📊 PRO: This Week in Visuals

INTC SAP KO PG IBM TMUS T LRCX INTC GEV TXN ISRG LMT HLT GM F LUV AAL

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🏭 Intel: Cash Infusion

☁️ SAP: Cloud Revenue Caution

🥤 Coca-Cola: Volumes Rebound

🧴 P&G: Tariff Relief Softens Blow

🌐 IBM: AI Bookings Surge

📶 T-Mobile US: Acquisition Boost

📞 AT&T: Subscriber Surge

🧠 Lam Research: China Headwinds

⚙️ Texas Instruments: Recovery Slows

⚡ GE Vernova: Electrification Surge

🦾 Intuitive Surgical: Da Vinci 5 Accelerates

🛰️ Lockheed Martin: Execution Rebounds

🏨 Hilton: Unit Growth Shines

🚗 GM: Guidance Soars

🚙 Ford: Novelis Fire Hits Outlook

🛩️ Southwest: Transformation Delivers

🦅 American Airlines: Profit Outlook Returns

1. 🏭 Intel: Cash Infusion

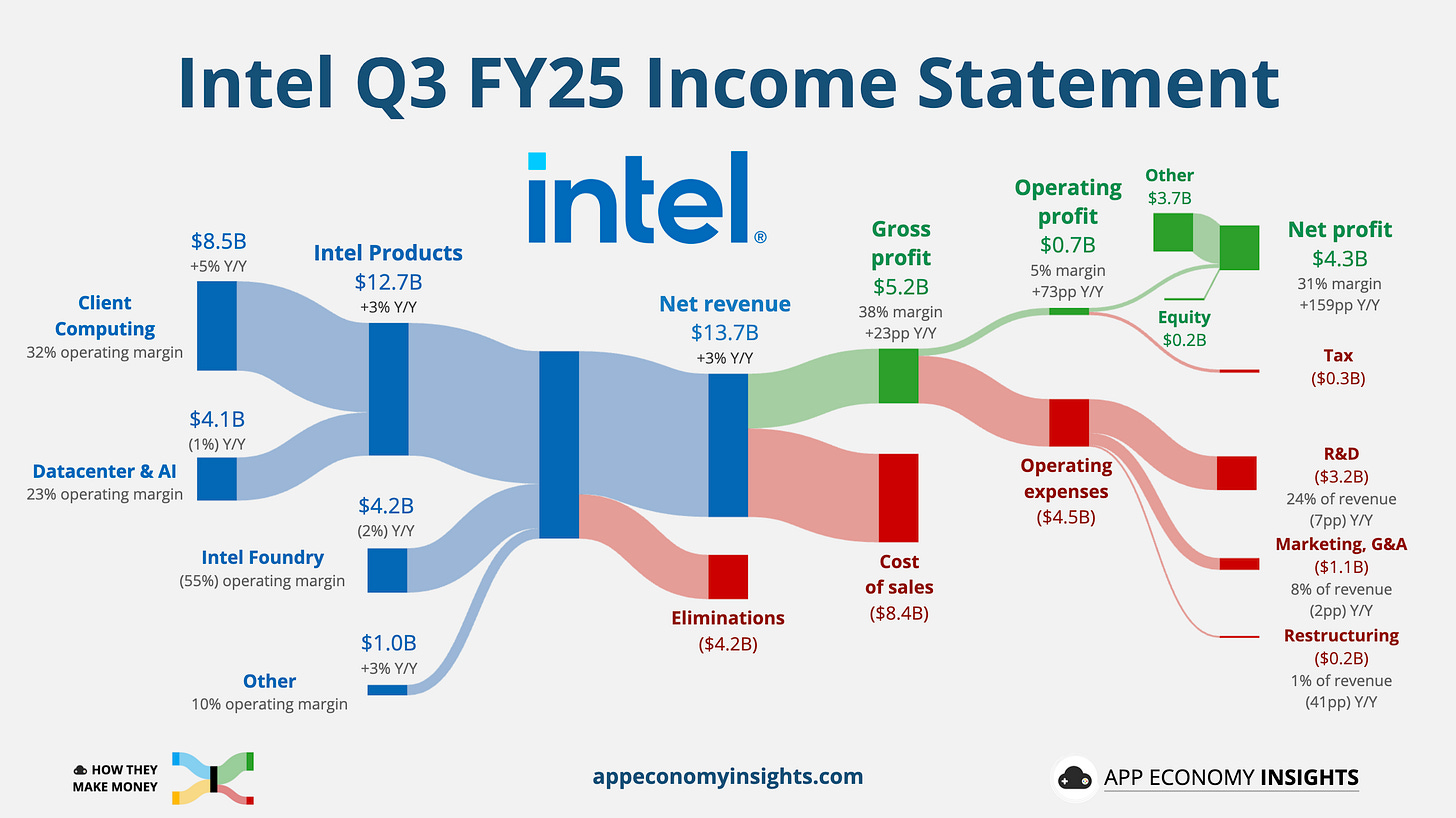

Intel’s Q3 revenue rose 3% Y/Y to $13.7 billion ($560 million beat), and non-GAAP EPS was $0.23, crushing estimates by $0.22 and returning the company to profitability.

