🚦 NVIDIA+Uber: AV Economics

Is there any autonomy upside for demand aggregators?

Welcome to the Premium edition of How They Make Money.

Over 240,000 subscribers turn to us for business and investment insights.

In case you missed it:

FROM OUR PARTNERS

Big Media Has Spent Billions Acquiring Iconic IP

When powerful entertainment brands secure valuable character IP, media giants pay billions to own it.

Disney paid $4B for Marvel.

Disney paid $4B for Lucasfilm.

Universal spent $1B+ on DreamWorks.

Now, Elf Labs owns a portfolio of 500+ trademarks & copyrights, that includes iconic characters like Cinderella and Snow White — and is transforming them with AI and next-gen media tech.

Their character portfolio has already generated $15M+ in royalties, and now the team–who is behind $6B+ in licensing deals across global entertainment brands–just secured a 200M+ TV distribution deal.

Elf Labs may be positioned for the same acquisition pattern — but shares are still available to everyday investors at just $2.25/share. And you can still secure 20% bonus shares if you invest by November 13th.

This is a paid advertisement for Elf Lab’s Regulation CF offering. Please read the offering circular at https://www.elflabs.com/

Tesla’s autonomy vision is well documented

First-party data from millions of cars, vertically integrated factories, and a cost per mile expected to collapse over time. The market has rewarded that vision with a $1.4 trillion valuation—a bet on a future where human drivers disappear, car ownership fades, and every vehicle becomes a computer on wheels.

Now contrast that with everyone else.

Even if you combined the market caps of every company in rideshare and delivery, you’d still fall short of half a trillion dollars. And for good reason: today’s on-demand platforms are expensive, low-margin, and constrained by human supply.

So it’s fair to ask: Is there any autonomy upside for demand aggregators?

