☁️ Oracle is Bleeding Cash

Plus: A look at Wealthfront's IPO

Welcome to the Free edition of How They Make Money.

Over 250,000 subscribers turn to us for business and investment insights.

In case you missed it:

Oracle is bleeding cash and must prove it can execute

Despite another jaw-dropping surge in future contracts, Oracle shares slumped 11% following its quarterly report. With this latest drop, shares are now over 40% below their September peak.

Why? The company is betting the farm on building the AI infrastructure of the future. The backlog is surging, but so is the bill to build it.

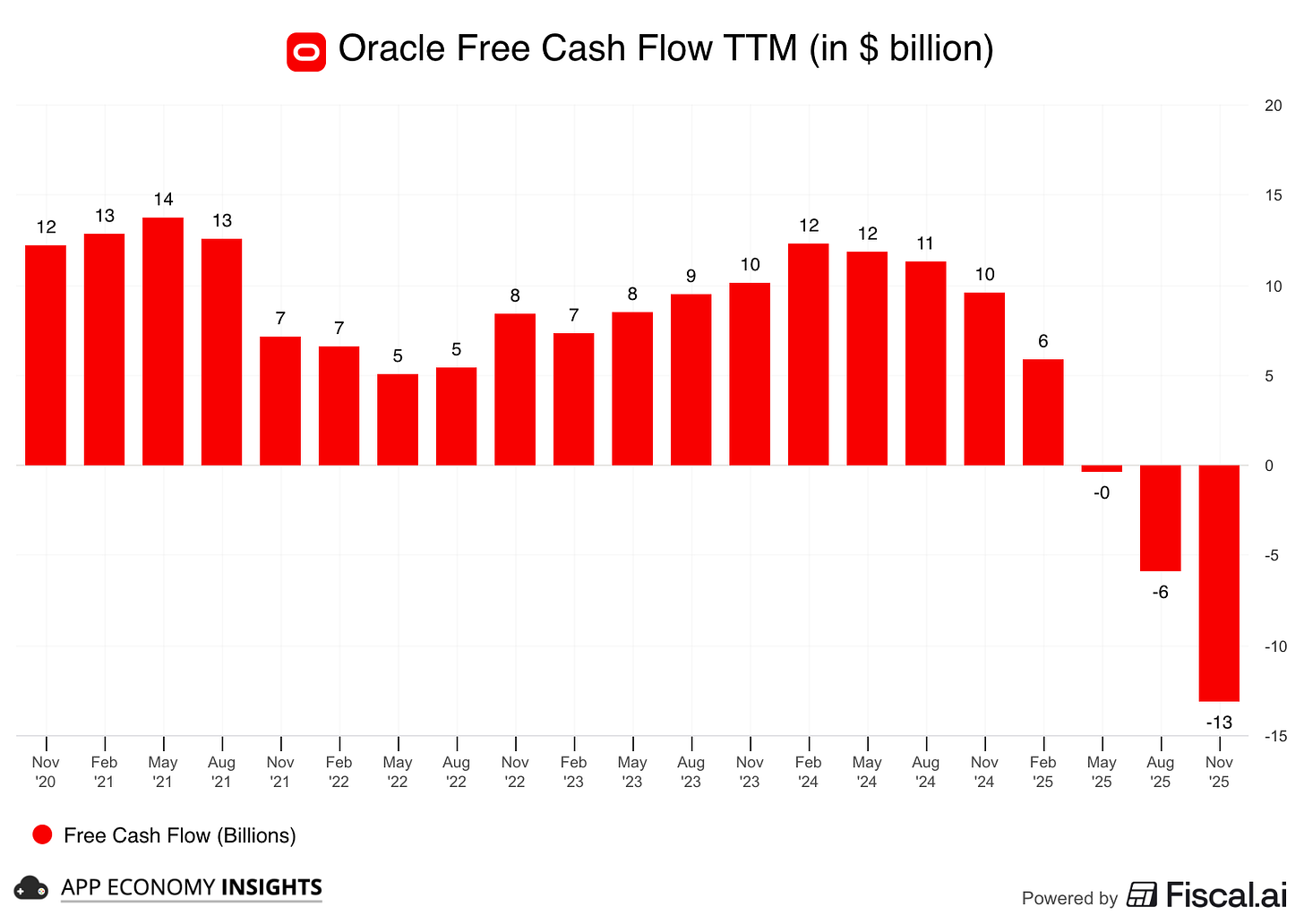

Oracle just raised its FY26 CapEx forecast by $15 billion to $50 billion, fueling fears about debt and cash burn. Free cash flow declined to negative $13 billion over the past 12 months (negative $10 billion in the last quarter alone).

