🏝️ Online Travel: Industry Showdown

From hybrid work to AI, what are the trends not to miss in a post-pandemic world

Greetings from San Francisco! 👋

Welcome to the new members who have joined us this week!

Join the 32,000+ How They Make Money subscribers receiving insights on business and investing every week.

Many readers have requested industry breakdowns and comparisons.

So we launched our Industry Showdown series.

We previously covered US banks, Luxury goods, and Streaming platforms.

Here is a sneak peek at the report today:

My goal is to give you the elevator pitch on a specific category:

Who are the main participants?

How do they make money?

What are the performance indicators to follow?

Today, we’ll break down online travel companies as follows:

The state of the market.

The leading players.

How they make money.

Key trends to watch.

1. The state of the market.

The online travel industry is poised for growth as the world continues to recover from the pandemic. According to Statista, the global online travel market was $475 billion in 2022. And it’s expected to grow at a 15% CAGR in the next 8 years based on the latest research from Spherical Insights.

The online travel industry has undergone a significant transformation in recent years, driven by advancements in technology, evolving consumer behavior, and, more recently, the impact of COVID-19. The industry is poised for a strong rebound, with travelers eager to explore new destinations and experiences.

During the pandemic, the online travel industry faced unprecedented challenges, with global travel restrictions, lockdowns, and social distancing measures leading to a sharp decline in bookings. However, the crisis also accelerated the adoption of digital services, as travelers turned to online platforms for information, flexibility, and safety assurances.

Here are the main categories you should know:

Online Travel Agencies (OTAs): These platforms allow users to book flights, hotels, car rentals, and vacation packages. Some of the major players include Booking.com and Expedia. There are two core OTAs business models:

Agency model: The customer pays the final price to the hotel (either at the time of the booking or at the check-in). After the check-out month, the hotel pays the agreed commission to the OTA.

Merchant model: The customer pays the final price to the OTA (not to the hotel). After the check-in date, the OTA pays the net price (final price less agreed commission) to the hotel.

Metasearch Engines: These websites aggregate information from multiple OTAs and other travel sources, allowing users to compare prices and book directly with suppliers. Examples include Kayak, Skyscanner, and Google Flights.

Home Sharing Platforms: These services enable individuals to rent out their homes or rooms to travelers, offering an alternative to traditional hotels. Examples include Airbnb, Expedia-owned Vrbo, and HomeAway.

Travel Planning and Review Websites: These platforms provide users with information, reviews, and recommendations to help them plan their trips. Examples include TripAdvisor, Lonely Planet, and Fodor's Travel.

Niche Travel Services: These specialized platforms cater to traveler needs or preferences, such as luxury travel, eco-tourism, or adventure travel. Examples include G Adventures, Black Tomato, and Scott Dunn.

As we recently touched on in our article about the art of spotting economic moats, assessing the growth of an industry is not enough to find winners.

Instead, Buffett explained that it requires determining the competitive advantage of a specific business within that industry, and the durability of that advantage.

So let’s drill down to these companies' market share, business models, competitive advantages, and recent developments.

2. The leading players.

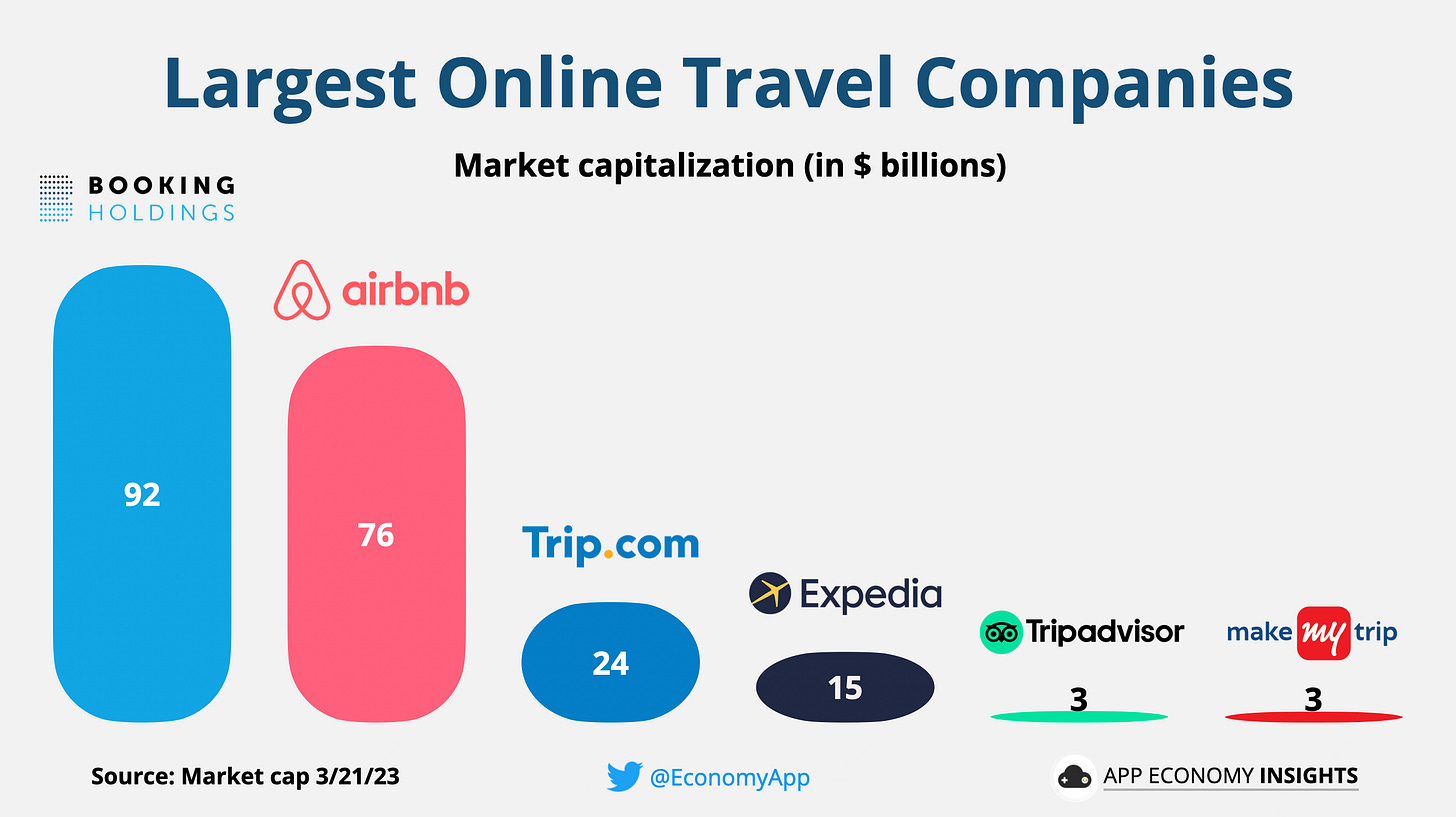

Some of the top public companies in the online travel industry include:

Booking Holdings (BKNG):

Market share: Booking Holdings, which owns Booking.com, Priceline, Agoda, and Kayak, among others, is the largest player in the online travel industry, with $121 billion in gross bookings in 2022 (about 25% market share). Booking has 28 million reported listings worldwide. Its initial success is often attributed to its agency model and aggressive M&A strategy.