🏥 The Biggest IPO Since 2021

Medline (MDLN) S-1 Teardown

Welcome to the Premium edition of How They Make Money.

Over 250,000 subscribers turn to us for business and investment insights.

In case you missed it:

Medline (MDLN) is going public this week

While tech investors have been glued to AI listings, the largest deal of 2025 comes from a very different sector: Healthcare Supply.

Medline is the plumbing of the US healthcare system. If you’ve ever been to a hospital, you’ve used their products, from surgical gowns and exam gloves to anesthesia kits and wheelchairs.

In 2021, Medline was taken private in a massive $34 billion leveraged buyout (LBO) by Blackstone, Carlyle, and Hellman & Friedman. It was one of the largest LBOs since the 2008 financial crisis. Now, just four years later, the private equity giants are bringing it back to the Nasdaq.

Medline is targeting a $55 billion valuation, making it the largest IPO since 2021.

I went through the 300+ pages of Medline’s S-1 so you don’t have to.

Today at a glance:

Overview

Business Model

Financial highlights

Risks & Challenges

Management

Use of Proceeds

Future Outlook

Personal Take

1. Overview

Medline has been the largest privately held manufacturer and distributor of medical supplies in the United States.

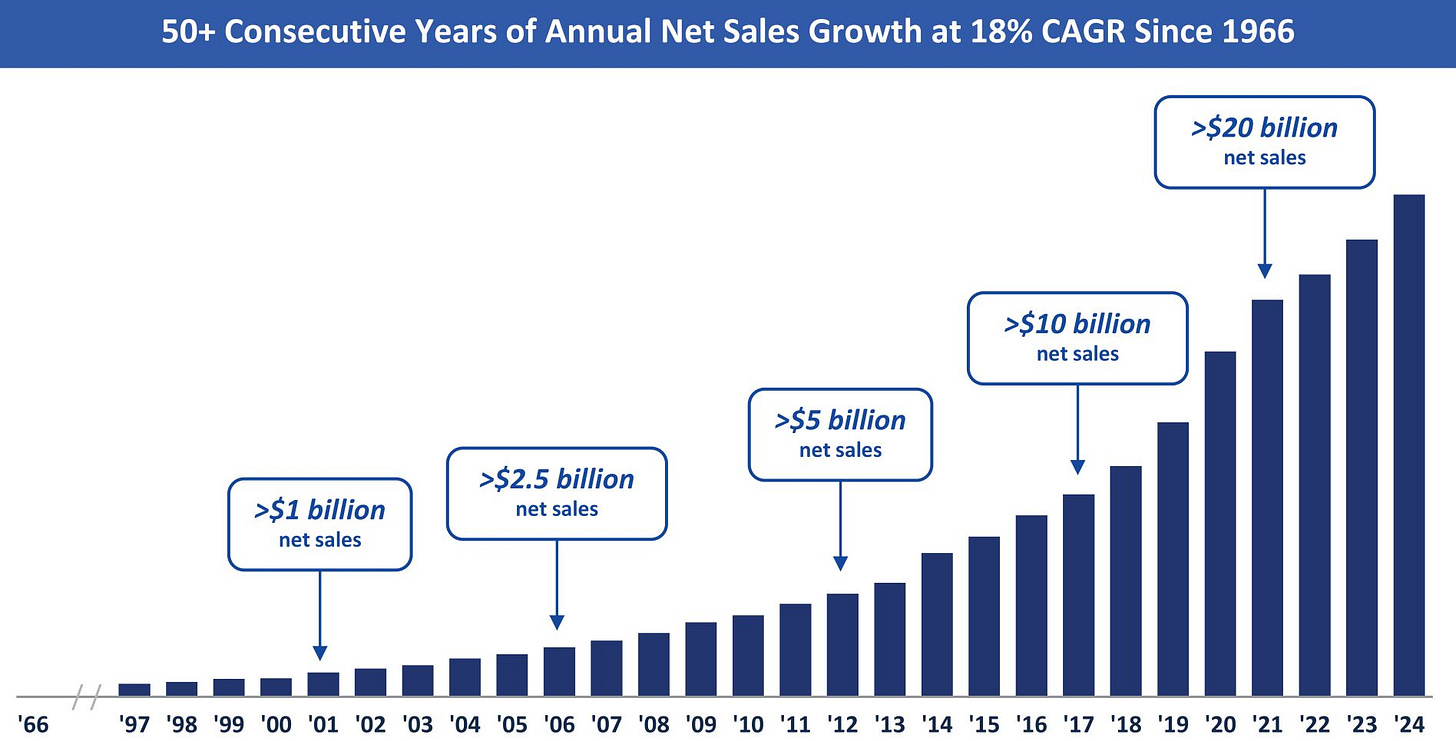

Founded in 1966 by the Mills family, the company traces its roots to 1910, when A.L. Mills began making butcher aprons for the Chicago stockyards. He soon realized that surgeons needed aprons too, and a healthcare dynasty was born.

For decades, Medline operated as a family business, compounding quietly. Today, it serves the entire continuum of care: hospitals, surgery centers, nursing homes, and physician offices.

Headquarters: Northfield, Illinois.

Mission: To make healthcare run better.

Ticker: MDLN (Nasdaq).

The “One-Stop Shop”

Let’s capture Medline’s scale in a few key numbers:

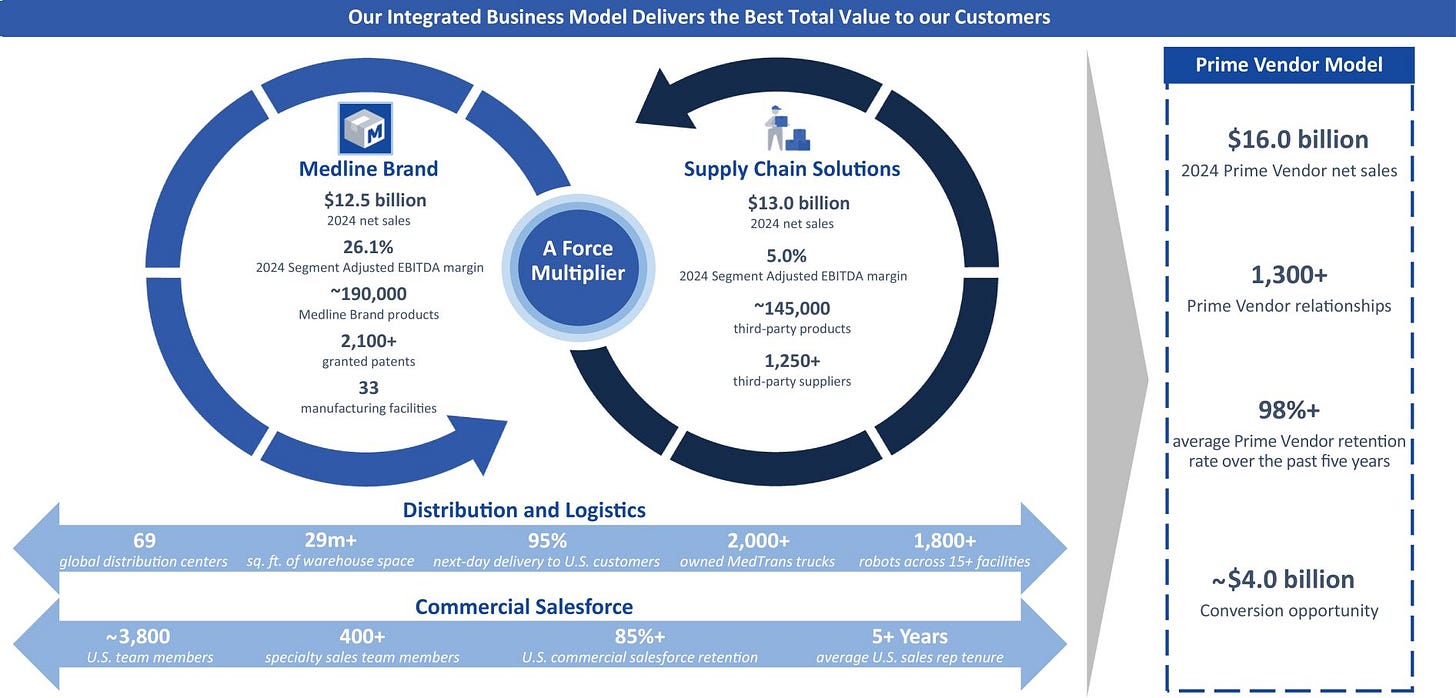

335,000+ products in their catalog.

69 distribution centers globally.

2,000+ trucks in their own fleet (”MedTrans”).

Next-day delivery to 95% of the US population.

The 2021 LBO Context

Why are we seeing an IPO now? In 2021, the Mills family sold a majority stake to private equity giants.

The goal was to accelerate global expansion and invest in infrastructure without the quarterly pressure of public markets. Now, these PE firms are looking for an exit (or at least liquidity), and the S-1 shows that their bet has paid off: Medline has grown revenue by roughly $5 billion since the buyout.

2. Business Model

Medline operates a vertically integrated model that blends Manufacturing and Distribution.

Most competitors do one or the other.

Manufacturers: Front line care and surgical solutions providers like 3M and Becton Dickinson make the products. It’s high-margin, but they lack the direct logistics relationship.

Distributors: Supply chain solutions providers such as McKesson and Cardinal Health move boxes. It’s a low-margin, high-volume game.

Medline does both. They use their distribution network to get in the door with hospitals, then upsell them on their own high-margin private-label products.

They report in two main segments:

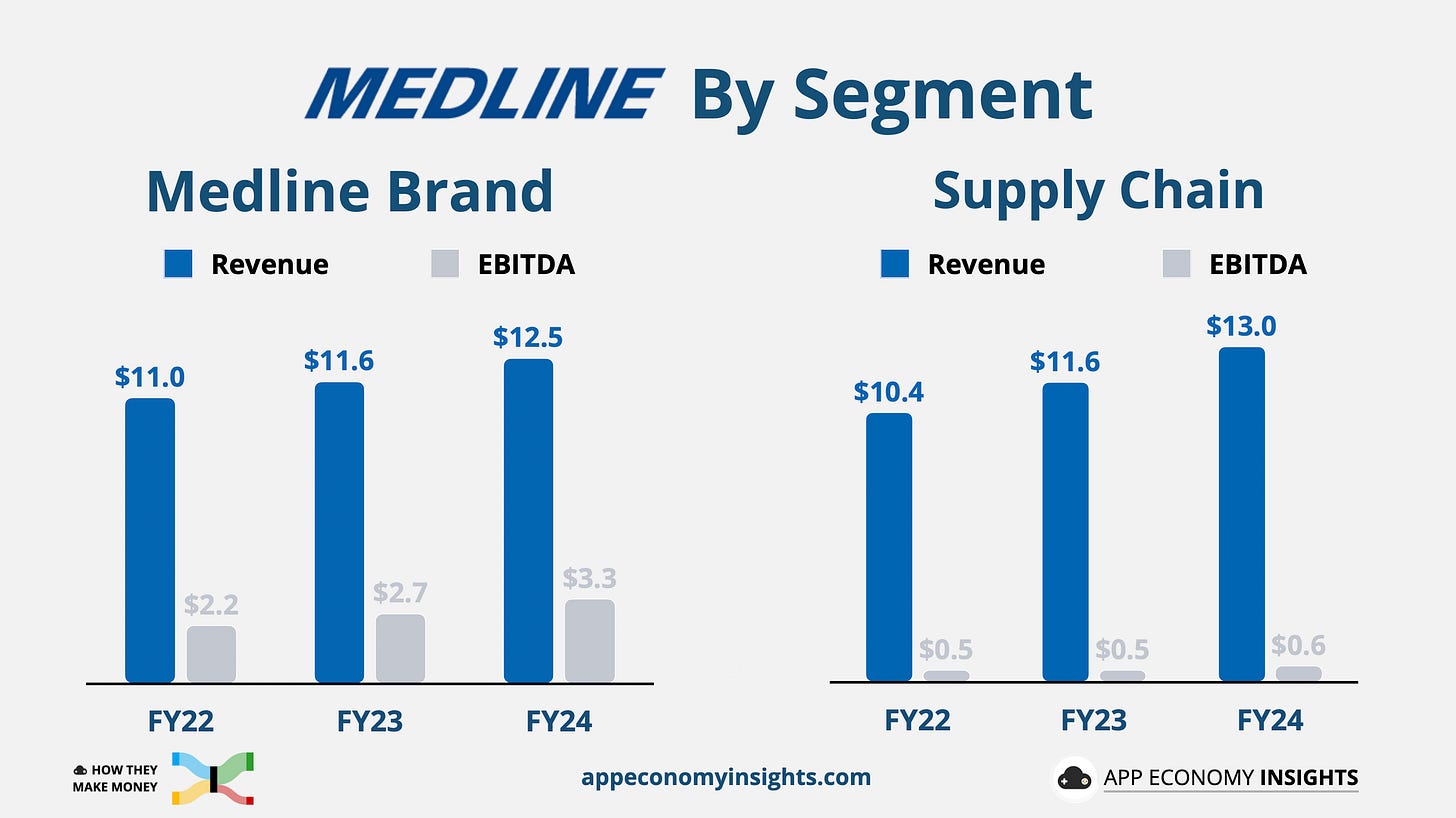

🏥 1. Medline Brand (~49% of Sales)

This is the profit engine. It includes products manufactured or sourced by Medline (surgical kits, PPE, sterile drapes).

Economics: While this is half of the revenue, it generates 84% of the EBITDA, thanks to a 27% adjusted margin.

Why it matters: By owning the manufacturing, Medline captures the margin that usually goes to third-party suppliers.

🚚 2. Supply Chain Solutions (~51% of Sales)

This is the logistics arm. They distribute products from other manufacturers alongside their own.

Economics: This generates only 16% of the EBITDA, with a much lower 5% adjusted margin.

Why it matters: It makes them a one-stop shop. Hospitals sign Prime Vendor contracts, designating Medline as their primary supplier.

The Flywheel

The business thrives on a simple but powerful cycle of land and expand:

Land: A hospital signs a Prime Vendor deal for logistics efficiency.

Audit: Medline analyzes the hospital’s total spend.

Expand: The company proves it can lower costs by swapping out third-party supplies for Medline Brand alternatives (standardization).

Win-Win: The hospital cuts costs, while Medline earns higher margins.

This lock-in is incredible. Medline reports a 98% retention rate for its Prime Vendor customers over the last 5 years. Medline Brand conversion steadily increases over the tenure of a contract.

3. Financial Highlights

Let’s turn to the financials and where the money flows.