🪙 Circle: Stablecoin Fever

First earnings test after a red-hot IPO

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Stablecoin fever is real.

Circle’s splashy June debut turned into a rocket ride, fueled by USDC momentum and fresh stablecoin rules from the Genius Act. Today brings the first real scoreboard: Circle’s first earnings as a public company. After a 5× run from the IPO price, this is the market’s first test of the story.

Also in today’s roundup: visuals on Nintendo’s record Switch 2 launch, Sea’s profitable growth, On’s DTC mix, and Monday.com’s stumble.

Today at a glance:

🍄 Nintendo: Switch 2 Off to the Races?

🌊 Sea: Scaling Profitably

🪙 Circle: Stablecoin Tailwinds

👟 On: Premium Momentum

📆 Monday.com: Conservative Guide

1. 🍄 Nintendo: Switch 2 Off to the Races?

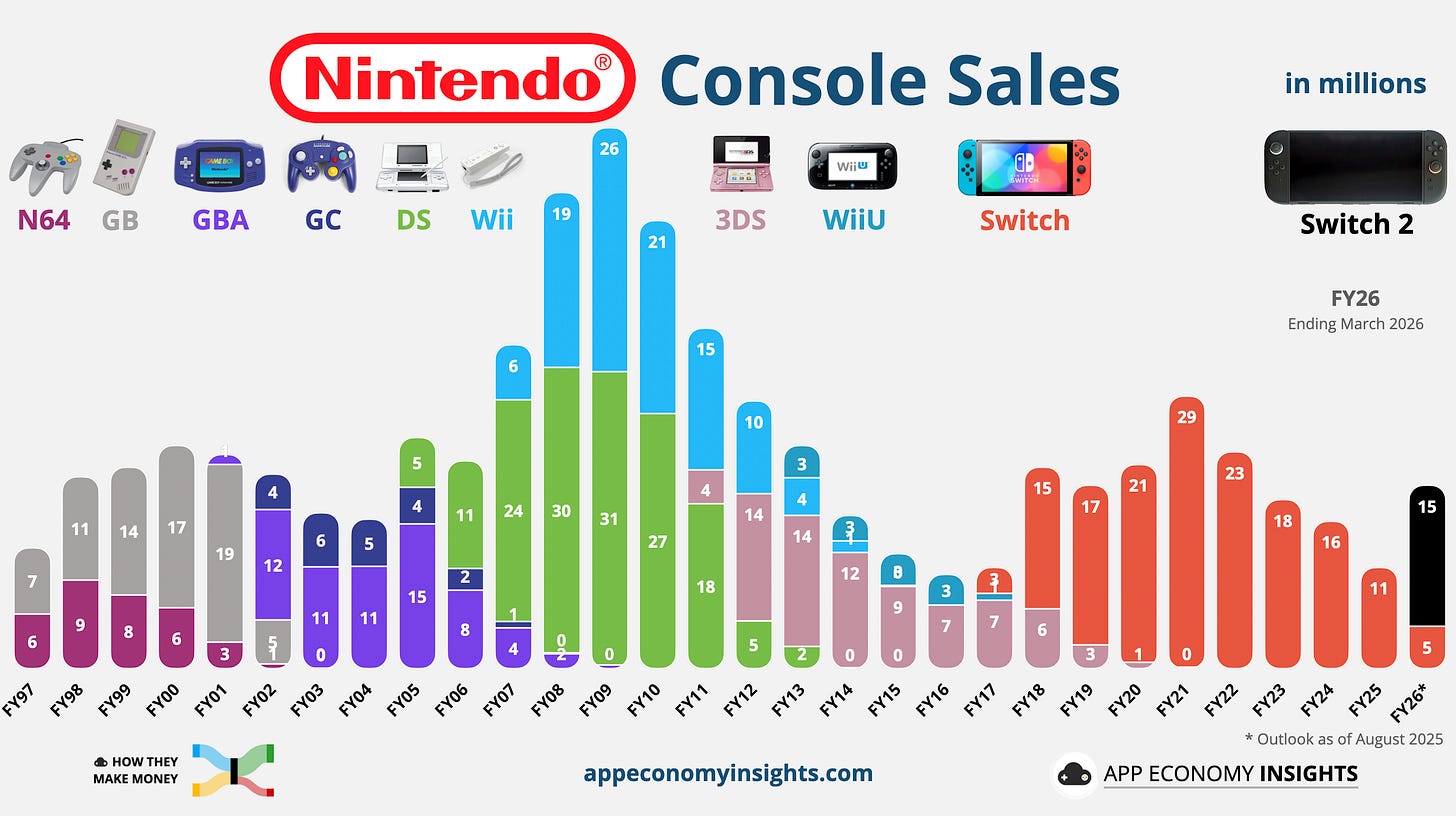

Seven weeks into launch, the Switch 2 is rewriting Nintendo’s record books. The $450 hybrid console shipped 6 million units in June (which was Q1 fiscal FY26 for Nintendo), and they were sold through by early August. That makes it the fastest-selling home console in history. For context, the original Switch moved 2.7 million units in its first month, but it would have sold far more if supply had matched demand.