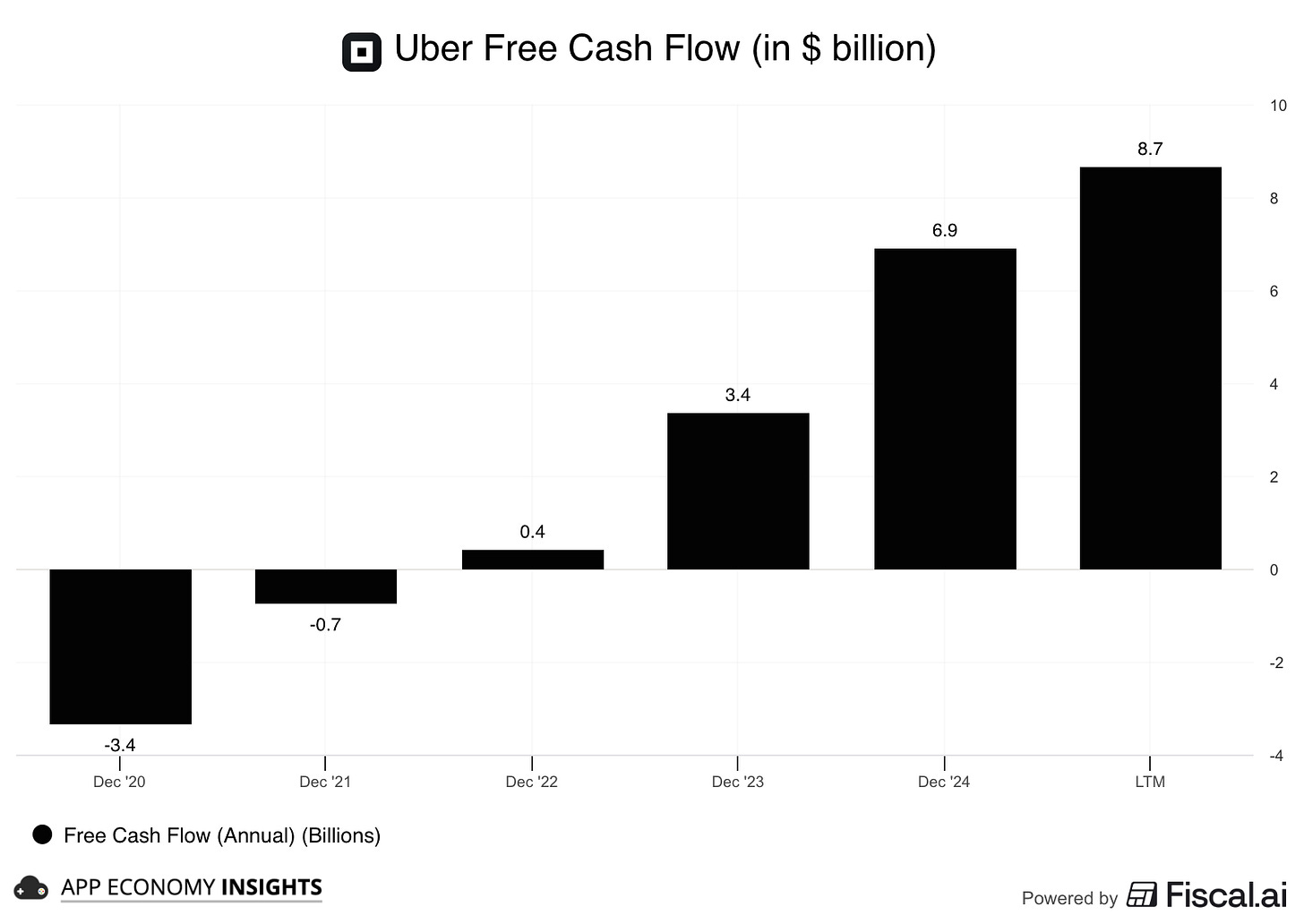

The market doesn’t think so. Uber trades at roughly 22x trailing free cash flow, a metric that has tripled in the past two years.

And yet, the latest Uber–NVIDIA partnership may point to a different outcome.

