Welcome to the Free edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

“Conviction in the AI megatrend is strengthening.”

That’s how Taiwan Semiconductor Manufacturing Company (TSMC) CEO C.C. Wei summed up the moment in his Q3 remarks, calling AI chip demand ”insane.”

The company now expects AI-related revenue to double in 2025 and grow about 45% annually for the next five years. 👀

And this isn’t coming from a niche player.

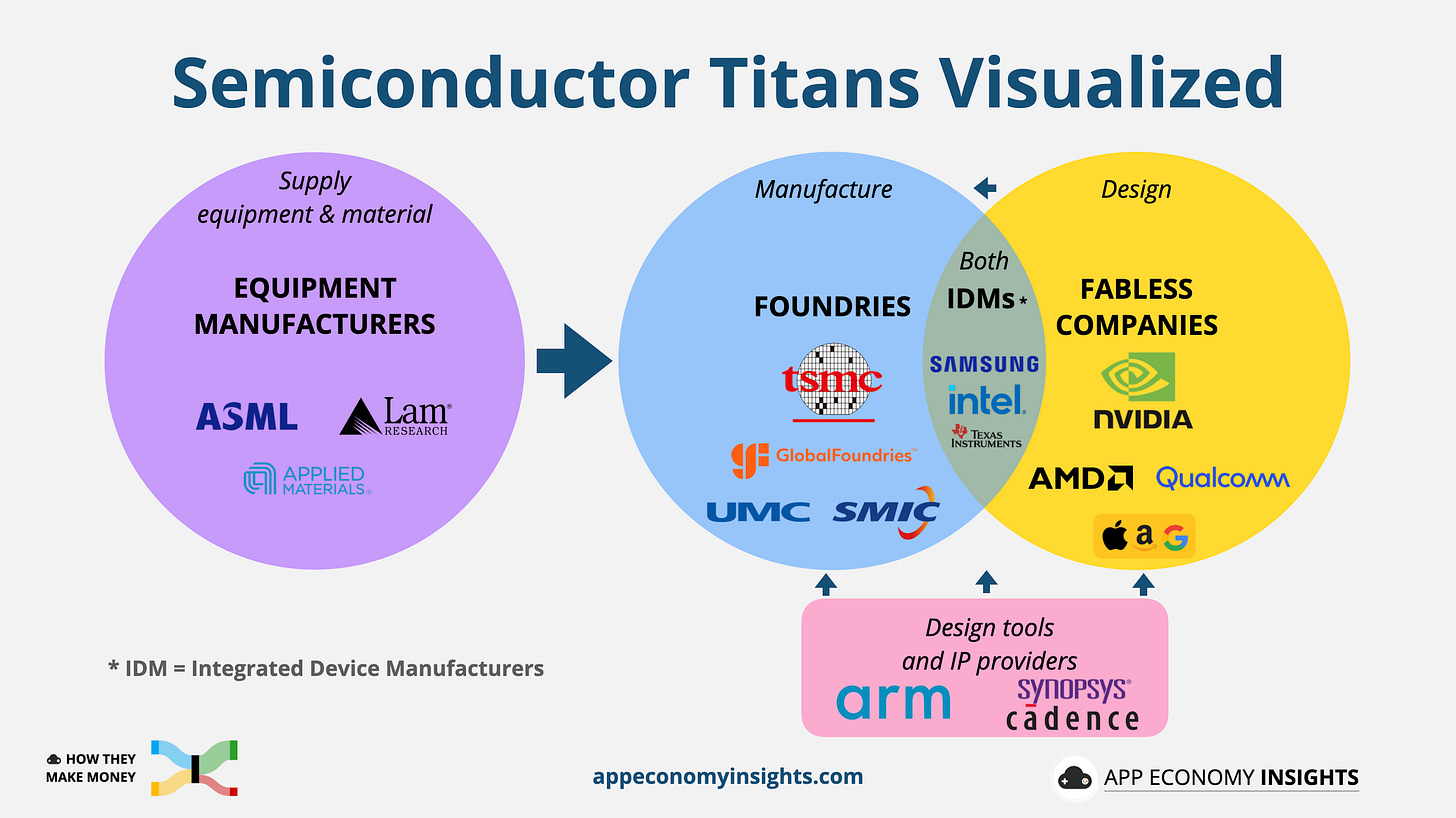

TSMC is the 9th most valuable company on the planet, and the foundry behind NVIDIA’s AI accelerators and Apple’s iPhone chips. It’s the beating heart of the global semiconductor supply chain, the critical bridge between chip design dreams and production reality.

If the AI era is an arms race, TSMC is the arsenal builder everyone depends on.

Disclosure: I own TSM in in App Economy Portfolio. It was the January 2023 Stock Idea, and the stock has quadrupled since then.

This quarter showed what that looks like in numbers, with record revenue, soaring profits, and raised growth expectations, all fueled by a wave of demand that shows no sign of slowing down.

Today at a glance:

TSMC keeps outperforming

Bottleneck and geopolitics

Key quotes from the earnings call

What to watch moving forward

1. TSMC keeps outperforming

Income statement:

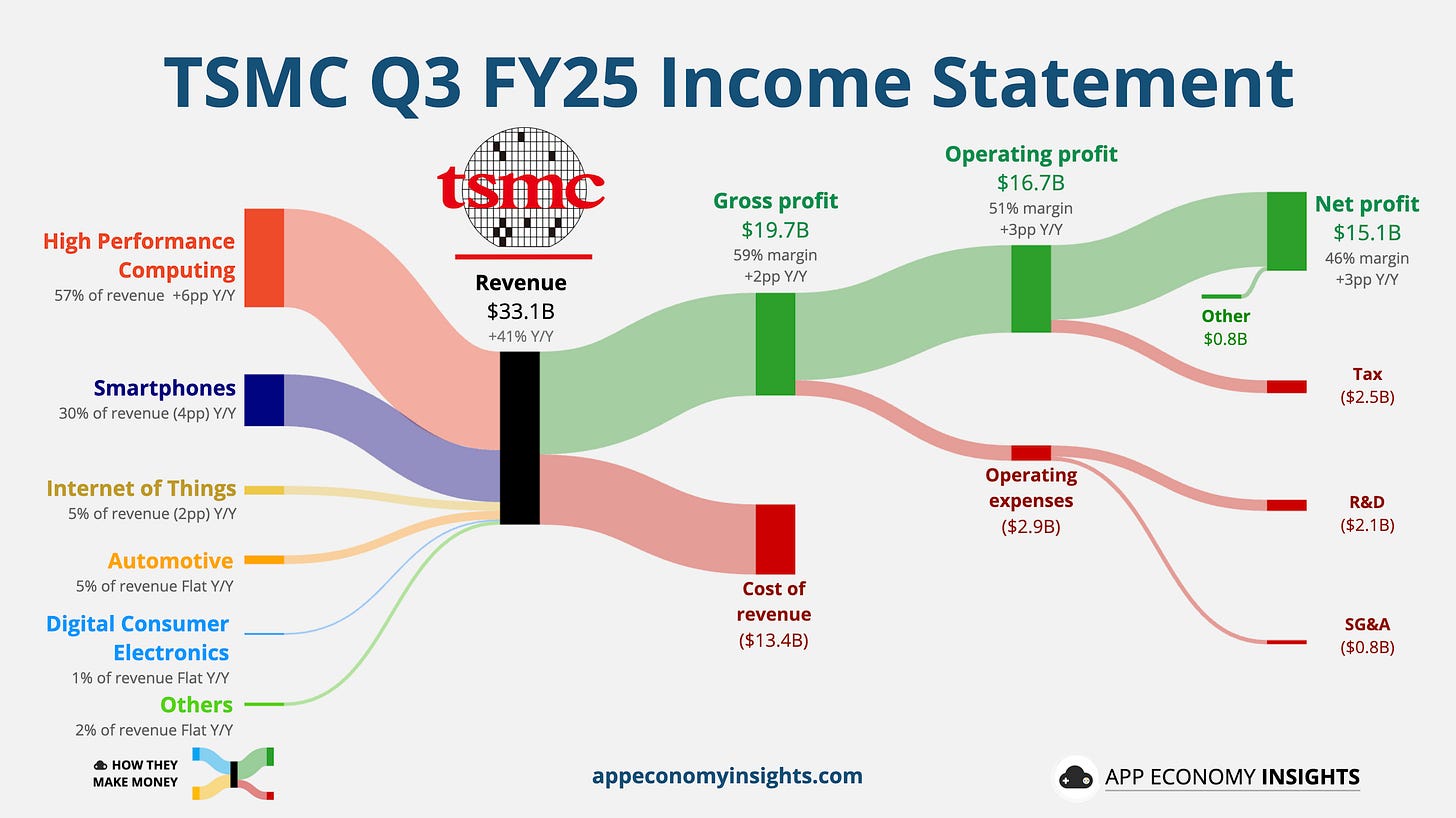

Revenue surged +41% Y/Y to $33.1 billion ($1.5 billion beat).