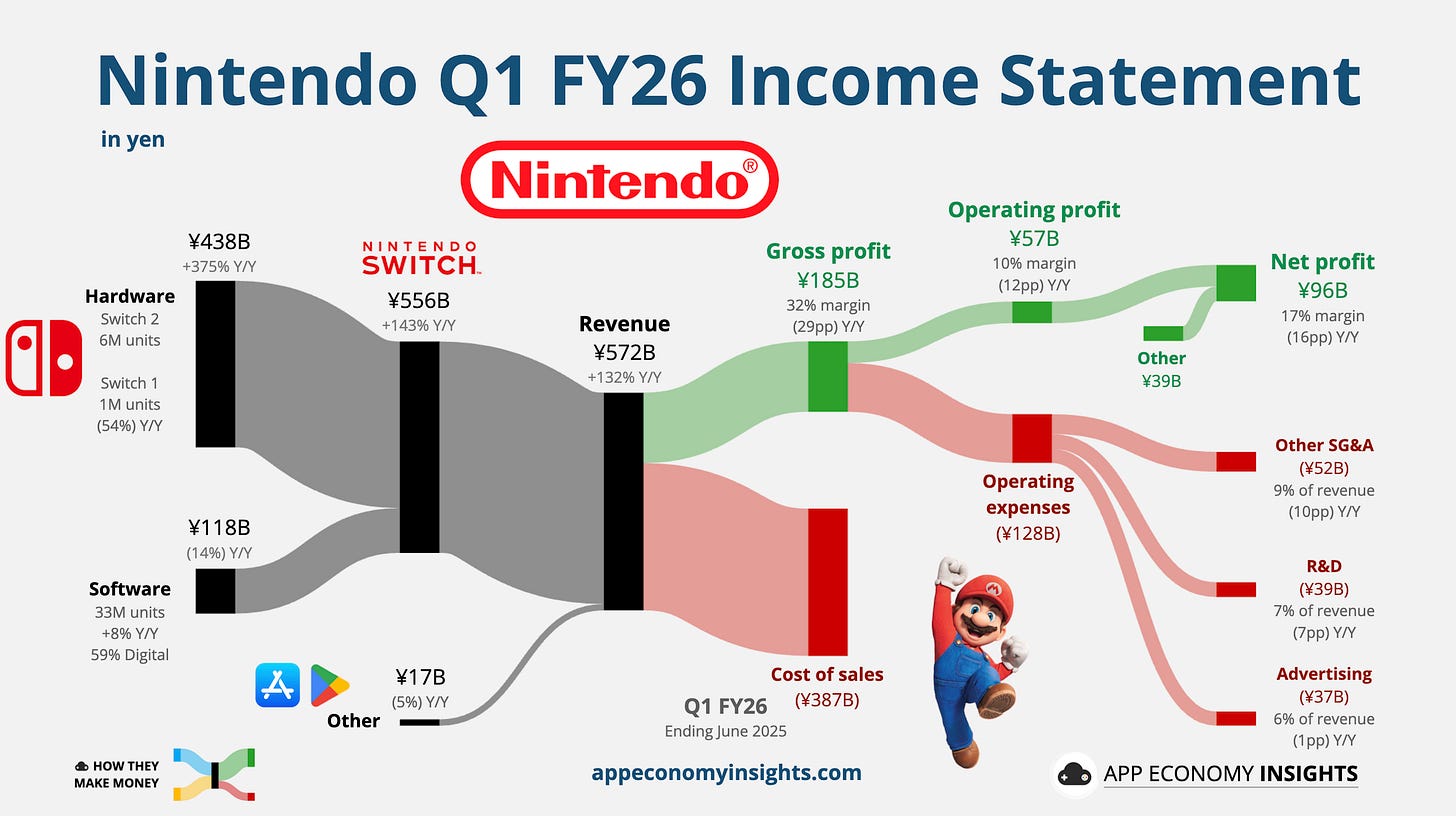

The hot start doubled Nintendo’s revenue to ¥572 billion ($3.8 billion), though operating profit was flat at ¥57 billion as marketing spend surged to promote the console and its marquee title Mario Kart World. Bundled with most hardware, the game has already sold 5.6 million units.

Nintendo left its Switch 2 FY26 forecast (12 months ending in March 2026) of 15 million units unchanged, setting up a potential underpromise-overdeliver story. Though reports of the console being easier to find on shelves may signal softening demand. The next big catalyst is Pokémon Legends: Z-A in October.

Despite a thin launch line-up, early momentum suggests Switch 2 will be “more of the same.” That’s exactly what Nintendo needs after the rough Wii-to-Wii U transition. By delivering a “better Switch” for an installed base of over 153 million, Nintendo is playing to its strengths.

Tariffs remain the wildcard. A new 20% US levy on Vietnamese-made hardware could turn the segment unprofitable, prompting talk of price hikes next fiscal year. For now, Nintendo is downplaying the impact. The focus is on keeping the Switch 2 hype rolling through the holidays.

2. 🌊 Sea: Scaling Profitably

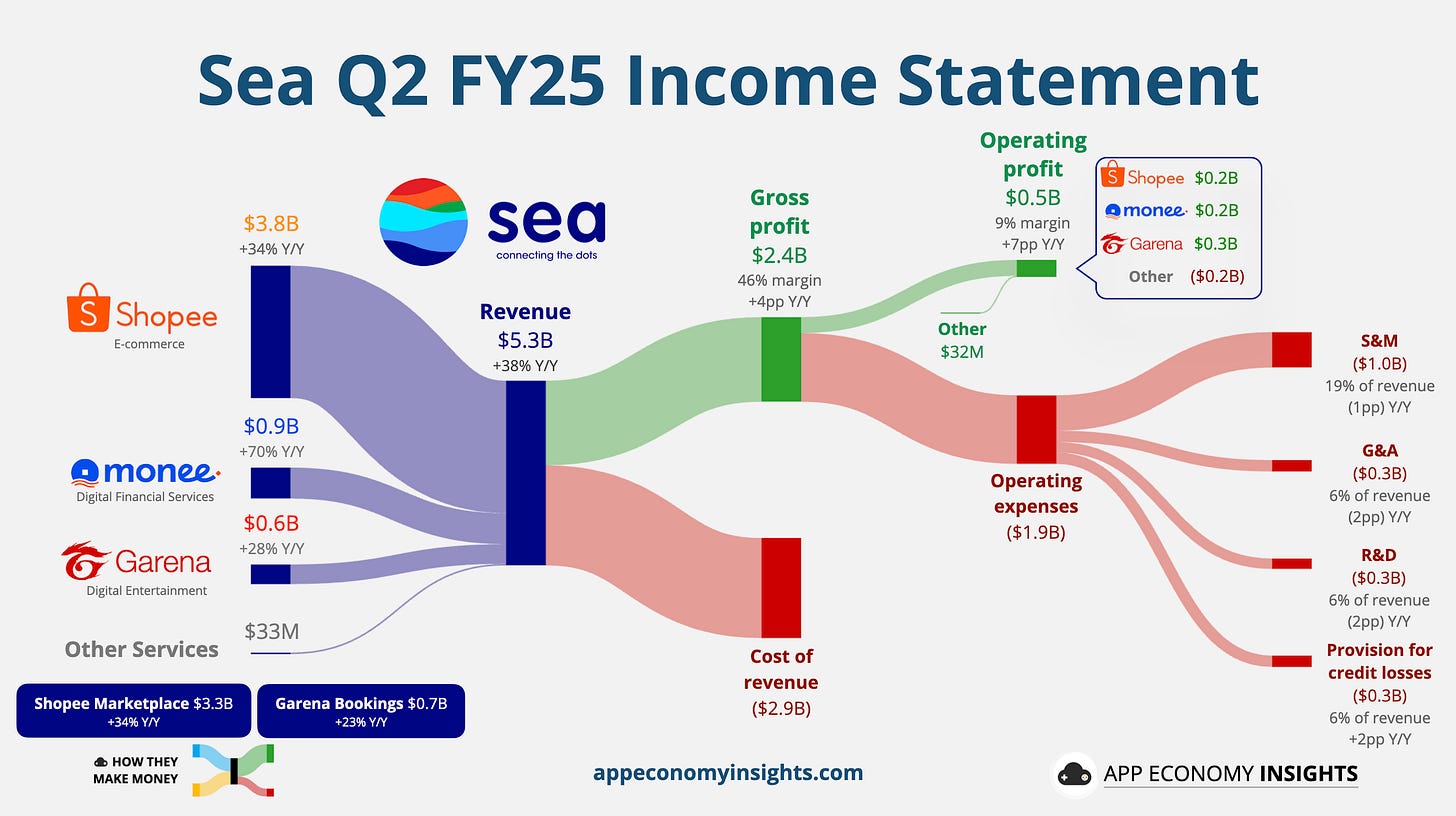

Sea’s revenue rose 38% Y/Y to $5.3 billion ($0.3 billion beat), though GAAP EPS was only $0.65 ($0.04 miss). Operating income skyrocketed to $488 million (vs. $83 million a year ago). Adjusted EBITDA surged 85% Y/Y to $829 million.

🟠 Shopee‘s GMV accelerated, up +28% Y/Y to $29.8 billion. Revenue surged even more, +34% Y/Y to $3.8 billion. Fending off TikTok Shop’s social commerce push and Lazada’s promos, Shopee’s edge is leaning on ad monetization and logistics density. In Brazil, Shopee’s flywheel keeps spinning despite Mercado Libre’s fortress. Proof that lower subsidies and faster delivery can coexist through more efficient operations.

🔵 Monee (formerly SeaMoney) revenue jumped 70% Y/Y to $883 million.

Fintech is quietly becoming the cross-sell machine: pay-at-checkout, working-capital loans for sellers, and expanding credit to prime users. Management expects the loan book to grow faster than Shopee GMV. Watch take rates and Non-Performing Loans (NPLs) to confirm quality over volume. So far, so good, with the NPL90 ratio remaining stable at 1%.🔴 Garena revenue rose 28% Y/Y to $559 million, as Bookings growth normalized to 23% Y/Y (the best indicator of future revenue growth). Free Fire was still the growth engine with over 100 million daily users. Guidance is now over 30% bookings growth in 2025. More IP collabs and new genres suggest a broader pipeline, not just a one-title bounce.

All told, Sea is scaling across e-commerce, fintech, and gaming without reigniting subsidy wars. In the coming quarters, watch TikTok Shop’s promo intensity, Brazil unit economics versus Mercado Libre, Monee’s credit quality, and Garena’s holiday slate. The through-line is growth and profits powered by ads, logistics density, and a fintech cross-sell that’s starting to look like a moat.