Meanwhile, actual revenue missed estimates slightly, reminding investors that signing a contract is easier than powering up a data center.

Let’s review the numbers behind the sell-off and the continued AI hypergrowth.

Today at a glance:

Oracle has something to prove

Robo-Advisor Wealthfront Goes Public

1. Oracle has something to prove

Q2 FY26 key metrics:

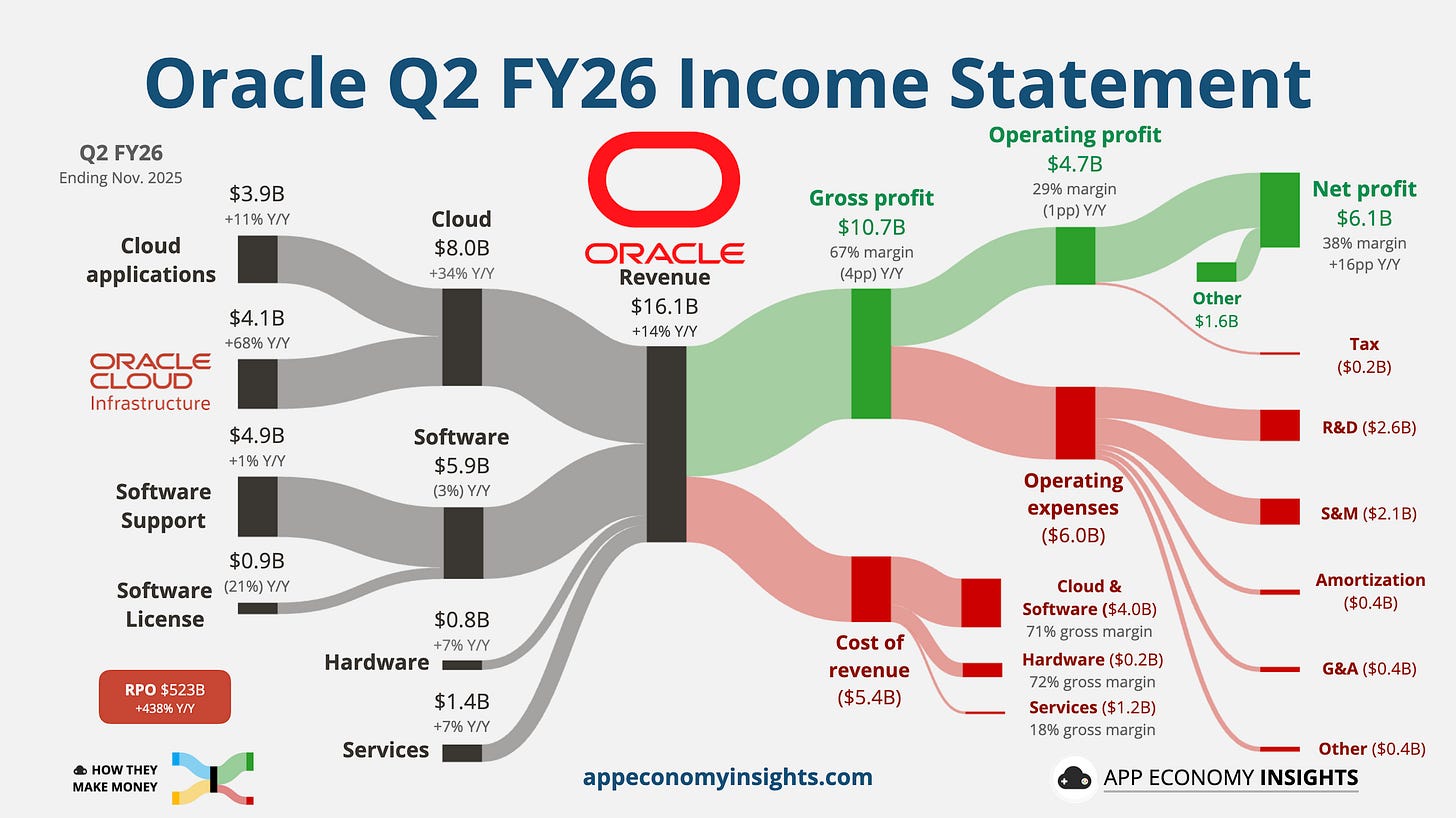

RPO surged 15% sequentially: After last quarter’s shocker, RPO (future revenue from existing contracts) grew another $68 billion in Q2 to $523 billion (+438% Y/Y). To put this in perspective, that is roughly 8x Oracle’s annual revenue. It gives tremendous visibility for the business, provided customers can pay, and Oracle can execute.

