🎬 The Ellisons' Hollywood Endgame

One app to rule them all?

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

The Paramount deal was just the beginning

Last week, Oracle ripped and briefly crowned Larry Ellison the world’s richest.

Meanwhile, his son David Ellison’s Skydance Media recently closed the deal with Paramount, and the merged company now trades under the ticker PSKY (we broke down the economics of the deal here 👇).

Now Paramount-Skydance is reportedly prepping a majority-cash bid for all of Warner Bros. Discovery, backed by the Ellison family. As the saying goes, one big studio acquisition may hide another.

There’s no formal offer yet, but the leak alone sent WBD flying more than 50% and put Hollywood on alert. Can the Ellisons snag Warner’s crown jewels before anyone else makes a move?

Let’s unpack what’s rumored, why it might make sense, and the potential impact.

Today at a glance:

The bid

The math

The strategy

Sports & ads ripple

Regulatory & execution risks

Who wins & who loses

FROM OUR PARTNERS

Former Zillow exec opens door to $1.3T market

Austin Allison sold his first company for $120M. He later served as an executive for Zillow. But both companies reached massive valuations before regular people could invest.

“I always wished everyday investors could have shared in their early success,” Allison later said. So he built Pacaso differently.

Pacaso brings co-ownership to the $1.3T vacation home market, earning $110M+ in gross profit in under 5 years. No wonder the same early investors who backed Uber, Venmo, and eBay already invested in Pacaso.

They even reserved the Nasdaq ticker PCSO. Now, after adding 10 new international destinations, Pacaso is hitting their stride.

And unlike his previous stops, you can invest in Pacaso as a private company. But you don’t have time to waste.

Invest before Pacaso’s opportunity ends Thursday night.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