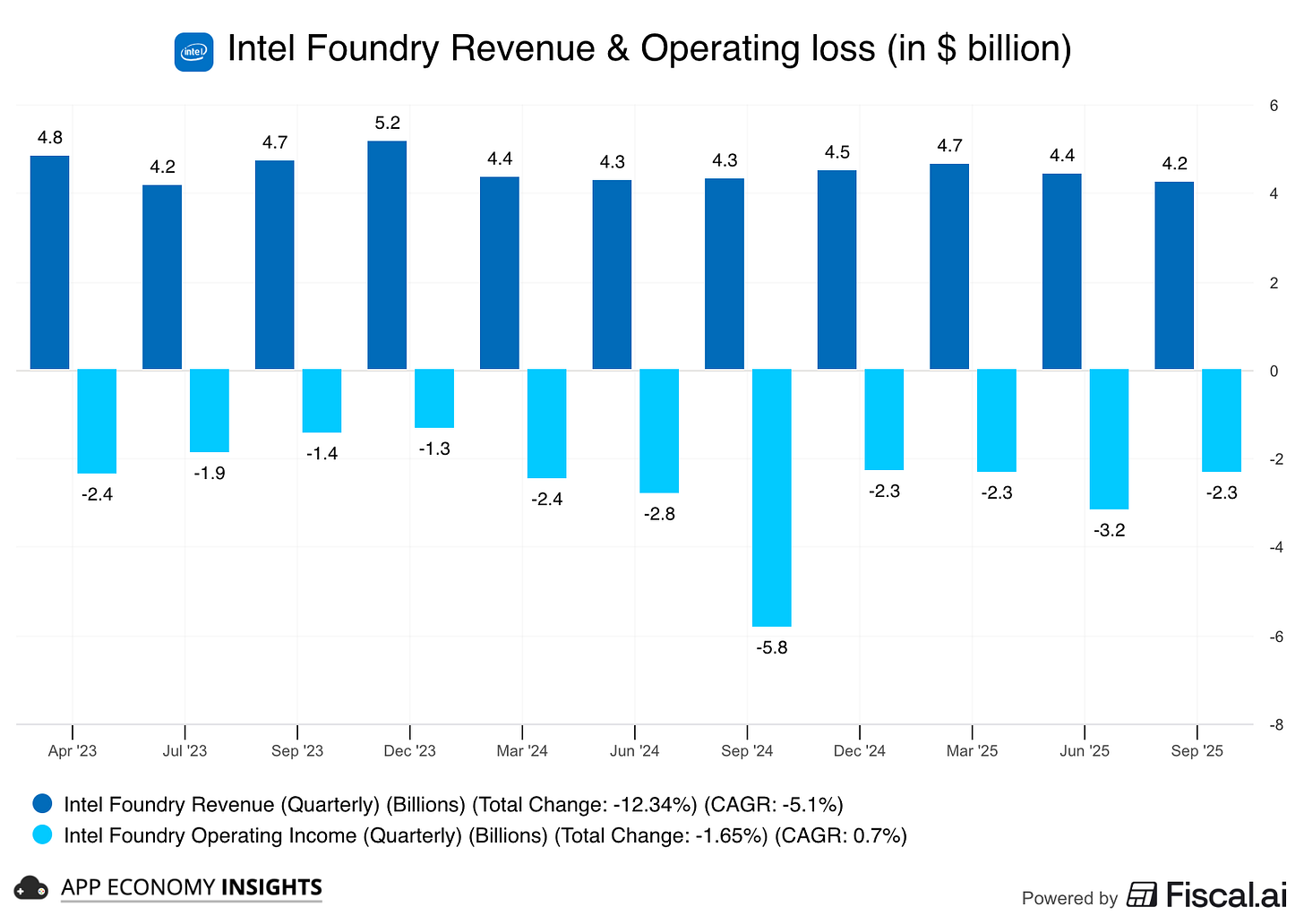

Client Computing ($8.5 billion) and Data Center & AI ($4.1 billion) both topped expectations, driven by early signs of a PC refresh cycle and accelerating AI demand. Foundry revenue declined 2% Y/Y to $4.2 billion, but its operating loss narrowed significantly to $2.3 billion from $3.2 billion last quarter.