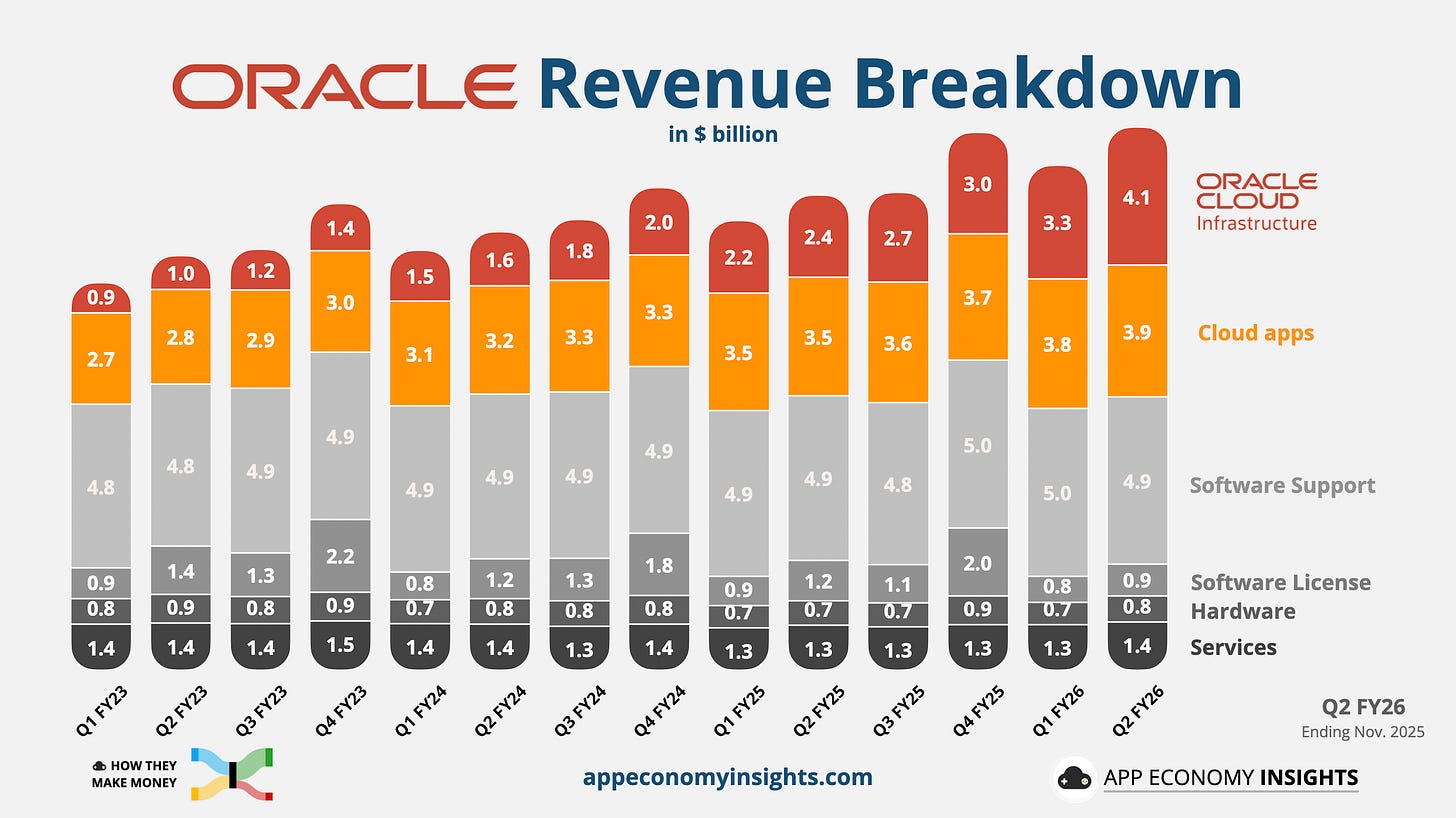

IaaS is going vertical: Oracle Cloud Infrastructure (OCI) revenue growth accelerated to 68% Y/Y (up from 55% in Q1 and 49% in Q4). This confirms that Oracle is capturing significant AI training demand, limited only by how quickly it can deploy GPUs and power.

The Ampere boost: Non-GAAP EPS beat expectations handily ($2.26 vs. ~$1.63 expected), but this included a $2.7 billion gain from selling a stake in chipmaker Ampere (buried in “other” in the top right of the visual below). Without this one-time windfall, the beat would actually be a large miss, which likely contributed to the market’s skepticism.

Income statement:

Revenue grew +14% year-over-year to $16.1 billion ($130 million miss).

☁️ Cloud grew +34% Y/Y to $8.0 billion.

🌐 Software declined 3% Y/Y to $5.9 billion.

🖥️ Hardware grew 7% Y/Y to $0.8 billion.

💼 Services grew 7% Y/Y to $1.4 billion.

The shift to IaaS compressed gross margins to 67% (-4pp Y/Y).

Operating margin was 29% (-1pp Y/Y).

Cash flow:

Operating cash flow TTM was up 10% to $22.3 billion.

Free cash flow TTM was negative $13.2 billion and remains under immense pressure due to the CapEx ramp.

The CapEx shock: Management raised the FY26 capital expenditure outlook to $50 billion. That is a $15 billion increase from the previous guide. Oracle is now spending on infrastructure at a scale rivaling the top hyperscalers (Amazon, Microsoft, Google).

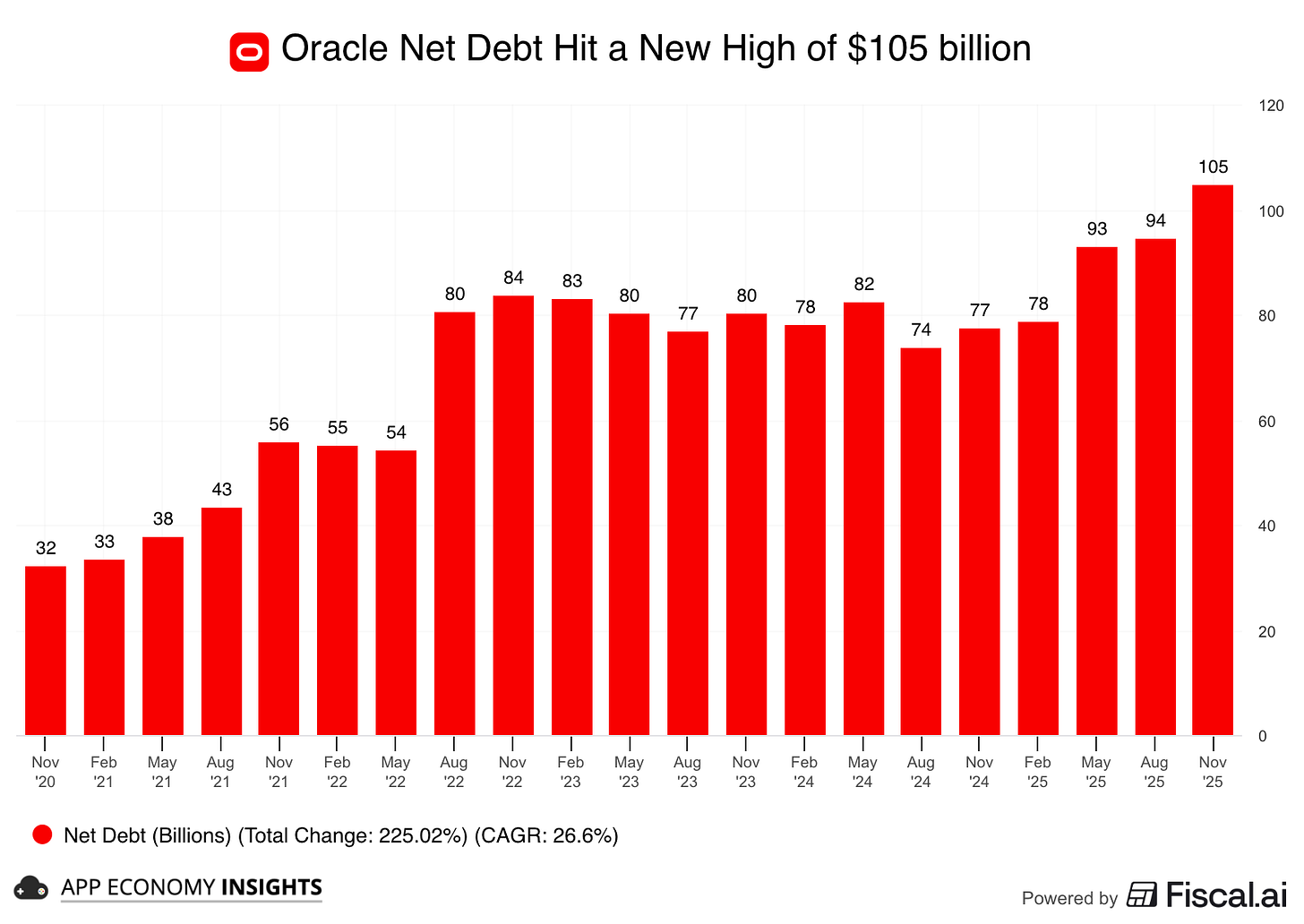

Balance sheet:

Net debt: $105 billion (roughly 4x net leverage based on $26 billion EBITDA TTM).

So what to make of all this?

📦 Backlog is real, but timing is everything: RPO of $523 billion is an astronomical number. But Project Stargate (the OpenAI mega-deal) and others won’t turn into cash until the data centers are built. Sequential RPO growth indicates demand is not slowing.

⚡ The CapEx gamble: Larry Ellison is essentially saying, “The demand is so guaranteed, we will spend whatever it takes.” Management hinted at potential relief valves, such as leasing chips or allowing customers to bring their own, to reduce the capital burden. If the AI cycle turns, Oracle is left with massive debt and empty server racks. If it holds, they become the 4th hyperscaler.

☁️ Acceleration continues: The most bullish signal is OCI accelerating to 68% growth. This is the core thesis. Oracle is growing its cloud infrastructure faster than AWS, Azure, or Google Cloud (on a smaller base), demonstrating that its GPU Supercluster architecture is gaining share.

🏗️ Construction risk: Revenue missed slightly because you can’t bill for a data center that isn’t finished. The bottleneck has shifted from selling to building. Management cited power availability and construction timelines as the governors on growth.

📉 Quality of earnings: The stock drop reflects a sober look at the bottom line. Combined with a debt-fueled spending spree, Wall Street is demanding near-term execution over long-term promises.

What to watch moving forward

Burn rate: Can Oracle fund $50 billion in CapEx without putting its dividend or credit rating at risk? Management avoided answering exactly how much capital they need to raise, so watch closely for debt issuance or even equity dilution.

Conversion speed: How fast does that $523 billion RPO turn into OCI revenue? We need to see IaaS revenue accelerate toward the $5-6 billion quarterly run rate to justify the spend.

Software drag: While IaaS rockets, the traditional business (License/Support/SaaS) is flat to down. Oracle needs the old business to keep printing cash to fund the new business. If the legacy business erodes too fast, the math gets harder.

Takeaway: The narrative is intact, but the price of admission keeps going up. Oracle is growing faster than ever in the cloud, but it is now leveraged to the hilt on the AI boom. It’s a high-risk, high-reward transition.

📊 Want to see how AMD and NVIDIA recently performed? Check out our latest monthly Earnings Visuals report.

🤖 Robo-Advisor Wealthfront Goes Public

Three years ago, Wealthfront was supposed to disappear. The original robo-advisor had agreed to be acquired by UBS for $1.4 billion, acknowledging that the path to independence was too steep.

But after the deal collapsed in 2022, Wealthfront pivoted.

Today, the company is going public with an IPO targeting a $2 billion valuation under the ticker WLTH. By walking away from the acquisition and betting on itself, the company has effectively created ~$600 million in shareholder value during a brutal fintech winter.

For years, Wealthfront was known as the pioneer of automated investing, collecting a modest 0.25% fee to manage your ETF portfolio. But if you look under the hood of their S-1, you’ll find a very different business model driving the returns today.

How did they pull it off? They stopped being just an investment manager and started acting like a bank.

📊 How Wealthfront Makes Money

The narrative used to be about “assets under management” (AUM) and advisory fees. While those are still growing, they are no longer the main event.