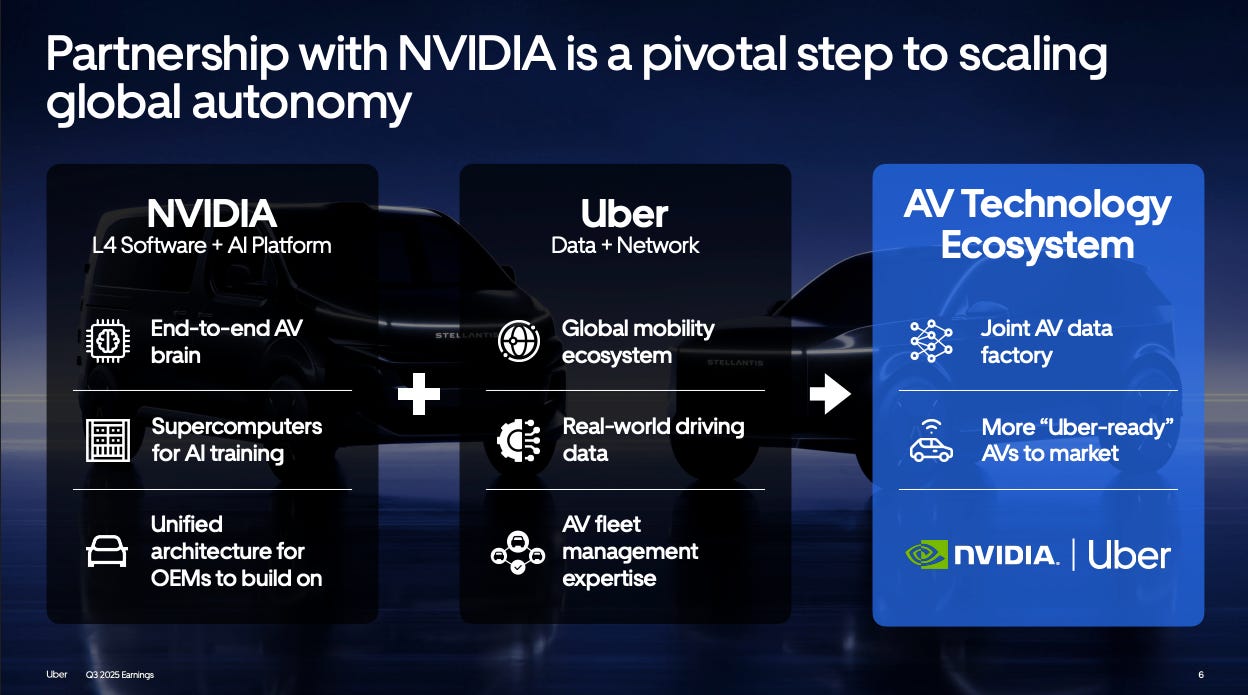

NVIDIA will supply the “L4 brain” and AI training computers. Uber brings the global ride-and-delivery network, driving data, and fleet-management infrastructure. Together, they’re building an AV Technology Ecosystem to bring “Uber-ready” autonomous vehicles to market. It’s the next step in Uber’s quiet AV expansion, already spanning 20+ partners. You can already order a Waymo on Uber in cities like Atlanta and Austin.

Why should you care? Because this partnership shifts autonomy from speculative to deployable. If Uber can integrate AVs at scale, its moat expands—from network effects and driver liquidity to data, logistics, and operational leverage. That could reprice what a rideshare business is worth.

The big idea: Uber’s alliance with NVIDIA marks a turning point. The question is not whether Tesla will dominate autonomy—but whether the platforms that control demand today can capture a meaningful share of the value. The ripple effects touch valuations, competitive advantage, and the entire timeline of disruption.

Today at a glance:

🚖 Uber: AV Aggregation Theory.

🛵 Grab: The Superapp Angle.

🚘 Lyft: Pragmatic Follower.

