📊 PRO: This Week in Visuals

LULU IOT RBRK HPE DOCU MDB NIO HQY ASAN

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🧘🏻 Lululemon: Tariff Troubles Mount

🌐 Samsara: Strength Meets Uncertainty

🔷 Rubrik: Riding the Resilience Wave

🖥️ HPE: Margin Pressures Remain

✍️ DocuSign: Lower Billings Outlook

🌱 MongoDB: Confidence Rebounds

⚡️ NIO: Restructuring in Motion

🏥 HealthEquity: Fraud Costs Fall

📝 Asana: AI Traction Grows

1. 🧘🏻 Lululemon: Tariff Troubles Mount

Lululemon’s Q1 revenue rose 7% Y/Y to $2.4 billion (in line), with EPS of $2.60 (beating by a penny) and gross margin expanding to 58%. International sales jumped 19%, led by 21% growth in mainland China, but US comps fell 2% as traffic softened. Same-store sales rose just 1%, missing expectations. Management touted strong product reception, including new lines like Daydrift and No Line Align. They maintained full-year revenue guidance of 5%–7% growth. But earnings guidance was cut to ~$14.68 (from $15.05), missing estimates.

Investors were spooked by soft US trends and rising cost pressure from new tariffs, driving shares down over 20%. Lululemon now assumes 30% duties on Chinese imports and 10% on others, posing a threat to margins. While the company plans modest price increases and supply chain efficiencies to offset the impact, these efforts are expected to bear fruit only in the second half. With US consumers increasingly cautious and growth slowing, the pressure is on. Still, Lululemon is betting on international momentum, new categories like running and tennis, and product innovation to carry its next phase.

2. 🌐 Samsara: Strength Meets Uncertainty

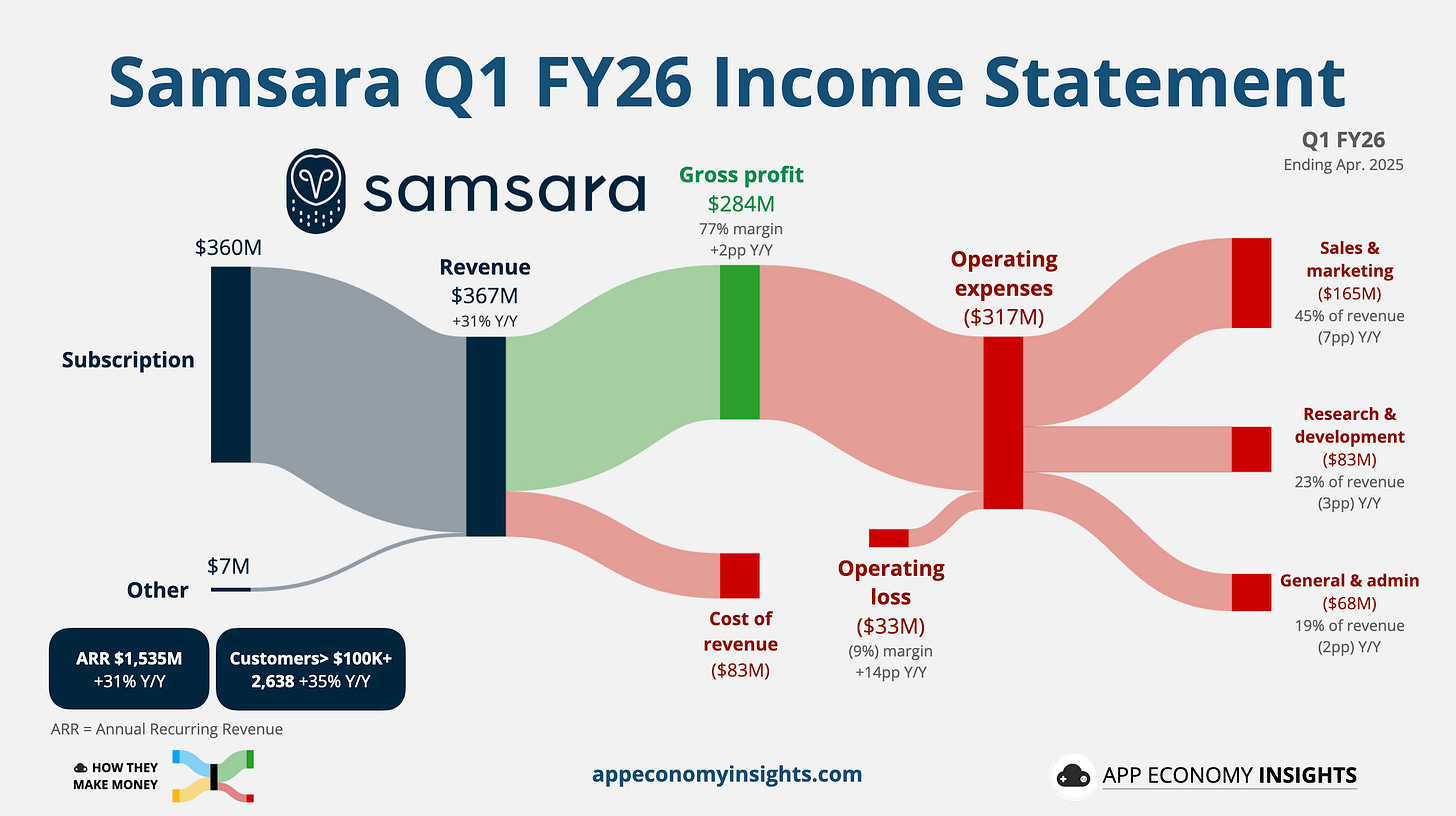

Samsara kicked off FY26 with a 31% Y/Y jump in revenue to $367 million ($15 million beat) and adjusted EPS of $0.11 (beating by $0.05). ARR reached $1.54 billion, up 31% Y/Y, with large customers ($100K+ ARR) rising 35% to 2,638. Gross margin reached a record 77%, and the operating loss margin improved to 9% (from 24% last year), indicating improving efficiency. AI-powered safety tools and major OEM integrations with Stellantis, Rivian, and Hyundai Translead reinforced Samsara’s strategy of embedding deeper into customer operations.

Despite the strong results and raised full-year revenue guidance to ~$1.55 billion, management cited “multimillion-dollar” headwinds from the dreaded “elongated sales cycles.” Tariff-sensitive sectors like transportation and construction were the main drivers. Samsara remains confident, leaning into AI, gamified safety features, and international momentum (with Europe hitting a record ACV contribution) to drive long-term growth.

3. 🔷 Rubrik: Riding the Resilience Wave

Rubrik kicked off FY26 with another standout quarter, reporting 49% Y/Y revenue growth to $278 million ($18 million beat) and a smaller-than-expected loss of $0.15 per share (beating by $0.17). Subscription revenue rose 54% to $267 million, driven by growing demand for cloud data protection and cyber recovery solutions.