🎧 Spotify: The Wrapped Effect

From music utility to agentic media platform

Welcome to the Free edition of How They Make Money.

Over 290,000 subscribers turn to us for business and investment insights.

In case you missed it:

Spotify just wrapped its FY25.

The company proved it can grow at a slower pace and still earn more. The market responded with shares jumping nearly 20% after record margins.

At the same time, management is repositioning Spotify as the infrastructure layer of the music industry and pitching an agentic media vision built around discovery and personalization.

Let’s dig in.

The big numbers

Spotify is accelerating in ways that surprised even its own leadership.

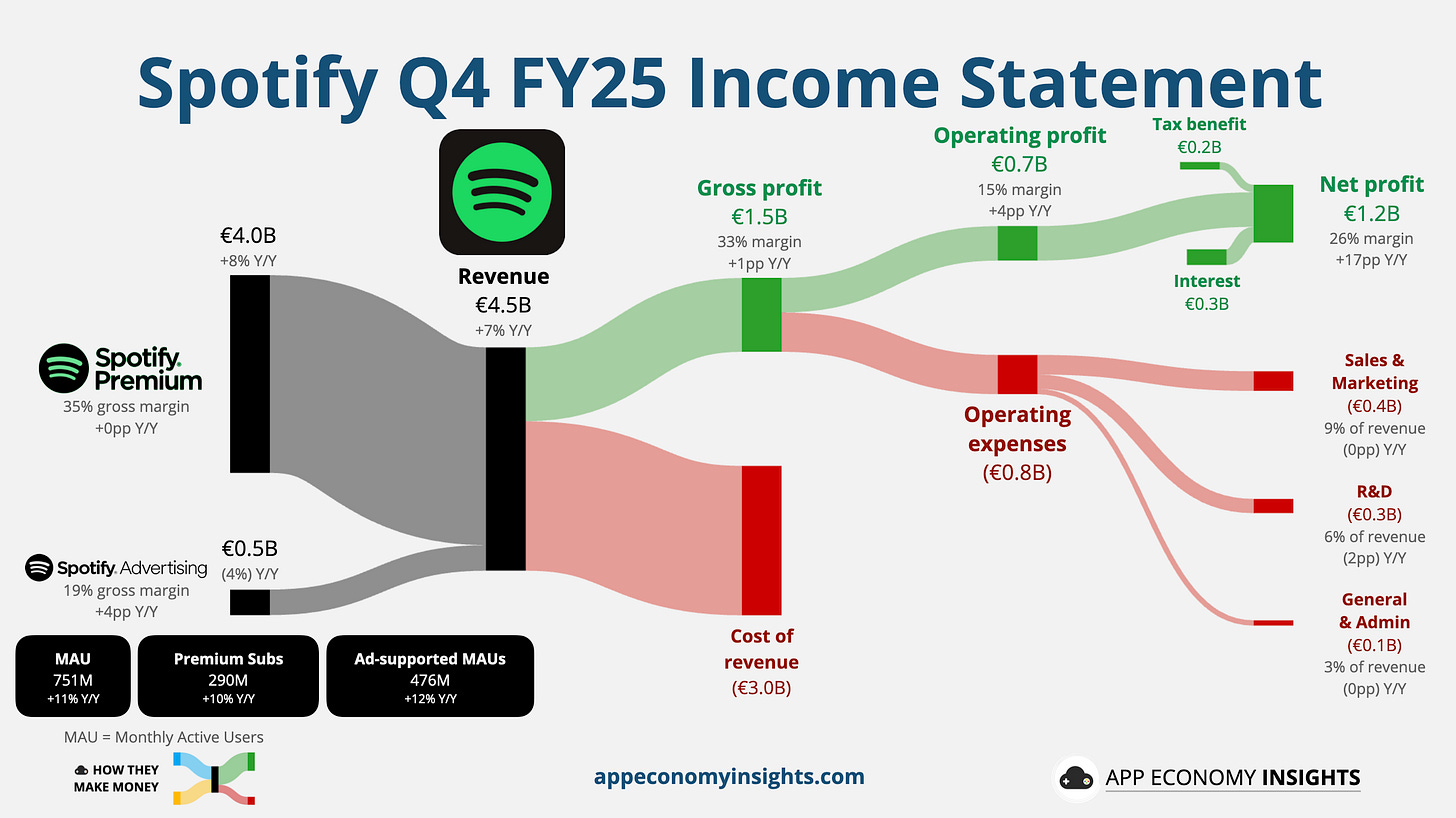

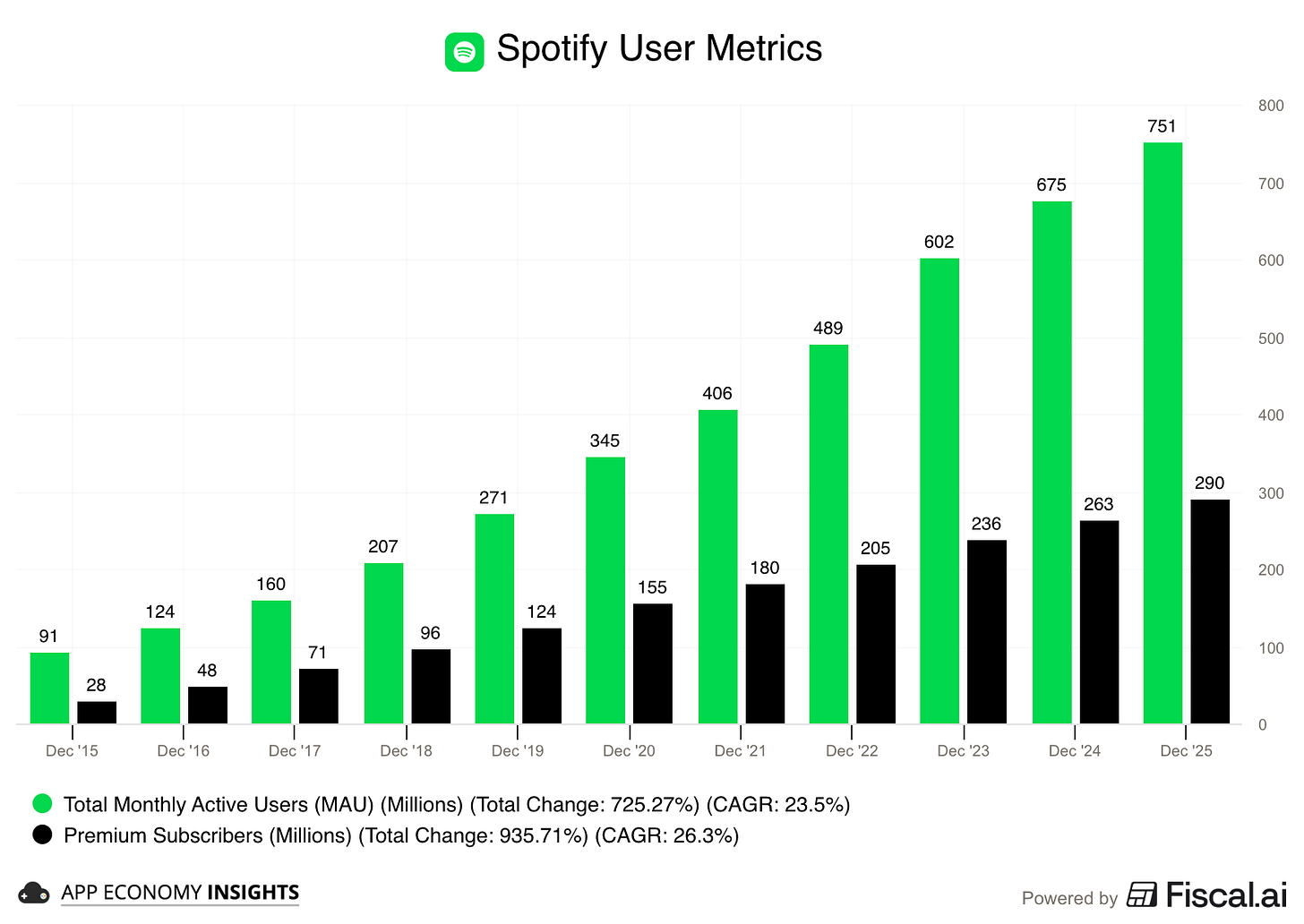

Monthly Active Users (MAUs): 751 million (+11% Y/Y). The company added a record 38 million net new users in Q4 alone, beating its own guidance by 6 million.

Premium Subscribers: 290 million (+10% Y/Y).

ARPU (Average Revenue Per User): €4.70, up 2% Y/Y in constant currency, benefiting from recent price hikes.

Revenue growth: +7% Y/Y to €4.5 billion (€10 million beat). Note that the company reports in euros and faced currency headwinds. Growth was +13% Y/Y in constant currency.

