🍿 Netflix Does Podcast Now?

K-Pop Demon Hunters shattered records while new formats emerge

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Move over Squid Game. K-Pop Demon Hunters is the captain now.

The animated film stormed past 325 million views in just four months, becoming the most-watched Netflix title ever. It spent 15 straight weeks in the global Top 10, and even hit No. 1 at the US box office (a first for a Netflix original).

That surge helped define a record Q3, fueled by a chart-topping soundtrack and rabid fandom. It was a rare streaming phenomenon, the kind that drives replays, sign-ups, and cultural relevance. Sequels, prequels, and spin-offs are already on the table.

But Netflix’s ambitions go well beyond scripted content. The company is testing low-cost, engagement-heavy formats, from video podcasts arriving in 2026 to social games you can play on your TV.

Let’s break it down.

Today at a glance:

Netflix Q3 FY25.

Spotify podcasts are coming.

Quotes from the earnings call.

The YouTube problem.

1. Netflix Q3 FY25

Income statement:

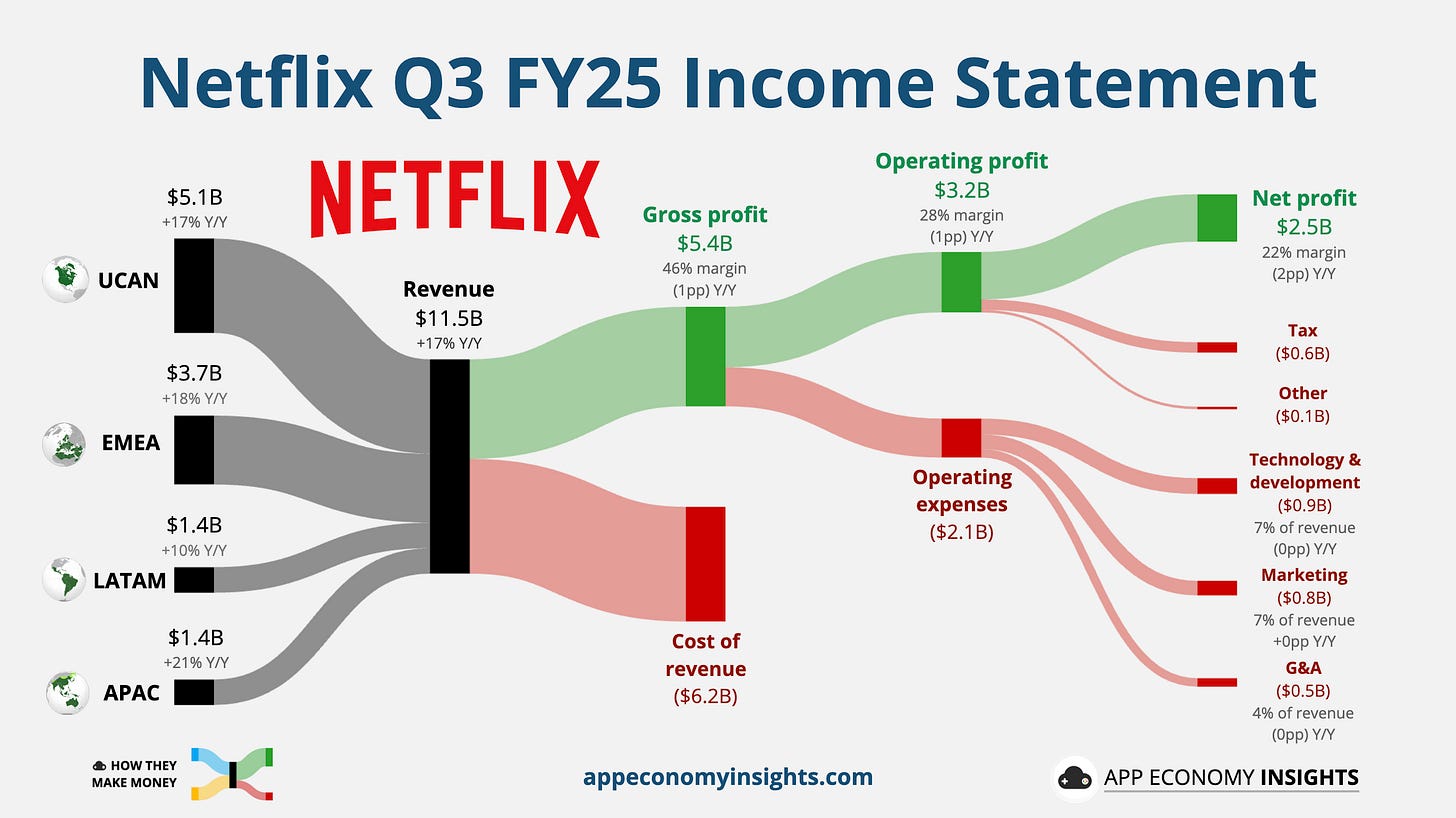

Revenue +17% Y/Y to $11.5 billion (in-line).

