Flow

Ideas move fast, but typing often slows them down.

Wispr Flow flips that script by turning your speech into written words instantly.

It listens to your voice, matches your tone, and adapts across your favorite tools like email, Slack, and Notion. The result is smoother writing without the usual start-stop to fix errors or reformat. When your thoughts flow freely, it’s easier to get more done with less friction.

If your writing process ever feels like a bottleneck, Wispr Flow is the upgrade that helps your productivity align with your pace of thinking.

1. Microsoft’s Q1 FY26

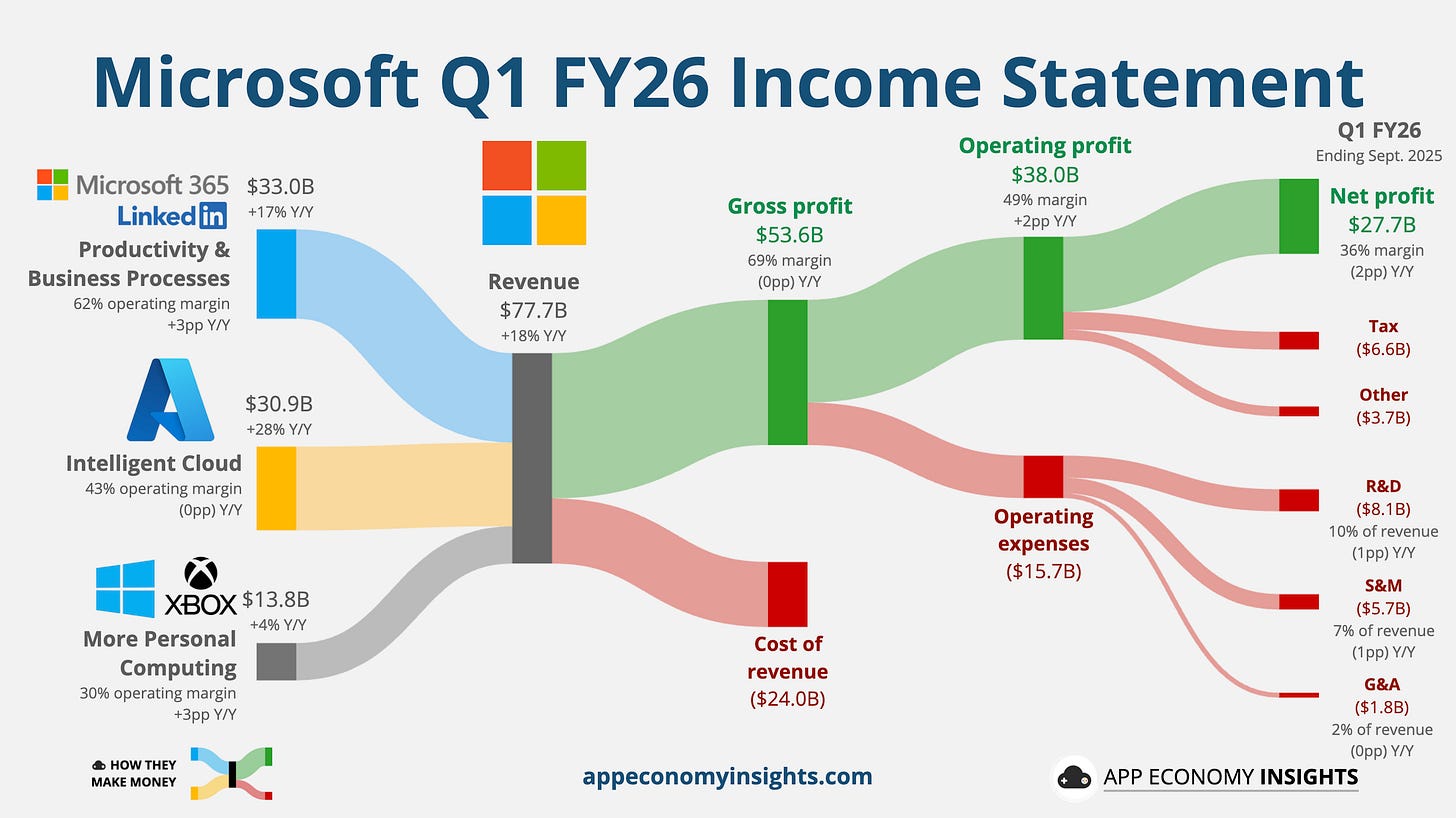

Income Statement:

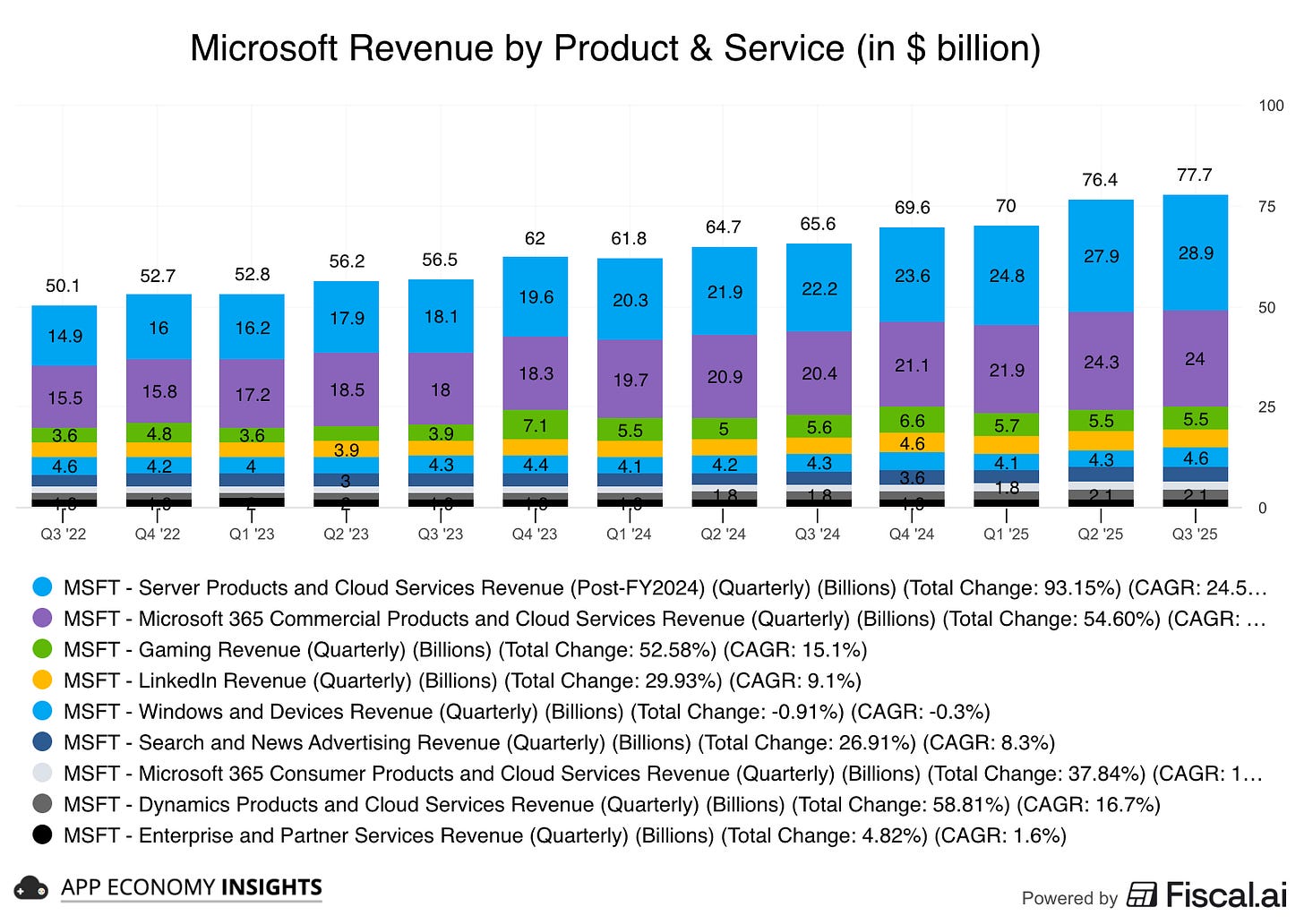

Revenue +18% Y/Y to $77.7 billion ($2.3 billion beat)

Gross margin 69% (flat Y/Y).

