🎮 EA: The Biggest LBO Ever

A record $55 billion bet on blockbuster franchises and recurring revenue.

Welcome to the Free edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Electronic Arts is set to go private

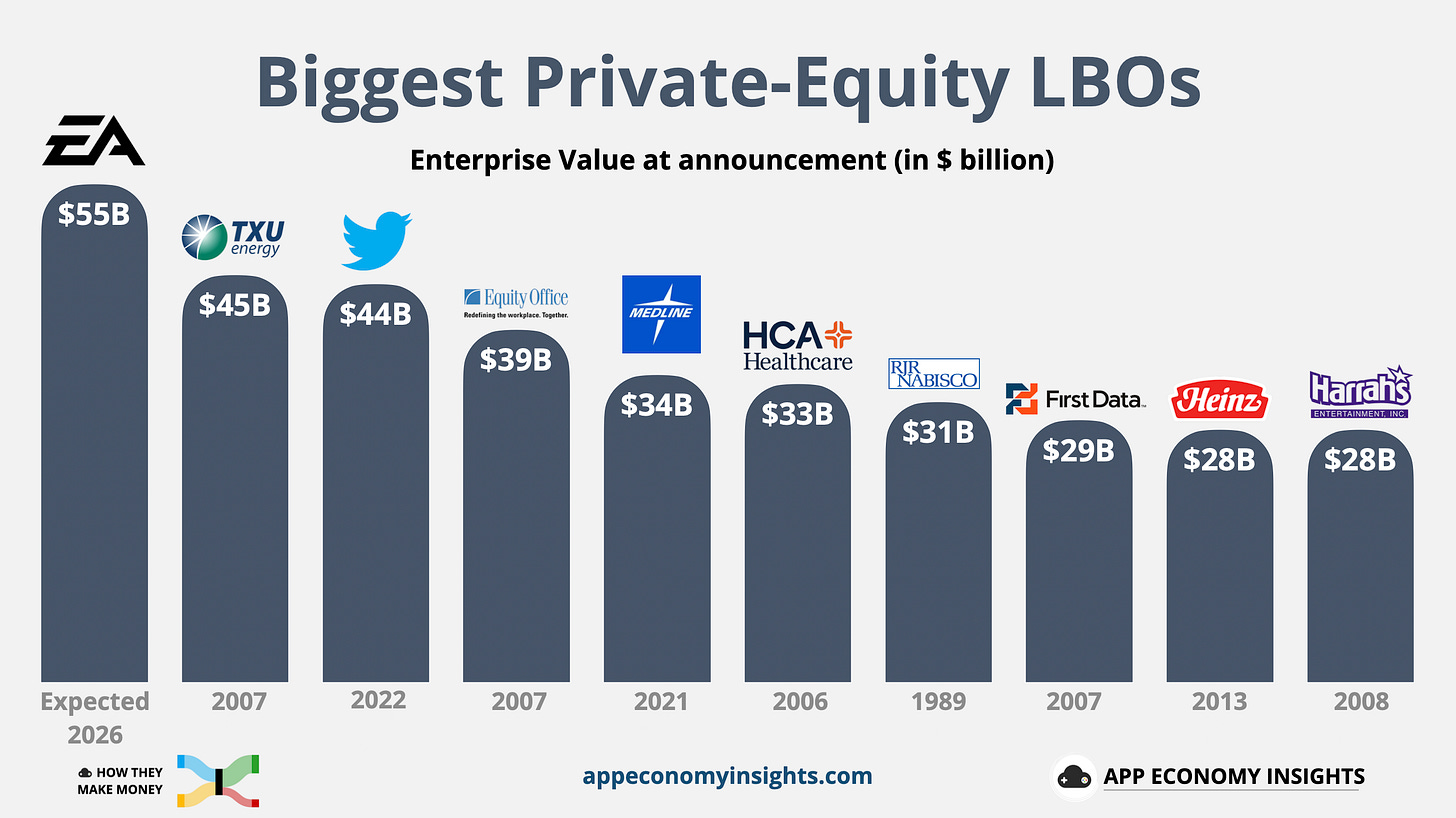

It’s a staggering $55 billion deal, smashing the record for the largest leveraged buyout in history.

Mega-LBOs are high-wire acts by definition. They’re built on mountains of debt, leaving no room for a single misstep and sporting a notoriously mixed track record of success.

But EA isn’t a typical target. It offers critical advantages private equity craves: iconic annual sports franchises, predictable recurring revenue from live services, and a scale few rivals can match.

So, what to make of this acquisition for EA and the gaming industry?

Let’s review what we know.

At a glance:

The Deal: Why go private, and why now?

The Target: How EA became a predictable cash-flow machine.

The Arena: What this means for the future of the gaming industry.

1. The Deal

EA is going private for $210 per share, representing a 25% premium to its pre-announcement stock price.

Who’s buying, and how?

Buyers: Consortium led by Silver Lake, Saudi Arabia’s Public Investment Fund (PIF), and Affinity Partners.

Financing: Roughly $36 billion in equity and $20 billion in debt, with JPMorgan leading the debt package. PIF is converting its existing ~10% public stake into equity in the newly private company.

Leadership: EA says Andrew Wilson stays as CEO and HQ remains in Redwood City.

Target date: Closing is targeted for EA’s fiscal Q1 2027 (ending June 2027), pending approvals. Early reports also mention $1 billion termination fee if the deal doesn’t go through, similar to what we have seen when Adobe tried to buy Figma.

Regulatory Scrutiny: The deal requires a mandatory US foreign-investment review (CFIUS) due to the involvement of Saudi Arabia’s PIF. This is a standard process for such transactions.

Why this structure fits EA

The consortium is betting on recurring live-service cash flows (FC/Madden Ultimate Team-style modes, Apex Legends, Battlefield, The Sims) and the calendar certainty of annual sports releases. That combination of predictability and scale is precisely what gives the buyers confidence to use so much debt.

What to watch

Licenses: NFL, F1, and the FC era (previously FIFA). Renewals and economics matter more with leverage, and the cash-cow franchises will do the heavy lifting.

Talent retention: Private ownership means less stock-based comp; keeping senior creatives is key.

Debt Service: The new EA will have significant interest payments. Any dip in performance or a broader market downturn will test its ability to service that debt. Watch for any pressure on cash flow, as the margin for error is now razor thin.

History check

Big LBOs tend to succeed when the asset has durable, non-cyclical cash and a clear exit path (sell-down, re-IPO, or strategic sale). They stumble when deals are struck at peak cycles, when cost cuts hit the product pipeline, or when talent/licenses wobble.

EA’s test is brutally simple: Grow bookings, generate enough free cash flow to cover massive interest payments, and relentlessly expand its core franchises. Failure in any one of these areas is not an option.