1. 🚖 Uber: AV Aggregation Theory

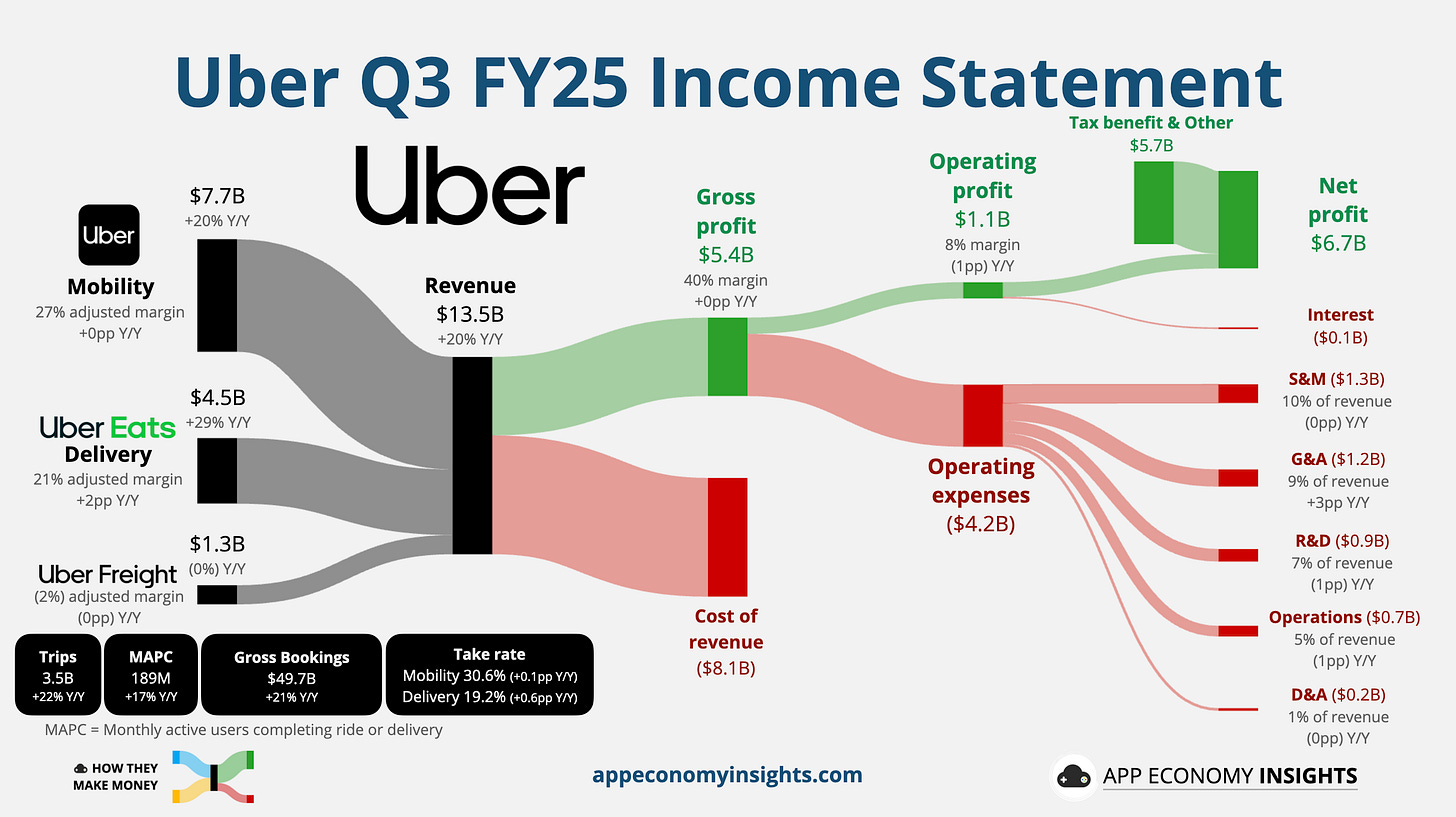

First, let’s look at where Uber is today. Q3 revenue rose 20% Y/Y to $13.5 billion ($240 million beat). A large one-off tax benefit distorted the net profit for the quarter, so it’s best to focus on operating profit.

Gross Bookings (the total dollar value spent by end users on Uber apps) surged 21% Y/Y to $49.7 billion (accelerating).

🚗 Mobility +20% Y/Y to $21.0 billion with a 30.6% take rate.

🛵 Delivery +25% Y/Y to $18.7 billion with a 19.2% take rate.

🚚 Freight flat Y/Y at $1.3 billion.

Monthly Active Platform Consumers (MAPC) rose 17% to 189 million.

Trips grew even faster at 22% Y/Y to 3.5 billion.

Despite the large top-line beat, adjusted EBITDA (up 33% Y/Y to $2.3 billion) and operating income of $1.1 billion both missed expectations, with management citing one-off legal and regulatory charges of $0.5 billion for the shortfall. It would have been a large beat without this temporary headwind. Free cash flow remained robust at $2.2 billion.

Looking ahead, Uber provided a mixed Q4 forecast. Gross Bookings guidance (+19% Y/Y to ~$53 billion) came in ahead of consensus, but the Q4 adjusted EBITDA forecast of (+34% Y/Y to ~$2.46 billion) fell $30 million short of analyst expectations. The trend remains very much alive, with adjusted profitability outpacing revenue growth and margins expanding.

The company prepares to shift its profit reporting to adjusted operating income (or adjusted EBIT) in 2026, a more conservative measure than adjusted EBITDA since it doesn’t exclude the DA part (Depreciation and Amortization). This approach makes sense since Uber has become a more mature, profitable business.

Uber’s six strategic growth areas

CEO Dara Khosrowshahi outlined six strategic growth areas:

Deepening engagement (more trips per user).

Hybrid future (human drivers + AVs).

Local commerce (grocery & retail).