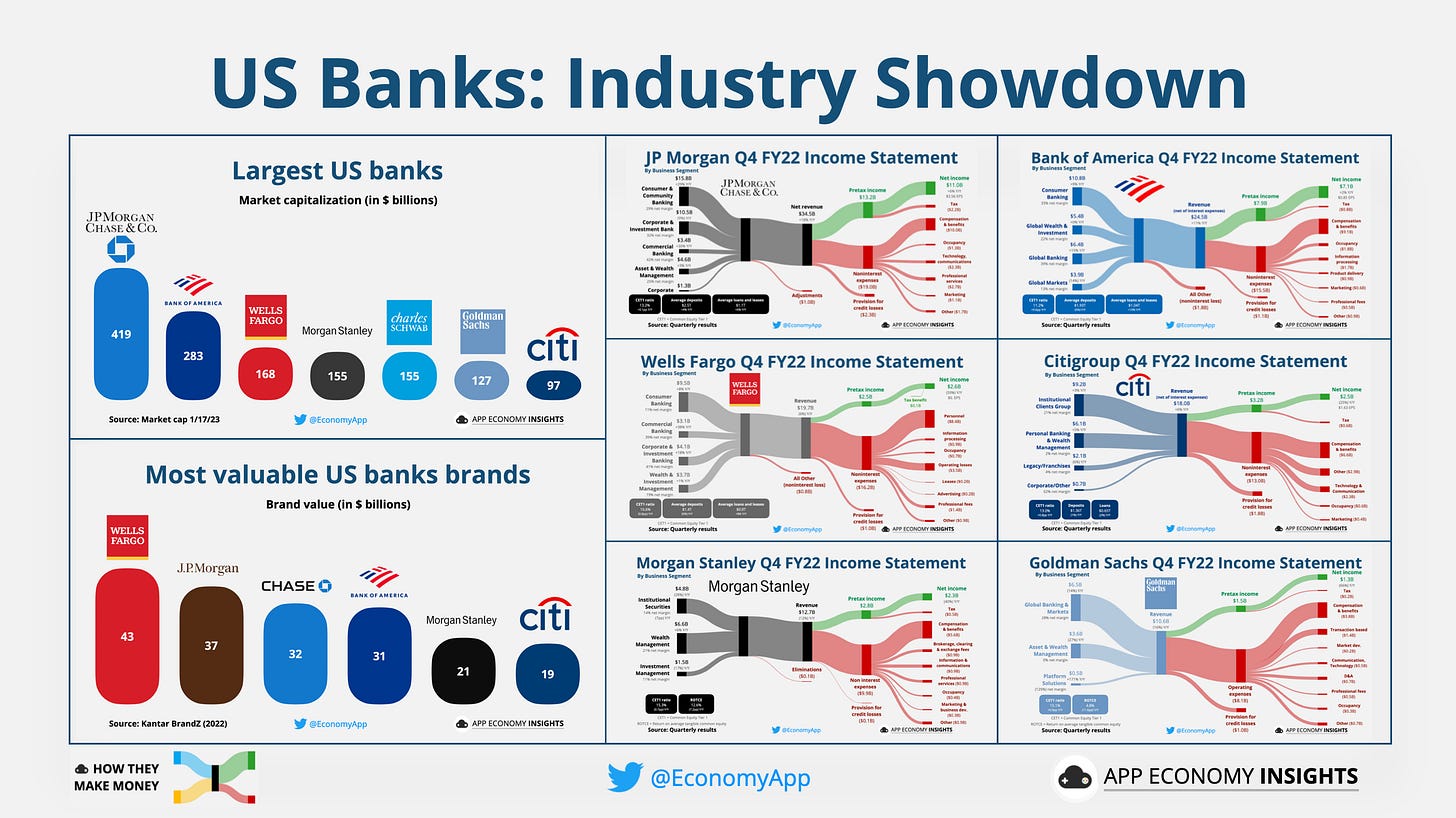

🏦 US Banks: Industry Showdown

What we learned from the big banks earnings and what to watch

Hello there! 👋

Greetings from San Francisco!

Welcome to the new members who have joined us this week!