Operating margin 49% (+2pp Y/Y).

EPS $4.13 ($0.47 beat).

Product and Services Breakdown:

☁️ Server products and cloud services $28.9 billion (+30% Y/Y).

📊 M365 Commercial products and cloud services $24.0 billion (+17% Y/Y).

🎮 Gaming $5.5 billion (-2% Y/Y).

👔 LinkedIn $4.7 billion (+10% Y/Y).

🪟 Windows and Devices $4.6 billion (+5% Y/Y).

🔎 Search and news advertising $3.7 billion (+15% Y/Y).

💻 Other $6.4 billion (+15% Y/Y).

Core business segments:

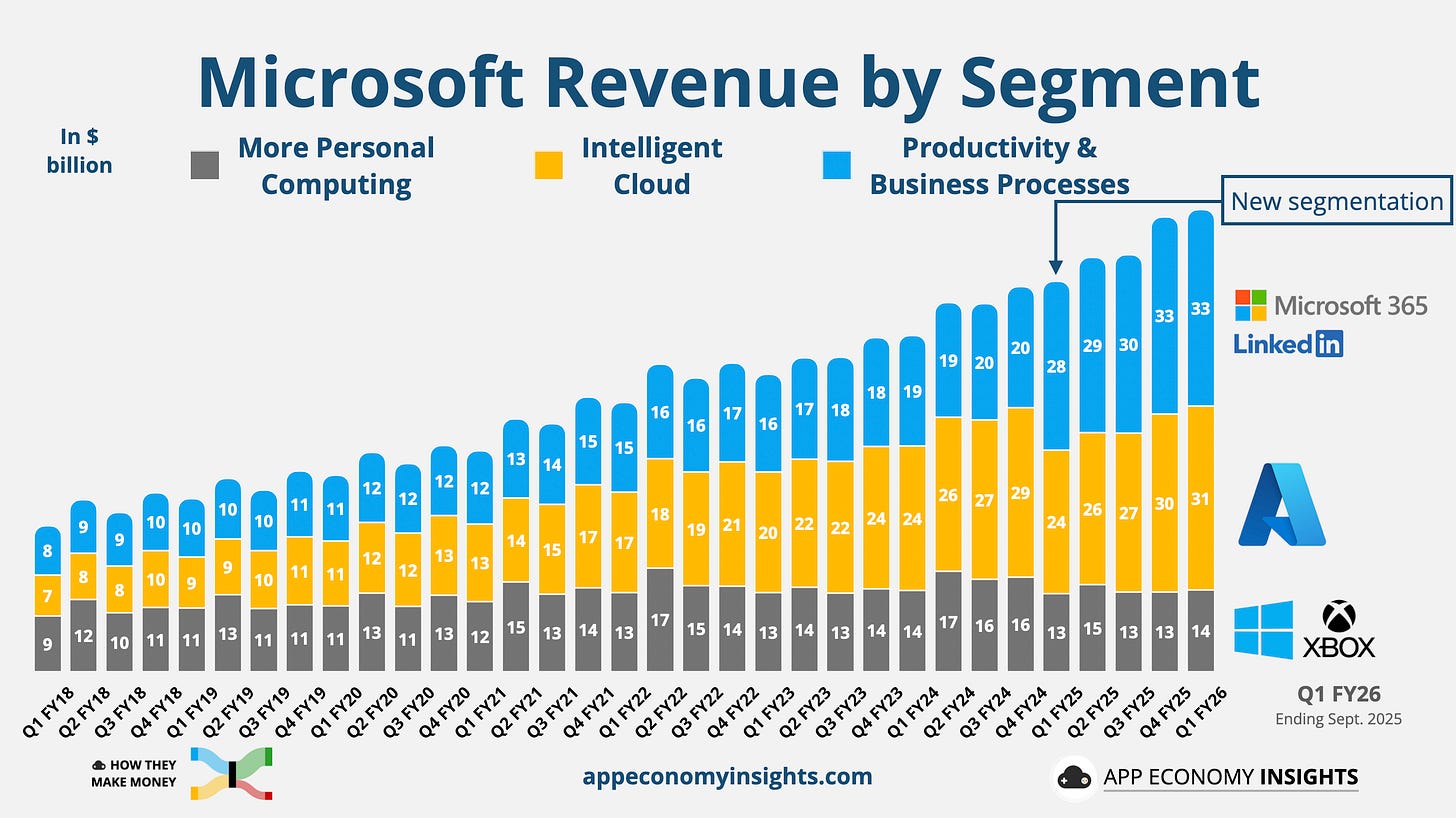

As a reminder, Microsoft restructured its business segments last year to better align reporting with current operations:

📊 Productivity and Business Processes grew 17% Y/Y to $33.0 billion ($0.7 billion beat). M365 Commercial and Consumer drove upside, with Copilot adoption fueling ARPU gains.