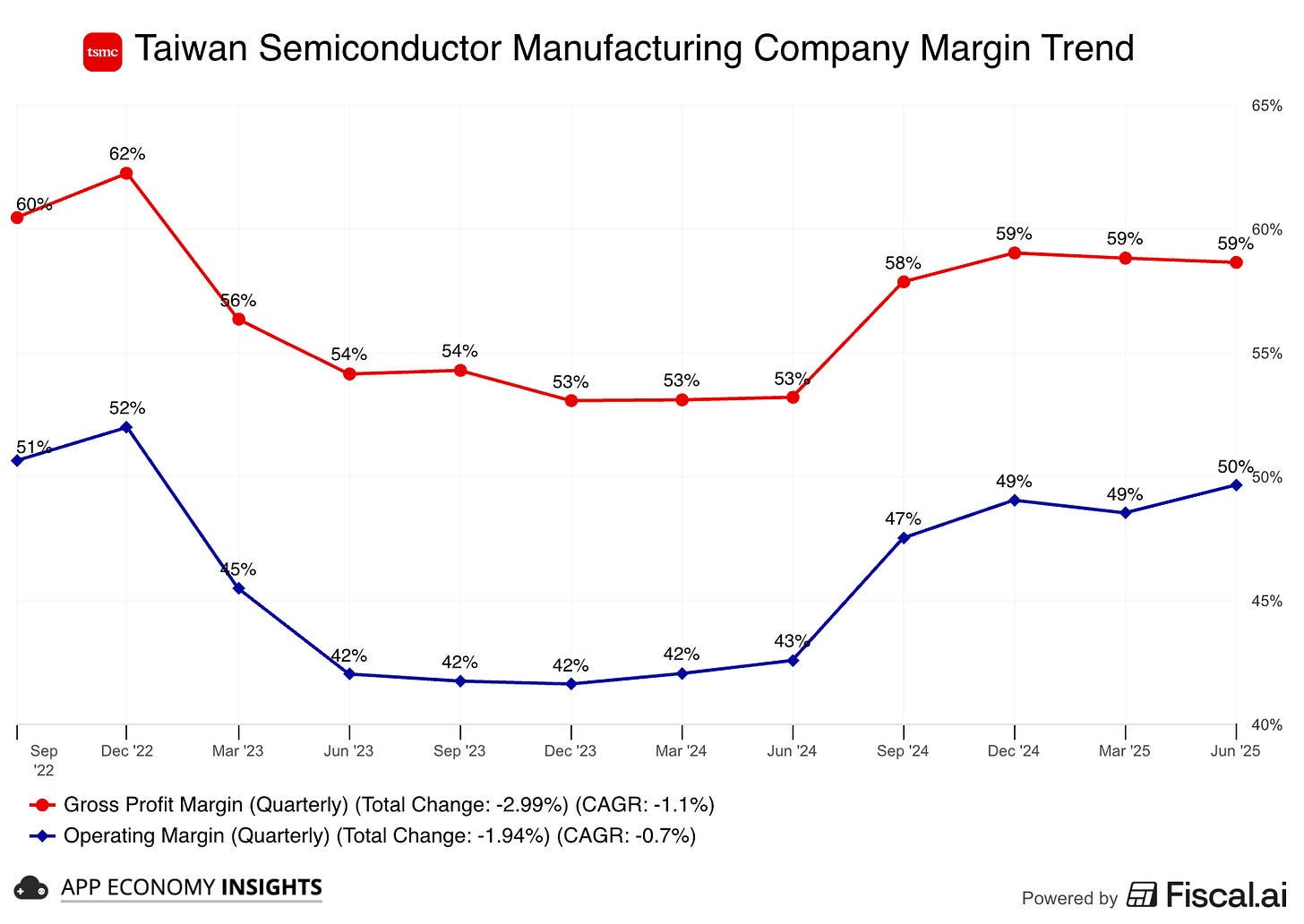

Gross margin was 59% (+2pp Y/Y).

Operating margin was 51% (+3pp Y/Y).

EPADR (American Depositary Receipt) was $2.92 ($0.32 beat).

