📊 PRO: This Week in Visuals

BRK MCD QCOM ARM ANET NVO AMGN PFE HOOD SBUX RACE MAR ABNB DDOG FTNT CPNG AXON TTWO XYZ YUM LYV EXPE FIG TTD TOST HUBS TWLO GPN PINS DKNG SNAP TEM NYT CELH HIMS PAYC DUOL KVYO MTCH DOCN PTON TRIP AMC

Welcome to the Saturday PRO edition of How They Make Money.

Over 240,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO members get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🦎 Berkshire: Buffett’s Final Call

🍟 McDonald’s: Deals Are Working

📲 Qualcomm: Handsets Rebound

📱 Arm: AI Data Center Bet Pays Off

🌐 Arista Networks: AI Targets Soar

🇩🇰 Novo Nordisk: New Guidance Cut

🧬 Amgen: Core Franchises Boost

💉 Pfizer: Cost Cuts Drive Beat

🪶 Robinhood: Crypto Miss

☕️ Starbucks: Turnaround Takes Hold

🛖 Airbnb: International Strength

🏨 Marriott: US Softness Persists

🏎️ Ferrari: Pricing Power Shines

🔒 Fortinet: SASE Soars

🇰🇷 Coupang: Triple-Digit Taiwan Growth

⚡️ Axon: AI Growth Pain

🐶 Datadog: Broad-Based Growth

🎮 Take-Two: GTA VI Delayed Again

🔲 Block: Gross Profit Acceleration

🌮 YUM Brands: Pizza Hut on the Block

🎤 Live Nation: Global Growth Fuels Record

✈️ Expedia: B2B Jumps

📢 HubSpot: AI & Multi-Hub Traction

📺 The Trade Desk: Kokai Fuels a Beat

🎨 Figma: $1 Billion Run Rate

📌 Pinterest: Weak Outlook

🍞 Toast: ARR Tops $2 Billion

💬 Twilio: Growth Accelerates Again

🌎 Global Payments: Genius Momentum

🧬 Tempus AI: First-Time EBITDA Positive

👑 DraftKings: Guidance Slashed

👻 Snap: AI Partnership Fuels Blowout

🦉 Duolingo: Missing the Streak

💻 Paycom: AI Efficiencies Continue

💊 Hims & Hers: Novo Talks Relaunched

🗞️ NYT: Subscriber Growth Accelerates

⚡️ Celsius: Turning Into a Monster

🏴 Klaviyo: Retention Rebounds

🔥 Match Group: Hinge Acceleration

🌊 Digital Ocean: AI Demand Accelerates

🚲 Peloton: Profitability Uptick

🍽️ Tripadvisor: “Experiences-Led” Reorg

🎓 Docebo: Core Growth Masked

🍿 AMC: Box Office Softens

1. 🦎 Berkshire: Buffett’s Final Call

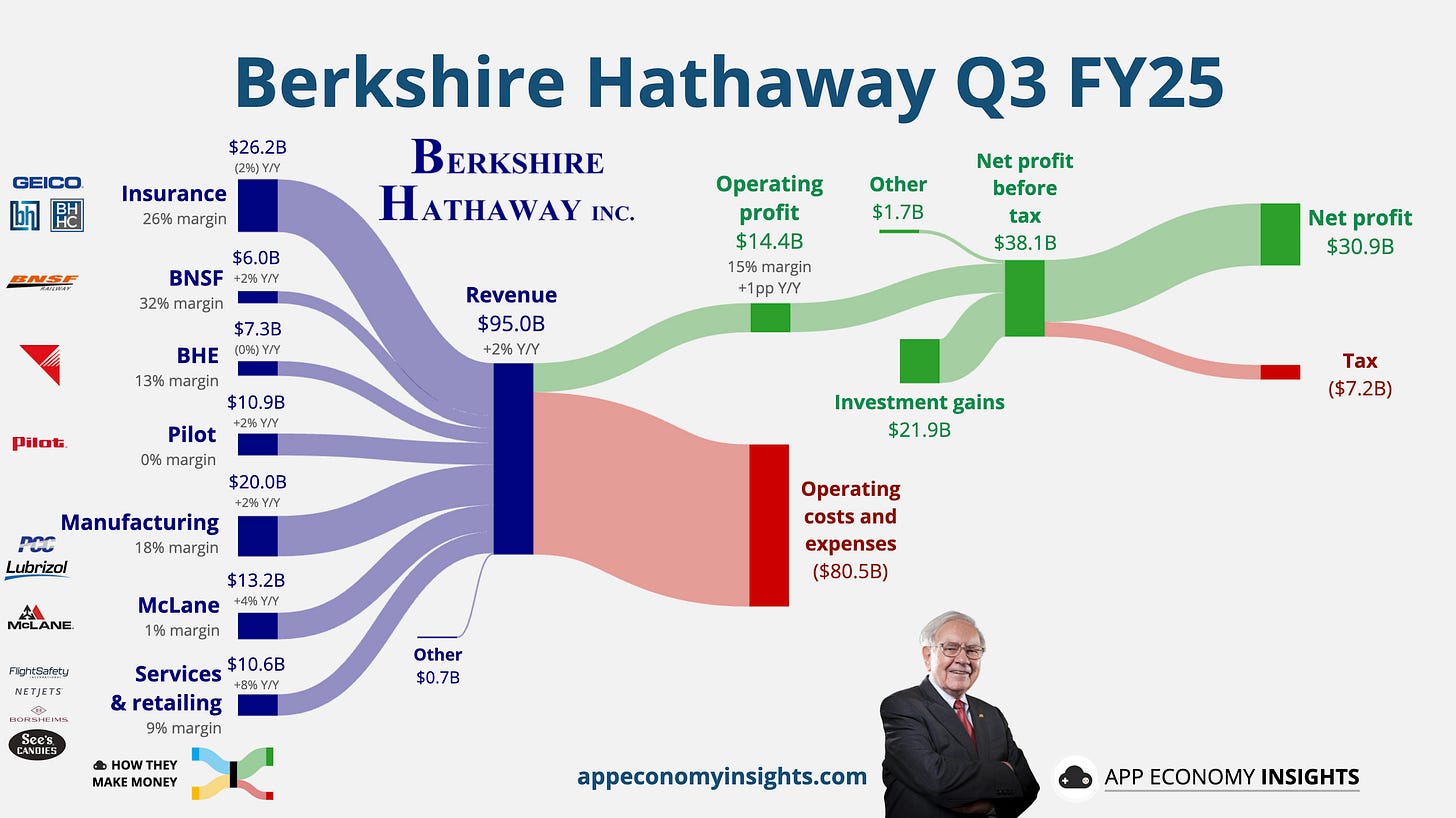

Berkshire Hathaway’s operating earnings improved to $14.4 billion in what marks Warren Buffett’s final earnings call as CEO. Revenue grew 2% to $95.0 billion, while net earnings rose 17% to $30.9 billion.

The operating profit jump was driven almost entirely by the insurance underwriting business, where earnings more than tripled to $2.4 billion due to a mild catastrophe season. Profit gains at BNSF (+5%) and manufacturing (+8%) also helped offset a 9% decline at Berkshire Hathaway Energy.

