🏦 Big Banks Back on Offense

Trading stayed hot in Q3 as dealmaking roared back

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

📈 Wall Street shifts into high gear

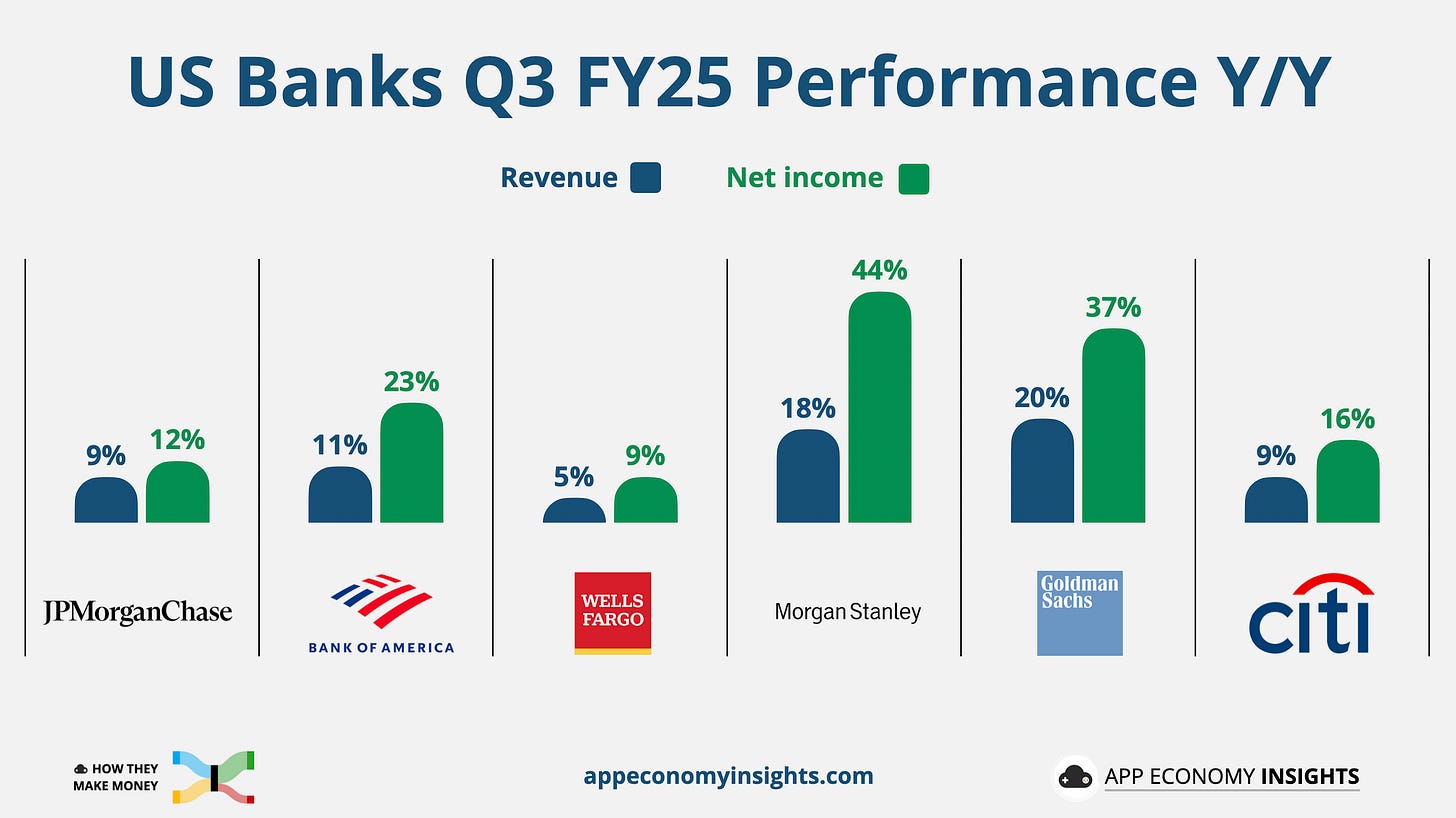

America’s biggest banks roared into Q3 with their strongest results in years, fueled by a surge in dealmaking, record trading desks, and resilient consumers.

M&A volumes topped $1 trillion, volatility kept markets busy, and wealth management quietly became a star performer as rising equity markets lifted client assets and fee income. Credit quality remains solid, loan growth is accelerating, and even long-dormant divisions like services and retail banking are setting records.

The tone from the top is cautious, with sticky inflation, tariffs, and softening job growth still on the radar. But beneath the macro noise, the message is clear: the banking giants are back on offense.

Let’s break down the results.

Today at a glance:

The Big Picture

JPMorganChase: Trading Boom

BofA: Dealmaking Breaks Out

Wells Fargo: New Era of Growth

Morgan Stanley: Equity Crown Tightens

Goldman Sachs: Dealmaking Dominates

Citigroup: Firing on All Cylinders

The Big Picture

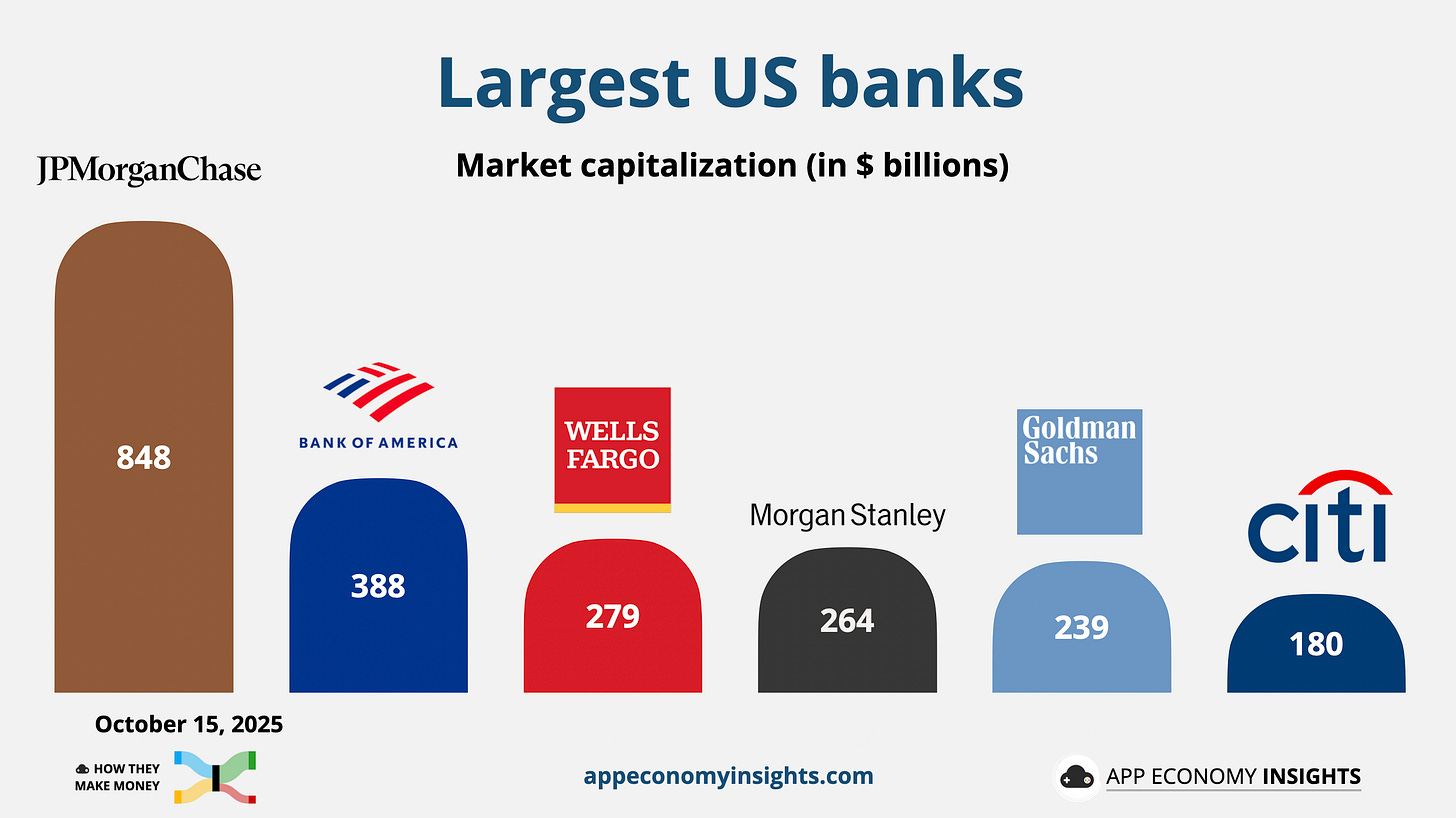

Here’s an updated look at the largest US banks by market cap.

As a reminder, banks make money through two main revenue streams:

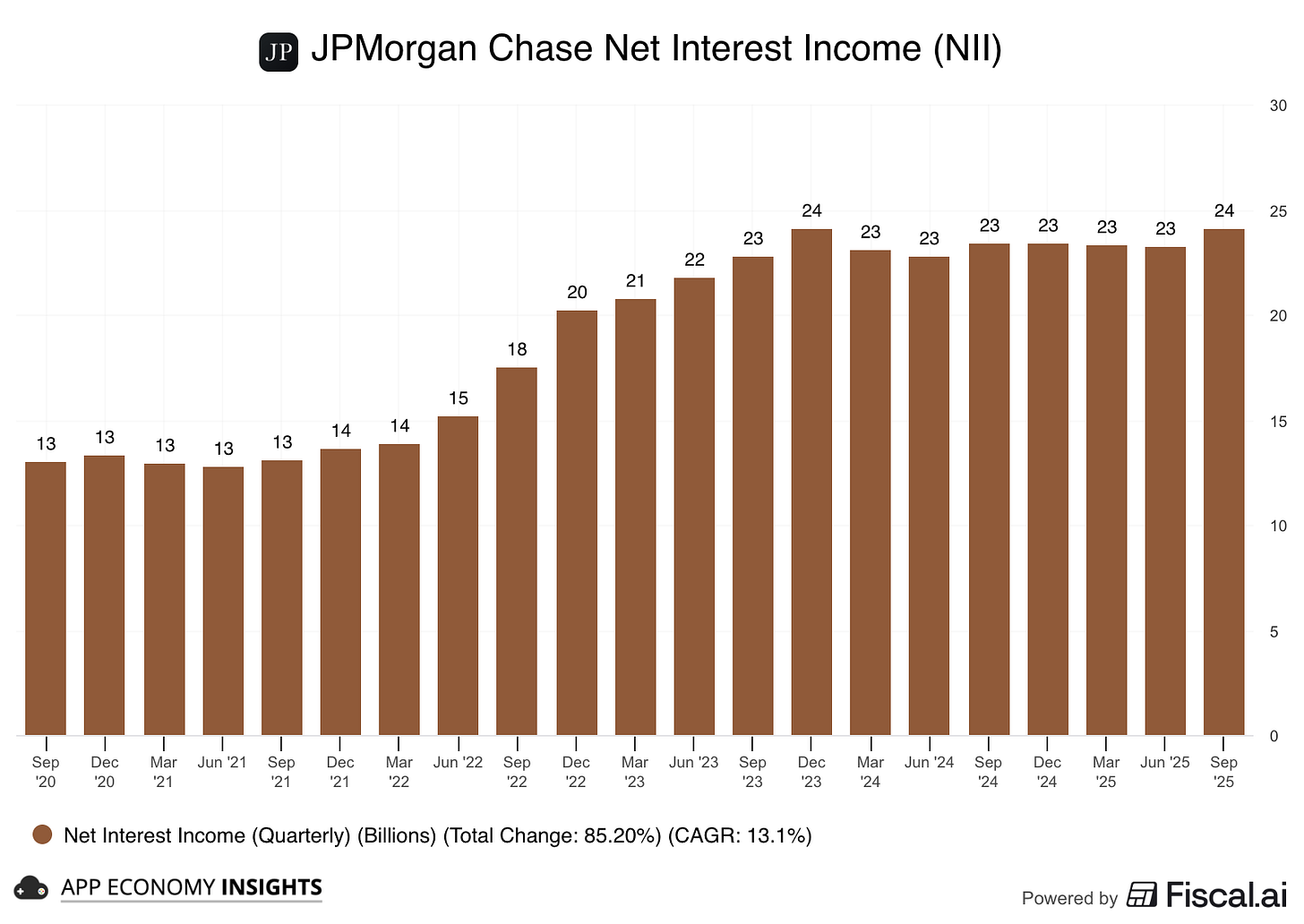

💵 Net Interest Income (NII): The difference between interest earned on loans (like mortgages) and interest paid to depositors (like savings accounts). It’s the primary source of income for many banks and depends on interest rates.

👔 Noninterest Income: The revenue from services unrelated to interest. It includes fees (like ATM charges), advisory services, and trading revenue. Banks relying more on noninterest income are less affected by interest rate changes.

Here are the significant developments in Q3 FY25:

📊 Dealmaking is back in business: M&A had its second-strongest third quarter ever. From Union Pacific’s planned $88 billion rail merger to Palo Alto’s $25 billion acquisition of CyberArk, confidence is returning in a big way, and advisory desks are humming again.

📈 Trading desks stay on fire: Volatility from tariffs, rate moves, and geopolitics kept clients repositioning portfolios, fueling another round of strong results. Record demand for financing from hedge funds kept both equities and FICC desks busy. Morgan Stanley reclaimed the equities crown from Goldman.

💼 Wealth steps into the spotlight: Rising stock markets gave wealth units a lift across the board. Client assets rose by double-digits at JPMorgan, Morgan Stanley, and Citi. It’s a clear sign that the push to diversify beyond lending into steadier, fee-based revenue is paying off.

🏦 Wells Fargo hits the gas: With its asset cap finally gone, Wells Fargo raised its return target to 17–18%, posted its strongest loan growth in three years, and climbed into the top 10 globally for M&A advisory.

⚠️ All eyes are on jobs: Consumers are spending and repayment rates look healthy, but most banks have padded reserves and called out signs of a softening labor market. Persistent inflation is also top of mind as credit quality stays in focus.

💸 Costs creep higher: Compensation climbed as deal activity surged, and banks are plowing more money into tech, AI, and talent. Even so, capital return remains strong.

🔑 Takeaway: Wall Street’s mood has flipped from cautious to confident. The engines of growth are running again, and banks are leaning forward.

Let’s visualize them one by one and highlight the key points.

JPMorganChase: Trading Boom

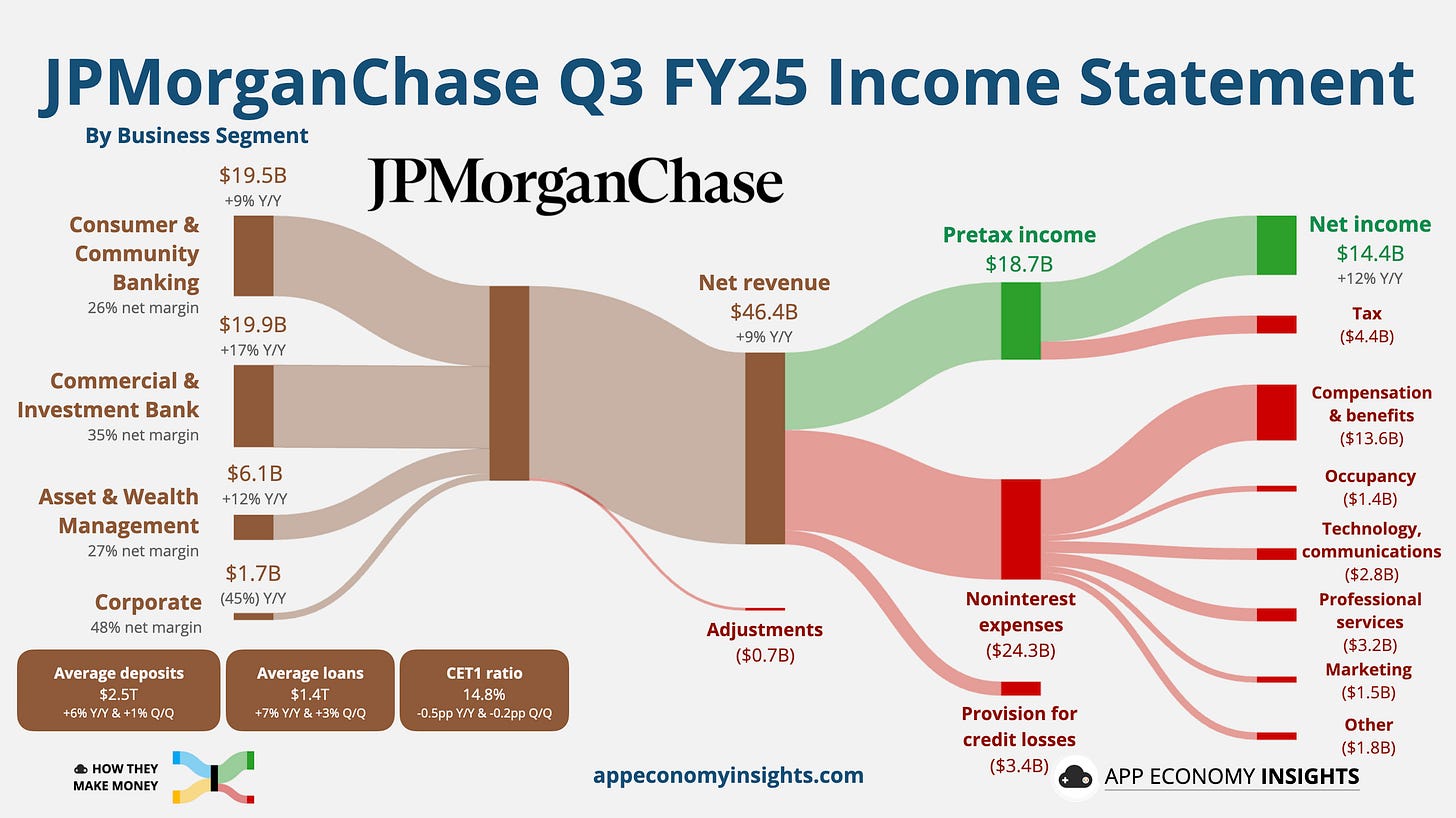

Net revenue grew 9% Y/Y to $46.4 billion ($1.5 billion beat):

Net interest income (NII): $24.0 billion (+2% Y/Y).

Noninterest income: $22.5 billion (+17% Y/Y).

Net income: $14.4 billion (+12% Y/Y).

EPS: $5.07 ($0.23 beat).

Key developments:

📊 Markets & dealmaking roar back: Trading revenue surged 25% to $8.9 billion (a new record), while investment-banking fees rose 16% to $2.6 billion, powered by a 53% surge in equity underwriting and the busiest IPO quarter since 2021. Equities trading jumped 33% to $3.3 billion, and fixed income rose 21% to $5.6 billion.

📈 Guidance nudged higher: JPMorgan lifted its full-year NII outlook again to ~$95.8 billion (from $95.5 billion in July), reflecting strong loan growth and pricing power despite slightly missing quarterly NII expectations by $0.2 billion.

💳 Consumers stay strong: Debit and credit card spending climbed 9%, revolving balances increased, and delinquencies fell. JPM cut its 2025 card charge-off forecast to ~3.3% (from ~3.6%) as credit quality held up. It’s also been the best year ever for new Chase Sapphire accounts.

⚠️ Credit losses rise: Provision for credit losses rose 9% to $3.4 billion, the highest since early 2020, as JPM added $810 million to reserves tied mainly to card services. Net charge-offs included $170 million tied to the collapse of auto lender Tricolor, which CEO Jamie Dimon called “not our finest moment.”

🏭 $1.5 trillion US investment push: JPM announced a decade-long initiative to bolster domestic manufacturing, defense, energy, and frontier tech. The plan includes up to $10 billion in direct equity and venture investments, aligning with US policy priorities but positioned as a commercial strategy.

🧠 AI productivity tailwinds: CFO Jeremy Barnum said AI is already driving measurable efficiency gains across operations, though the company remains “anchored in facts and reality” when evaluating its impact.

🌐 Macro headwinds remain: Dimon cautioned about “a heightened degree of uncertainty” from tariffs, trade tensions, sticky inflation, and elevated asset prices. He noted “signs of softening, particularly in job growth,” and warned that credit losses in some non-bank financial sectors could be worse than in a typical downturn.

🔑 Takeaways: JPMorgan delivered a strong quarter across Main Street and Wall Street, with record trading revenue, surging deal activity, and resilient consumers. Yet the bank is preparing for a bumpier road ahead.

Key quote:

CEO Jamie Dimon: “While there have been some signs of a softening, particularly in job growth, the US economy generally remained resilient. However, there continues to be a heightened degree of uncertainty stemming from complex geopolitical conditions, tariffs and trade uncertainty, elevated asset prices and the risk of sticky inflation.”