2. The Target

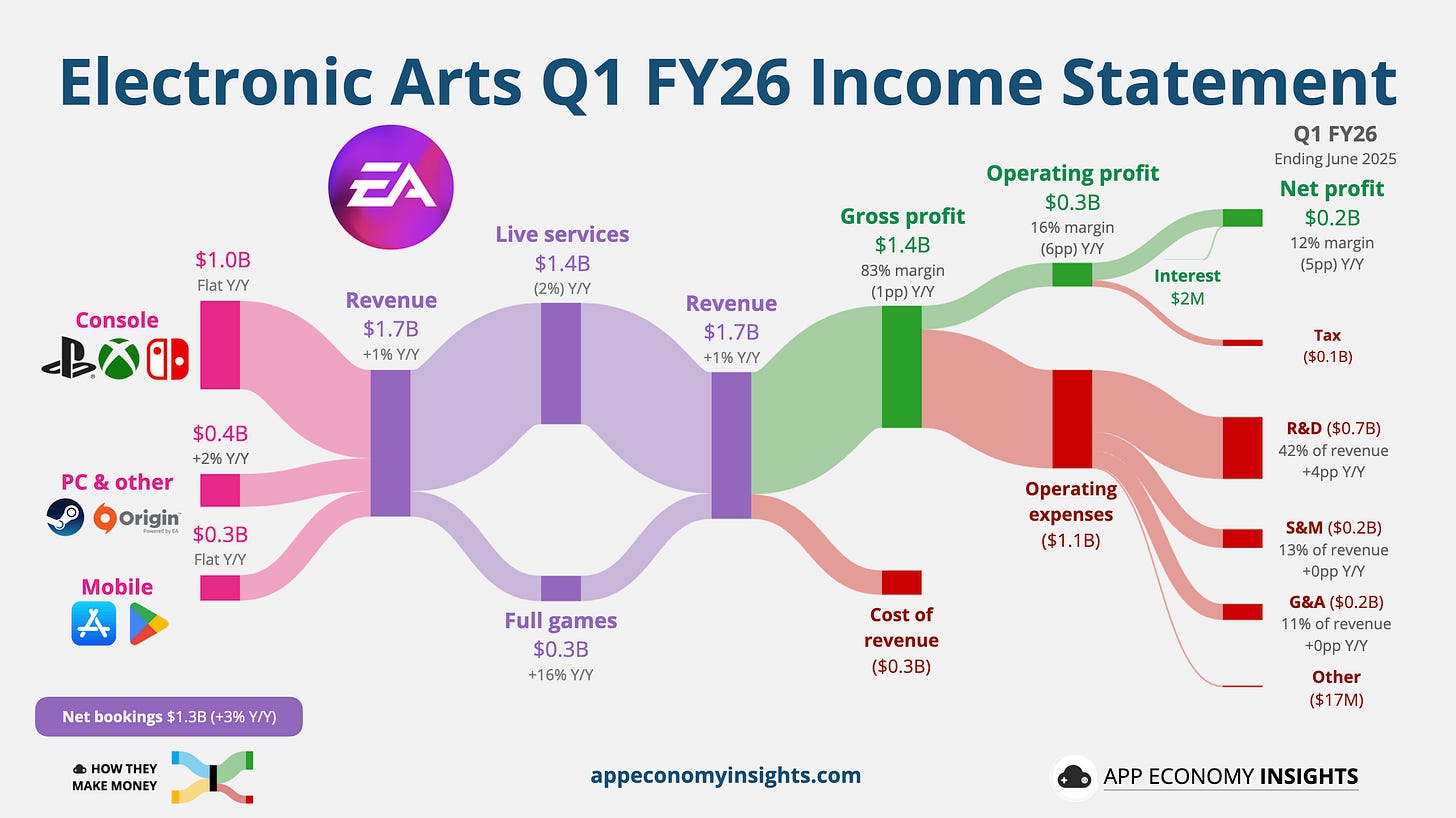

Live Services are the center of gravity

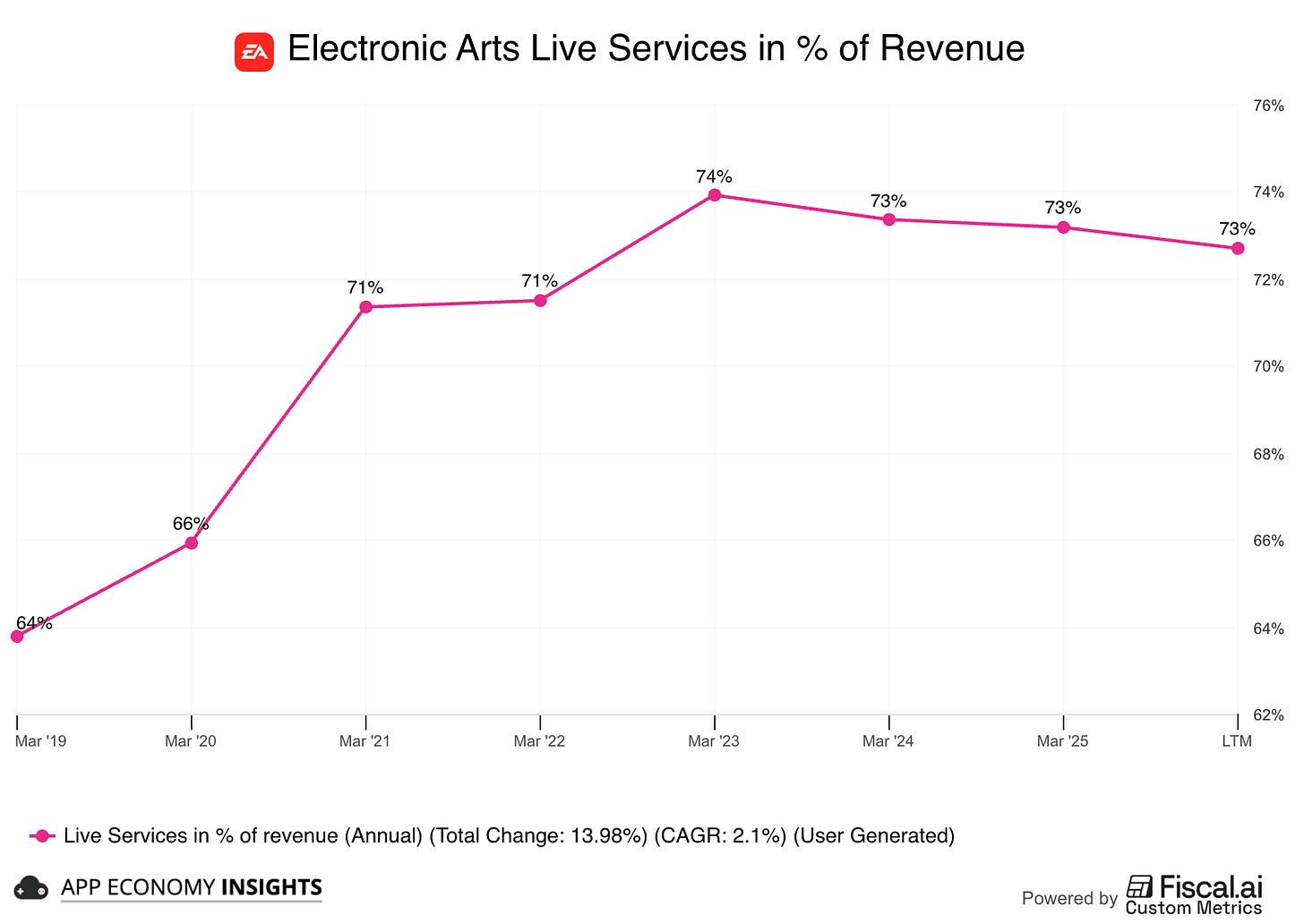

Think products like Ultimate Team–style modes, microtransactions, subscriptions. They made up 73% of the overall revenue in the past 12 months, up from 64% in FY19 (ending in March).

I created the graph below using the Custom Metrics screen on Fiscal.ai, our data platform partner. It allows you to visualize any ratio or specific segment or KPI over time. In this example, I used Live Services revenue in % of overall revenue.

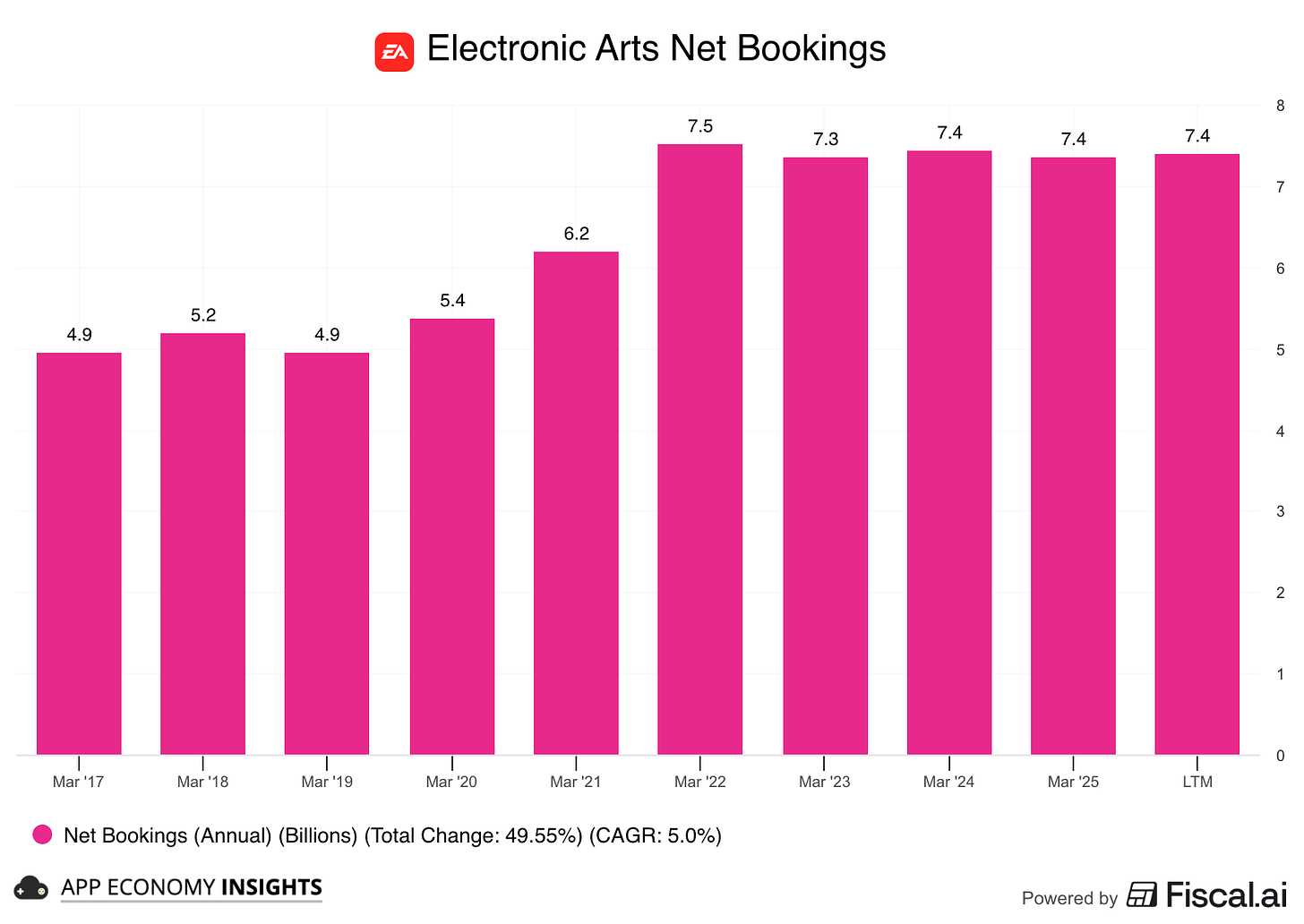

Net bookings are flat since 2022

Net bookings = The total dollar value of what players bought from EA in the period (full games, in-game add-ons/live services, subscriptions, and mobile) whether or not EA has recognized it as GAAP revenue yet.

Plateauing: Net bookings set a high watermark of $7.5 billion in FY22 and have been flat since. Sports titles are mature at this stage of the console cycle. Apex Legends comps got tougher. Fewer ‘step-function’ launches in the past 3 years.

Industry backdrop: The global games market has been nearly flat over this stretch, from $184 billion in 2022 to a projected $189 billion in 2025, with consoles leading modest growth while mobile slowed. So EA has been in line with the industry.

LBO lens: stability is good for a leveraged buyout, but a return to growth will require new content catalysts.