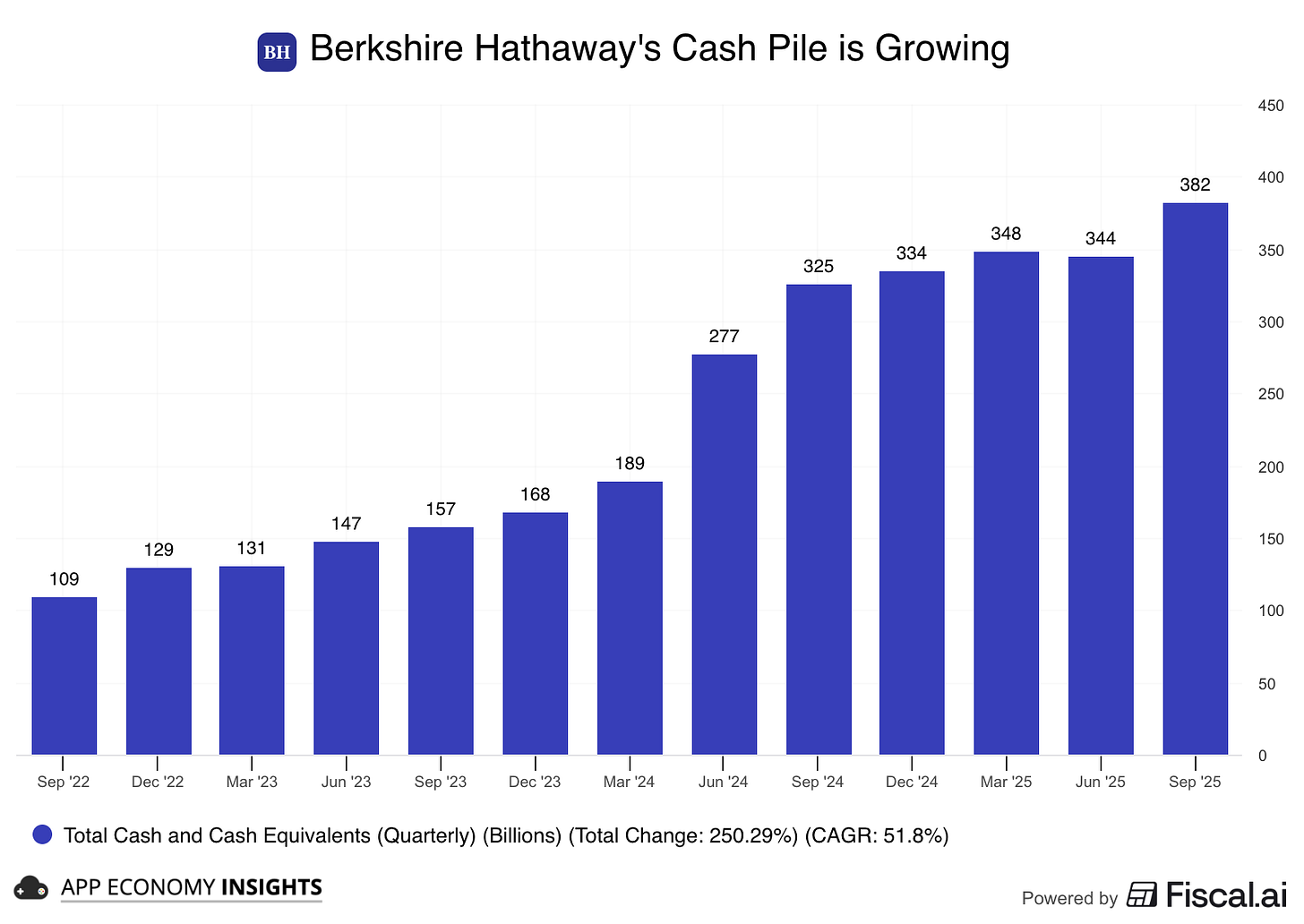

The cash hoard swelled to a new record of $382 billion, up from $344 billion in June. Berkshire’s cautious stance continued, with no share buybacks for the fifth straight quarter and net equity sales of $6.1 billion. The company has been a net seller of stocks for the 12th consecutive quarter.

With Buffett set to step down as CEO at year-end, successor Greg Abel inherits the massive war chest and a stock that has underperformed since the retirement announcement. However, Abel’s first major move was announced just after Q3 closed: a $9.7 billion deal to buy OxyChem, signaling a new catalyst and the first significant deployment of the cash pile.