Join the fast-growing How They Make Money community to receive weekly insights on business and investing.

Many readers have requested industry breakdowns and comparisons.

So we recently started our Industry Showdown series.

Today, we turn to US Banks. They just reported their Q4 FY22 performance. We share what we learned from the reports and what to watch.

Here is a sneak peek at the report today:

My goal is to give you the elevator pitch on a specific category:

Who are the main participants?

How do they make money?

What are the performance indicators to follow?

Today, we’ll break down US banks as follows:

The state of the market.

The leading players.

How they make money.

Key trends to watch.

1. The state of the market.

The banking industry has many different segments and sub-segments, each with its unique characteristics:

Consumer banking: Services to individuals and small businesses, such as savings and checking accounts, mortgages, loans, and credit cards.

Commercial banking: Services to larger businesses and corporations, such as loans, lines of credit, and trade financing.

Investment banking includes underwriting, issuing and selling securities, and providing financial advice to companies and governments.

Private banking: Services to high net-worth individuals, such as wealth management and investment advice.

Central banking: A country's central bank is responsible for implementing monetary policy, regulating the banking system, and ensuring financial stability.

Online banking: Banks that operate primarily online and offer banking services through the internet.

Community banking: Banks that focus on serving the needs of a specific community, usually a local area.

These are just a few examples. These sub-segments help us understand the performance of the big bank as we look at their revenue by segment/division (more on that in a minute).

The big US banks just reported their earnings.

Banks are called bellwethers (leading indicators suggesting a larger economic trend). This is because they are intertwined in many aspects of the economy, such as consumer spending and business loans. Moreover, it gives them a unique foresight. So when the CEOs of the biggest banks have the same outlook, you want to pay attention.

While the banks benefit from a higher rate environment, they believe we are facing an economic downturn in the year ahead, notably an uptick in unemployment closer to 5% (compared to 3.5% in December 2022).

JP Morgan Chase CEO Jamie Dimon explained:

“We still do not know the ultimate effect of the headwinds coming from geopolitical tensions including the war in Ukraine, the vulnerable state of energy and food supplies, persistent inflation that is eroding purchasing power and has pushed interest rates higher, and the unprecedented quantitative tightening.”

Quantitative tightening is when a central bank reduces the amount of money in the economy by selling securities and decreasing the amount of money it lends to banks.

Bank of America CEO Brian Moynihan said:

“Our baseline scenario contemplates a mild recession. ... But we also add to that a downside scenario, and what this results in is 95% of our reserve methodology is weighted toward a recessionary environment in 2023.”

We’ll cover in a second how the anticipation of a recession impacts these companies’ financials.

2. The leading players.

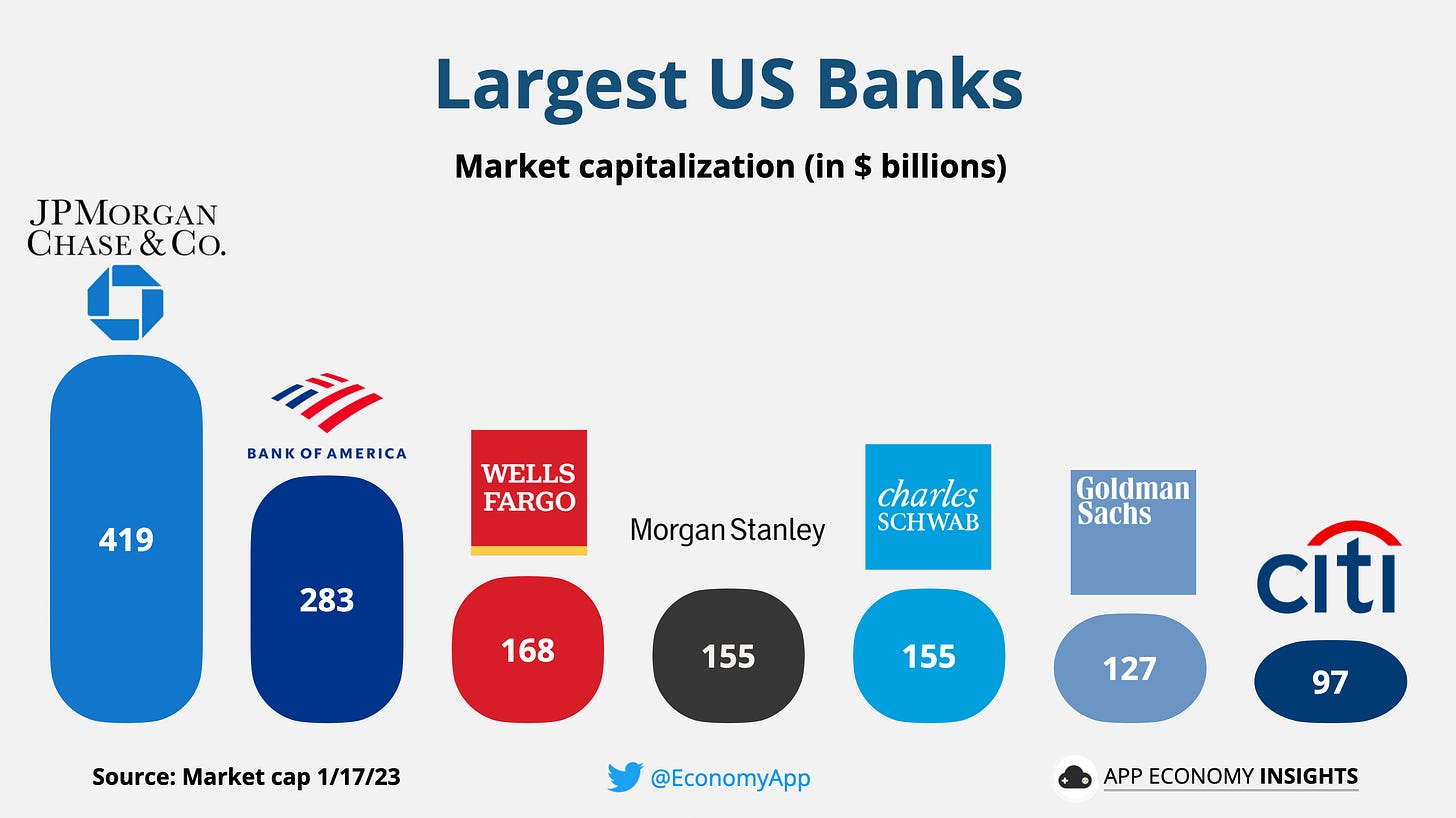

The seven largest US banks by market cap (as of January 2023) are:

JP Morgan Chase (JPM): $419 billion market cap.

Bank of America (BAC): $283 billion.

Wells Fargo (WFC): $168 billion.

Morgan Stanley (MS): $155 billion.

Charles Schwab (SCHW): $155 billion.

Goldman Sachs (GS): $127 billion.

Citigroup (C): $97 billion.