☁️ Intelligent Cloud grew 28% Y/Y to $30.9 billion ($0.7 billion beat), driven by Azure across all workloads.

🎮 More Personal Computing grew 4% Y/Y to $13.8 billion ($0.9 billion beat), with Search ads and XBOX hardware softening.

Key Trends:

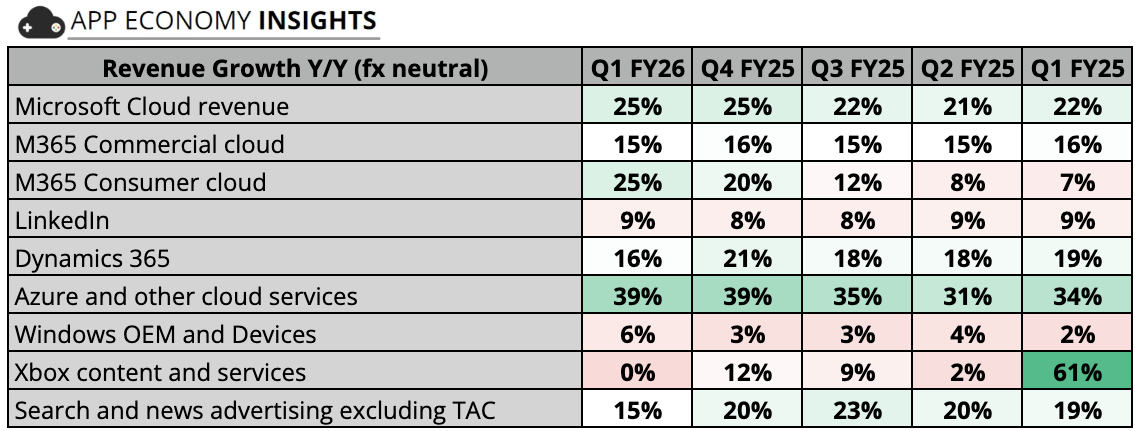

The table below compares growth year-over-year in constant currency following the new segmentation. Some of the products and services overlap.

Microsoft Cloud grew 25% Y/Y to $49.1 billion. It now accounts for 63% of total revenue. Broad-based momentum across Azure and M365, with Copilot attach and usage now meaningful but still early in terms of revenue recognition.

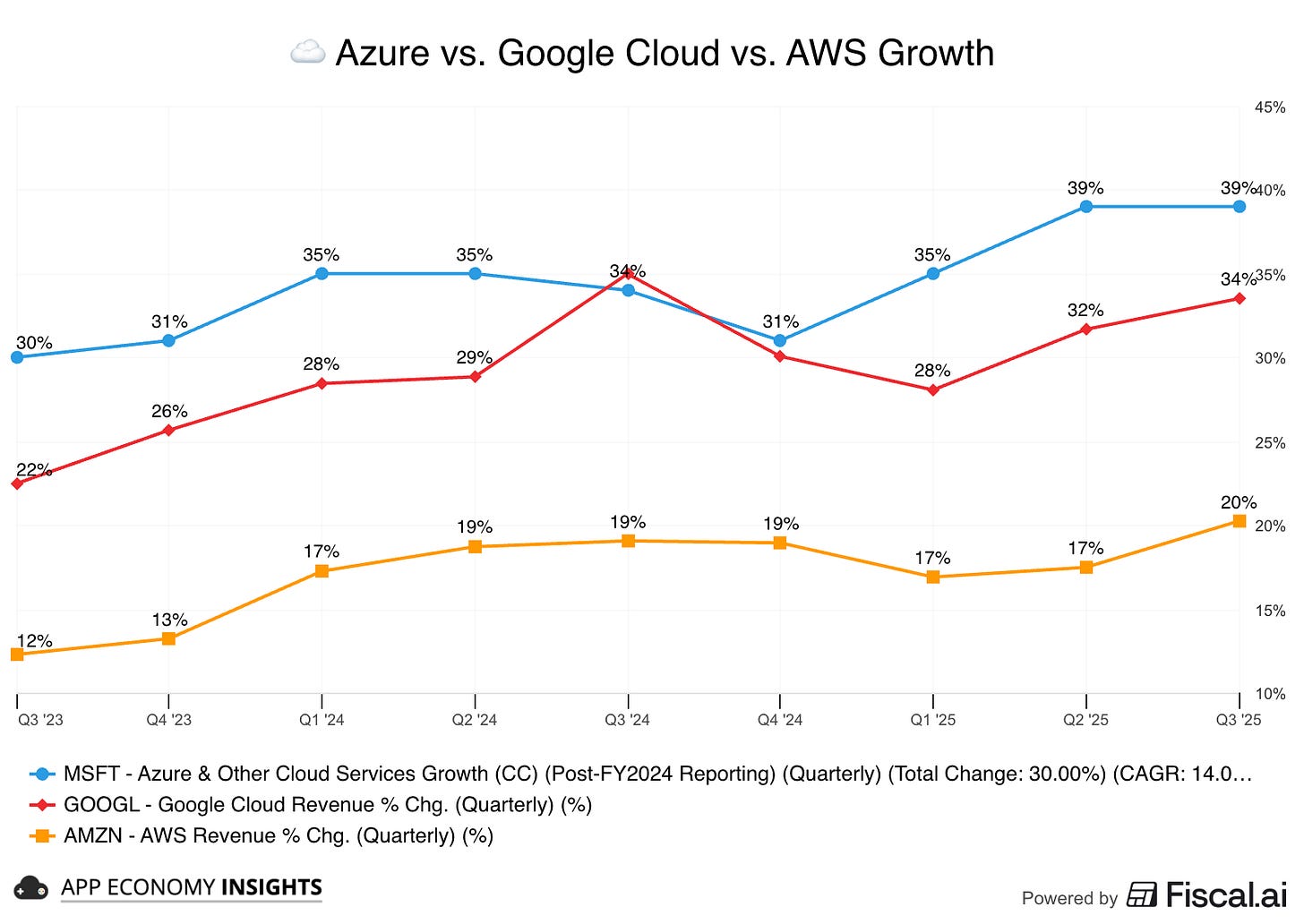

Azure is running the show and driving the growth of ‘Server products and cloud services’ and Microsoft Cloud. It showed no slowdown this quarter.

Consumer products saw another big acceleration on the M365 side, boosted by an ARPU growth from the recent price increase and subscriber growth of 7%.

Xbox growth has normalized after the Activision acquisition was completed in Q2 FY24. GamePass could not offset a continued decline in hardware sales.

Advertising grew at the same pace as Google Search this quarter, despite a much lower base (less than 7%).

Cash flow:

Operating cash flow grew 32% Y/Y to $45.1 billion.

Free cash flow grew 33% Y/Y to $25.7 billion.

