⚡ Tesla: From Bad to Worse

As sales fall, autonomy must save the day

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

⚡ Tesla’s year goes from bad to worse

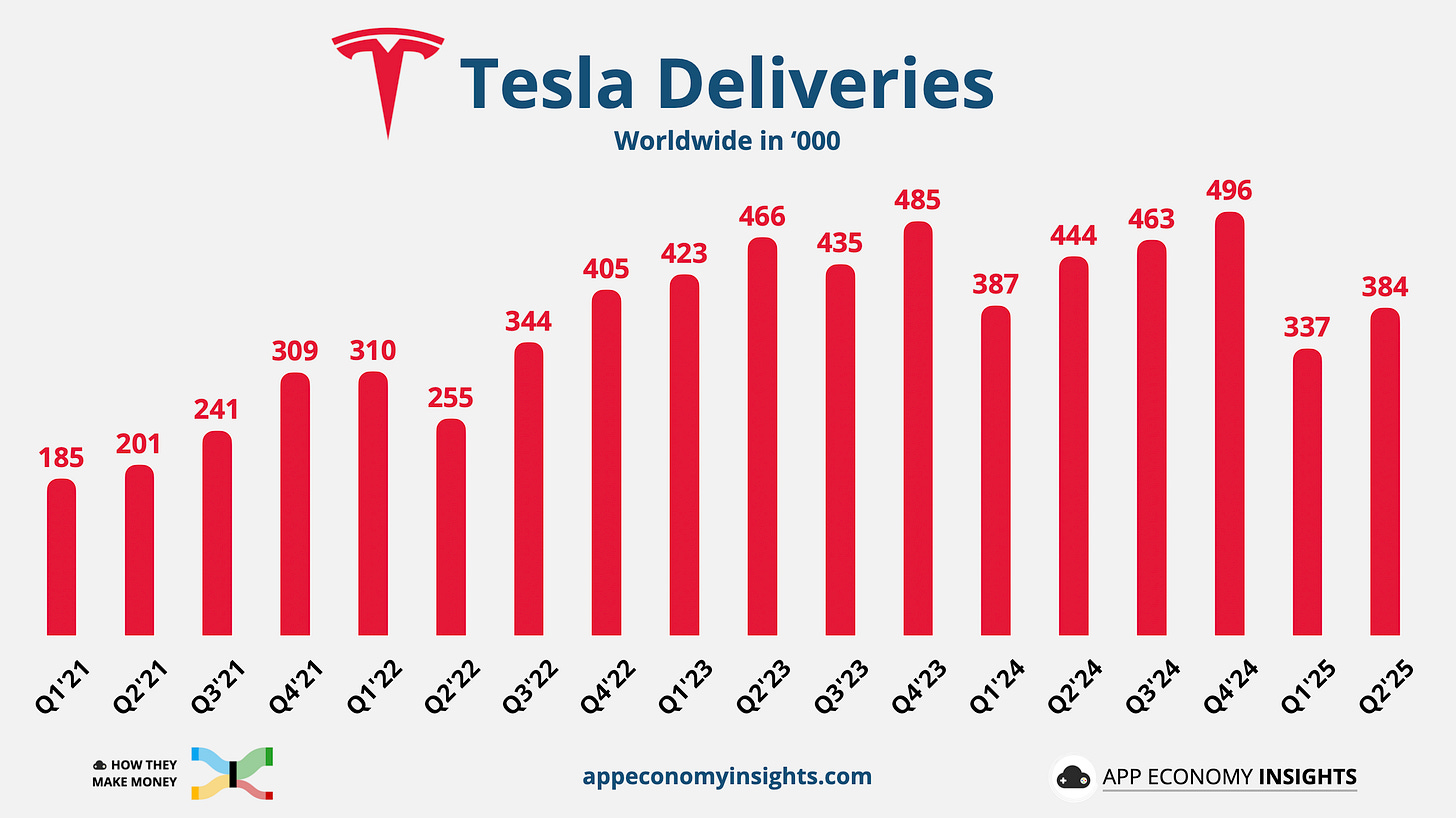

Global deliveries just fell 13%, their steepest quarterly drop ever.

Revenue is declining, margins are compressing, and cash flow has dried out.

Only weeks after promising to focus more on the company following his exit from DOGE (Department of Government Efficiency), Elon Musk announced a new political movement: the America Party. The move quickly escalated his feud with Trump, who called him “off the rails.” According to a Quinnipiac poll, 77% of Americans rejected the idea outright.

That’s not the pivot shareholders were hoping for. TSLA is now down over 30% from its December 2024 peak, while the broader market is hitting new all-time highs.

Of course, if you view Tesla purely as an auto business, Q2 results remain very poor. But if your focus is on its bets in energy, AI, and robotics, this quarter likely won’t change your thesis.

In Musk’s own terms during the call: “autonomy is the story.” But even if the moonshots in robotaxi and robotics succeed, they’re years away from offsetting collapsing vehicle demand and face regulatory hurdles.

Yes, Tesla’s robotaxi program could unlock tremendous value. But at what point does mounting evidence of brand erosion start to undermine even the most ambitious upside?