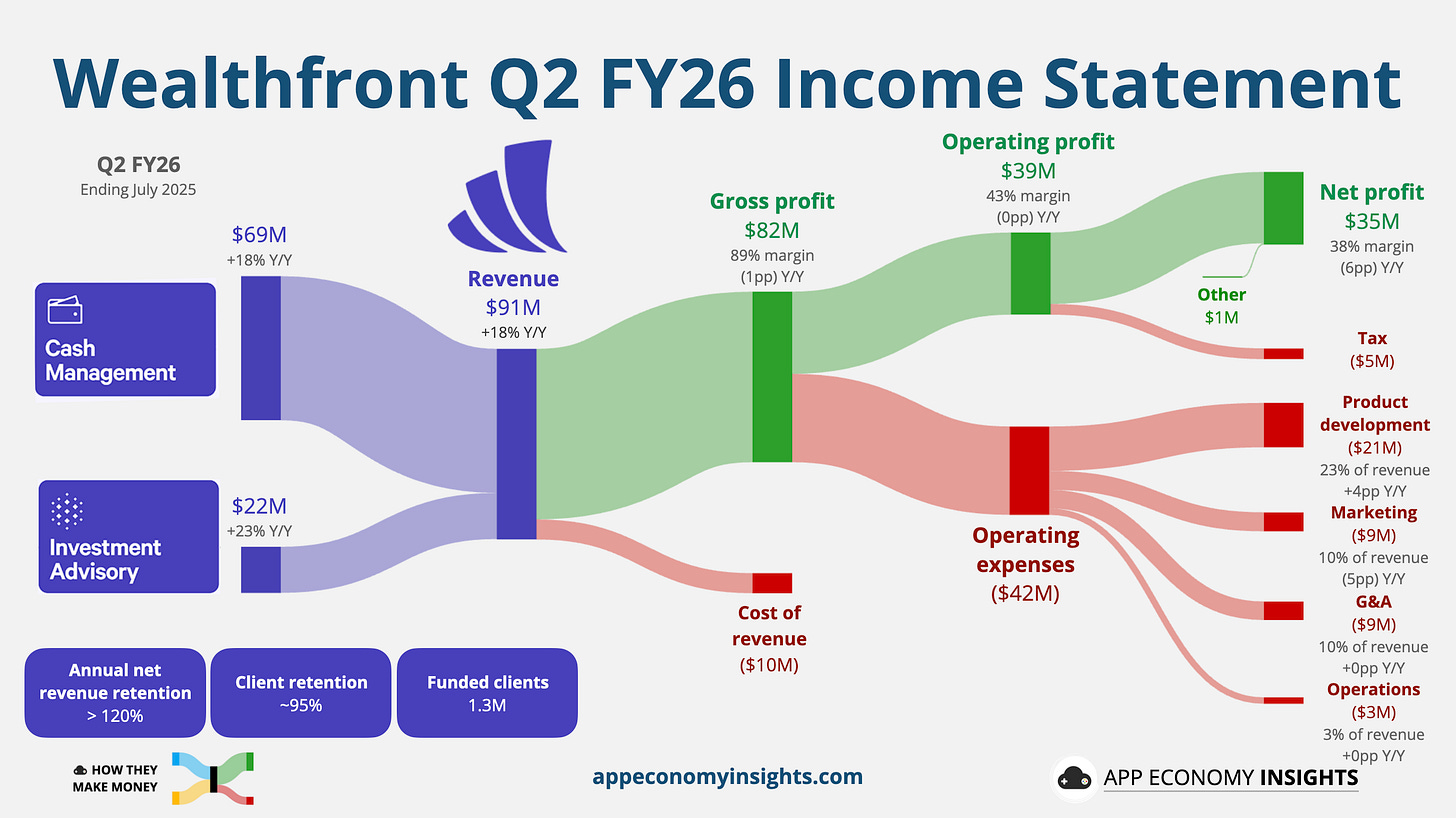

In the most recent quarter (Q2 FY26, ending July 2025), Wealthfront reported $91 million in net revenue. Here is the breakdown that matters:

Cash Management: $69 million (~76% of revenue).

Investment Advisory: $22 million (~24% of revenue).

The takeaway? Wealthfront makes three times more money from the cash sitting in your high-yield account than it does from managing your investments.

This shift occurred when they launched their cash account, leveraging partner banks to offer high yields. By capturing the spread (the difference between what they earn on client cash and what they pay out in interest), they unlocked a massive, high-margin revenue stream.

📈 The Bull Case: A Profitable Fintech

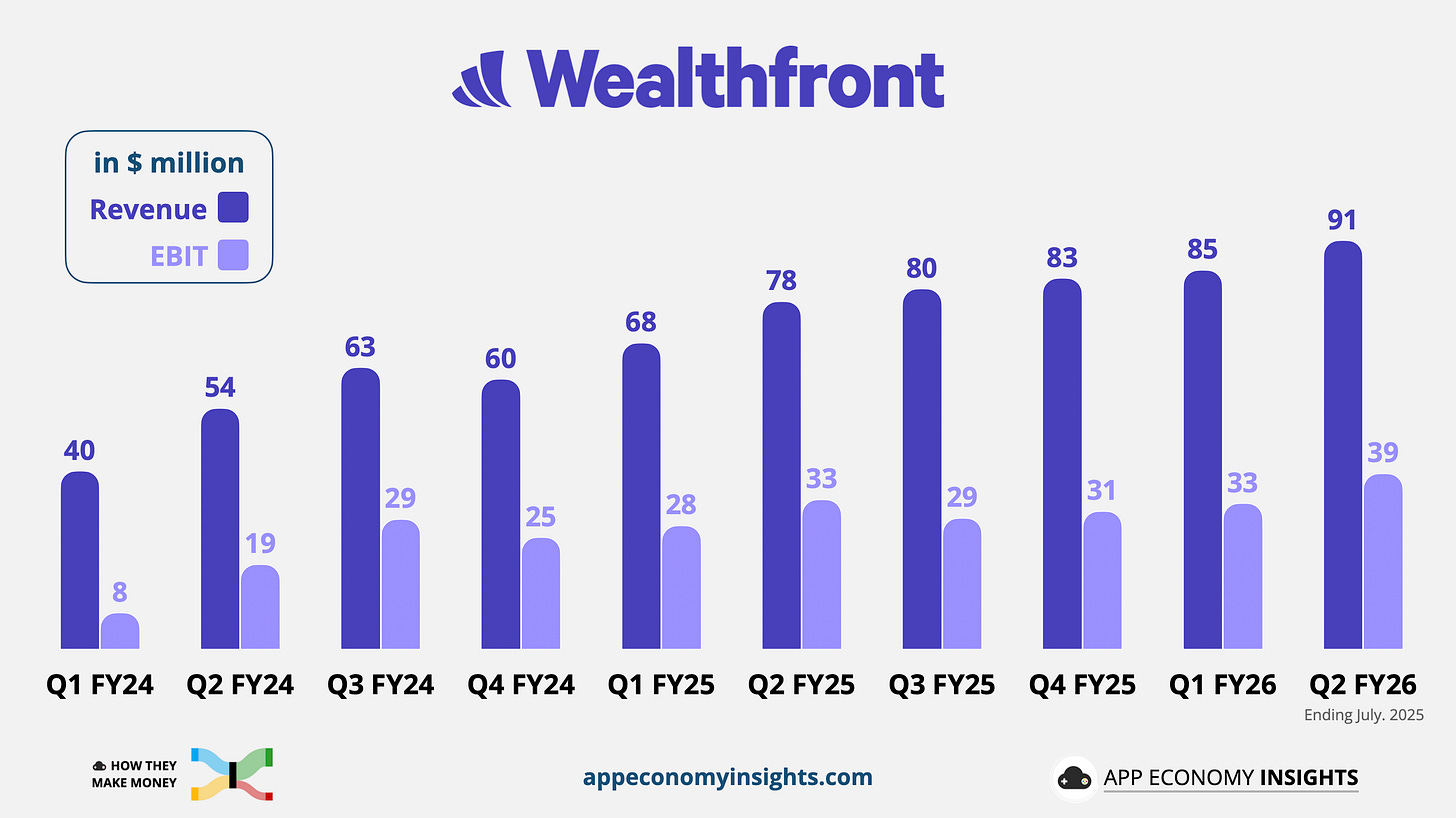

Unlike the wave of cash-burning fintech IPOs we saw in 2020 and 2021, Wealthfront is structurally profitable.

Net income: They generated $39 million in EBIT (earnings before interest and taxes) last quarter alone, with a pristine 38% net profit margin.

Demographics: They have 1.3 million funded clients, heavily skewed toward Millennials and Gen Z, a cohort entering their prime earning years.

Retention: Their “Net Dollar Retention” is over 120%. This means existing customers are adding more money to the platform every year, fueling growth without Wealthfront having to spend a dime on marketing to them.

📉 The Bear Case: The Interest Rate Trap

The very thing that makes Wealthfront a cash cow today is also its biggest risk. In 2022, Wealthfront was a slowing advisory business (growing just 16% Y/Y according to private market research from Sacra). The pivot to cash management, capitalizing on high interest rates, is behind the acceleration.

But this profitability is tied directly to the Federal Reserve. When rates are high, Wealthfront earns a fat spread on $47 billion in cash assets. If the Fed cuts rates significantly, that revenue stream shrinks automatically.

Investors buying WLTH are effectively betting that the company can cross-sell these cash-parking clients into fee-paying investment accounts before high yields disappear.

Takeaway: At a $2 billion valuation, Wealthfront is priced as a comeback story. They walked away from a $1.4 billion acquisition and nearly tripled their revenue in three years. It offers a rare combination of growth and GAAP profitability.

However, the identity crisis remains. Is this a technology platform revolutionizing wealth management? Or is it a beautifully designed interface for cash arbitrage?

The market (and the Fed) will decide moving forward.

That's it for today.

Happy investing!

Want to sponsor this newsletter? Get in touch here.

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Save 15% with this link.

Disclosure: I own AMD, AMZN, GOOG, META, and NVDA in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Question- software was down, but you included license/support/SaaS in your comments. SaaS was up at least 11%. While smaller in terms of rev, it’s been growing at double digit rates for some time now. It’s also a higher margin and will be a delivery mechanism for agentic ai, assuming oracle doesn’t screw it up.

Exceptional breakdown of Oracle's high-leverage bet on AI infrastructure. The gap between $523B RPO and actual cash generation is the real story here. I watched similar construction risks play out with earlier cloud buildouts but never at thislevel of capital intensity. Executon speed vs burn rate will detmine everything.