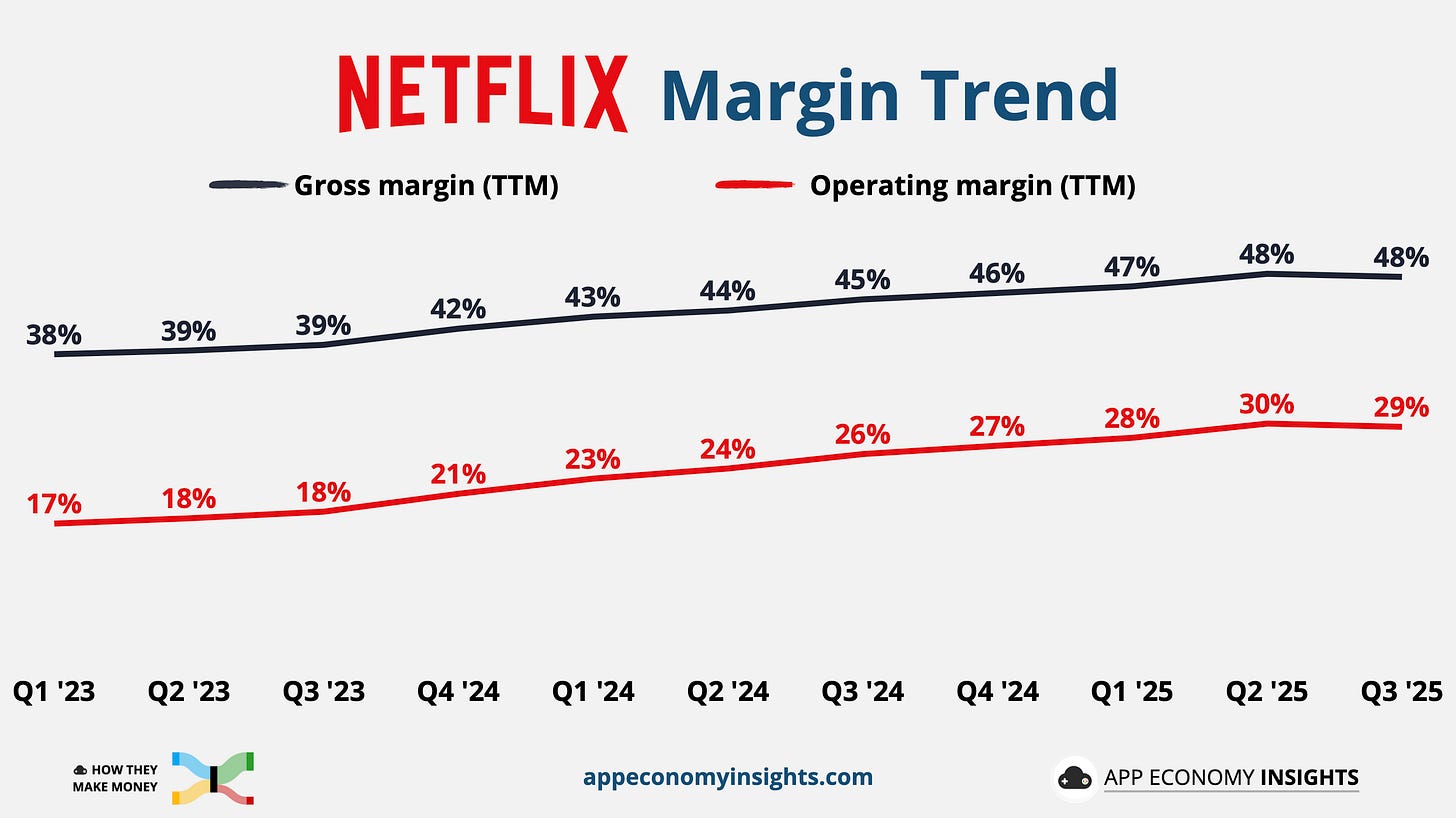

Operating margin 28% (-1pp Y/Y).

EPS $5.87 ($1.10 miss).

Cash flow (TTM):

Operating cash flow: $9.6 billion (22% margin).

Free cash flow: $9.0 billion (21% margin).

Balance sheet:

Cash and short-term investments: $9.3 billion.

Debt: $14.5 billion.

FY25 Guidance:

Revenue +17% fx neutral to $45.1 billion ($0.1 billion raise).

Operating margin 29% (0.5pp cut).

So, what to make of all this?

📈 Margin miss due to a big one-off: A ~$619 million Brazil tax expense cut operating margin by 5 points to 28%, missing the 31.5% guidance as a result. Management doesn’t expect it to be a lasting drag. The adjustment was booked at cost of revenue, and therefore impacted gross margin too. The long-term margin improvement trend should resume in 2026.

📢 Ads remain the growth engine: It was the best ad quarter yet and still on track to more than double in 2025. Over half of new sign-ups in ad markets choose the ad plan.

🍿 Content still travels: K-Pop Demon Hunters showed Netflix’s knack for capturing the zeitgeist with releases that travel worldwide and drive engagement.

🟣 Live is now material: The live slate keeps ramping (notably boxing), and Q4 will bring the Christmas Day NFL doubleheader, offering premium inventory for ads and churn defense.

🌍 FX headwinds return: Currency swings had a small impact, preventing another revenue beat. A reminder to look beyond the headline.

🧭 Guidance improves: Q4 revenue guided to ~$12.0 billion ($0.1 billion beat) with EPS ~$5.45 (slight beat). Full-year revenue improved $0.1 billion to ~$45.1 billion while FY25 margin trimmed to ~29% due to the one-off Brazil tax impact.

💸 Capital firepower intact: With TTM free cash flow at ~$9 billion and the cash hoard at ~$9.3 billion, Netflix can fund bigger live rights, accelerate ads tooling, and keep buying back stock opportunistically ($7 billion so far this year).

🎮 New bets provide option value: Advertising is scaling, with new formats on the way (video podcasts and party games) expanding the surface area. But these will take time to be needle-movers. Let’s review the details.