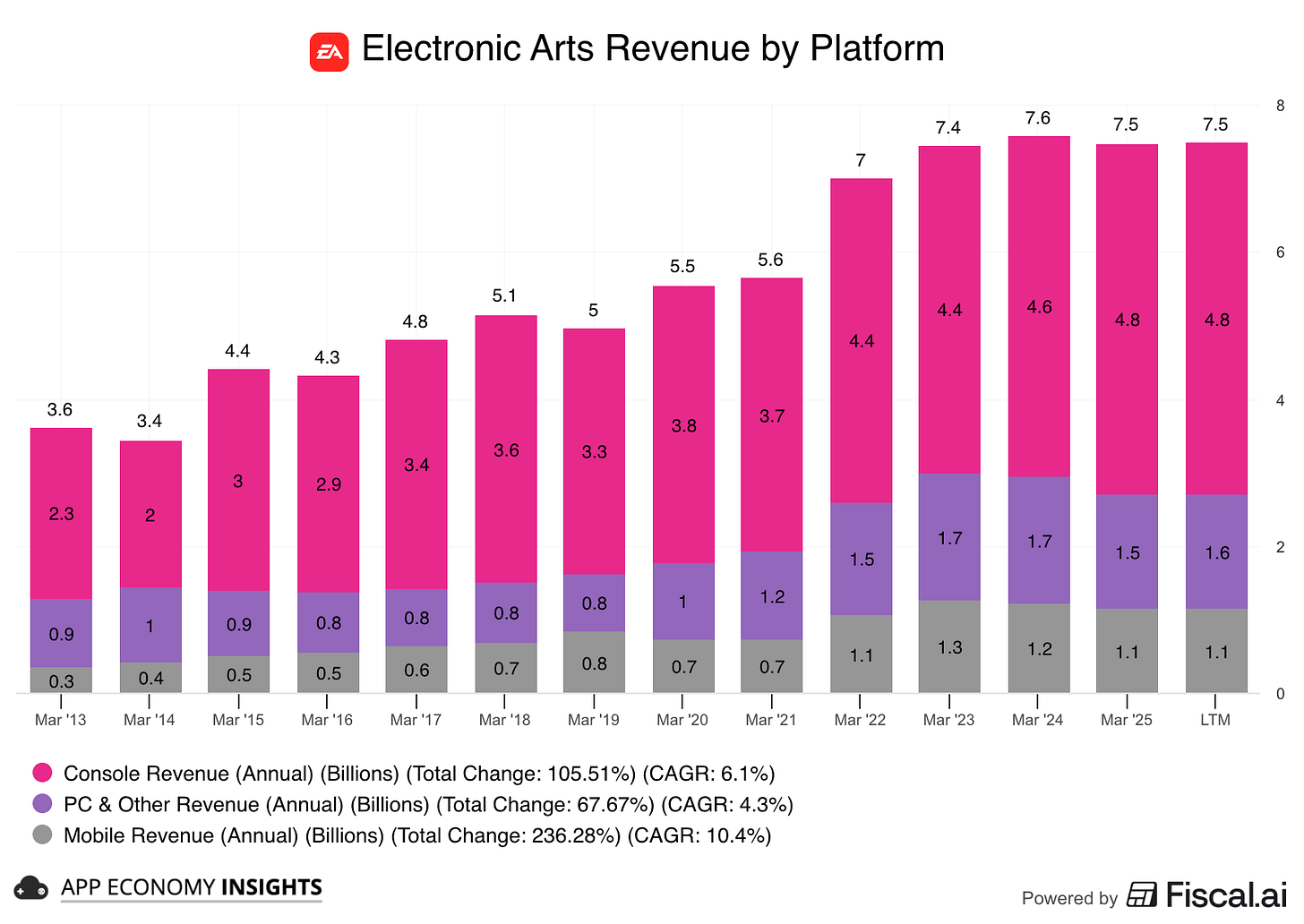

Console is still the bedrock

Console is the anchor: Across the last decade, console has carried the bulk of revenue and captured most live-ops spend. The PS4→PS5 / Xbox One→Series transition didn’t break the model. Attach rates to Ultimate Team–style modes deepened on console.

PC is the steady No. 2: Smaller than console but meaningful, helped by Apex Legends, F1, and by frictionless digital delivery (EA Play/Steam).

Mobile grew through acquisitions: EA has struggled with mobile and most of its growth there since 2021 came from the acquisition of Glu Mobile ($2.1 billion) and Playdemic ($1.4 billion).

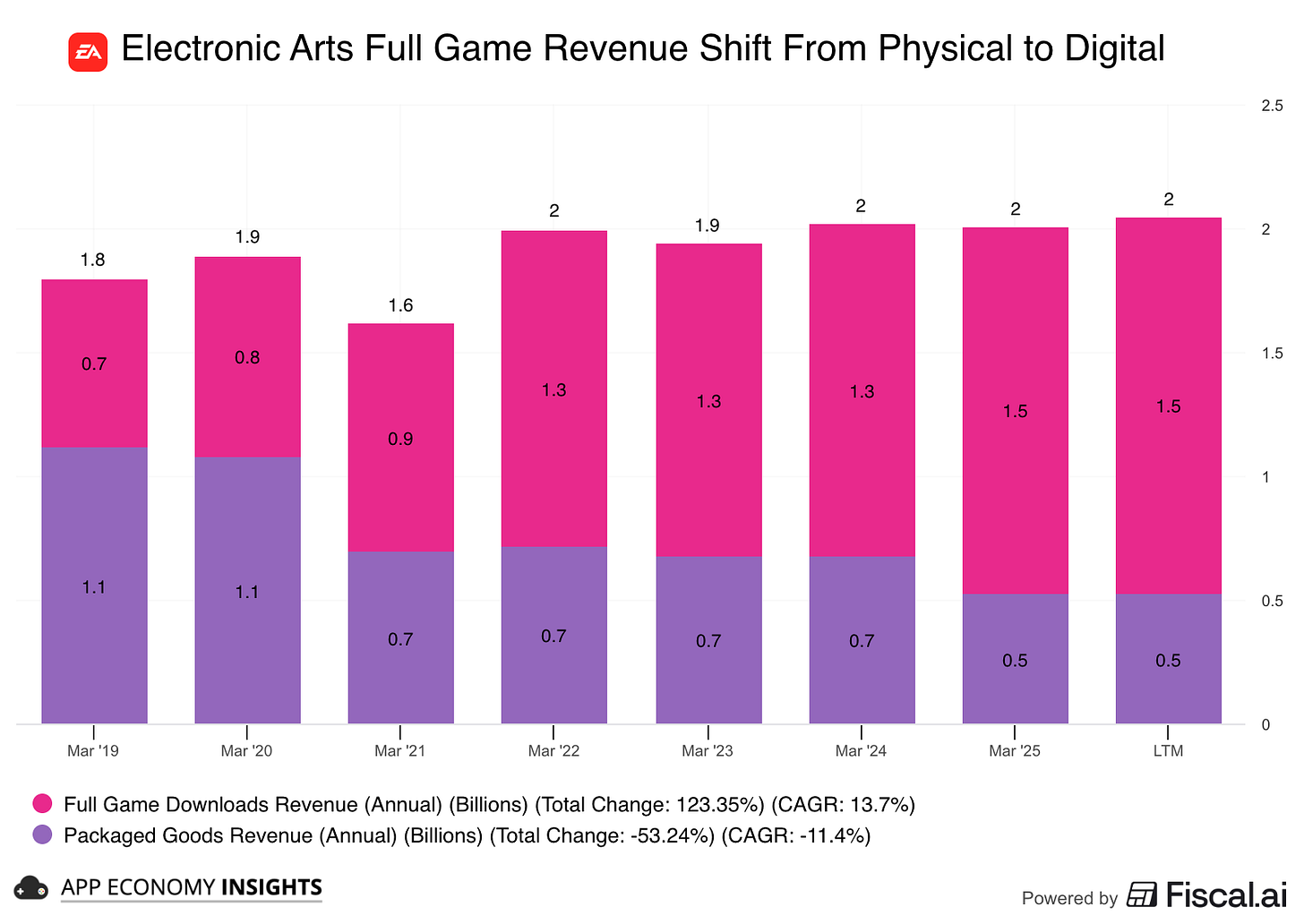

Physical → digital is basically done: The secular shift lifted mix, raised margin (no discs, no retail cuts), and increased the surface area for recurrent spend.

The shape of EA’s P&L

High gross margin: Digital delivery and live-ops content yield software-like gross margins. Platform fees and licensing are the big line items in cost of revenue.

Marketing is reasonable: Annual sports cycles and evergreen live services lower the need for blockbuster launch spend every year. Marketing scales with tentpoles rather than spiking unpredictably.

R&D is heavy by design: Ongoing engine work, live-ops tooling, annual sports updates, and large creative teams keep R&D as the biggest OpEx bucket. This is where cadence is funded.

Very profitable business: EA has maintained an operating margin above 20% in four of the past five fiscal years.

Why EA became an obvious target

Predictability: Seasonal sports franchises + evergreen live-ops = steady bookings. The other IPs, like Battlefield and The Sims, offer potential for recurring entries over longer cycles.

Strong free cash flow: The digital mix and live services translated into a ~25% free cash flow margin profile, which adds a margin of safety.

Where it’s fragile

License dependence: NFL, FC, F1. These games rely on sports franchises and likenesses, with royalty payments that involve lower margins. The loss of the FIFA partnership didn’t prove fatal, but it created an opening for new competitors to emerge.

Franchise concentration: Sports games and F2P title Apex Legends carry a lot. Because of this concentration, a single franchise misstep would be immediately and painfully visible in the booking trend.

3. The Arena

Where EA’s deal sits

Playbook contrast: Microsoft-Activision was a strategic consolidation (platform + IP + distribution). EA is a sponsor-led LBO math (leverage underwritten by predictable cash flows) with an operational focus rather than synergy headlines.

Why gaming fits LBOs now: Evergreen IP, live-ops monetization, subscriptions, and long tails dampen earnings volatility. That’s exactly what debt investors want.

Sovereign capital’s arc: PIF & Savvy Games Group have placed chips across the stack (publishers, esports, distribution). This bid extends that footprint and normalizes sovereign money in core gaming assets.

The deal’s fine print

Why this capital matters: Deep pockets mean EA can fund multi-year live-ops and big bets without quarterly whiplash. That aligns with an LBO built on recurring bookings.

Liquidity & re-listing path: If Silver Lake re-lists down the road, today’s structure could morph into a more “traditional” exit later. That’s useful context for timelines.