1. The bid

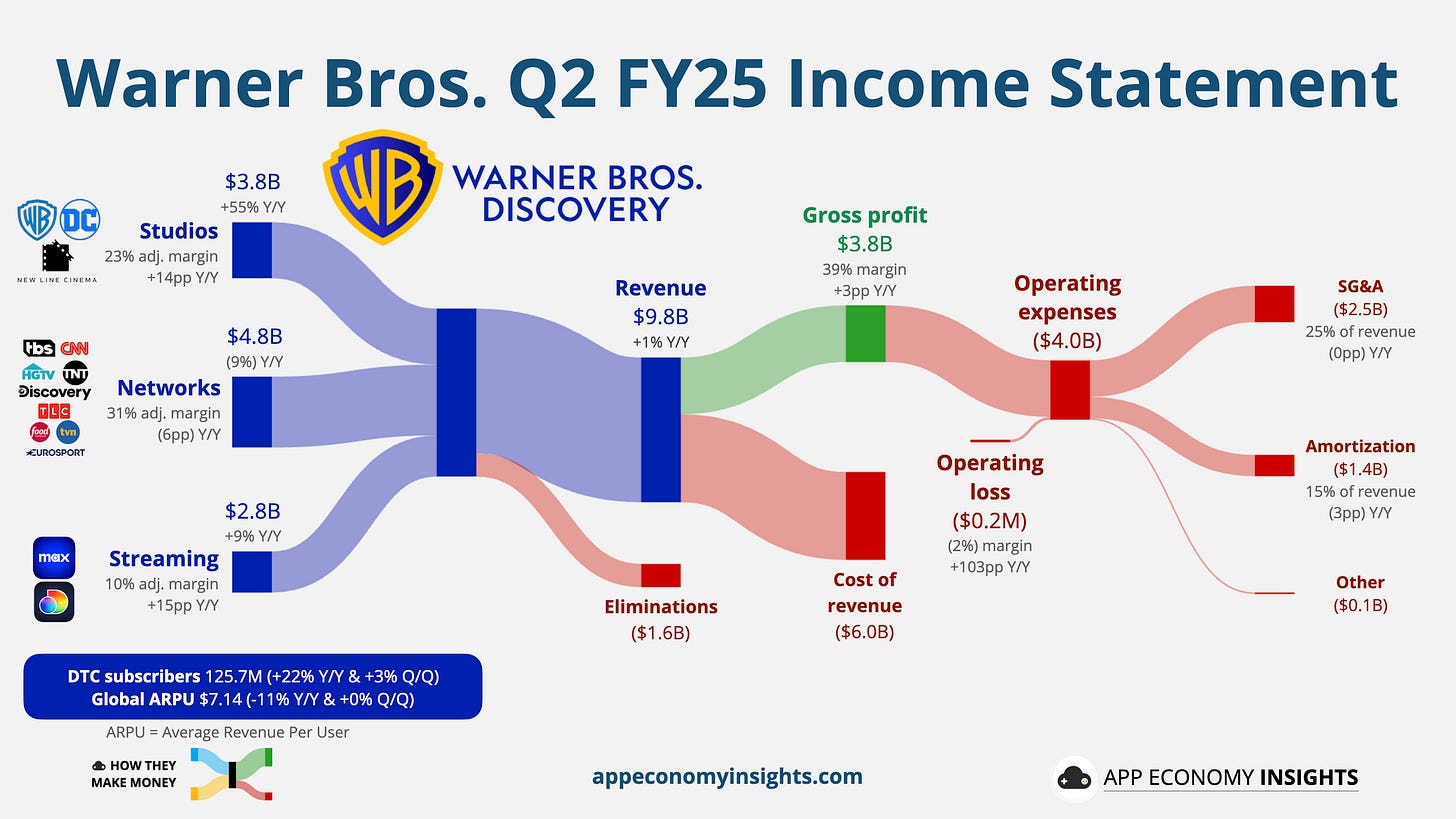

The take-all bid: It’s a take-all swing at Warner Bros. Discovery. The deal involves the entire company: Studios, streaming, and the declining cable networks. In other words, they want to buy the whole house before a split can set separate prices.

Why now: Warner has been laying the groundwork to separate the business:

Streaming/Studios on one side (HBO Max, Warner Bros., DC).

Networks on the other (CNN, TNT/TBS, international cable).

A take-all approach jumps the line. Paramount’s goal could be to buy the valuable IPs before a split can set market prices for the parts or invite multiple bidders to cherry-pick assets.

What it actually means: A majority-cash deal means real money on the table, not a stock swap. The Wall Street Journal says the offer would be backed by the Ellison family, then rounded out with partner equity and financed debt. Cash-forward signals conviction and could appeal to WBD holders who might discount someone else’s stock.

The missing pieces: There’s no formal bid before the board, no price or binding terms disclosed, and no public financing packet detailing banks, partners, or covenants.

2. The math

A cash-heavy, take-all bid only works if three things line up: the money, the leverage, and the operating economics that turn into free cash flow.

The money

The Ellison family’s wealth is estimated at nearly $400 billion (primarily tied to Oracle ownership), and financing could fill any gap. We would likely be looking at a large premium to WBD holders, combined with a refinanced debt, fees, and integration with Paramount-Skydance. The market is already reflecting this in WBD shares with a high level of confidence.

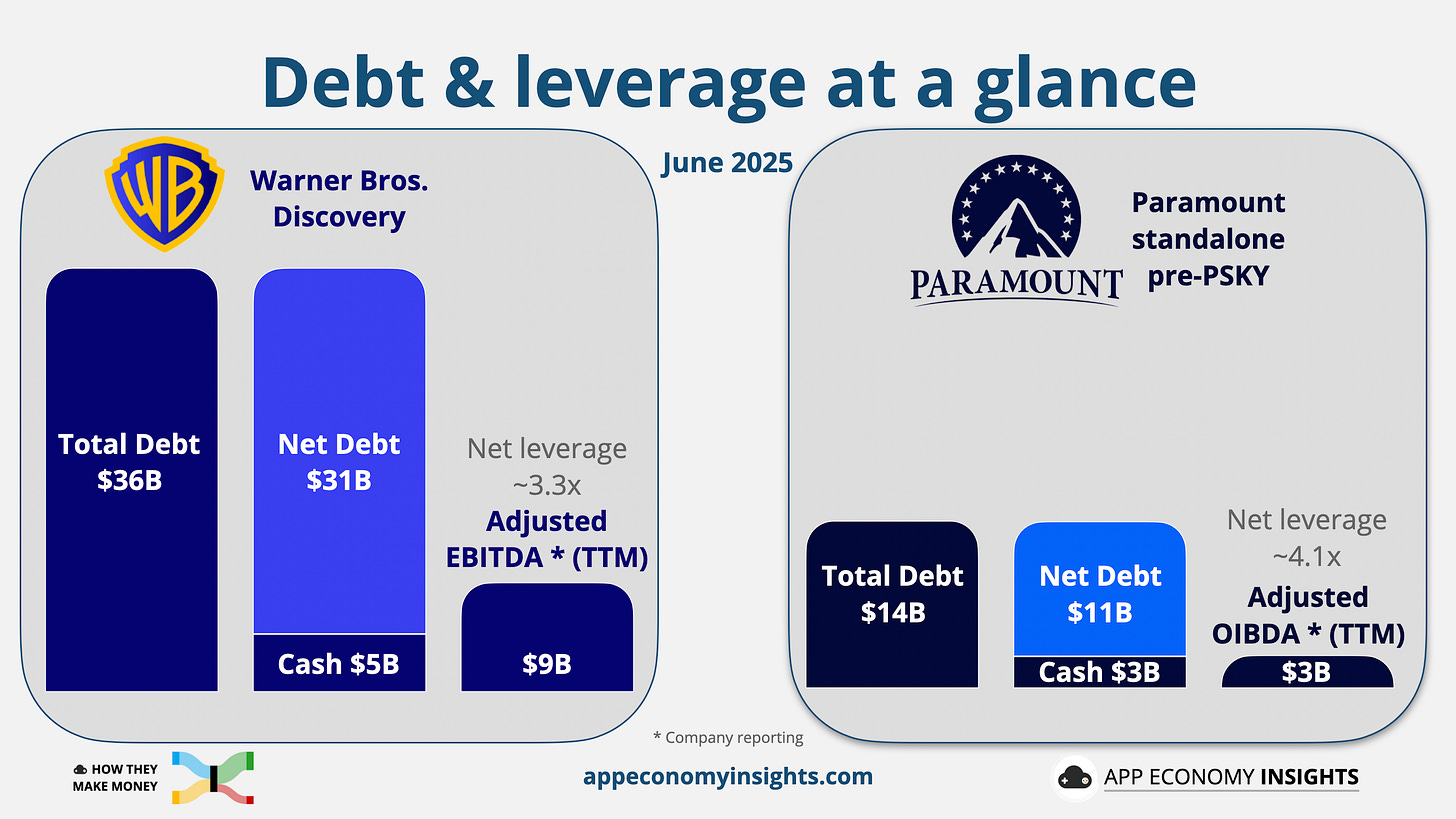

The leverage

As of June 30, 2025. Warner Bros. Discovery carries roughly $31 billion in net debt (gross debt minus cash), about 3.3× net leverage (net debt divided by trailing EBITDA, a shorthand for balance sheet risk). In a take-all deal, a buyer inherits that stack and adds new borrowings to fund the cash piece. The post-close job is to grow EBITDA and use free cash flow (and any asset sale) to push leverage down each year.

The operating economics

Where savings will come from: Management would likely retire duplicate platforms and tools, consolidate marketing and distribution spend, and look for standard G&A efficiencies. Revenue lift from ARPU, ad yield, or wholesale reach would come as an upside.