Revenue by platform:

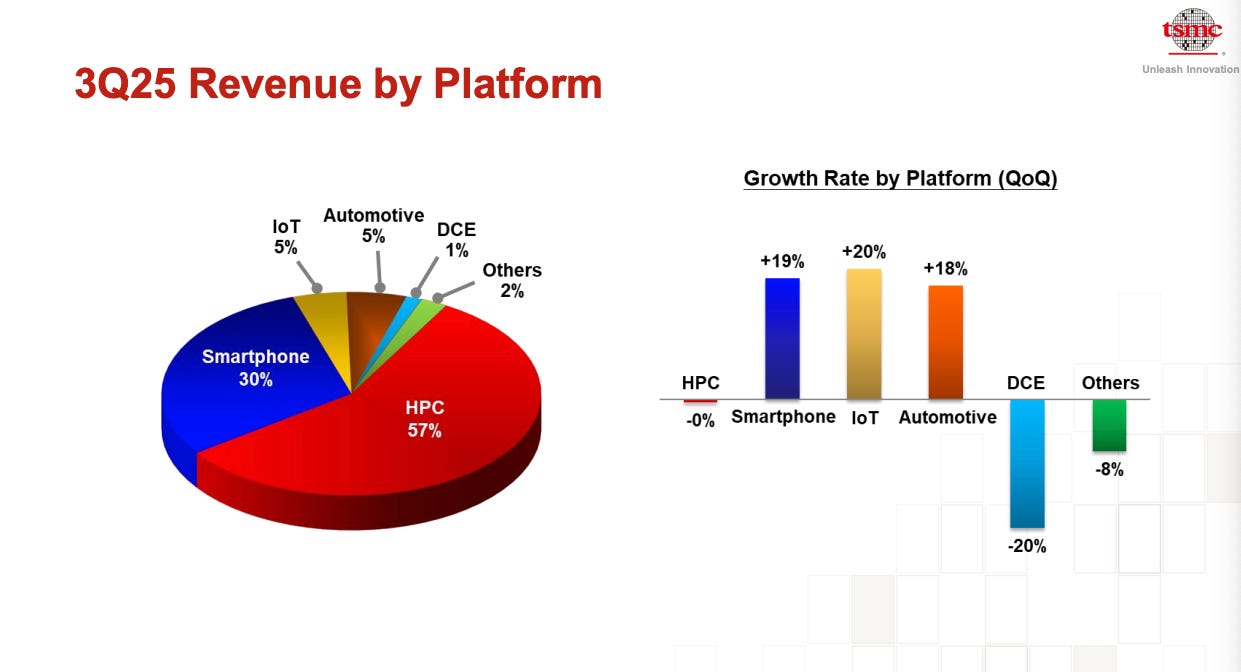

💻 High-Performance Computing (57% of overall revenue, +6pp Y/Y).