Gross margin: Expanded again to a record 33.1%, primarily thanks to an improvement in ad-supported gross margin, notably from podcasts.

Operating margin: 15% (a massive jump from 11% million a year ago).

Free cash flow: €834 million for the quarter and €2.9 billion for FY25.

Financially, the story has shifted from growth at all costs to margin expansion and shareholder returns. With €9.5 billion in cash and short-term investments, the company repurchased $433 million of its own shares during the quarter.

What drove the beat?

Management credited two major factors for the upbeat quarter:

The Wrapped effect: 2025 was the biggest Wrapped campaign ever. Over 300 million users engaged with their year-end recaps, driving the highest single day of subscriber sign-ups in the company’s history.

Product expansion: The rollout of audiobooks in more European markets and the beta launch of music videos in the US and Canada helped deepen user engagement.

How we got here

This was Spotify founder Daniel Ek’s final quarter as CEO. Taking a page from the Netflix playbook, he passed the baton to two co-CEOs: Gustav Söderström (formerly Chief Product & Technology Officer) and Alex Norström (formerly Chief Business Officer).

Ek laid out a three-part framework for Spotify up to this point:

The intersection strategy: Spotify wins by solving problems at the intersection of consumers and creators. If a feature helps both, it’s a green light.

The R&D arm of music: Ek doesn’t see Spotify as a distributor but as the technology infrastructure for the music industry.

Ubiquity over control: Spotify works on over 2,000 devices from 200 brands. They chose to be everywhere rather than building a walled garden, which is why they believe they’re winning the “car and home” battle against Apple and Google.

