🛒 Retail: Industry Showdown

E-commerce, omnichannel, social, subscriptions and much more

Greetings from San Francisco! 👋

Welcome to the new members who have joined us this week!

Join the 33,000+ How They Make Money subscribers receiving insights on business and investing every week.

Many readers have requested industry breakdowns and comparisons.

So we launched our Industry Showdown series.

We previously covered the following:

My goal is to give you the elevator pitch on a specific category:

Who are the main participants?

How do they make money?

What are the performance indicators to follow?

Today, we’ll break down retail companies as follows:

The state of the market.

The leading players.

How they make money.

Key trends to watch.

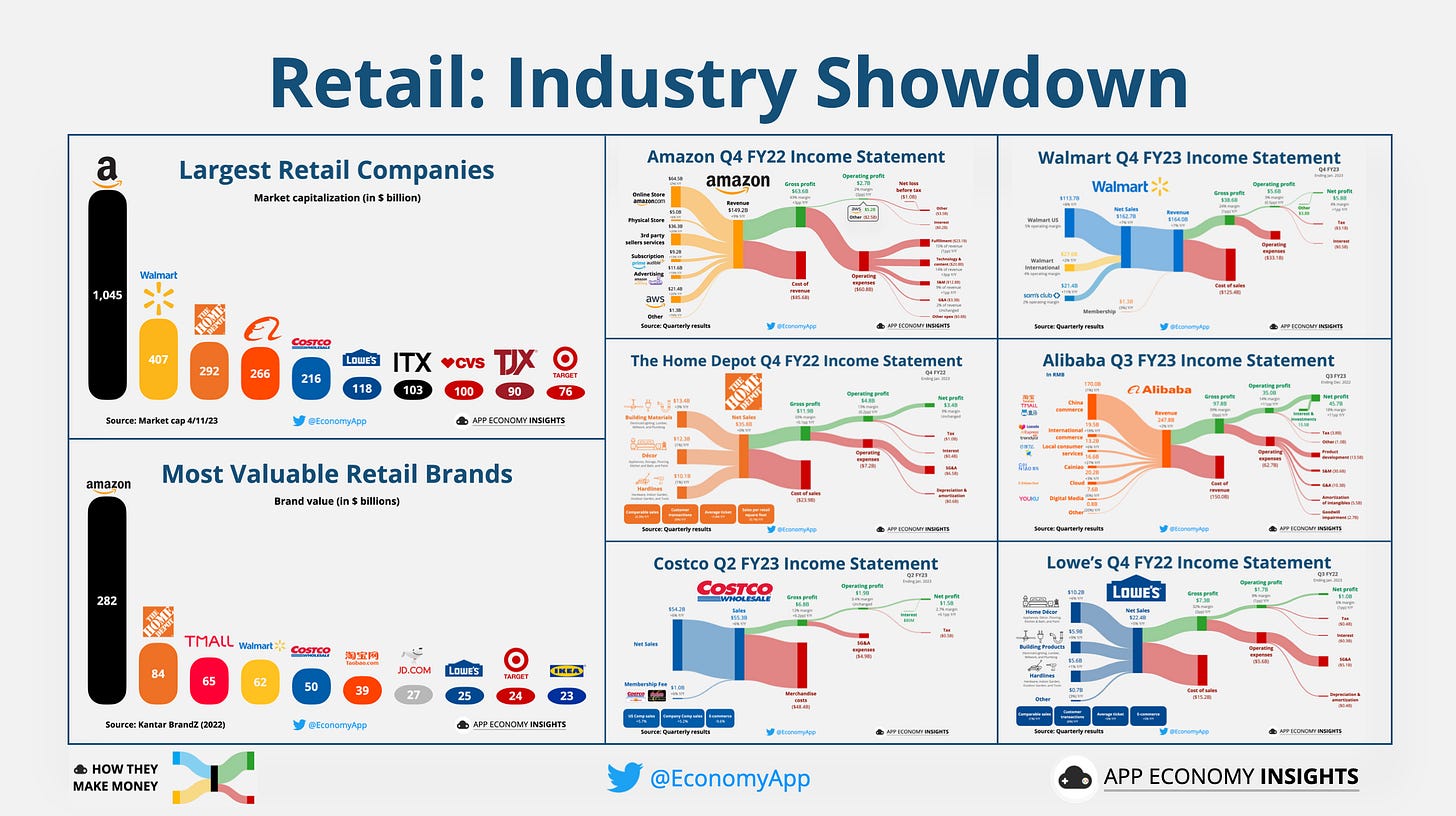

Here is a sneak peek at the report today:

At the recent Daily Journal annual meeting, Charlie Munger said:

“I regard Alibaba as one of the worst mistakes I ever made. In thinking about Alibaba, I got charmed with the idea of their position on the Chinese Internet. I didn’t stop to realize they’re still a God damn retailer. It’s going to be a competitive business, the Internet. It’s not going to be a cakewalk for everybody. […] It may be online retailing, but it’s also still retailing. And I got a little out of focus and that let me overestimate the future returns from Alibaba.”

This may come as a shock. After all, Costco is one of Charlie’s favorite investments ever. Here’s what he said in the same interview:

“The trouble with Costco is that it’s 40x earnings, but except for that it’s a perfect damn company and it has a marvelous future. It has a wonderful culture and it’s been run by wonderful people. I love everything about Costco. I’m a total addict. And I’m never gonna sell a share.”

So it’s not all doom and gloom for retail investments, as long as you keep your assumptions for future earnings in check.

The retail industry is dynamic and ever-evolving, with major players constantly adapting to shifting consumer preferences, emerging technologies, and new market trends.

In this article, we’ll explore the business models of the largest retail companies, their financial performance, and the key trends shaping the future of the retail landscape.

So let’s dive in!

1. The state of the market.

In 2023, the global retail industry is expected to be worth over $28 trillion globally (+19% Y/Y), according to Deloitte. It’s expected to grow to $33.5 trillion in 2026, at a CAGR of 6%.

The industry includes a wide variety of businesses, from small, independent retailers to large, multinational corporations.

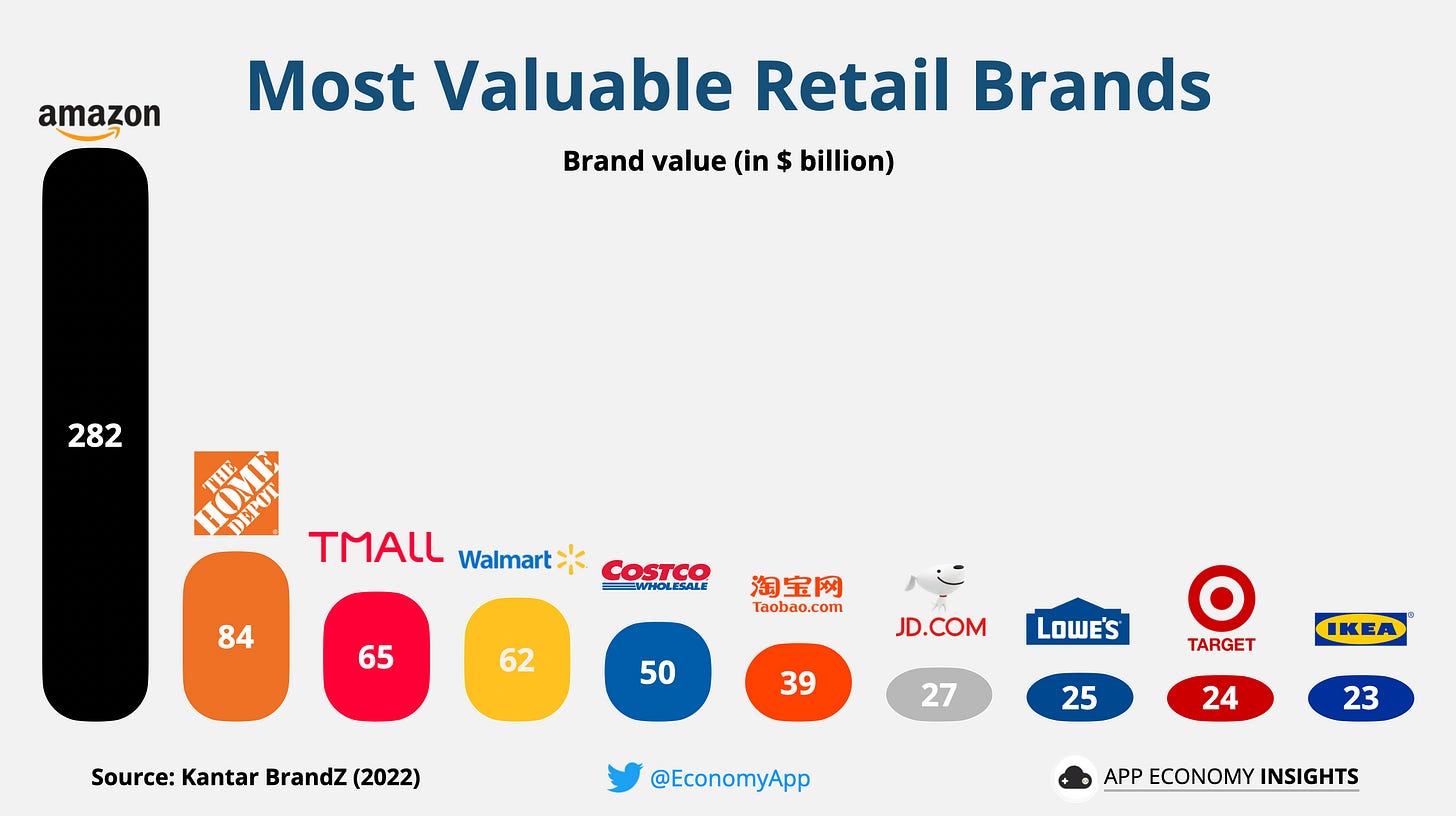

Every year, Kantar BrandZ ranks the most valuable global brands based on their financial contributions to their parent companies and consumer insights. According to the 2022 report, the most valuable retail brands were:

Amazon ($282 billion).

The Home Depot ($84 billion).

Tmall ($65 billion).

Walmart ($62 billion).

Costco ($50 billion).

Taobao ($39 billion).

JD ($27 billion).

Lowe’s (25 billion).

Target ($24 billion).

IKEA ($23 billion).

Some of the key trends that are shaping the retail industry in 2023 include:

The rise of e-commerce: Online shopping has experienced exponential growth over the past decade, further accelerated by the COVID-19 pandemic. As consumers embrace the convenience and variety offered by e-commerce, the online retail market continues to expand at an impressive rate. It’s expected to account for over 21% of global retail sales by 2023 (+4pp Y/Y), according to eMarketer.

The decline of brick-and-mortar stores: The rise of e-commerce negatively impacts brick-and-mortar stores, as more and more consumers are choosing to shop online. As a result, many retailers are closing stores or downsizing their operations, from J.C. Penney to Sears, to Kmart and Toys R Us.

Omnichannel retailing: As the line between online and offline shopping continues to blur, retailers are adopting omnichannel strategies to provide seamless, integrated experiences across multiple touchpoints. By leveraging data and technology, companies can create personalized shopping experiences, improve inventory management, and enhance customer service.

Social commerce: Consumers can browse and purchase products directly from the social media platforms they use daily, connect directly with brands, and get recommendations from friends and family. Brands can expand their reach.

AI and personalization of retail: Retailers are increasingly using technology to personalize the shopping experience for consumers. This includes using data to recommend products likely to be of interest to each customer, as well as providing customized content and offers. For example, Amazon uses ML (machine learning) to recommend products based on past purchases and browsing history.

Direct-to-consumer (DTC): Many brands bypass traditional retail channels and sell directly to consumers through their own e-commerce platforms and physical stores. This approach gives companies more control over their brand narrative, customer experience, and pricing. Examples include Warby Parker, Glossier, and Harry’s. As DTC brands continue to gain traction, traditional retailers may face increased competition and margin pressures.

Rise of experiential retail: To differentiate themselves in an increasingly crowded market, retailers create unique, immersive experiences that can’t be replicated online. This trend has given rise to experiential retail concepts, such as pop-up shops, interactive displays, and in-store events. Retailers that can successfully integrate experiential elements into their stores have the potential to drive foot traffic, increase customer engagement, and boost sales. Examples include Nike Rise, Apple Stores, and IKEA.

The focus on sustainability: Consumers are becoming more conscious of the environmental and social impact of their purchasing decisions, which is driving retailers to adopt more sustainable practices and demonstrate their commitment to social responsibility. Retailers that can effectively communicate their sustainability initiatives and social values may benefit from increased customer loyalty and brand differentiation.

2. The leading players.

The retail industry is a complex and diverse ecosystem encompassing many business models and product categories. Here are the top 10 largest public retail companies.

So let’s drill down to the top companies in the space, focusing on their market share, business model, competitive advantages, and recent developments.

By understanding the strengths and weaknesses of these companies, investors can make more informed decisions about where to allocate their capital.