📊 PRO: This Week in Visuals

CSCO SHOP AMAT AZN KO MCD TMUS ANET APP NTES HOOD ABNB MAR HLT HERMES L'OREAL KERING RACE F NET DDOG COIN ADYEN FISV KHC EXPE QSR TWLO TOST Z DKNG PINS HUBS LYFT KVYO MNDY

Welcome to the Saturday PRO edition of How They Make Money.

Over 290,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO members get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🌐 Cisco: AI Boom & Margin Squeeze

🛍️ Shopify: The Cost of Agentic Growth

⚙️ Applied Materials: AI Ramp Begins

🧬 AstraZeneca: Oncology Drives the Beat

🥤 Coca-Cola: Rare Miss & A New Boss

🍟 McDonald’s: The Grinch Wins Christmas

📶 T-Mobile US: Guidance to the Rescue

🌐 Arista Networks: AI Validation

📱 AppLovin: The Great Disconnect

🎮 NetEase: Hitting the Brakes

🪶 Robinhood: The Crypto Fade

🛖 Airbnb: Growth Acceleration

✈️ Expedia: B2B Powerhouse

🏨 Marriott: Credit Card Kicker

🏨 Hilton: Guidance Gloom

👜 Hermès: The Untouchable

💄 L'Oréal: Luxe Drag But Derma Shine

🧣 Kering: Not as Bad as Feared

🏎️ Ferrari: Luxury of Less

🚙 Ford: Tariff Shock

☁️ Cloudflare: The Agentic Internet

🐶 Datadog: Best in Show

📈 Coinbase: Cyclical Reset

💳 Adyen: Growth Reset

💳 Fiserv: Hard Reset

🌭 Kraft Heinz: The Great Pause

🍔 RBI: Burger King Remodels Slow

💬 Twilio: AI Infrastructure Pivot

🍞 Toast: Profitable Pivot

🏠 Zillow: Rentals Boom But Profit Gloom

👑 DraftKings: Prediction Gamble

📌 Pinterest: Exogenous Shock

📢 HubSpot: Agentic Pivot Pays Off

🚘 Lyft: Headline Shock

🏴 Klaviyo: Autonomous Growth

📆 Monday.com: Guidance Trap

1. 🌐 Cisco: AI Boom & Margin Squeeze

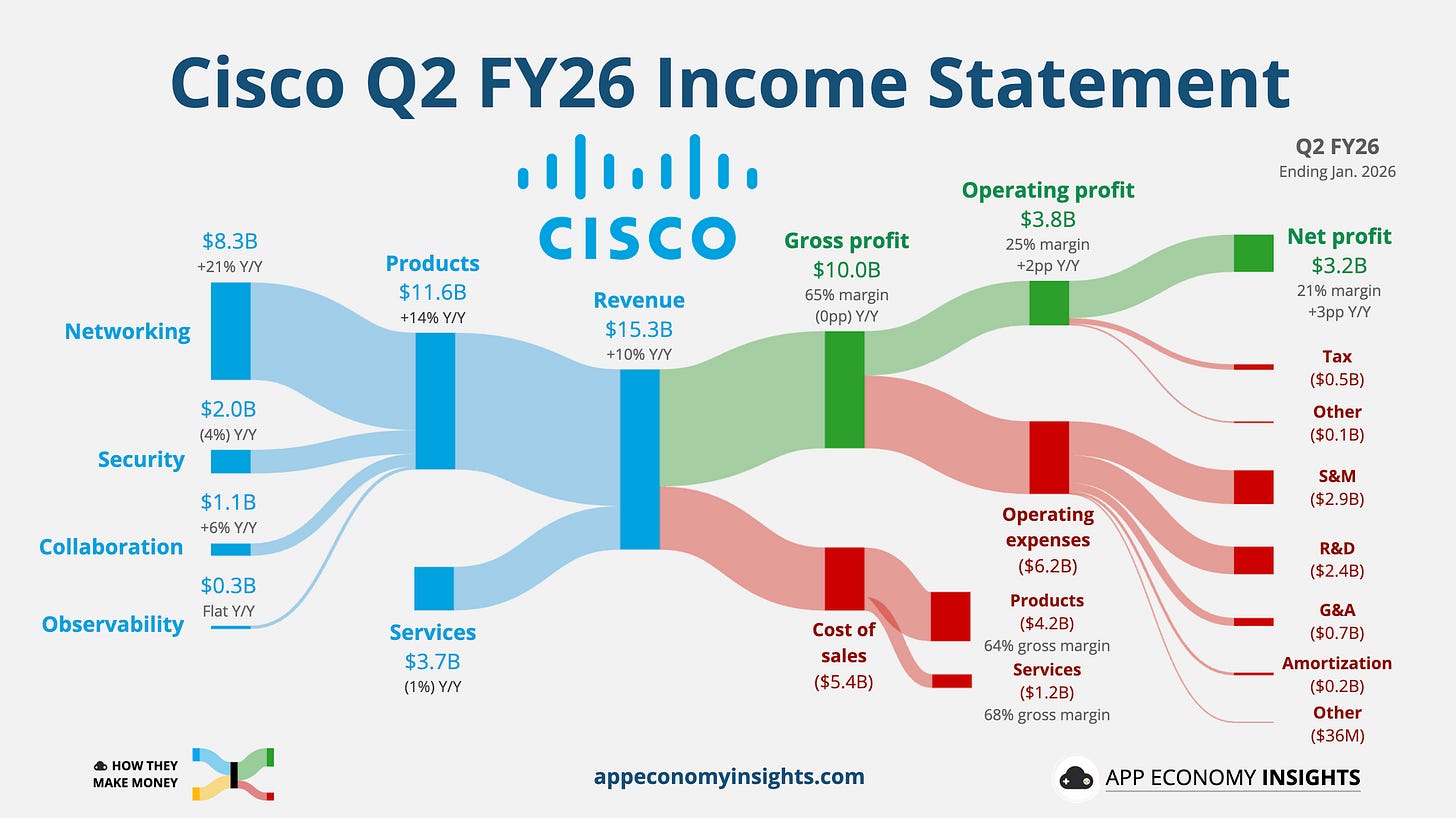

Cisco’s Q2 FY26 (January quarter) revenue accelerated to 10% Y/Y growth, hitting $15.3 billion ($230 million beat), while adjusted EPS came in at $1.04 ($0.02 beat).

The AI infrastructure momentum continued. AI orders from hyperscalers jumped to $2.1 billion in the quarter (up from $1.3 billion in Q1). Consequently, management raised its FY26 AI orders outlook to exceed $5 billion, driven by demand for its Silicon One chips and 800G optical pluggables.

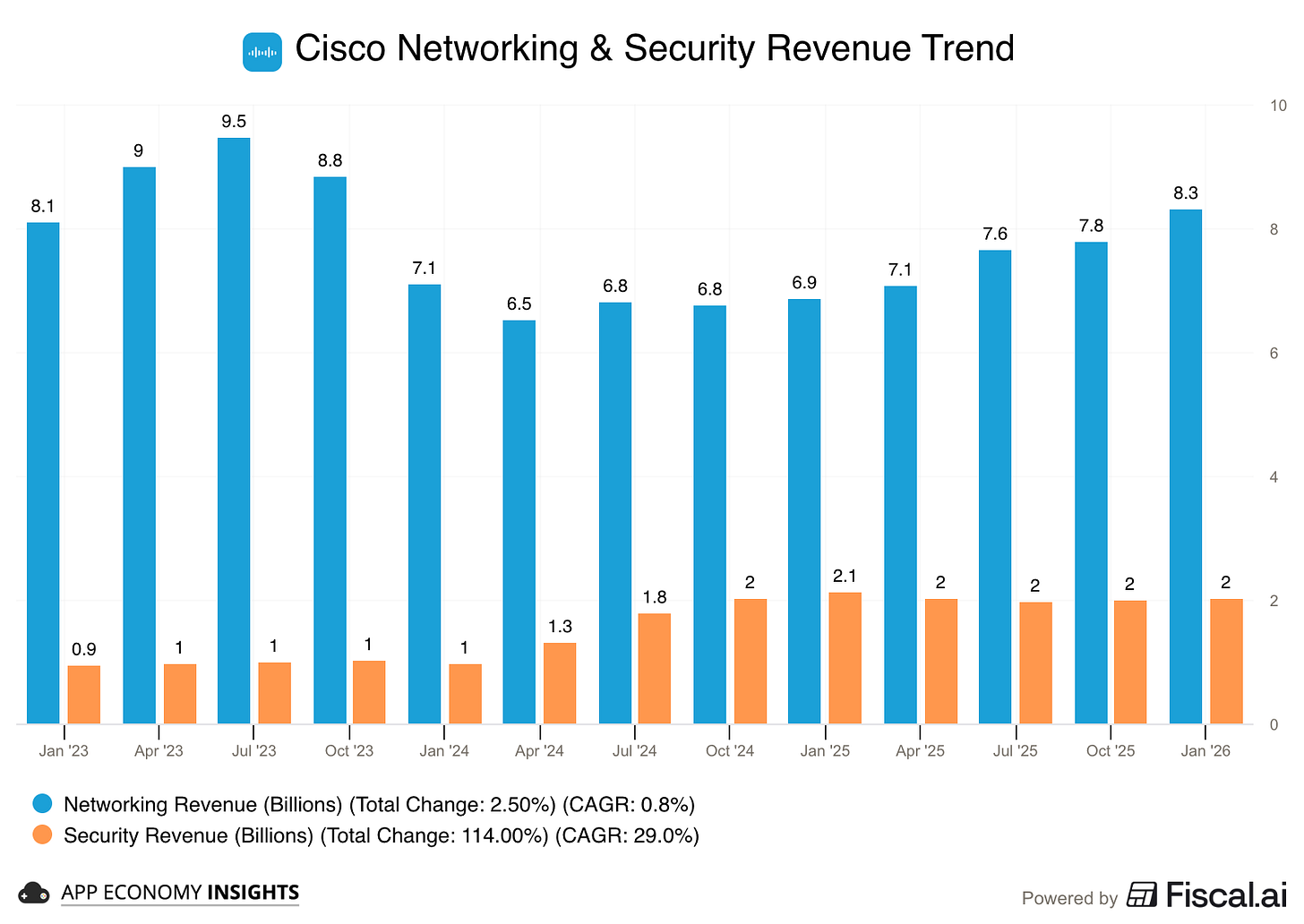

Networking revenue surged 21% Y/Y, fueled by the hyperscaler spend and a campus refresh cycle. However, Security revenue declined 4%, continuing to lag as the portfolio transitions and integrates Splunk (acquired in March 2024).

Despite the top-line beat and accelerating AI story, shares fell post-earnings due to a disappointing margin outlook. Management guided Q3 adjusted gross margins to ~66% (well below the 68.2% consensus), citing surging memory chip prices that are inflating costs faster than Cisco can raise prices.

Cisco raised its full-year FY26 guidance again, now forecasting revenue of $61.2–$61.7 billion (up from $60.2–$61.0 billion). The company also raised its quarterly dividend to $0.42 per share. While the AI growth thesis is playing out faster than expected, investors are now grappling with the near-term profitability tax of that growth.

2. 🛍️ Shopify: The Cost of Agentic Growth

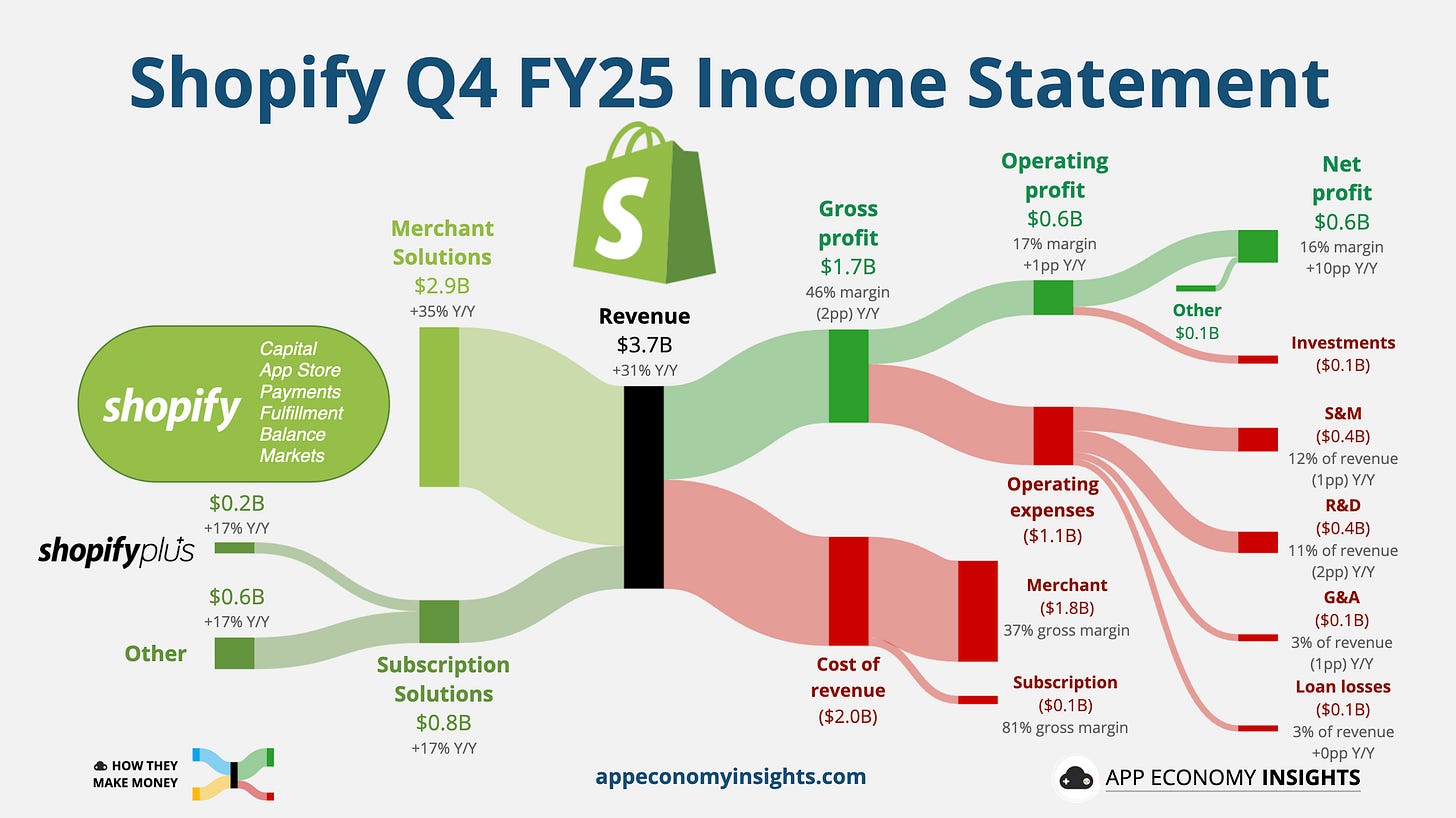

Shopify closed FY25 with a high-octane quarter that highlighted a deepening tug-of-war between growth and profitability.

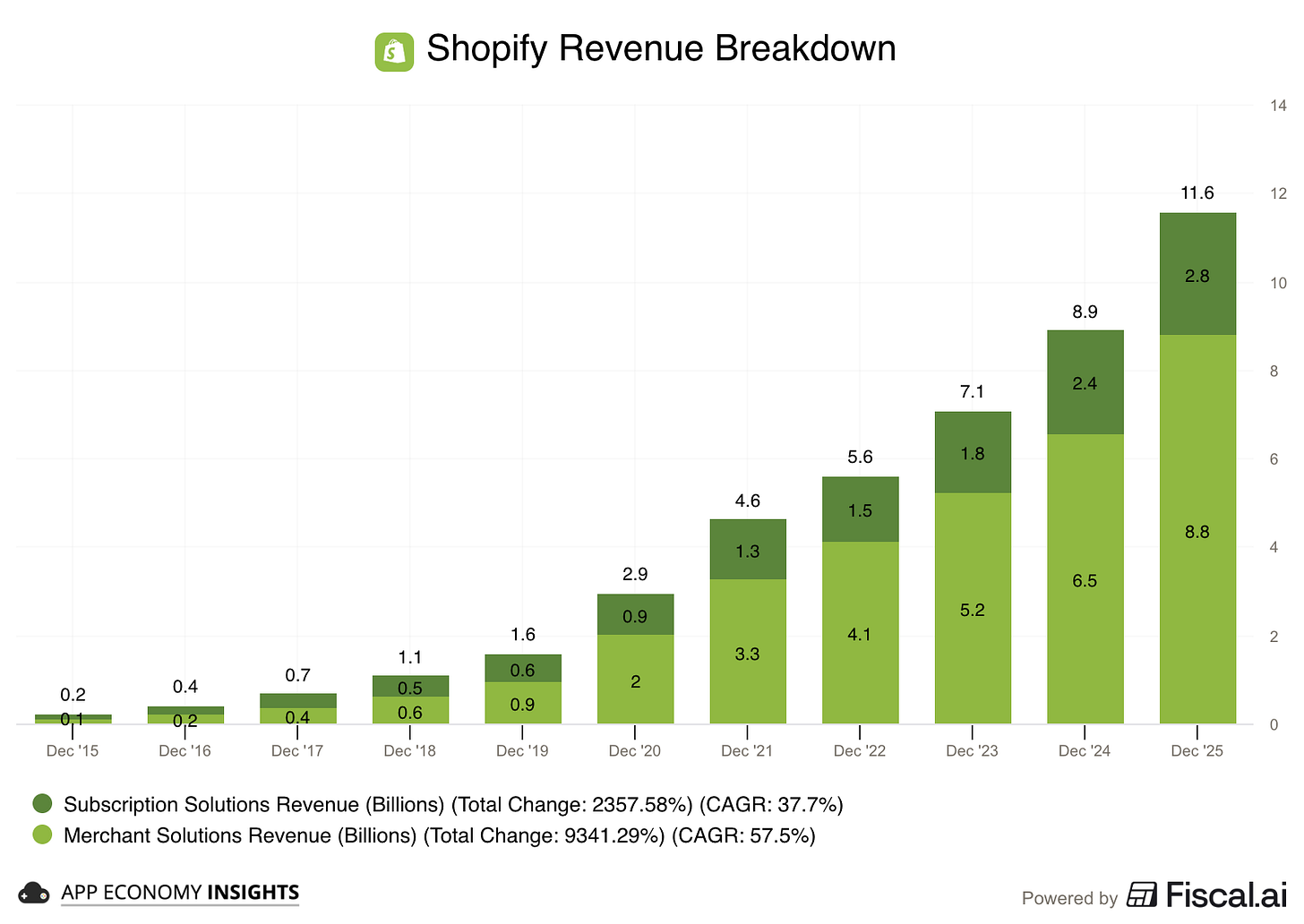

Q4 revenue surged 31% Y/Y to $3.7 billion ($80 million beat), and Gross Merchandise Volume (GMV) climbed 31% to $124 billion. For the full-year, revenue rose 30% Y/Y to $11.6 billion. This marked the highest annual revenue growth since the COVID boom of 2021.

The stock plunged despite the top-line beat and the authorization of a new $2 billion share buyback. The culprit was the bottom line. Adjusted EPS of $0.48 slightly missed the $0.51 consensus, and management guided for Q1 Free Cash Flow margins to dip into the “low-to-mid teens” (down from 19% in Q4) as they aggressively ramp up spending on AI. Sounds familiar?

The company is betting heavily on the Agentic Internet, launching the Universal Commerce Protocol (UCP) in collaboration with Google to allow AI agents to shop on behalf of consumers. While management argued that “no one is better positioned” for this shift, investors are punishing the immediate margin compression required to build this infrastructure.

On the bright side, the core business is firing on all cylinders. B2B GMV exploded 84% Y/Y, International revenue grew 36%, and the company guided for Q1 revenue growth in the “low-thirties”—significantly ahead of the 25% consensus.