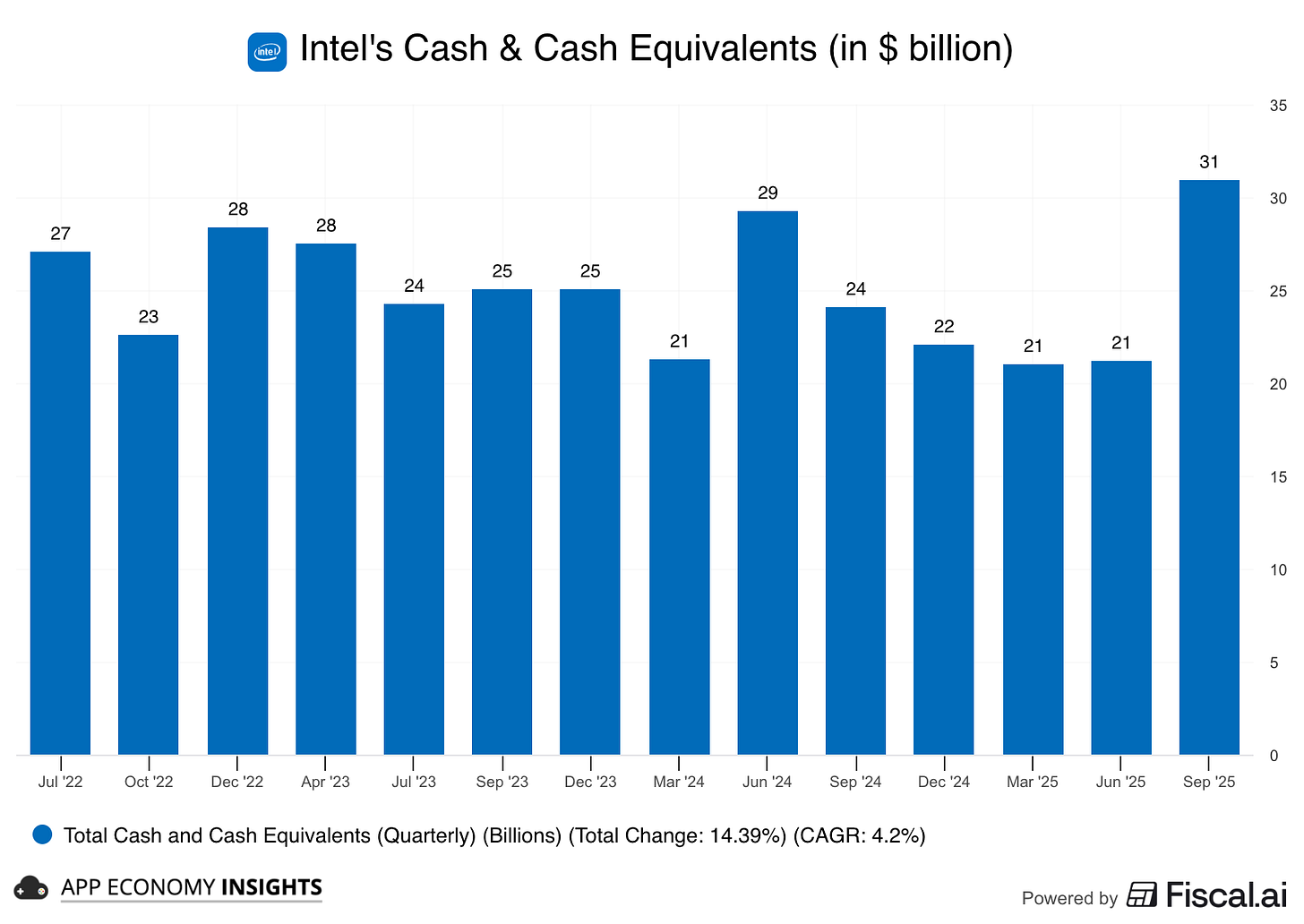

CEO Lip-Bu Tan highlighted improved execution and strategic progress, particularly in AI, citing partnerships with NVIDIA and SoftBank that boosted confidence and cash reserves. Intel strengthened its balance sheet considerably, ending the quarter with nearly $31 billion in cash, helped by $5.7 billion in US government funding and $5.2 billion from divestitures in Altera (spun off) and Mobileye. Restructuring remains on track, and next-gen Panther Lake CPUs are slated for launch soon.

Still, the outlook tempered enthusiasm. Intel guided Q4 revenue to ~$13.3 billion ($0.1 billion miss, though roughly flat sequentially ex-Altera). Crucially, gross margin is expected to fall back to ~36.5% (from 38%) due to mix shifts and new product ramps. While management raised the CY25 PC market outlook and pointed to strong AI demand, ongoing supply constraints (expected to peak in Q1’26) and the weak margin guidance caused the stock’s initial post-earnings rally to fade, signaling that the turnaround still faces significant hurdles.

2. ☁️ SAP: Cloud Revenue Caution

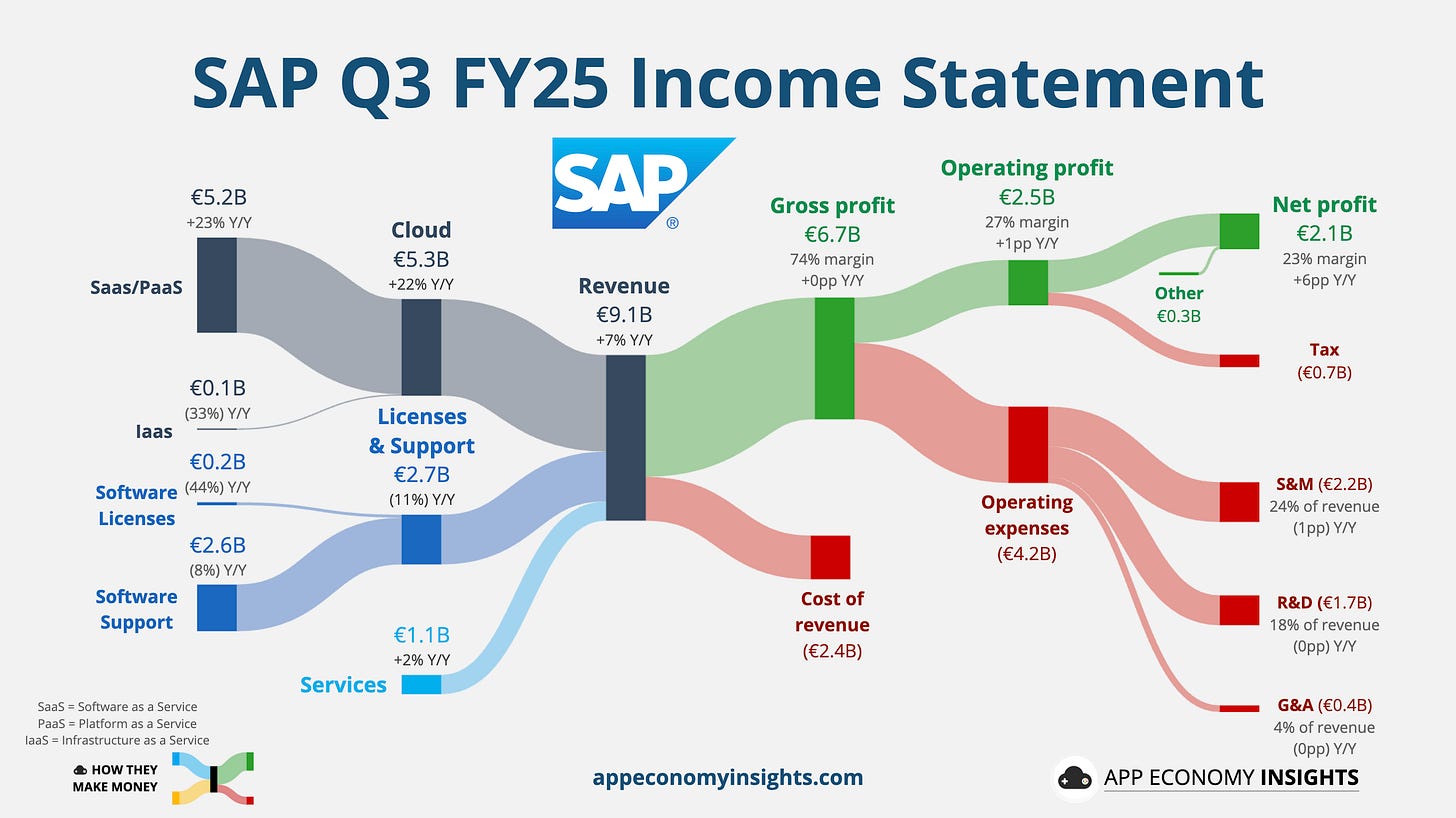

SAP’s Q3 revenue rose 7% Y/Y to €9.1 billion (a slight €10 million miss), while non-IFRS EPS came in strong at €1.59 (€0.09 beat). Non-IFRS operating profit increased 15% Y/Y, reflecting continued margin discipline.

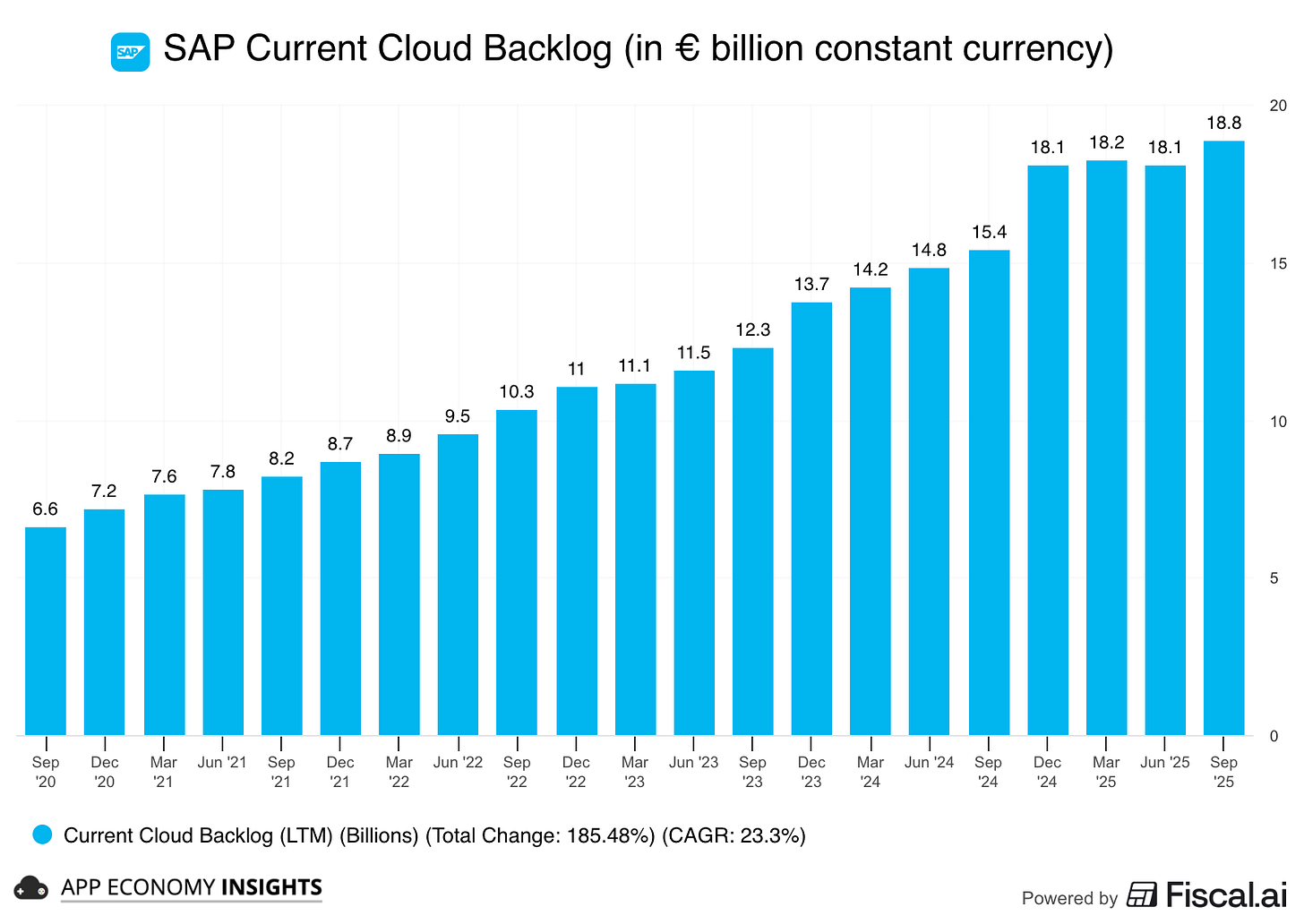

Cloud revenue slightly missed estimates, climbing 22% to €5.3 billion (or 27% in constant currency (cc)). ERP Cloud growth moderated slightly to 31% cc (from 34% in Q2). The current cloud backlog remained healthy, up 27% cc to €18.8 billion.

CEO Christian Klein highlighted strong adoption across the Business Suite, including Business Data Cloud and AI, stating SAP is gaining market share. The company pointed to a strong Q4 pipeline, bolstered by deals pulled forward from 2026 and notable wins like a $1 billion contract with the US Army. SAP reiterated its application-focused strategy, partnering with infrastructure providers rather than competing directly like Oracle.

However, management signaled persistent macro headwinds. SAP now expects cloud revenue towards the lower end of its €21.6–€21.9 billion range, while guiding non-IFRS operating profit towards the upper end of its €10.3–€10.6 billion range. Free cash flow guidance was slightly raised to €8.0–€8.2 billion. Despite the cloud revenue caution, management expressed confidence in executing against its strong Q4 pipeline and achieving accelerating total revenue growth in 2026.

3. 🥤 Coca-Cola: Volumes Rebound

Coca-Cola’s Q3 revenue grew 5% Y/Y to $12.5 billion ($90 million beat), while adjusted EPS was $0.82 ($0.04 beat). Global unit case volume returned to growth, rising 1% after dipping last quarter, while price/mix remained strong at +6%.