💰 Wall Street's Top Stocks in Q2

What funds were buying in the AI digestion phase

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Every quarter, funds managing over $100 million must disclose their portfolios, offering a rare glimpse into the minds of elite investors.

13F filings capture trades from April 1 to June 30. The backdrop: tariff whiplash, an AI digestion phase, and an IPO window reopening.

With that context, let’s see where the smart money leaned.

Today at a glance:

Hedge funds’ strategies.

Top buys and top holdings in Q2.

Case studies.

Implications for individual investors.

Before we dive in, a quick reminder: blindly copying hedge fund trades is a terrible strategy.

Investing is like shooting 3-pointers. Even Steph Curry, the greatest shooter ever, misses more than half the time. There are no sure bets, even for the pros.

Your behavior matters more than your portfolio. As Peter Lynch said, “Know what you own and why you own it.”

Conviction is what helps you hold through volatility. And conviction comes from doing your own work, not borrowing someone else’s.

As Ian Cassel puts it:

“You can borrow someone else’s stock ideas but you can’t borrow their conviction. […] Do the work so you know when to sell. Do the work so you can hold. Do the work so you can stand alone.”

Some limitations of 13F filings:

Omit short positions and cash reserves.

Offer a partial view, leaving out smaller funds.

Exclude non-US equities, bonds, and commodities.

Can be dated, given their submission 45 days post-quarter.

With all this said, let’s see what top funds were buying and holding in Q2.

1. Hedge funds’ strategies

Hedge funds are financial powerhouses known for flexible, aggressive strategies designed to beat the market.

Here’s what typically shapes their moves:

Market conditions: Long in bull markets, defensive or short in bear markets.

Sector trends: Shifts in regulation or consumer behavior can steer capital.

Company fundamentals: Strong earnings, free cash flow, and leadership matter.

Macro factors: Rates, inflation, geopolitics—all influence positioning.

Quant models: Many funds lean on proprietary algorithms to find edge.

Risk management: Diversification, hedging, and position sizing are key.

Investor sentiment: Fear and greed can create mispriced opportunities.

Still, it doesn’t always work out.

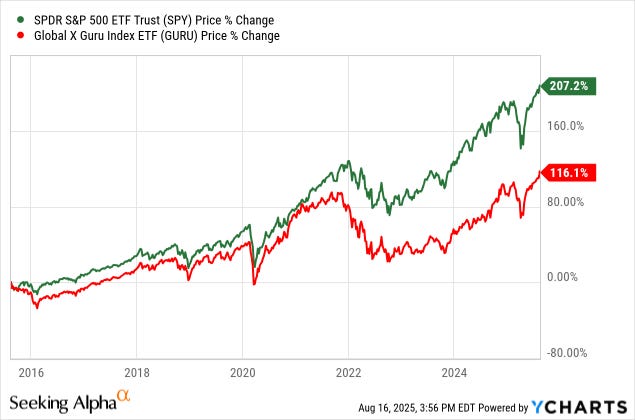

The Global X Guru ETF (GURU), built to track top hedge fund holdings, has underperformed the S&P 500 over the past decade, even before fees.

And those fees matter. The classic “2 and 20” model (2% of assets + 20% of gains) can seriously eat into returns. No wonder many individual investors are choosing simpler, lower-cost strategies.

2. Top holdings and top buys in Q2

In early 2020, just before the COVID market turmoil, I curated a list of 20 top-performing hedge funds using TipRanks data. The selection focused on alpha relative to the S&P 500, and I also included a few funds frequently featured in my social feeds and podcast rotation. It’s not perfect, but it remains a solid directional filter.

Top 5 holdings end of June 2025:

The nine stocks below represent nearly half of the top holdings listed:

🤖 AI tech stack: META, NVDA, AMD, TSM.

☁️ Hyperscalers: AMZN, GOOG, MSFT.

📦 Global commerce: MELI, SE.

Now let’s turn to the more actionable insights: