📊 PRO: This Week in Visuals

JNJ ASML AXP BLK SCHW UAL DPZ

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

💊 J&J: Strategic Split

🔬 ASML: AI Orders Shine

💳 Amex: Platinum Refresh Pays Off

📈 Blackrock: $13.5 Trillion in AUM

🏦 Charles Schwab: Retail Surge

🛩️ United Airlines: Premium Focus

🍕 Domino’s: Stuffed Crust Momentum

1. 💊 Johnson & Johnson: Strategic Split

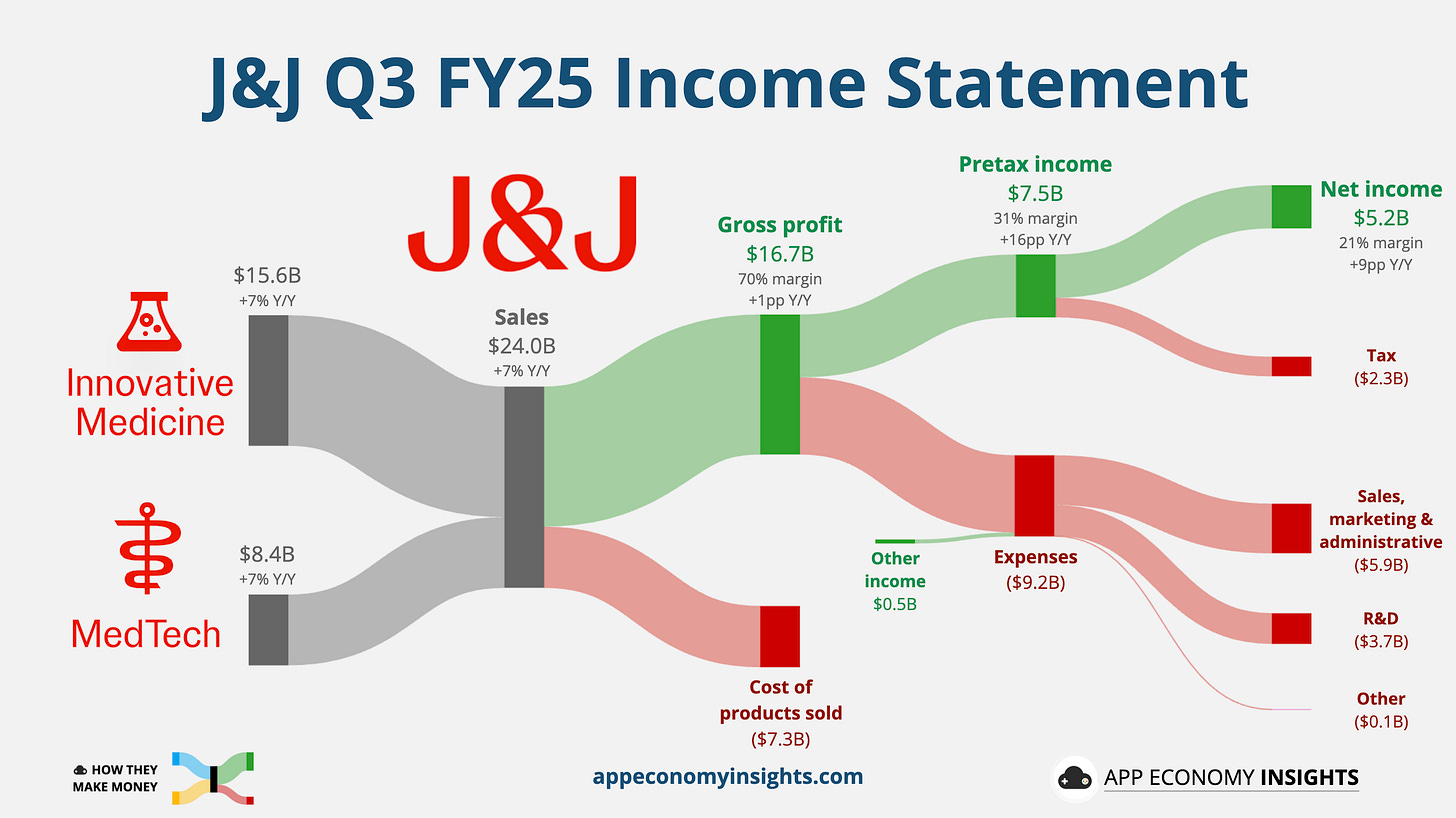

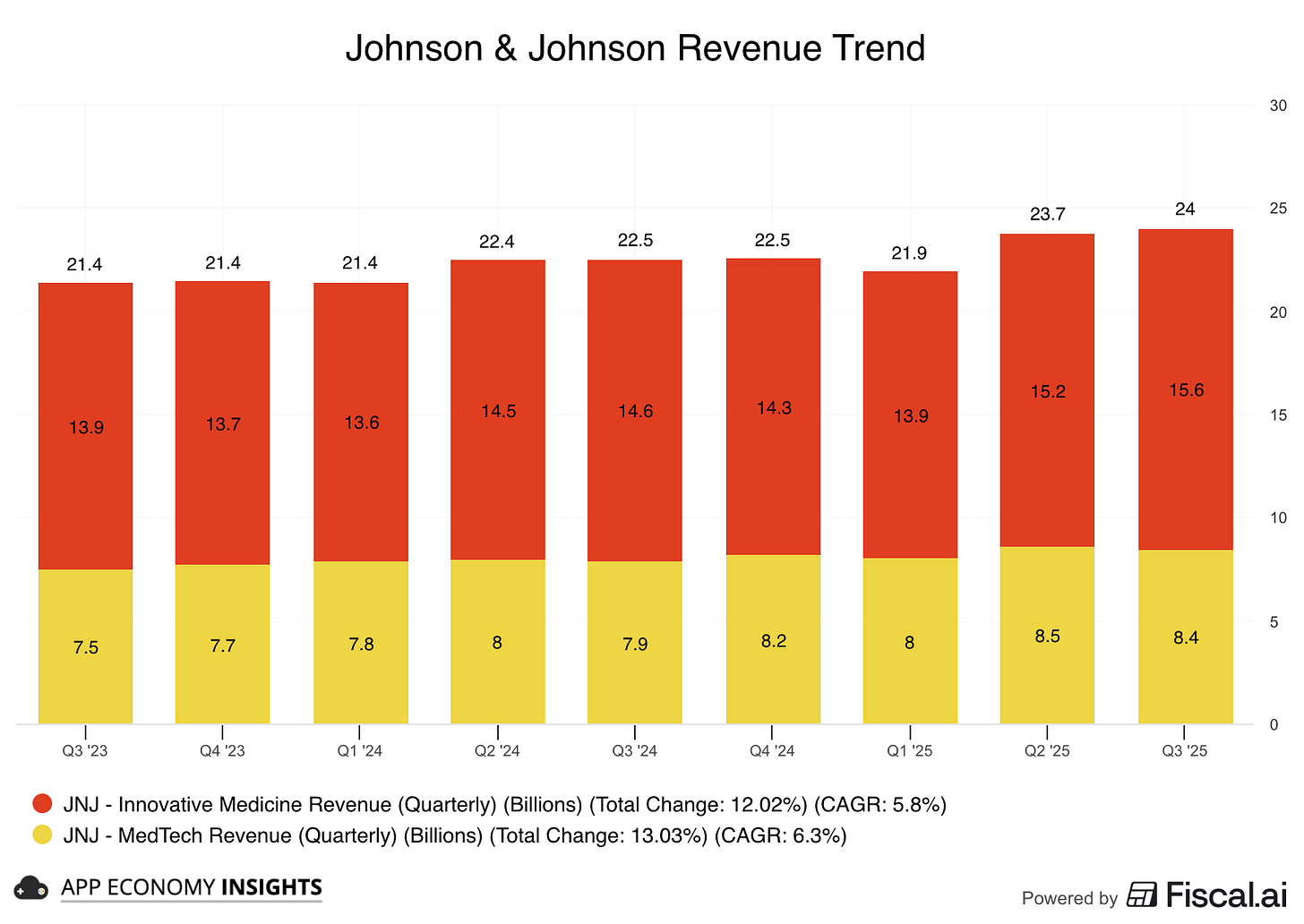

J&J’s Q3 revenue rose 7% Y/Y to $24.0 billion ($240 million beat), and adjusted EPS was $2.80 ($0.04 beat).

Innovative Medicine rose 7% to $15.6 billion, driven by strong performance in Oncology, with Darzalex up 20% and Carvykti surging 81%. Meanwhile, Immunology declined 10% despite Tremfya jumping 40%, only partially offsetting the continued 42% decline of Stelara due to biosimilar competition.

MedTech sales grew nearly 7% to $8.4 billion, led by double-digit growth in Cardiovascular, helped by the performance of recent acquisitions like Abiomed and Shockwave.

The quarter’s biggest news was a major strategic pivot: J&J announced plans to spin off its slower-growing $9.2 billion orthopedics business (DePuy Synthes) within 18-24 months to sharpen its focus on higher-growth markets.

Following the Q3 results, J&J raised its full-year reported sales guidance to ~$93.7 billion ($0.3 billion raise) while reaffirming its EPS outlook. Management emphasized momentum in its innovative pipeline, projecting several new $5 billion peak-year assets. While Stelara erosion and political pressure on drug pricing remain headwinds, the company is aggressively reshaping its portfolio to accelerate growth.

2. 🔬 ASML: AI Orders Shine

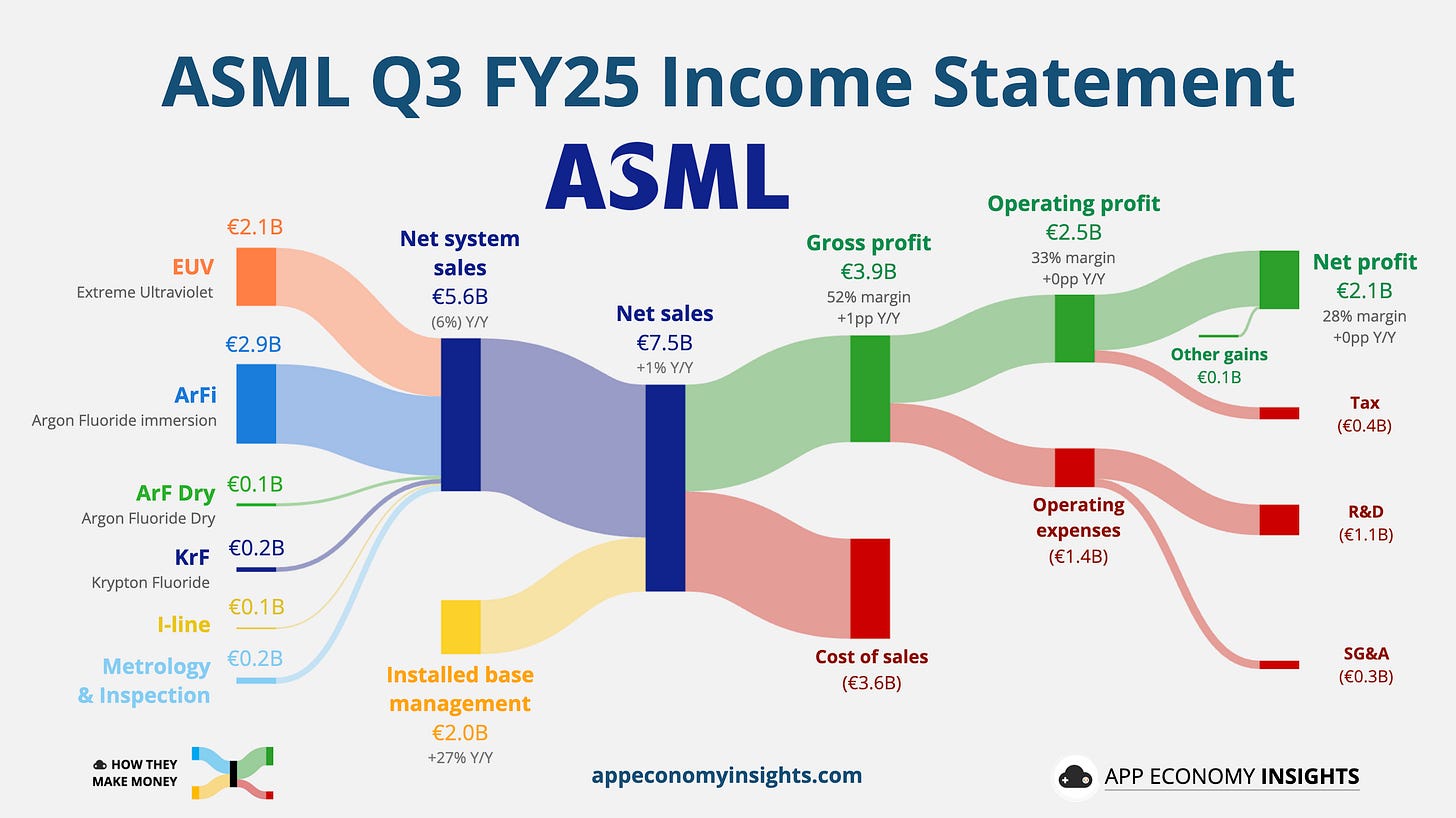

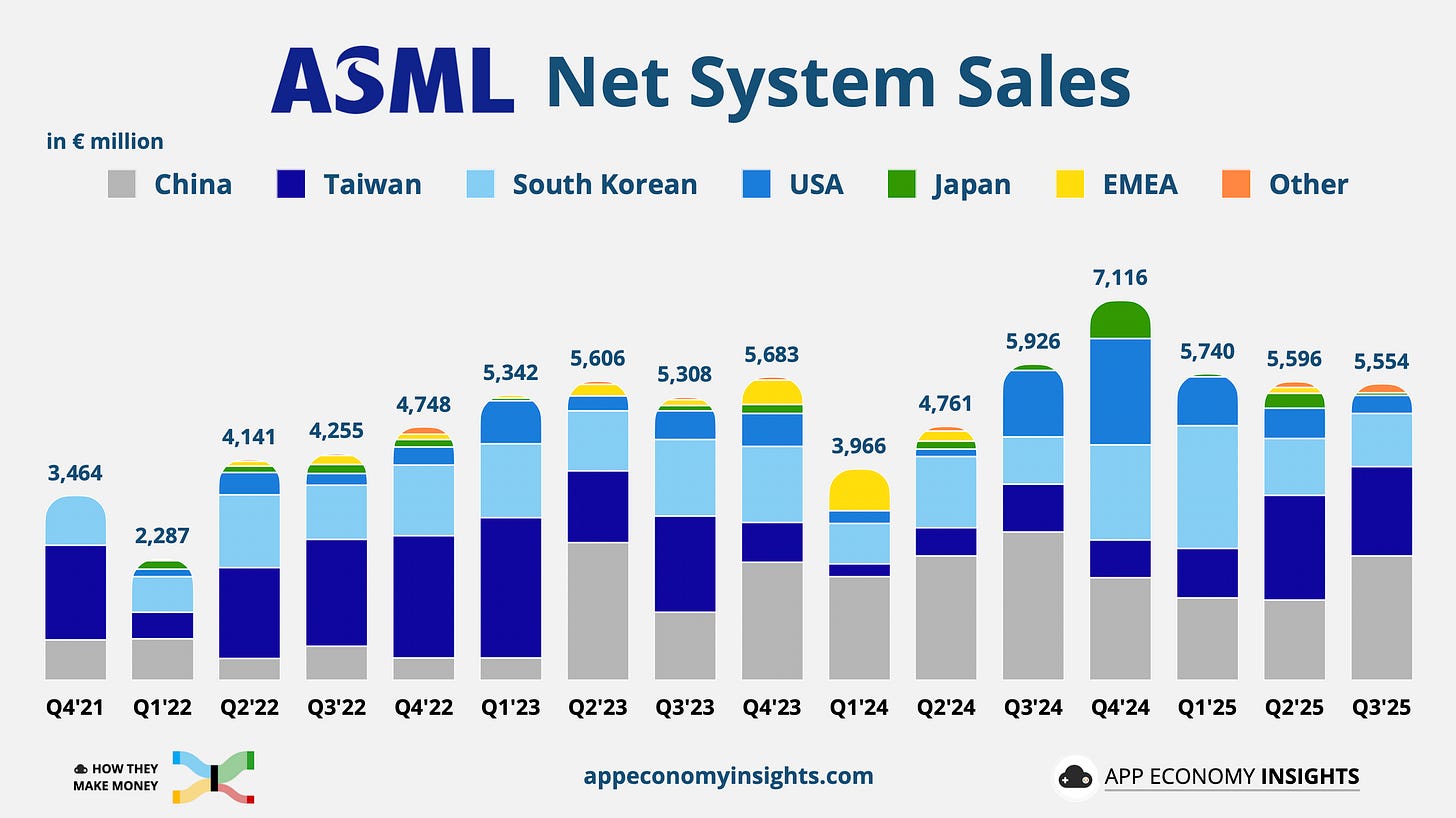

ASML reported Q3 revenue of €7.5 billion (€210 million miss), but beat on profit with EPS of €5.48 (€0.06 beat). Bookings remained robust at €5.4 billion, easily surpassing estimates (€0.5 billion beat), driven by a massive €3.6 billion in new orders for its most advanced EUV machines as the AI boom continues. Gross margin improved to 52%, beating consensus and landing at the high end of guidance.

Management reaffirmed its full-year 2025 guidance for 15% revenue growth and 52% gross margin. For 2026, ASML sought to calm investor nerves by stating that sales would “not be below 2025,” establishing a floor after last quarter’s uncertainty. However, CEO Christophe Fouquet explicitly warned that sales to China are expected to decline significantly next year (from 30% of revenue in 2025 down to roughly 25% in 2026), offsetting some of the AI-driven strength.

AI-related demand was the clear driver, fueling the strong EUV bookings as more customers invest in advanced logic and DRAM. However, the China risk has intensified. The region jumped to become the largest market at 42% of system sales this quarter, up from 27% last quarter. The outlook remains a tale of two opposing forces: a booming AI cycle versus a sharp, policy-driven downturn in what is now its largest market.

3. 💳 Amex: Platinum Refresh Pays Off

American Express reported Q3 revenue growth of 11% Y/Y to $18.4 billion ($380 million beat) and EPS of $4.14 ($0.16 beat), fueled by accelerating cardmember spending and an 18% jump in card fees.

The recently revamped Platinum Card was a standout, with new US Platinum account acquisitions doubling pre-refresh levels. CEO Steve Squeri called it the “strongest start we’ve ever seen with a refresh.”