📱 Smartphone (30% of overall revenue, -4pp Y/Y).

💡 IoT (5% of overall revenue, flat Y/Y).

🚘 Automotive (5% of overall revenue, flat Y/Y).

🎮 Digital Consumer Electronics (1% of overall revenue, flat Y/Y).

Others (2% of overall revenue, flat Y/Y).

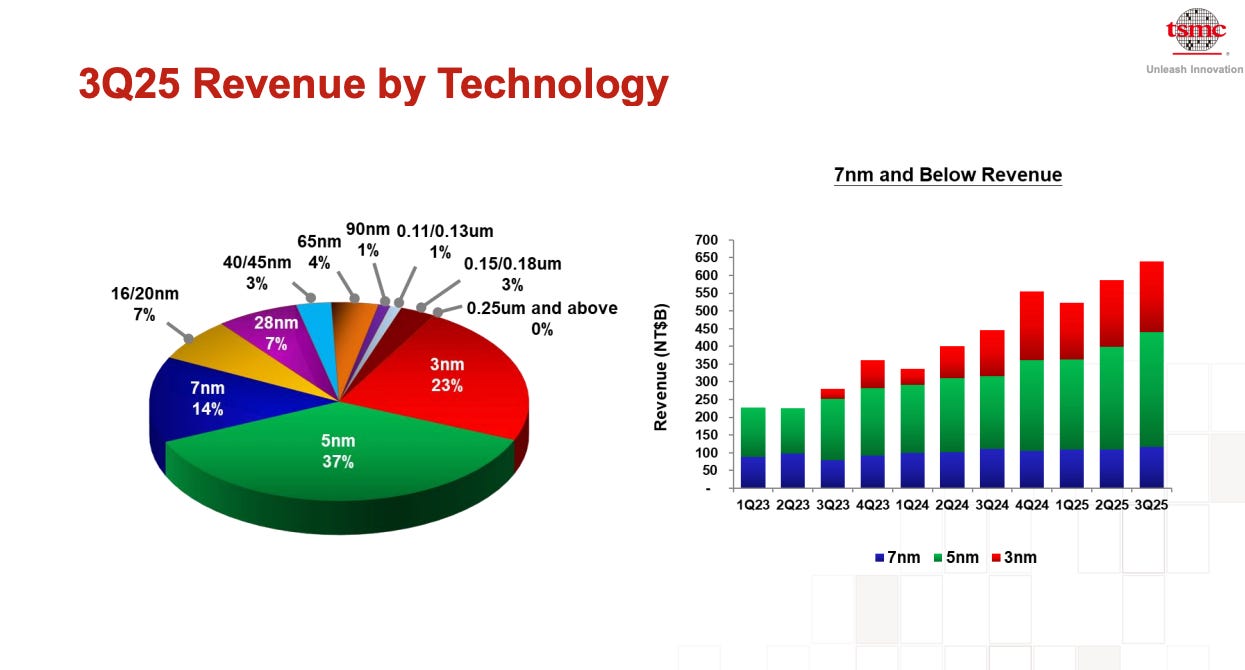

Revenue by technology:

3nm (23% of overall revenue, +3pp Y/Y).

5nm (37% of overall revenue, +5pp Y/Y).

7nm (14% of overall revenue, -3pp Y/Y).

16nm and above (26% of overall revenue, -5pp Y/Y).

Cash flow:

Operating cash flow margin was 43% (-9pp Y/Y), a decline linked to working capital changes as demand surged and production scaled.

Free cash flow margin was 14% (-10pp Y/Y).

Balance sheet:

Cash, cash equivalents, and short-term investments: $90.1 billion.

Long-term debt: $28.8 billion.

Q4 FY25 Guidance:

Revenue ~$33.3 billion ($2.0B beat).

Gross margin ~60%

Operating margin ~50%

So what to make of all this?

💥 Record quarter on AI demand: Revenue surged 41% Y/Y to $33.1 billion (or 30% in local currency to NT$990 billion), beating estimates and setting a new high. Net income reached $15.1 billion, as AI-fueled orders from NVIDIA, AMD, Apple, and others drove massive growth.

🔮 Guidance raised again: TSMC now expects mid-30% revenue growth in 2025 (local currency), up from ~30% previously. It’s the second upgrade in three months, signaling deep confidence in AI’s momentum.

⚙️ HPC still leads the charge: High-performance computing (AI + 5G) accounted for 57% of revenue. Advanced nodes (7nm and below) made up 74% of wafer revenue, with strong traction in 3nm and high utilization at 5nm.

🏗️ Capex ramps up again: Minimum 2025 capital spending was raised to $40 billion (from $38 billion), focused on capacity expansion for leading-edge nodes and advanced packaging.

🇺🇸 US expansion accelerates: TSMC is securing land for a second Arizona “gigafab” cluster to meet soaring US demand and mitigate tariff risks. Total US investment commitment is $165 billion.

🗓️ Q4 outlook: Management expects $33.3 billion in revenue ($2.0 billion beat), with gross margins around 60%, supported by continued strong demand for leading-edge process tech.

🫧 Bubble talk dismissed: Despite comparisons to the dot-com era, TSMC says AI demand is real and fundamental, citing exponential growth in tokens processed by major AI players.

📈 Market reaction: TSM shares are up 53% YTD, adding over $260 billion in market cap since the last guidance hike.

2. Bottleneck and geopolitics

The AI boom has turned TSMC’s strengths into pressure points.

🧠 Packaging is the new bottleneck

The insatiable demand for AI accelerators goes beyond wafers. It’s about what happens after they’re made. Advanced packaging technologies like CoWoS (chip-on-wafer-on-substrate) are essential for connecting high-performance chips, and right now, they’re the limiting factor.

TSMC is racing to expand that capacity. It’s doubling CoWoS output into 2026, building two new advanced packaging fabs in Arizona, and partnering with a major OSAT player already breaking ground nearby. Backend throughput will determine how fast AI systems can scale.

🌏 Geopolitics loom large

While demand is booming globally, political friction threatens to reshape the map. New US tariff proposals include potential 20%+ duties on Taiwan semiconductor exports and even a 100% levy unless chips are manufactured domestically. Meanwhile, China’s access to leading-edge chips remains uncertain amid escalating export restrictions. Rare-earth export restrictions and US sanctions are adding further uncertainty.

Beyond trade, Taiwan’s central role in chipmaking could become a bargaining chip itself. Roughly 90% of the world’s most advanced semiconductors are produced on the island, which means Taiwan’s tech dominance could be used as leverage in future negotiations between Washington and Beijing. That risk is part of why TSMC is racing to diversify production to the US, Japan, and Europe. These moves are designed as much to de-risk geopolitics as to meet soaring demand.

Geopolitical maneuvering will shape where future fabs are built, and how quickly capacity scales. That’s why TSMC is securing land for a second “gigafab” cluster in Arizona, a strategic hedge against policy shocks and trade volatility.

3. Key quotes from the earnings call

Check out the post-call Q&A on Fiscal.ai here.

CEO C.C. Wei

On AI demand:

“AI demand actually continue to be very strong [...] stronger than we thought 3 months ago. [...] The number are insane.“

TSMC says AI demand is running even hotter than expected and now sees growth slightly above its already-bold 45% CAGR forecast, driven by token growth and new AI workloads. This is not a typical cycle.

On compute intensity:

“The number of tokens increase is exponential. [...] Almost every 3 months, it will exponentially increase. [...] That’s why we are still very comfortable that the demand on leading edge semiconductor is real.“

This surge in compute demand underpins why TSMC expects AI-related revenue to grow so fast. The exponential jump in tokens per model ensures that even if the number of customers stabilizes, their compute needs will not.

On capacity planning:

“Right now, we pay a lot of attention to our customers’ customer [...] we talk with them and see how they view the AI application [...] and then we make a judgment about how AI is going to grow.“

TSMC isn’t just relying on direct customer forecasts anymore. It’s building visibility further down the stack. That reduces forecasting risk and helps ensure new fabs and packaging lines align with long-term demand.

On the packaging bottleneck

“Everything related like front-end and back-end capacity is very tight. We are working very hard to make sure that the gap will be narrow.“

Advanced packaging (CoWoS) is still supply-constrained into 2026, underscoring how backend capacity has become as critical as front-end nodes in the AI era.

CFO Wendell Huang

On scaling while protecting returns

“A higher level of capital expenditures is always going to be correlated with higher growth opportunities in the following years. [...] As long as we believe there are business opportunities, we will not hesitate to invest.“

TSMC is linking its ~$40–42 billion CapEx directly to multiyear AI growth. The key signal is that revenue is rising faster than CapEx.

On next-gen nodes:

“N2 is well on track for volume production later this quarter. [...] N2’s structural profitability is better than the N3.“

The next wave of node migration begins now. With better economics and demand from both smartphones and AI, N2 sets up a stronger gross margin profile in 2026 and beyond, partially offset by the ramp-up of overseas fabs.

4. What to watch moving forward

TSMC is riding the AI megatrend harder than anyone else. Here’s what to watch as the story unfolds from here.

Key metrics

AI revenue mix: With AI-related revenue expected to grow 45% annually, it will be the most important component of the thesis.

Node migration: Keep an eye on the ramp of N2 volume production (starting late 2025) and N2P/A16 in 2026. These nodes are structurally more profitable and could expand gross margins despite overseas fab dilution.

CapEx trajectory: Any hints of further increases could signal even stronger demand visibility, or pressure on free cash flow if operating cash flow lags.

US footprint: Watch for progress on the Arizona gigafab cluster and advanced packaging fabs. US expansion is a strategic hedge against tariff risk and a requirement for winning future hyperscaler deals.

Potential risks

Geopolitical shocks: Tariffs, export controls, or escalating US–China tensions could reshape demand patterns, especially if China access remains constrained.

Overseas cost drag: Overseas fabs still carry 2–3% margin dilution in early years. If costs rise faster than planned, that could weigh on profitability.

Packaging bottlenecks: Persistent constraints in back-end capacity could limit near-term upside, even if demand remains strong.

Forecasting challenges: Management admits the AI forecast remains hard to pin down. Rapid shifts in end-customer demand could lead to mismatches between capacity and utilization.

The investor view

Ultimately, two clear narratives have emerged:

📈 Bull case: TSMC is the indispensable enabler of the AI era. Explosive compute demand, new node ramps, and deep customer visibility give it a multi-year growth runway few companies can match.

📉 Bear case: Geopolitics, overseas cost drag, and packaging bottlenecks could slow progress. And with expectations already sky-high, even small stumbles could hit the stock hard.

The story is clear: TSMC sits at the center of the AI build-out. The megatrend is real and accelerating, but investors must stay mindful of execution risks and policy shocks. Even the most unstoppable trends rarely move in straight lines.

That's it for today.

Happy investing!

Want to sponsor this newsletter? Get in touch here.

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Start an account for free and save 15% on paid plans with this link.

Disclosure: I own AAPL, AMD, ASML, and NVDA in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Hello 🖐️ We provide a list of SBA grant funding opportunities for both business and personal use, with a 80% approval rate. Are you interested in applying?