📊 PRO: This Week in Visuals

ADBE SNPS RBRK CHWY GME

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🎨 Adobe: AI Acceleration

🧠 Synopsys: China Headwinds

🔷 Rubrik: Fusing AI with Cyber Resilience

🐶 Chewy: Autoship Flywheel

🎮 GameStop: Profitable Surprise

FROM OUR PARTNERS

Keep This Stock on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

Created by a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profits in less than 5 years.

No surprise the same firms that backed Uber and Venmo already invested in Pacaso. But you don’t have to be a Wall Street firm to invest. Pacaso is giving the same opportunity to everyday investors, and 10,000+ people have already joined them.

And you can join them today for just $2.90/share. But don’t wait too long.

Invest in Pacaso before the opportunity ends September 18.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

1. 🎨 Adobe: AI Acceleration

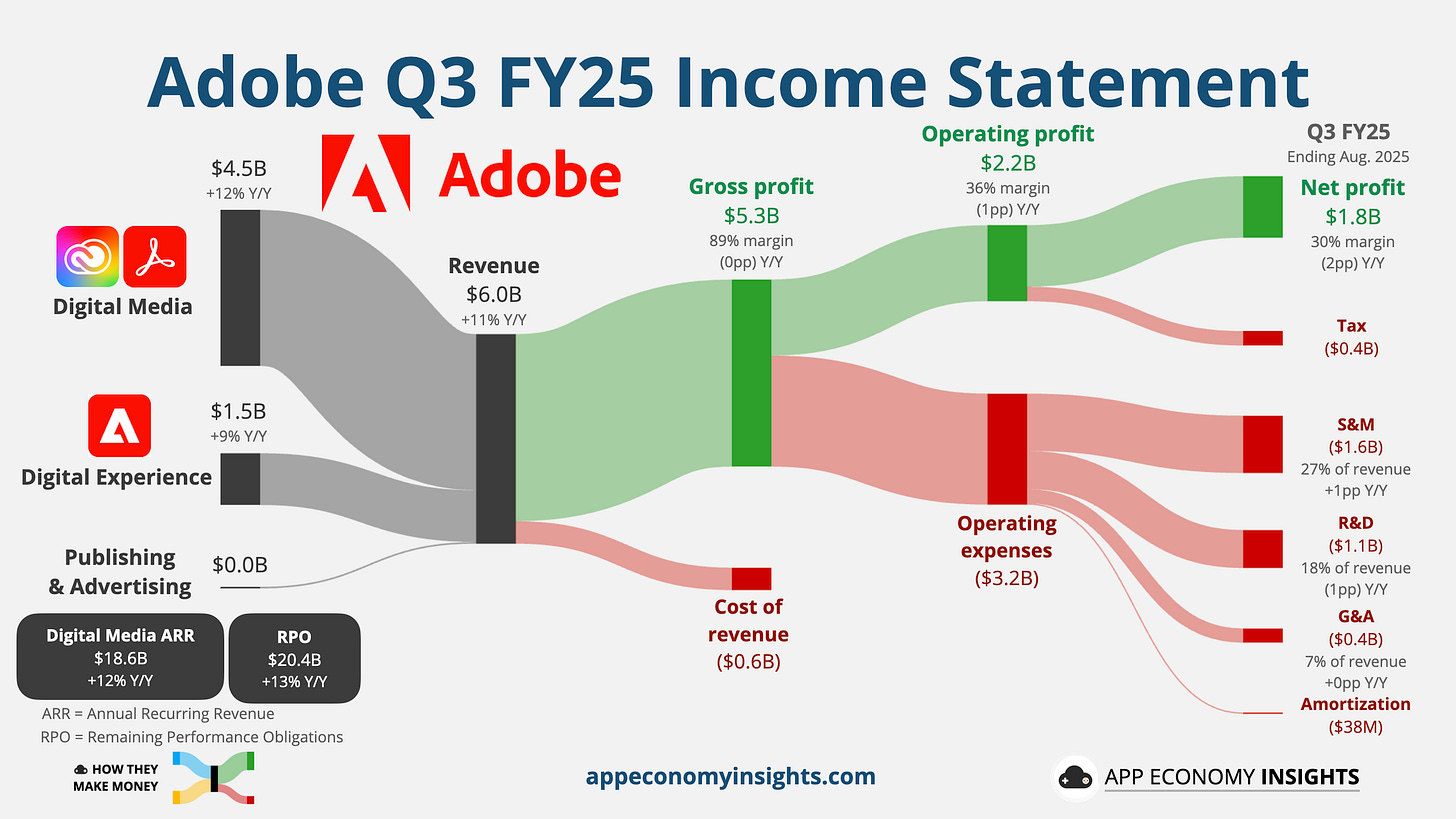

Adobe's Q3 revenue grew 11% Y/Y to $6.0 billion ($80 million beat) while adjusted EPS landed at $5.31 ($0.13 beat), as the company delivered a rebuttal to doubts about its AI strategy.

Management raised its full-year revenue outlook by more than $100 million for the second consecutive quarter to ~$23.7 billion at the midpoint. RPO (future revenue already under contract) accelerated to 13% Y/Y (from 10% Y/Y in Q2), reaching $20.4 billion, with 67% to convert in the next 12 months. The core Digital Media segment grew 12% to $4.5 billion, while Digital Experience rose 9% to $1.5 billion.

The standout story was the tangible progress in AI monetization.

CEO Shantanu Narayen announced that “AI-influenced” ARR has now surpassed $5 billion, which is a nice soundbite, but also a bit of a stretch. More concretely, Adobe has already exceeded its full-year target for "AI-first" ARR, surpassing the $250 million goal a quarter early.

While competition from AI-native startups remains a critical threat (Canva, Figma, Midjourney, Runway, and more), this quarter’s concrete AI metrics and accelerating RPO growth provided powerful evidence that Adobe is successfully monetizing AI to accelerate revenue growth. In a notable shift from previous quarters, the results and guidance sent shares higher, suggesting that Adobe is beginning to win back investor confidence in its ability to not just defend, but expand its creative moat.

2. 🧠 Synopsys: China Headwinds

Synopsys stumbled in Q3, reporting revenue of $1.7 billion ($30 million miss) and adjusted EPS of $3.39 (a significant $0.36 miss), as geopolitical risks flagged in prior quarters materialized.

The core Design Automation business remained strong, growing 23% to $1.3 billion, driven by continued demand for AI chip design. However, this was overshadowed by a severe downturn in the Design IP segment, where revenue fell 8% Y/Y, missing estimates by over $120 million.

Management attributed the IP shortfall to a trifecta of issues: new US export restrictions disrupting business in China, challenges at a major foundry customer, and internal missteps on product roadmaps.

In response to the headwinds, Synopsys issued a disappointing Q4 profit forecast, slashed its full-year EPS guidance, and announced plans to reduce its global headcount by 10%. The quarter marks a sharp reversal, where the China risk is no longer a looming threat but a direct hit to a key business segment, forcing the company into a significant strategic pivot and restructuring despite ongoing strength in its core Electronic Design Automation (EDA) tools.

The quarter was also marked by the closing of the transformational Ansys acquisition, but it closed too late (July 17) to have a material impact on revenue.

3. 🔷 Rubrik: Fusing AI with Cyber Resilience

Rubrik continued its strong momentum in Q2, posting 51% Y/Y revenue growth to $310 million ($28 million beat) and a near-breakeven adjusted loss of $0.03 per share, smashing estimates by $0.31.

Wall Street was not impressed, with shares falling nearly 20% after the print. So, what happened here?