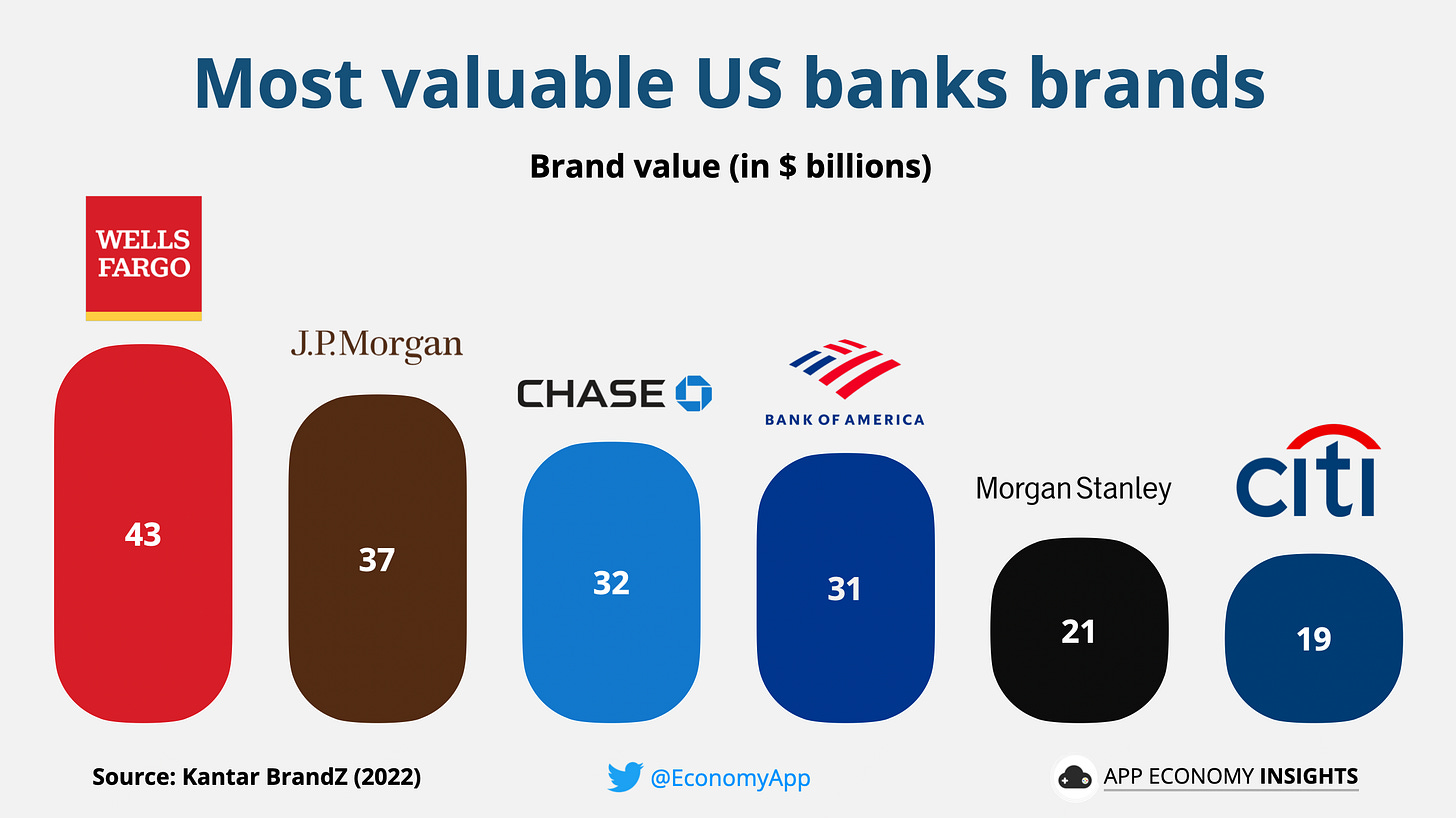

Every year, Kantar BrandZ ranks the most valuable global brands based on their financial contributions to their parent companies and consumer insights. According to the 2022 report, the most valuable US banks brands were:

Wells Fargo ($43 billion).

JP Morgan ($37 billion).

Chase ($32 million).

Bank of America ($31 billion).

Morgan Stanley ($21 billion).

Citigroup ($19 billion).

Two of these brands, JP Morgan and Chase, are under the same company. Note that a company like Bank of America owns other brands like Merrill Lynch.

These six brands are in the top 15 banks globally. Other large global banks at the top include:

RBC and TD (Canada)

ICBC, China Merchants Bank, China Construction Bank (China)

HSBC (United Kingdom).

3. How they make money.

Banks generate revenue in a variety of ways, but the main types of revenue are:

Interest income: Banks make money by charging interest on loans they make to individuals and businesses. They also earn interest on deposits that customers make with them.

Fees and commissions: Banks charge various fees and commissions for account maintenance, wire transfers, and ATM usage.

Trading and investment income: Banks make money by trading securities such as stocks, bonds, and derivatives, and by investing in other assets such as real estate and private equity.

Other income: Banks may generate additional income through various other activities such as credit card issuing, insurance, and wealth management.

It is worth noting that the mix of these revenue streams can vary depending on the bank's business model and strategy. Some banks, for example, may rely more heavily on interest income from loans, while others may generate more revenue from fees and investment activities.

Several performance indicators are commonly used to measure the financial performance of banks. Here are a few key ones: