☁️ Amazon: Worth Every Penny

The company is proving that rising CapEx is money well spent

Welcome to the Premium edition of How They Make Money.

Over 240,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members love our latest Earnings Visuals report!

Digest the performance of hundreds of companies in seconds.

Amazon (AMZN) just gave Wall Street the proof it was waiting for.

Last Friday, we discussed AWS as the “most likely beneficiary” of the new deal between Microsoft and OpenAI, after Azure lost its right of first refusal on cloud infrastructure.

Well, well, well. AWS and OpenAI just inked a $38 billion seven-year deal, granting OpenAI access to hundreds of thousands of NVIDIA GPUs, with the option to scale to tens of millions of CPUs for agentic workloads.

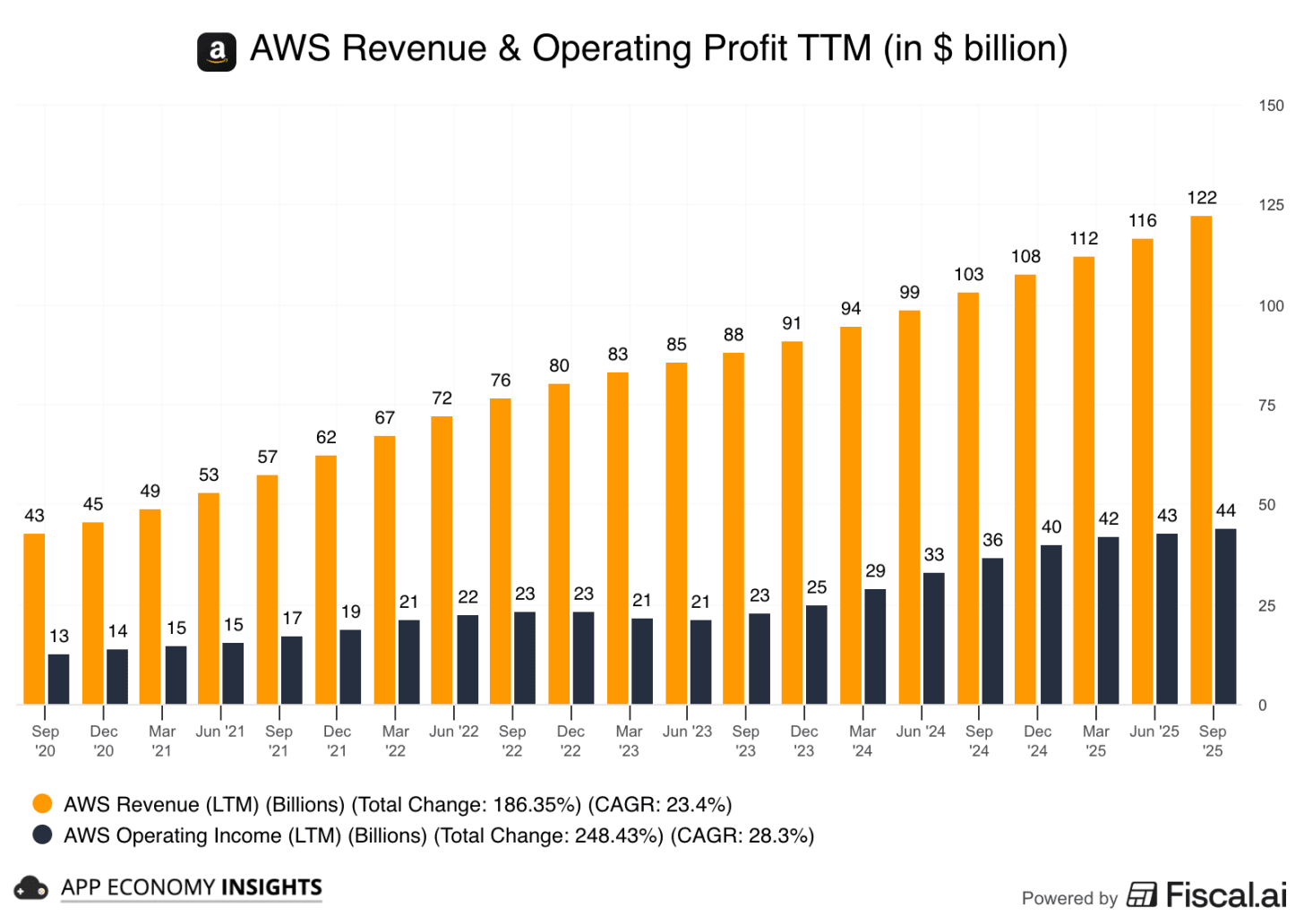

The timing couldn’t be better. AWS growth just accelerated to 20% Y/Y, its best performance in nearly three years, showing that Amazon’s aggressive CapEx, now expected to reach $125 billion in FY25, is paying off. The stock jumped over 10% after earnings as investors rewarded tangible progress on AI monetization.

CEO Andy Jassy’s message was simple:

“We’re going to continue to be very aggressive in investing in capacity because we see the demand. As fast as we’re adding capacity right now, we’re monetizing it.”

With AWS revenue scaling past a $132 billion annual run rate, Amazon has turned a narrative of market-share anxiety into one of renewed conviction.

Today at a glance:

Amazon Q3 FY25.

The OpenAI deal implications.

Key quotes from the call.

What to watch moving forward.

1. Amazon Q3 FY25

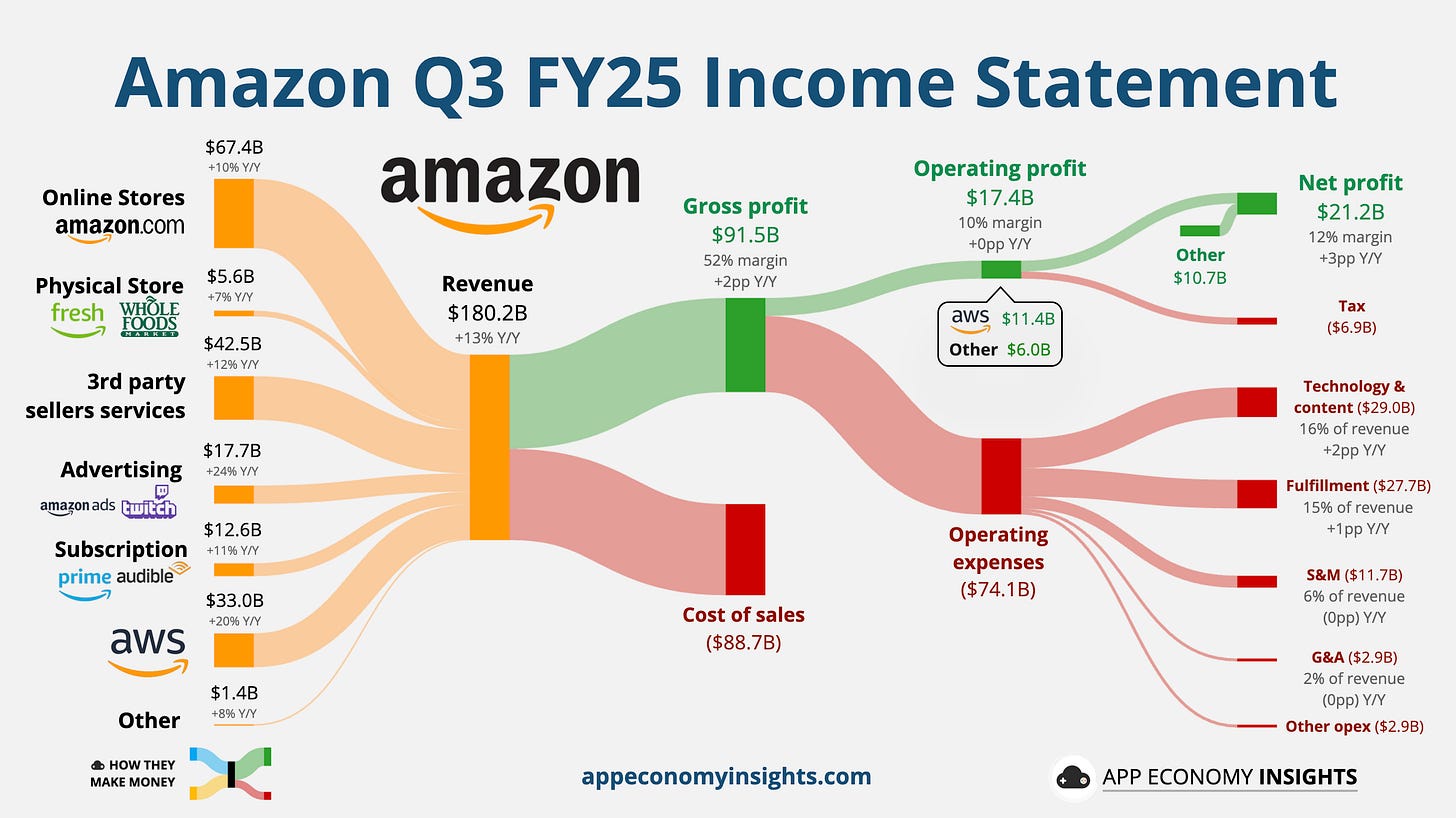

Income statement:

Revenue breakdown:

💻 Online stores (37% of overall revenue): Amazon.com +10% Y/Y.

🏪 Physical store (3%): Primarily Whole Foods Market +7% Y/Y.

🧾 3rd party (24%): Commissions, fulfillment, shipping +12% Y/Y.

📢 Advertising (10%): Ad services to sellers, Twitch +24% Y/Y.

📱 Subscription (7%): Amazon Prime, Audible +11% Y/Y.

☁️ AWS (18%): Compute, storage, database, & other +20% Y/Y.

Other (1%): Various offerings, small individually +8% Y/Y.

Revenue rose +13% Y/Y to $180.2 billion ($2.4 billion beat).

Gross margin was 52% (+2pp Y/Y).

Operating margin was 10% (+0pp Y/Y).

AWS: 35% margin (-3pp Y/Y).

North America: 5% margin (-1pp Y/Y).

International: 3% margin (-1pp Y/Y).

EPS $1.65 ($0.39 beat).

Cash flow:

Operating cash flow TTM was $131 billion (+16% Y/Y).

Free cash flow TTM was $15 billion (-69% Y/Y), driven by the operating cash flow growth, offset by a 78% rise in Capex to $116 billion.

Balance sheet:

Cash, cash equivalent, and marketable securities: $94 billion.

Long-term debt: $51 billion.

Q4 FY25 Guidance:

Revenue ~$209.5 billion ($1.4 billion beat).

Operating income $21 to $26 billion (+11% Y/Y in the mid-range).

So, what to make of all this?

☁️ AWS rebounds: AWS revenue rose 20% Y/Y to $33 billion, accelerating from 17% Y/Y in Q2 and the fastest pace since 2022, showing that AI infrastructure demand is translating into growth. Custom chips and new data-center capacity helped offset power and supply constraints. Of course, AWS trails Azure’s 39% and Google Cloud’s 34% growth from lower bases, but it’s still adding the most revenue from a dollar standpoint.

📦 Retail steady: Non-AWS revenue grew 12% Y/Y, including 11% growth in North America and 14% internationally. Prime sign-ups held steady, showing shoppers still see value despite inflation and tariffs.

🏗️ Peak CapEx: Free cash flow dropped sharply as capital expenditures ballooned past $34 billion in a single quarter. Amazon leads the world in capital spending, guiding $125 billion for FY25.

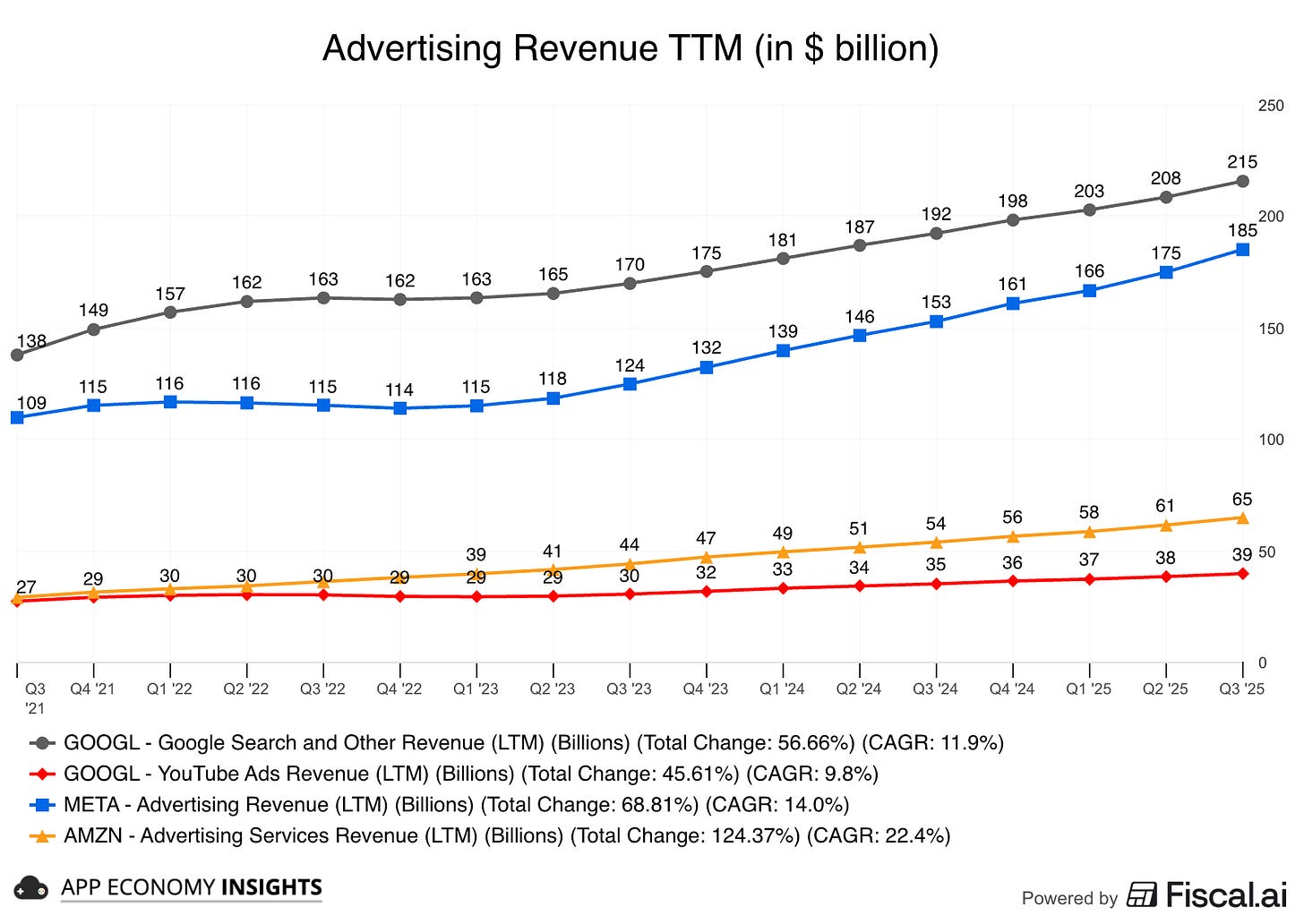

📢 Advertising keeps firing: Ad revenue surged 24% Y/Y to $17.7 billion, outpacing both Google Search and YouTube. Integrations with Roku, Disney, and Prime Video are expanding Amazon’s connected-TV footprint, while a new multi-touch attribution model is sharpening ROI and boosting advertiser confidence. This high-margin segment remains a pillar of the bull case.

📉 Margins hold: Operating income reached $17.4 billion (flat Y/Y), but excluding one-time legal and severance costs, profits would exceed $21 billion. Company-wide margins stayed near 11%, supported by retail efficiencies and ad mix, yet free cash flow collapsed to $14.8 billion as AI-driven capex accelerated.

🔮 Guidance stays grounded: For Q4, Amazon projects $206–213 billion in revenue (+10–13% Y/Y) and $21–26 billion in operating income, implying steady but not explosive growth.