Ads are a drag on the flywheel

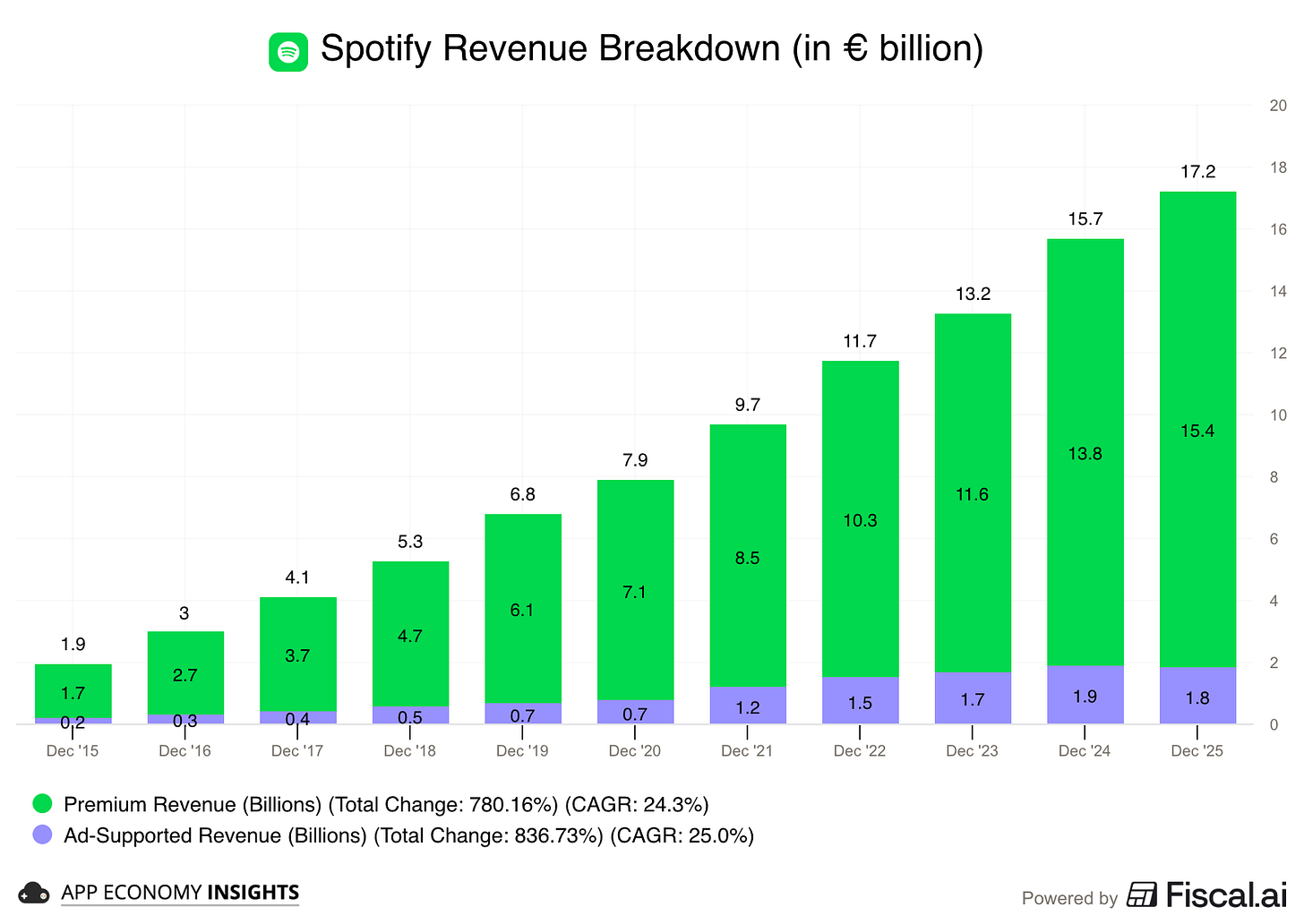

The Ad-Supported segment remained the clear low-light. Ad revenue grew only 4% Y/Y in constant currency (it declined 4% Y/Y on a reported basis), continuing a trend of soft monetization that stands in stark contrast to the subscription side of the house.

Despite a massive base of 476 million ad-supported MAUs (up 12% Y/Y), Spotify still struggles to translate eyeballs into dollars as efficiently as Big Tech. Management has previously signaled that 2025 was a transition year for ads, but with growth not expected to truly accelerate until the second half of 2026, this segment acts as a persistent drag on the overall growth story.

The real insight, however, is the gross margin expansion within the ad tier, which hit record levels primarily due to “content cost favorability” in podcasting. For years, podcasts were a massive cash burn. They are now finally becoming margin-accretive. By pivoting from expensive exclusive deals to a broader marketplace model, Spotify is proving it can make the ad business profitable even if it isn’t yet a high-growth engine.

The strategic bet is that Spotify can eventually unlock the kind of high-ARPU targeted advertising that powers Meta and YouTube. That outcome is far from guaranteed.

Audio has structural limits. Unlike visual feeds, ads cannot be scrolled past. Ad load is constrained. That likely caps ARPU below video and social platforms.

There is also a data quality gap. Spotify understands moods and habits, but it lacks the high-intent commercial signals that make Google and Meta so effective for performance marketing. Mood data supports branding. It does not drive clicks.

How AI impacts Spotify

Spotify does not see AI as a threat. It sees it as leverage.

Co-CEO Gustav Söderström argues that disruption isn’t caused by technology alone. It’s caused by new business models enabled by that technology. Spotify’s bet is that AI won’t eliminate aggregators. It will make them more important.

If AI makes it easier to create music, the world will drown in supply. When supply becomes infinite, discovery becomes scarce. And discovery is Spotify’s core product.

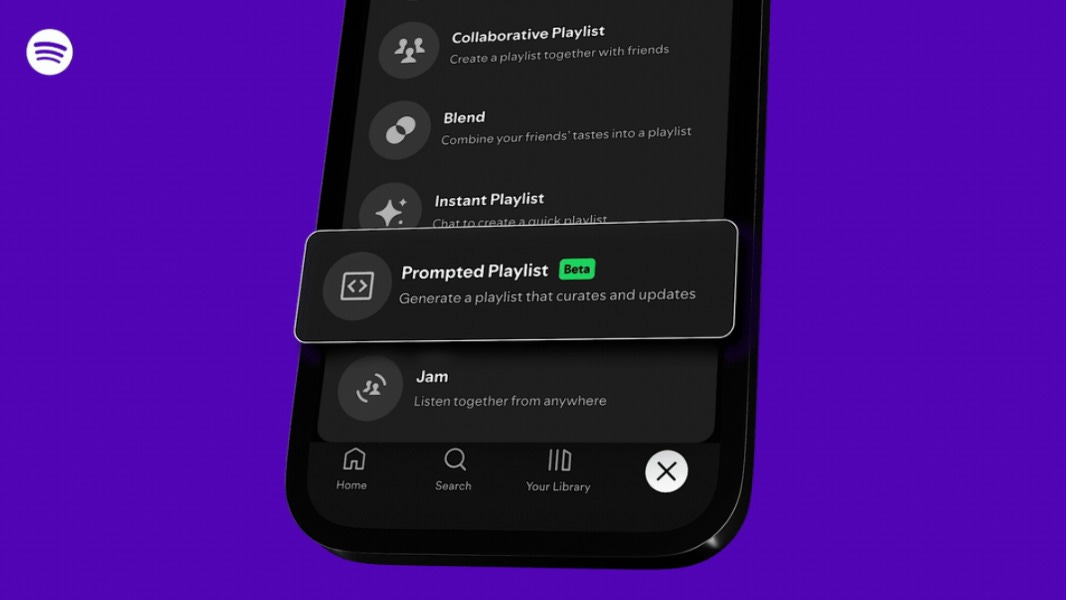

Already, 90 million users engage with the AI DJ. The new Prompted Playlist feature lets users “write their own algorithm,” turning Spotify into an interactive recommendation engine rather than a passive library. Users can also exclude suggested songs, like creating new rules for an LLM.

This is the key. AI threatens creators more than platforms. The more content exists, the more valuable the filter becomes.

Spotify is positioning itself as that filter. Management called it an “agentic media platform” that translates language, mood, and context into taste.

If that works, AI doesn’t compress Spotify’s moat. It widens it.

What’s the moat?

Spotify does not own its content. Labels capture close to 70% of revenue. The catalog is largely the same across Apple, YouTube, and Amazon.

So where is the edge?

It lives in experience, data, and scale:

Personalization at depth: Spotify is building a dataset that connects language to taste at global scale. “Workout music” or “sad songs” are not objective categories. They are subjective signals defined by hundreds of millions of users every day. That feedback loop trains recommendation systems that are difficult to replicate without similar scale and engagement.

Network gravity: With 751 million monthly users, Spotify is the default destination for audio. Artists and podcasters launch where distribution is largest. Innovation compounds where attention concentrates. That reinforces Spotify’s position as the primary discovery engine in music.

Behavioral switching costs: Playlists, follows, listening history, and algorithmic tuning create friction. The subscription price is low. The time invested is not. Research firm Antenna estimates Spotify’s net churn at around 2%, with nearly 90% of audio users sticking to a single platform.

This is not a wide moat built on exclusive content. It is a narrow moat built on habit, data, and distribution scale.

AI can make the music, but Spotify is where it breaks into the culture. As long as Spotify owns the charts and the discovery, they own the power over creators. A simple algorithm push can make or break an artist, a la Netflix.

Scale alone brings new business opportunities. For example, Spotify just partnered with bookshop.org, allowing listeners in the US and the UK to buy physical books in one click from the app. It’s an example of a strategy trying to meet customers where they are and cater to their extra needs, whatever they might be.

YouTube remains the wild card

YouTube remains the primary long-term challenger. While Spotify is the king of audio, Alphabet’s video giant owns the world’s attention. YouTube currently boasts over 2.7 billion MAUs. This scale is more than 3.5x larger than Spotify’s user base, giving YouTube an almost unfair funnel for its music services.

YouTube Music and Premium crossed 125 million subscribers in March 2025, up from 100 million a year prior. YouTube has been adding ~2 million paid subs per month on average, essentially matching Spotify’s pace. The paid subscriber base is likely close to 145 million by now, roughly half of Spotify’s Premium subs.

Alphabet is increasingly pushing its “unified content” bundle, where $13.99/month removes ads from the world’s largest video platform while simultaneously providing its music streaming service.

As YouTube Premium’s subscriber base rises, it creates a default subscription that could eat Spotify’s lunch. For a user already paying for ad-free YouTube and getting Music as a bonus, an extra $12.99/month for Spotify becomes a redundant “music tax.” YouTube Music also leverages a decade of video watch history to inform its recommendations—implicit data that Spotify’s “likes” and “saves” struggle to match. As Gen Z increasingly treats YouTube as their primary discovery engine (serving both video and audio), Spotify’s narrow moat will depend on its ability to prove that its standalone experience is worth the extra cost of a separate subscription.

Looking forward

Can Spotify turn cultural relevance into economic power? Can it raise ARPU without damaging the user experience? Can it defend its role as the primary music discovery engine as YouTube bundles music into a broader ecosystem?

Spotify now has the scale, data, and cash flow to execute. Yet audio carries structural limits that may cap ARPU expansion. The next phase likely requires new monetization layers beyond the current model.

Investor Day in May should provide clearer signals on how management intends to translate that foundation into sustained operating leverage.

That’s it for today!

Stay healthy and invest on!

Want to sponsor this newsletter? Get in touch here.

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Start an account for free and save 15% on paid plans with this link.

Disclosure: I own AAPL, AMZN, GOOG, and META in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.