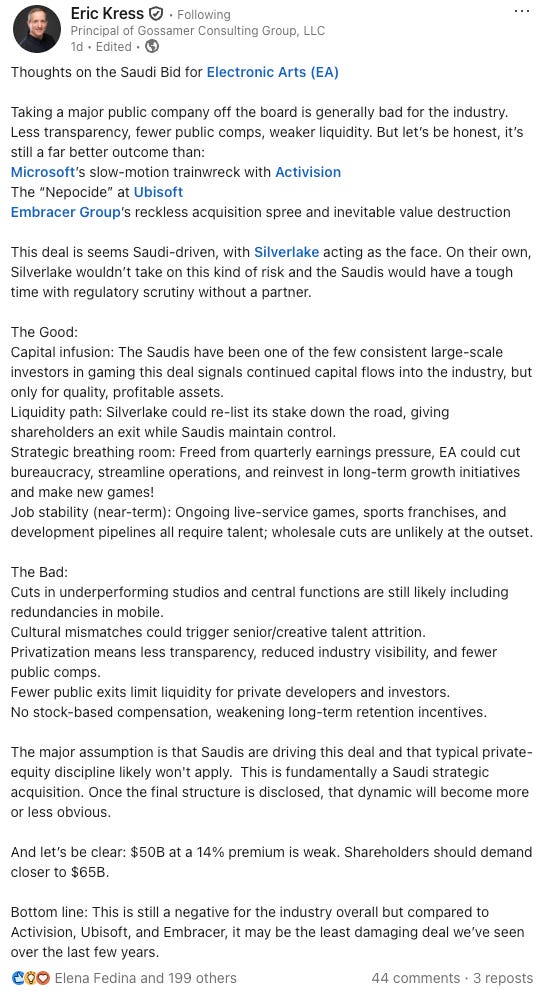

Premium debate: A ~25% premium, as seen in this deal, can look “light” for trophy assets. Sponsors would argue that the currency is certainty and speed. But the real benefit for the company will be post-close investment pace in the roadmap, not the headline premium.

An outside perspective

Below is a post from Eric Kress (Gossamer Consulting) that neatly frames why a take-private can be both a relief and a risk for the industry. I’m sharing it because it surfaces trade-offs across capital, cadence, and transparency, and it contrasts this deal with other recent outcomes

Activision: sold to a platform owner.

Ubisoft: independence reinforced by family/strategic holders.

Embracer: restructuring and portfolio pruning.

What to watch next in gaming

Follow-on LBOs: If debt markets stay open, expect more bids for IP-rich, live-ops-heavy assets and tooling companies. Big tech could also be on the case, and Take-Two has long been a rumored acquisition target as the largest independent US pure play, with GTA arguably the most valuable IP in the industry.

Sovereign money’s next moves: Where Gulf capital shows up next: Studios, sports-rights, or infrastructure. We previously discussed how Liberty Media was approached by the Saudi PIF for the F1 Group.

Regulatory stance: Outcomes of foreign-investment reviews will set the bar for future cross-border deals in gaming.

Licensing leverage: Leagues and major IP holders may seek longer terms and higher rev-shares as sponsors rely on their durability.

Platform economics: Any shift in storefront fees or promo rules at Sony/Microsoft/Steam changes third-party margins across the board.

Subscription pressure: Game Pass/PS Plus bundling is rising. Does it amplify live-ops attach or compress full-game ARPU industry-wide?

Deal supply: Restructurings (Embracer-style) feed assets into the market. Buyers will cherry-pick live-ops winners.

Exit lanes: Re-IPOs vs strategic sales, whichever reopens first, will shape sponsor behavior for the next few years.

Who’s next?

NetEase, Take-Two, Ubisoft, SEGA, Square Enix, Capcom, Nexon, CDProjekt, and Paradox are next in line from a scale standpoint.

What do you think? Hit reply or let me know in the comments!

That's it for today.

Happy investing!

Want to sponsor this newsletter? Get in touch here.

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Start an account for free and save 15% on paid plans with this link.

Disclosure: I own NTES in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members. The Starter Stocks for 2025-2026 just came out.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

To me, this is not a much a trouble,one or 2 few change in policy can wipe the whole investment off

It's a risk for Saudis as well

Aside from exposing the country to saudi nationals trooping, I don't really see a real threat yet

The white elephant in the room continues to be the long term implications of allowing the Saudis to sink their money into Western society and what kind of video games they won't allow to be made any longer that could have been allowed previously. When is the US government going to say enough is enough? They probably won't, unfortunately.