✨ Luxury Goods: Industry Showdown

Learn the key players and trends to watch in a few minutes

Hello there! 👋

Greetings from San Francisco, and Happy New Year!

Welcome to the new members who have joined us this week!

Join the fast-growing How They Make Money community to receive weekly insights on business and investing.

Many readers have requested industry breakdowns and comparisons.

So I’m starting 2023 with a new series.

I call it Industry Showdown.

Here is a sneak peek at the report today:

My goal is to give you the elevator pitch on a specific category:

How big is the industry?

Who are the main participants?

How do they make money?

What are the performance indicators to follow?

I visited my family in France for the holidays and spent a few days in Paris. During my trip, I was bombarded by luxury goods ads. Our recent post on LVMH, the world's largest luxury company, proved very popular. So I figured this category could be a great place to start.

Today, we’ll break down the personal luxury goods category as follows:

Market size and expectations.

The leading players.

How they make money.

Key trends to watch.

1. Market size and expectations.

What exactly qualifies as luxury goods, you may ask?

Luxury goods are defined as non-essential but desirable products. They are typically associated with wealth and status.

In short, they include expensive things, such as designer handbags, jewelry, makeup, fine food and spirits, you name it. So if it’s nice and you can’t afford it, it’s probably a luxury item.

Luxury items can include fancy cars and boats or even services like private full-time chefs or chauffeurs.

Defining what qualifies as a luxury item is somewhat subjective and depends on a person’s financial circumstances. One person’s trash is another person’s treasure.

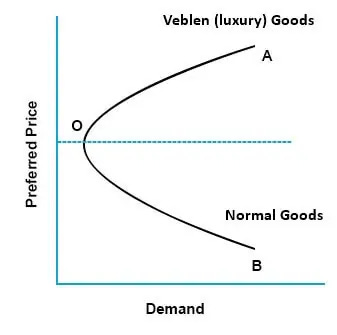

A great paradox of the luxury industry is that it includes Veblen goods (named after Thorstein Veblen, who introduced the concept of conspicuous consumption).

So what is a Veblen good? It’s an item for which demand increases as the price increases. Why? Because consumers see it as a status symbol.

Veblen goods challenge the fundamental law of demand. Most goods see a downward slope as the price increases. A Veblen good would lose its exclusive appeal if its price dropped. For highly coveted items, the higher the price, the less likely other consumers can afford them, reinforcing their perceived value for the affluent consumer who buys them.

Veblen classified two consumption behavior categories:

Invidious comparison: A person’s desire not to be perceived as lower-class (status sought by higher-income groups).

Pecuniary emulation: A person’s desire to be perceived as upper-class (status sought by lower or middle-income groups).

The luxury goods industry is highly competitive, and companies that succeed in this space often do so by creating unique, high-quality products that appeal to discerning consumers. Therefore, marketing and branding are critical as companies strive to create a strong luxury image and build a loyal customer base.

There are also many different business models within the luxury goods industry, including manufacturer-owned stores, franchises, and licensing agreements.

Important note: when evaluating the industry, most market intelligence firms focus on personal luxury goods (excluding luxury vehicles, services, or food and beverage).

According to Bain & Company, the global personal luxury goods market reached $290 billion in 2021. It was a V-shaped recovery after a Covid-induced collapse in 2020. 2022 is expected to show a 15% year-over-year growth fx neutral, a sign of a continued rebound. However, things could get more complicated in 2023 if we enter a global recession.

Based on an EMR forecast, the industry is expected to grow at a CAGR (compound annual growth rate) of 5% in the next five years. So it’s a relatively slow growth category, but growing nonetheless.

The market is usually segmented by product:

Watches and Jewelry.

Perfumes and Cosmetics.

Clothing.

Bags/Purses.

Others.

In addition, you’ll often hear about segmentation by distribution channel:

Offline: in-store purchase.

Online: e-commerce.

Offline is by far the leading distribution channel. It’s a critical segment for the luxury goods industry because the decision-making is based on touching and feeling the product. In addition, the in-store experience allows for more opportunities to upsell the customer. Offline sales still make up 78% of luxury sales in the US and China, based on eMarketer estimates. But based on projections by Luxe Digital, offline is expected to decline to 70% of luxury retail sales by 2025 as the industry embraces the rise of the app economy.

The Americas became the largest region in 2021, with 31% of the luxury market. However, China represents a growing share and is expected to be the leading region by 2025.

2. The leading players.

Every year, Kantar BrandZ ranks the most valuable global brands based on their financial contributions to their parent companies and consumer insights. According to the 2022 report, the most valuable luxury brands were:

Louis Vuitton ($124 billion).

Hermès ($80 billion).

Chanel ($53 million).

Gucci ($38 billion).

Dior ($11 billion).

Cartier ($10 billion).

Rolex ($9 billion).

Saint Laurent / YSL ($7 billion).

Tiffany & Co. ($7 billion).

Prada ($6 billion).

Some of these brands are consolidated by the same company. For example, French conglomerate LVMH owns Louis Vuitton, Dior, and Tiffany & Co (acquired in 2020 for $15.8 billion).

Shifting to the actual public companies behind these brands, the five largest by market cap (as of January 2023) are:

LVMH 🇫🇷: $382 billion market cap.

L’Oréal 🇫🇷: $196 billion.

Hermès 🇫🇷: $170 billion.

Kering 🇫🇷: $74 billion.

Richemont 🇨🇭: $64 billion.

These companies are gigantic. For context, Nike, the most valuable clothing and accessories brand outside of Europe, is worth $183 billion.

There are other smaller players outside of Europe, such as Titan Company (India) and Chow Tai Fook (China). Other smaller European companies include Prada (Italy) and Burberry (United Kingdom). In addition, companies like Chanel or Rolex are privately owned.

L’Oréal doesn’t always make the cut in rankings of luxury companies because some of its consumer products might not qualify as luxury items. However, L’Oréal is a luxury giant. In the first half of 2022, it made more revenue from its luxury division (€6.8 billion) than Hermès across all of its products (€5.5 billion) — more on that in a second.

3. How they make money.

Let’s use our usual income statement charts to break down the top five businesses in the industry and find out how they make money.