Let’s break it down.

Today at a glance:

Tesla Q2 FY25.

Brand erosion by the numbers.

Key quotes from the earnings call.

Big Tech’s (upcoming) robotaxi war.

1. Tesla Q2 FY25

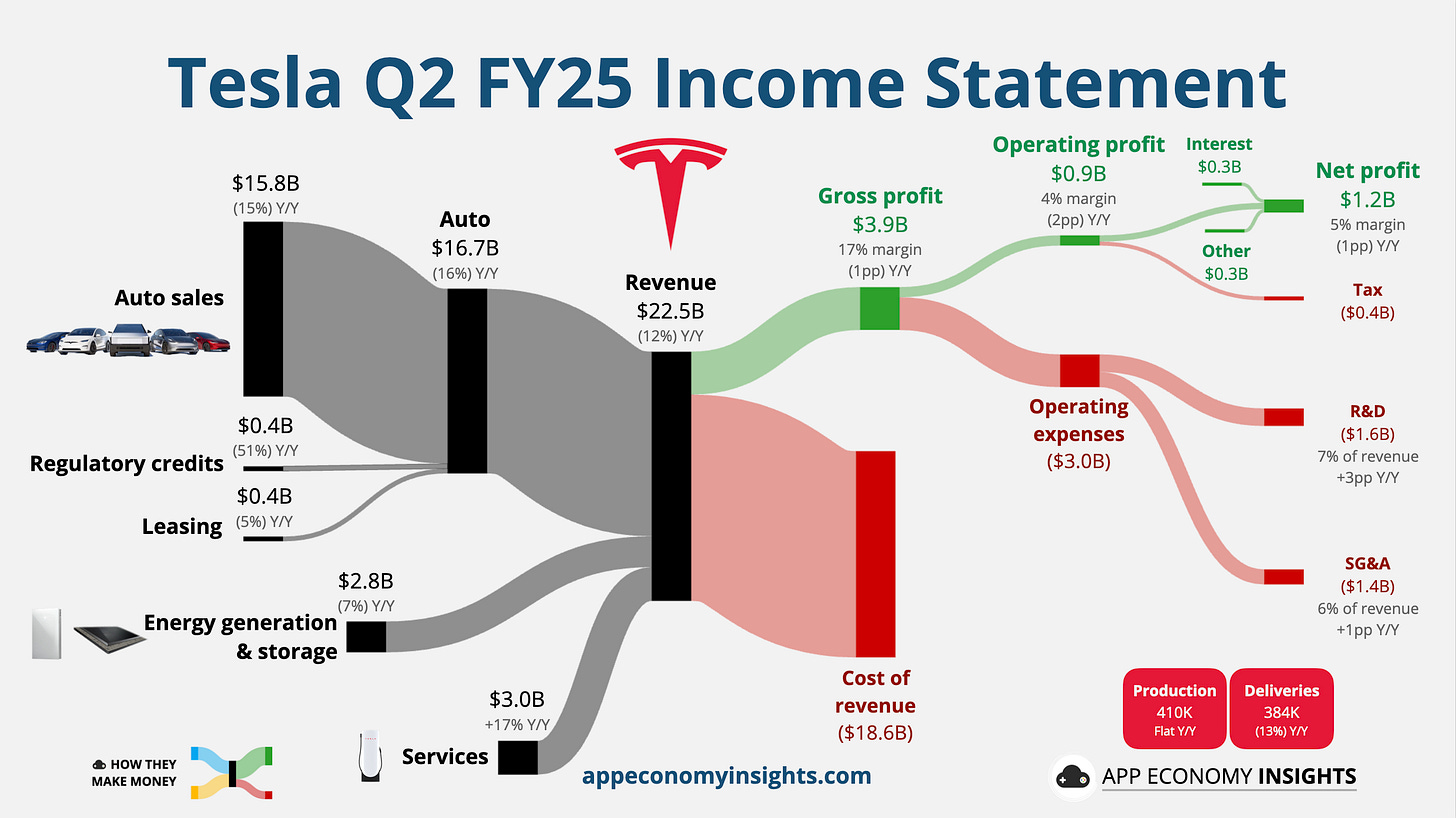

Tesla's revenue comes from three primary sources:

🚗 Automotive: Revenue from selling electric vehicles, including models S, 3, X, Y, and the Cybertruck (74% of revenue).

🌞 Energy Generation and Storage: Revenue from solar products and energy storage solutions, like Solar Roof and Powerwall (12% of revenue).

🔌 Services and Other: Revenue from vehicle service, Supercharger network, and sales of automotive parts and accessories (14% of revenue).

Deliveries -13% Y/Y to 384K vehicles, the worst quarterly slip ever.

Production flat Y/Y at 410K vehicles.

Income statement:

Revenue -12% Y/Y to $22.5 billion ($0.4 billion beat).

Gross margin 17% (-1pp Y/Y).

Operating margin 4% (-2pp Y/Y).

Non-GAAP EPS $0.40 (in-line).

Auto revenue fell 16% Y/Y while the non-auto segments were up 4%, partially offsetting the decline. Energy alone is now 22% of Tesla’s gross profit.

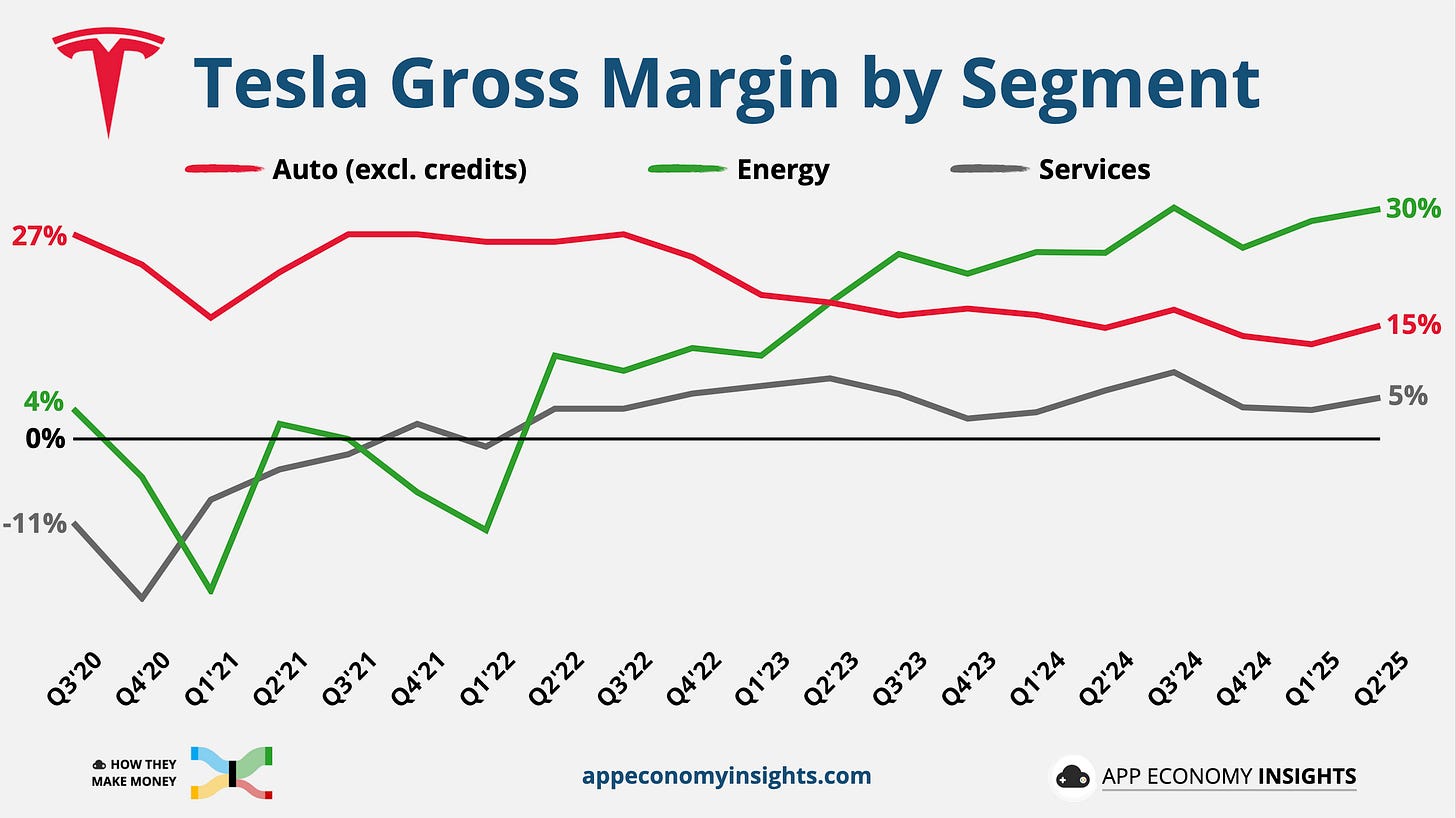

Gross margin trends:

Auto: 15% (excluding credits), a rebound from 12.5% in Q1.

Energy: 30%, the highest margin segment improving again.

Services and Other: 5%, the 13th consecutive profitable quarter.

Tesla’s historically strong margins have been supported by gigafactory scale, direct-to-consumer sales, and minimal marketing costs. But those advantages are being eroded by price cuts and rising competition.

Cash flow:

Operating cash flow: $2.5 billion, down 30% Y/Y, reflecting the revenue decline and margin compression.

Free cash flow: $0.1 billion, a massive 89% drop from last year, due to lower operating cash flow combined with Capex growing 19% Q/Q to $2.4 billion. Still, the company is underspending compared to its previous $10 billion full-year target, and now expects only $9 billion in FY25.

Guidance:

FY25 outlook: Tesla again withheld full-year guidance, citing trade policy and political backlash. A return to growth, predicted earlier this year, now looks unlikely. Commentary on tariffs only deepened the uncertainty. Remember: Musk predicted 20–30% growth for FY25 late last year.