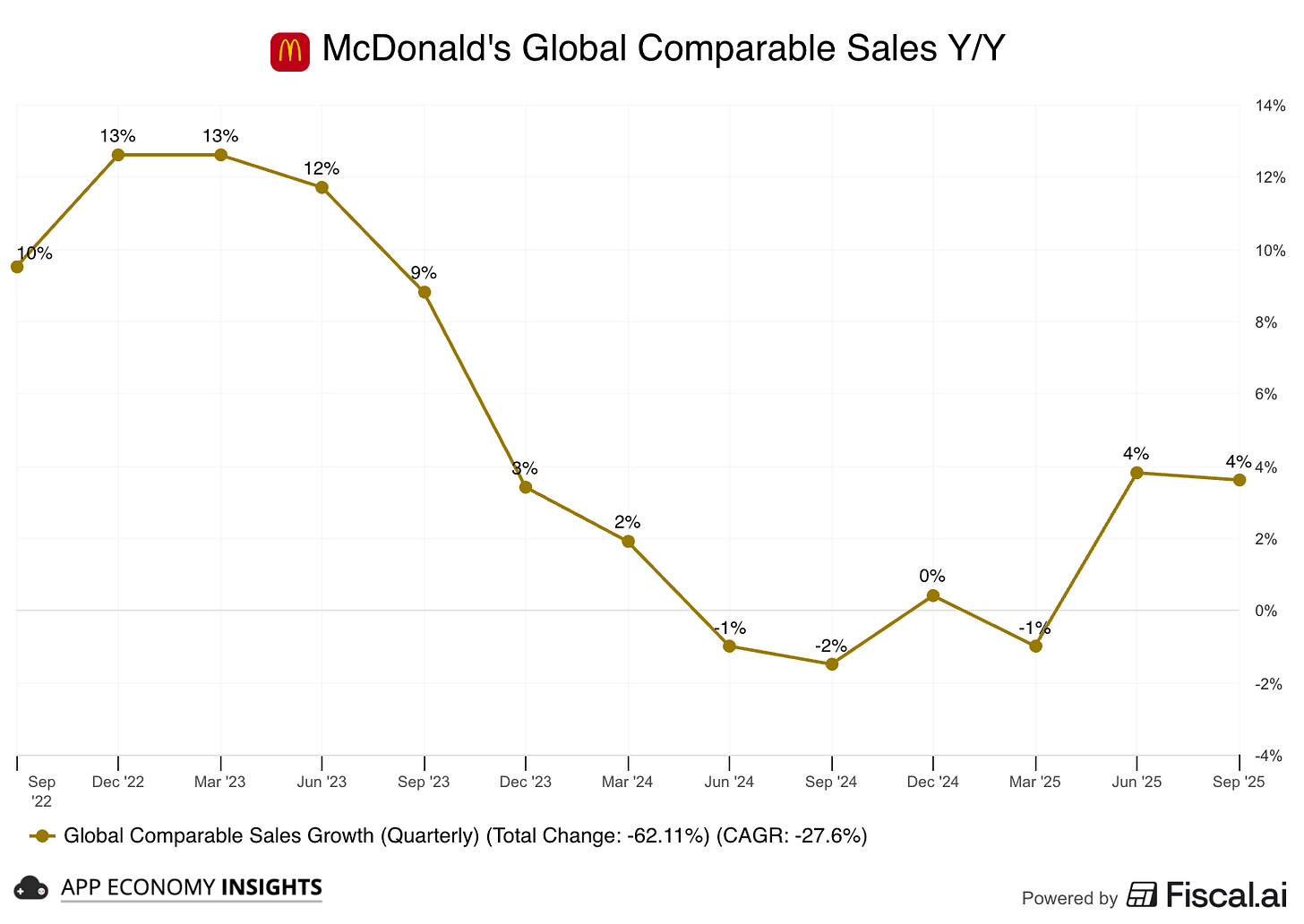

2. 🍟 McDonald’s: Deals Are Working

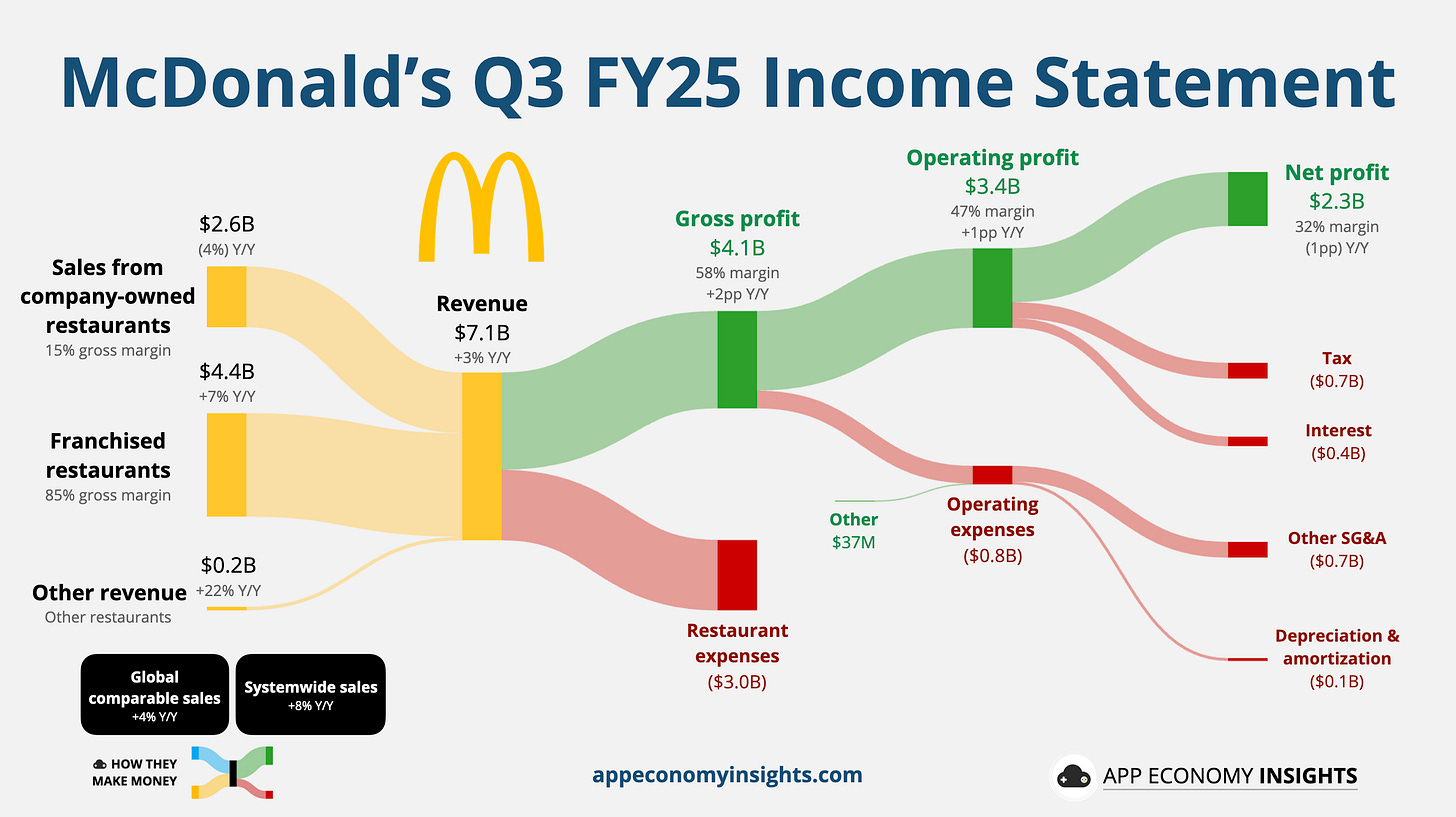

McDonald’s Q3 revenue rose 3% Y/Y to $7.1 billion ($10 million miss), and adjusted EPS was $3.22 ($0.11 miss). The profit miss was driven by $91 million in one-time restructuring and transaction charges related to its South Korea and Israel businesses.

Global same-store sales continued their rebound, rising 4% (beating estimates), and US comps grew 2% (also a beat). US growth was driven by positive check growth from successful promotions like the Snack Wrap and various value bundles.

International Operated Markets (+4%) and International Developmental Licensed Markets (+5%) once again outperformed the US, with strong results in Germany, Australia, and Japan.

McDonald’s reaffirmed its full-year operating margin guidance in the mid-to-high 40% range. Loyalty sales continued to surge, hitting a record $9 billion for the quarter ($34 billion for the trailing twelve months) as the company remains on track for its 250 million loyalty user target.

Despite a “challenging environment,” CEO Chris Kempczinski highlighted that the company is “fueling momentum” by delivering “everyday value and affordability.” The strategy is working, as McDonald’s appears to be successfully winning over cash-strapped consumers who are pulling back from fast-casual rivals like Chipotle.