Balance sheet:

Cash, cash equivalents, and investments: $102 billion.

Long-term debt: $35 billion.

So what to make of all this?

📈 Azure is still supply-constrained: Headline growth will bump around quarter to quarter. While there are many moving pieces, both GCP and AWS managed to accelerate this quarter.

🏗️ Capex shock—by design: Capex hit ~$34.9 billion in the quarter (+74% Y/Y), with roughly half on chips and the rest on data-center real estate. Microsoft says AI capacity will grow over 80% in FY26 and its data-center footprint will roughly double in two years—telegraphing that elevated spend is front-loaded to unlock constrained Azure demand.

🔌 Still hitting the wall on power & space: Management guided Azure growth to 37% Y/Y next quarter and reiterated that supply bottlenecks will linger—think grid interconnects, power, and buildouts—so mix and pricing (vs. pure volume) still do some heavy lifting in the interim.

📊 Forward visibility improved: Commercial RPO rose 51% to $392 billion, a new high. That backlog—tilted to multi-year AI/infra commitments—keeps a floor under growth even if capacity gating continues.

🧠 OpenAI is a below-the-line drag: Other expenses were a $3.7 billion hit, including $4.1 billion of losses from Microsoft’s equity-method investment in OpenAI. Ex-OpenAI, other income was actually positive (thanks to interest income), which helps explain why operating results looked sturdier than GAAP net income suggests.

💵 Capital returns continue: Despite outsized CapEx, Microsoft returned $10.7 billion via buybacks/dividends, an approach in contrast with Amazon, which hasn’t repurchased stock in years, and doesn’t pay a dividend.

2. The new OpenAI agreement

🤝 Microsoft + OpenAI rewrite the rules

The new agreement reshapes where Microsoft benefits most, and where it must now compete. Azure gets guaranteed scale deep into the next cycle, but OpenAI has more freedom than ever to work with other partners and chase AGI on its own terms.

Here’s a look at the cap table of the new OpenAI Public Benefit Corporation (PBC):

What Microsoft gets:

27% of the new OpenAI PBC (valued at ~$135 billion).

Commercial rights to OpenAI models through 2032, including post-AGI breakthroughs.

Azure demand locked with $250 billion in OpenAI contracted spending.

No more exclusive cloud route (OpenAI can pursue other infrastructure).

If OpenAI claims AGI, an independent expert panel must verify it.

Once AGI is confirmed (or in 2030), revenue-sharing ends and access to OpenAI research narrows.

Microsoft can pursue AGI independently, but compute is capped if built on OpenAI tech.

Why it matters: The rewritten terms remove a valuation overhang for Microsoft, with investors now able to fully credit its OpenAI stake. The Azure commitment also helps justify record AI capex with deep demand visibility. But by giving OpenAI freedom to fundraise and expand across clouds and revenue streams (including ads), the deal widens the competitive front against AWS and raises fresh concerns for Alphabet.

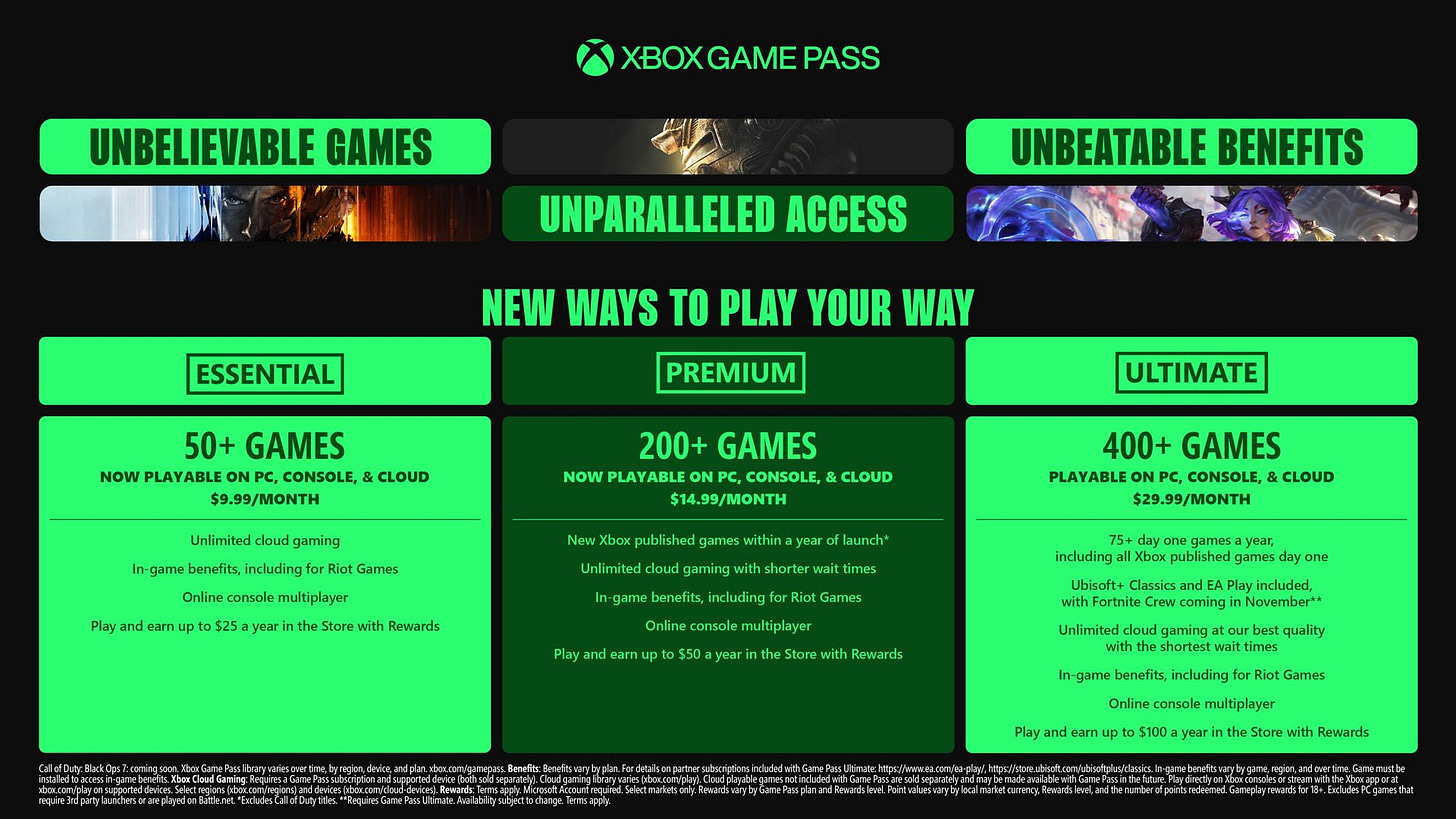

🎮 GamePass takes some heat

Microsoft just overhauled Game Pass and raised prices, and the reaction has been spicy.

New tiers and prices: Ultimate jumps 50% to $29.99/mo. Microsoft says the lineup expands (400+ games, 75+ day-one titles, Ubisoft+ Classics, 1440p cloud), but the sticker shock is real.

Confusion globally: PC Game Pass also rises (from $11.99 to ~$16.49/mo), Ultimate’s Call of Duty add-on discount was quietly pulled, and some regions saw staggered timing on the hike.

Why the hike now: Reporting from Bloomberg suggests Call of Duty Black Ops 6 on day-one Game Pass last year cannibalized as much as $300 million in sales, even as it spiked subs, pushing Microsoft to rebalance the economics.

Competitive context: Sony has been nudging PS Plus pricing and catalogs, but without a comparable day-one model, which helps preserve full-price sales on PlayStation.

Platform > plastic: Nadella says the strategy is to make Xbox a layer across devices—smart TVs, PCs, handhelds, cloud apps—so “hardware is one endpoint, not the endpoint.” That lines up with the Fire TV/TV-app push, PC focus, and selective first-party releases on rival platforms.

What that means for Game Pass: More endpoints = larger TAM, but less leverage from console exclusivity. Economics must come from ARPU lift (tiering, add-ons, cross-buy) and IP monetization at full price when day-one doesn’t make financial sense.

Bottom line: Game Pass is pivoting from growth-at-all-costs to a premium, multi-endpoint bundle that protects flagship IP. The “everything is an Xbox” move widens reach but weakens the old console-lock playbook—so success hinges on ARPU expansion and IP pricing discipline. If sub churn from price hikes outpaces ARPU gains—or if cross-platform releases blunt differentiation—Sony keeps the advantage while regulators keep asking hard questions.

3. Earnings call takeaways

Check out the earnings call transcript on Fiscal.ai here.

Satya Nadella and Amy Hood shared critical milestones across Microsoft’s portfolio.

On AI scale & capacity:

"We will increase our total AI capacity by over 80% this year and roughly double our total data-center footprint over the next 2 years […] Fairwater (WI) will scale to 2 GW alone.”

Azure’s supply crunch is real. Microsoft is front-loading build-outs (multi-GW sites) to unlock constrained demand.

On demand signals:

"Microsoft Cloud revenue $49B (+26%) […] commercial RPO up 50% to nearly $400B with a ~2-year weighted-average duration."

A record backlog of $368 billion gives Microsoft multi‑year revenue visibility and validates its aggressive AI CapEx ramp.

On CapEx & cash mechanics:

"We now expect FY26 CapEx growth rate to be higher than FY25."

The CapEx peak is not yet in. Management is prioritizing share capture while signals stay hot.

On Copilot/agents adoption:

"We now have 900 million MAU of AI features […] first-party Copilots surpassed 150 million MAU. […] Copilot chat adoption is accelerating—up 50% Q/Q […] agent users doubled Q/Q. […] PwC added 155k seats this quarter […] 200k+ deployed […] 30M interactions in 6 months […] saving millions of hours in productivity."

The feature-to-agent shift is happening. Usage intensity is rising, implying pricing power and ARPU runway ahead.

On a potential AI bubble and concentration risks:

"We’ve been short capacity for many quarters […] demand is increasing across many places […] short-lived assets match contract duration. […] We say no to demand that’s too concentrated by customer/location/workload […] we’re building a fungible fleet for 1P and 3P."

Build risk is mitigated by duration-matched gear and booked demand, so this isn’t blind overbuild. Discipline on deal mix protects long-run margins and optionality.

4. What moves the needle

🔌 Azure demand: OpenAI’s $250 billion Azure commitment turns AI demand into backlog-like visibility and helps justify record AI capex intensity, but keep the execution risk in mind. Now, the shift in cloud market share will tell the main story.

☁️ Multi-cloud chessboard: Removal of Azure's right-of-first-refusal frees OpenAI to court AWS (the most likely beneficiary). Oracle sentiment improves with funding clarity. Google faces risk if OpenAI expands successfully into ads and browser-based agents.

💸 Capex supercycle endurance: Microsoft signaled AI data center spend measured in gigawatts with FY26 capex tracking over $110 billion. Returns hinge on keeping utilization high as rivals scale.

🧠 Copilot monetization vs. adoption: The runway is huge across M365, but paid seat conversion remains the gating factor. Microsoft is pushing packaging and seller motions to expand attach.

🎮 Gaming monetization mix: Game Pass plan changes and Activision library moves keep subscription ARPU and engagement in focus as hardware cycles normalize.

⚖️ Regulatory friction: EU pressure already forced Teams’ unbundling. Scrutiny of AI tie-ups and cloud dominance continues in the UK/EU, which could shape pricing and bundling.

Next up:

A massive PRO coverage tomorrow with over 30 companies visualized.

Deep dive into Amazon’s earnings next week for Premium readers. We’ll visualize how the cloud race stacks up.

That’s it for today!

Stay healthy and invest on.

Want to sponsor this newsletter? Get in touch here.

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Start an account for free and save 15% on paid plans with this link.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Disclosure: I own AMZN, CRM, GOOG, and META in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.