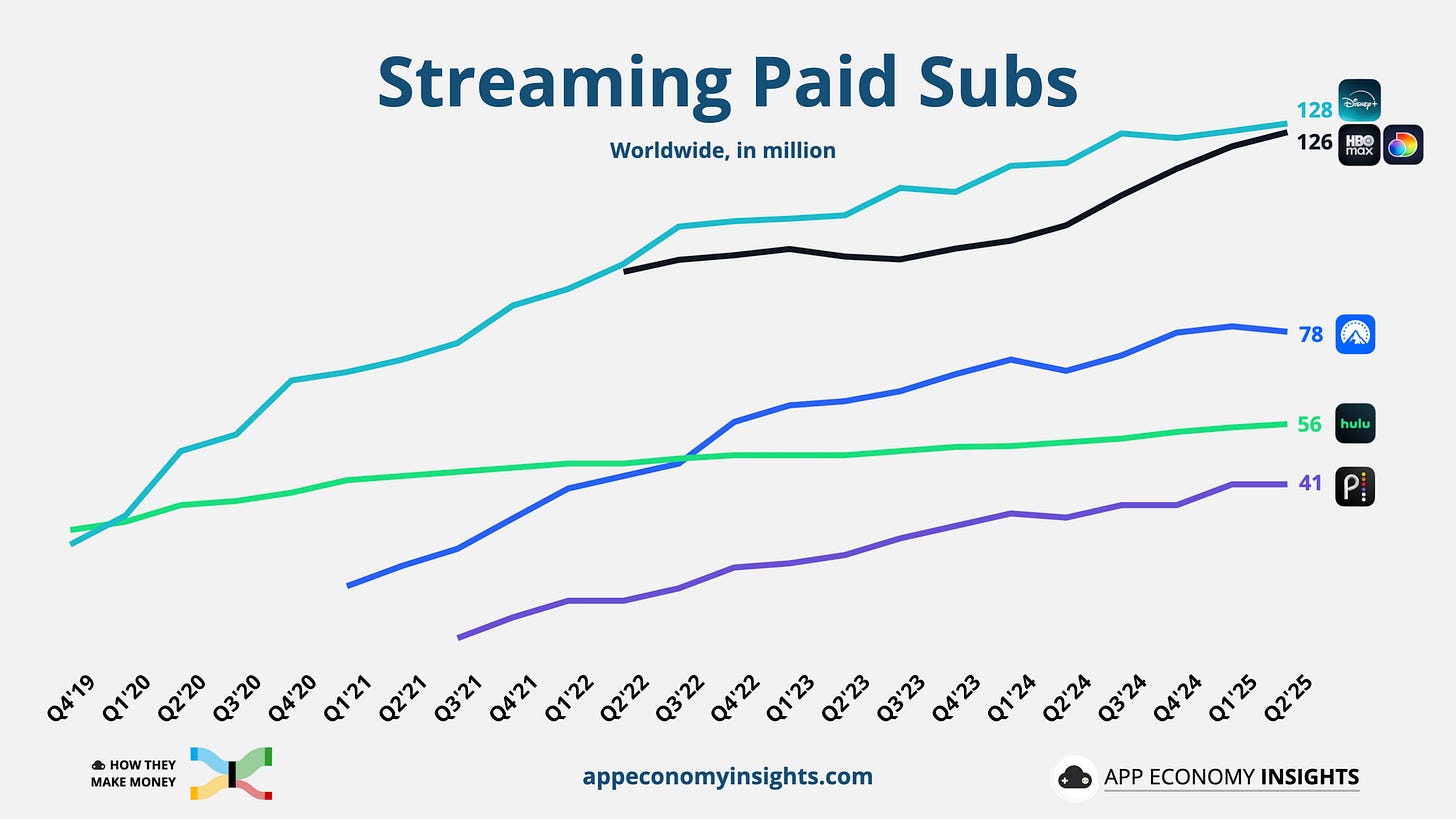

Why scale is the key: A larger library inside one experience tends to raise hours per sub and ad impressions, support pricing power, and reduce churn. All these small moves can compound at scale. At the end of June, Paramount+ counted 78 million paid subscribers, and HBO Max had 126 million. Combining these two would immediately leapfrog the Disney bundle and be only second to Netflix.

The ultimate test: Free cash flow improvement. After cash content spend and capex, can a merged entertainment giant bring net debt down each year while covering the interest bill? Easier said than done, given that a large portion of the business is in a secular decline.

What investors will want to see: Clear, long-term goals for the streaming business, including targets for:

Subscribers and churn.

Average Revenue Per User (ARPU).

Engagement metrics (hours engaged, ads per hour, and so on).

3. The strategy

This type of merger only works if the product gets simpler, the slate gets louder, and the ad machine gets smarter.

At its core, the thesis is scale combined with simplification that turns viewing time into higher ARPU and lower churn. Here’s how to assess it.