3. 📲 Qualcomm: Handsets Rebound

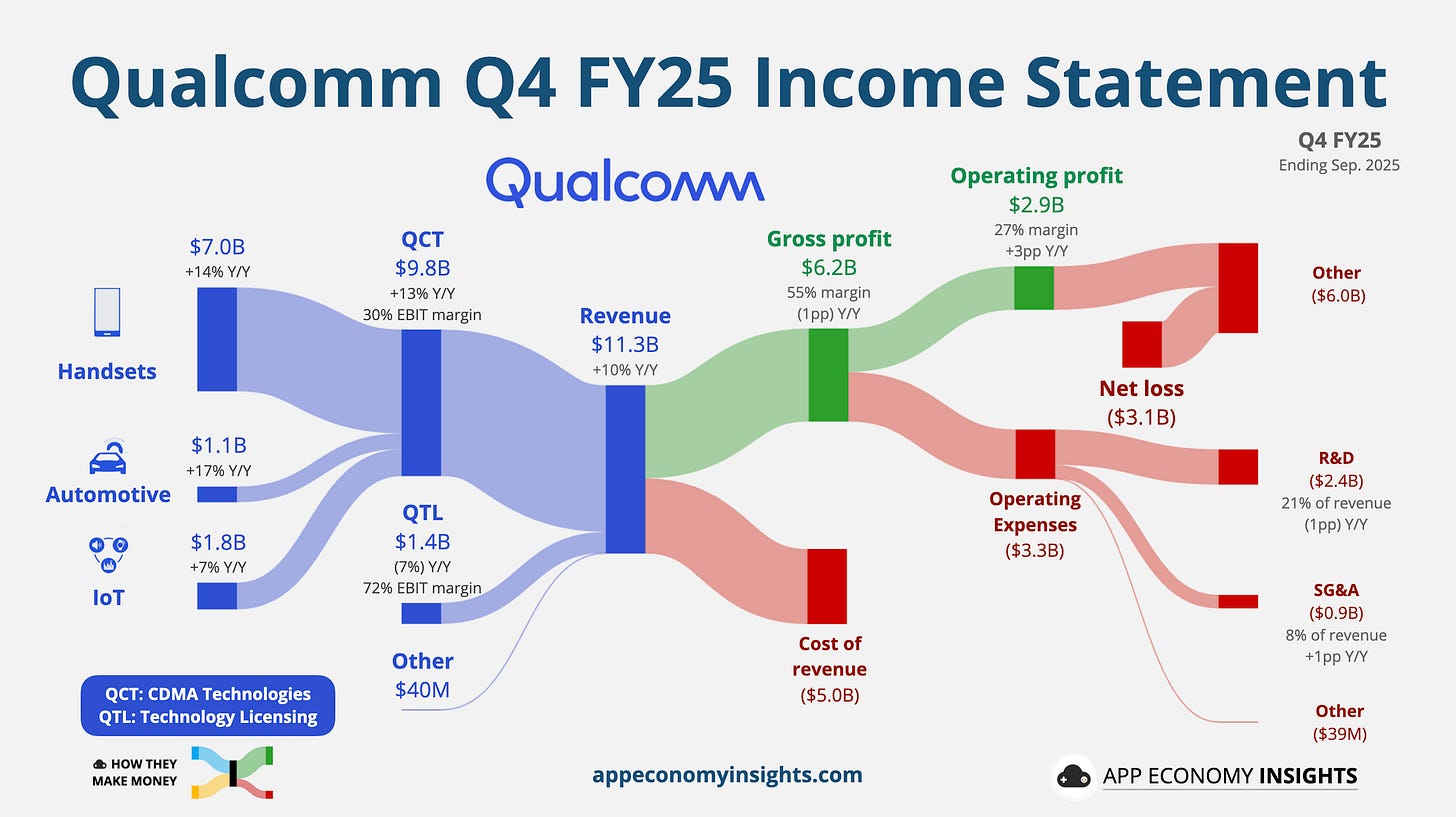

Qualcomm’s fiscal Q4 (September quarter) revenue rose 10% Y/Y to $11.3 billion ($510 million beat), with non-GAAP EPS of $3.00 ($0.13 beat). The results were driven by a 13% Y/Y growth in the QCT segment to $9.8 billion.

Handsets revenue was the standout, jumping 14% Y/Y to $7.0 billion, signaling strong demand in the premium Android tier, particularly from Samsung. Automotive revenue hit a record $1.1 billion (+17% Y/Y), and IoT grew 7% to $1.07 billion. Licensing (QTL) revenue fell 7% Y/Y to $1.4 billion.

Despite a $5.7 billion non-cash one-off charge related to a US tax bill, the company generated record free cash flow of $12.8 billion for the full fiscal year and returned $3.4 billion to shareholders in the quarter.

Management issued a blockbuster Q1 FY26 forecast, guiding revenue to $11.8–$12.6 billion and non-GAAP EPS to $3.30–$3.50, both well above consensus. The company expects record QCT Handsets revenue in Q1, driven by new Snapdragon flagship launches. CEO Cristiano Amon highlighted momentum in AI PCs (150+ designs in pipeline), automated driving, and an accelerating push into the AI data center market, with a ramp now expected in FY27.