🏈 Disney vs. YouTube TV

The battle for streaming’s front doors

Welcome to the Free edition of How They Make Money.

Over 250,000 subscribers turn to us for business and investment insights.

In case you missed it:

🏈 The plot thickens between Disney and YouTube TV

Disney’s channels (including ESPN, ABC, and FX) have gone dark on YouTube TV after new contract talks broke down. YouTube TV quickly countered with a $20 opt-in credit for subscribers, signaling Google believes it holds the stronger hand.

Two weeks in, Disney is reportedly losing roughly $4 million per day in affiliate fees, and Monday Night Football ratings are down ~21%. Disney is pushing its new ESPN Unlimited app and its Fubo partnership to regain leverage, but early signs suggest viewers may not follow.

A decade ago, Disney was the obvious favorite: live sports, beloved franchises, must-have content. Today, distribution is the gatekeeper — and YouTube TV’s 8+ million paid subscribers may not chase another app just to watch one network. The power has shifted quietly but decisively toward the platforms that control the doorway to live television.

That makes today’s negotiations and the wider battle around content aggregation and who ultimately controls the studios at Warner all the more important.

Today at a glance:

📈 Streaming subscriber trends

🏰 Disney: Entertainment Slips

🦚 Comcast: Broadband Bleed Slows

🎥 Warner: Studios & Streaming Shine

⛰️ Paramount: New Plan & $3 Billion Cuts

📺 Roku: Strong Guidance Spark Rally

FROM OUR PARTNERS

Ditch the 1–2% AUM bleed

Traditional advisors quietly skim $20,000–$100,000+ off your portfolio every year—forever.

Range doesn’t.

It’s the all-in-one wealth management platform built for $300K+ households, powered by zero AUM fees and one transparent flat rate.

No hidden cuts. No percentage games. Just relentless optimization.

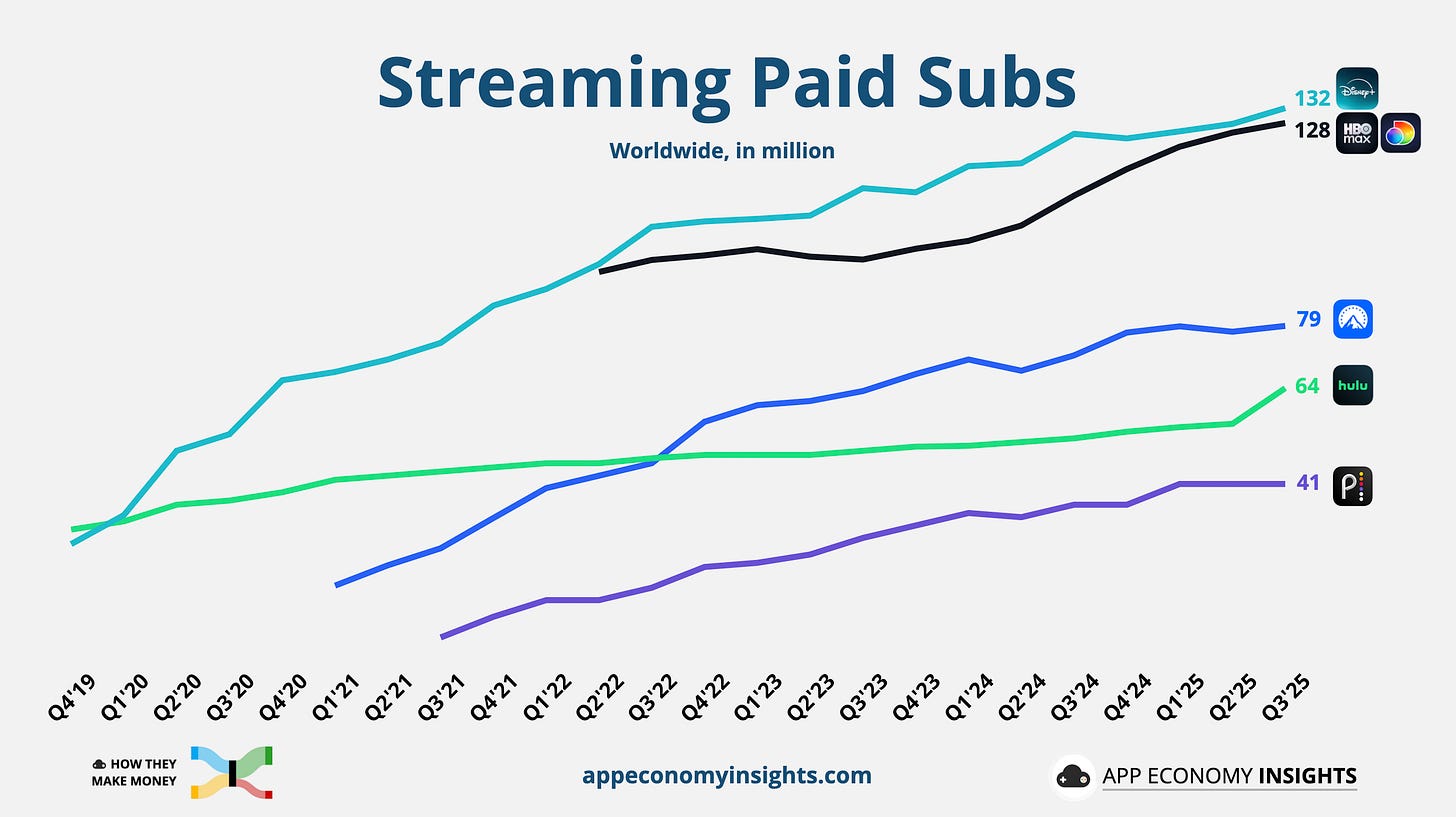

📈 Streaming subscriber trends

Remember, Netflix capped 2024 with 302 million members, but has stopped sharing membership numbers. That leaves us focusing on the best of the rest. Let’s zoom in on the streaming platforms still reporting their figures.

Of course, the outlier here is Hulu, jumping from 55 million to 64 million in the September quarter. It was almost entirely driven by distribution-led gains rather than organic standalone growth. Disney expanded its Charter bundle footprint during the quarter, pulling millions of households into Hulu’s subscriber count even if they never actively signed up for the service.

Because Disney reports Hulu subs on a “distribution-included” basis, these bundled households count the same as retail subscribers, inflating gross adds but pressuring ARPU (which declined this quarter). In other words, Hulu didn’t suddenly become a breakout growth engine. It grew because Disney pushed Hulu deeper into carrier bundles ahead of its pivot away from reporting subscriber numbers altogether, making this spike more of a structural reporting artifact than a demand signal.

Note: Platforms like YouTube Premium, Prime Video, and Apple TV+ don’t share subscriber numbers quarterly—if at all.

Now, let’s break down how the biggest players performed this quarter.

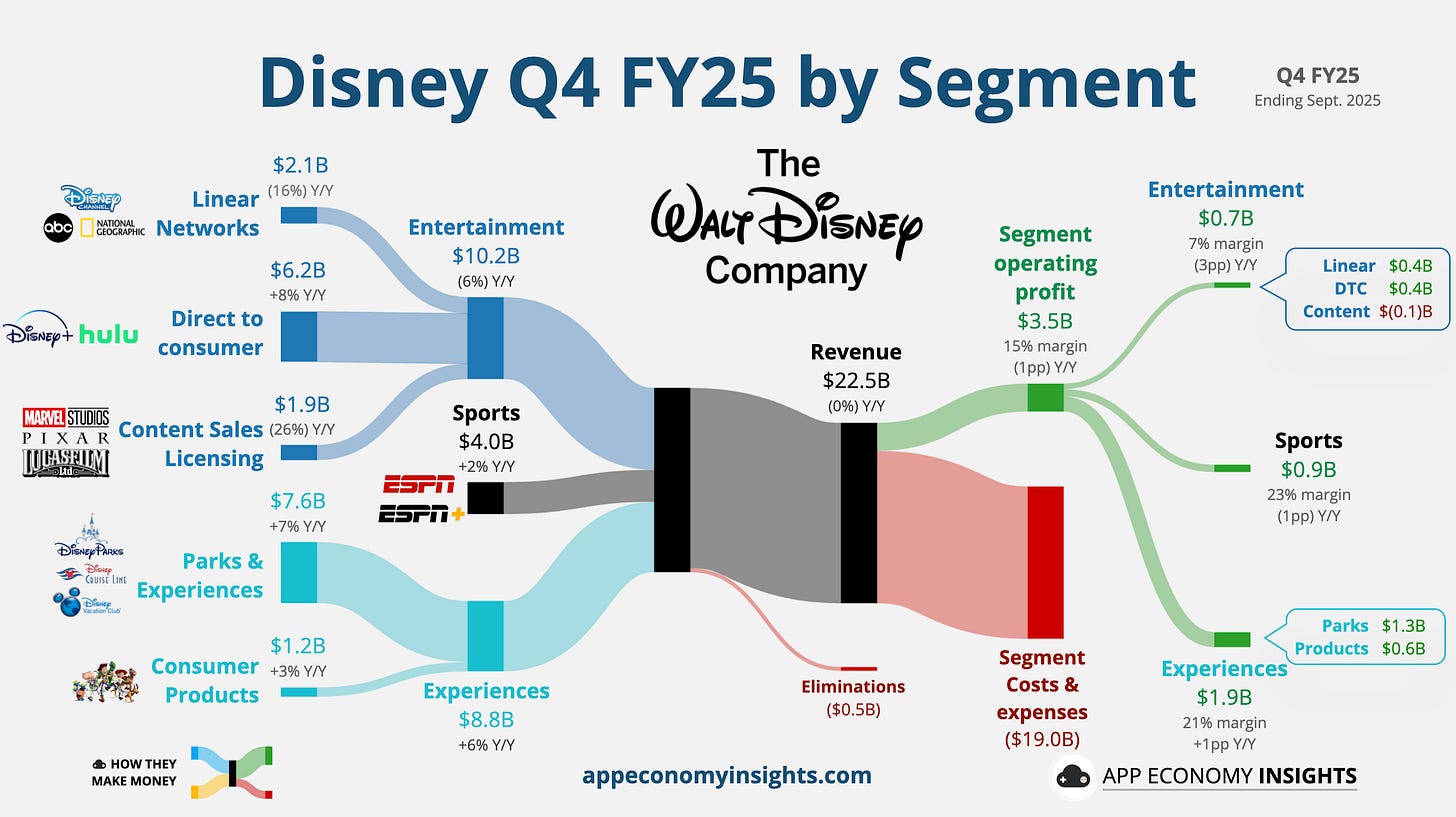

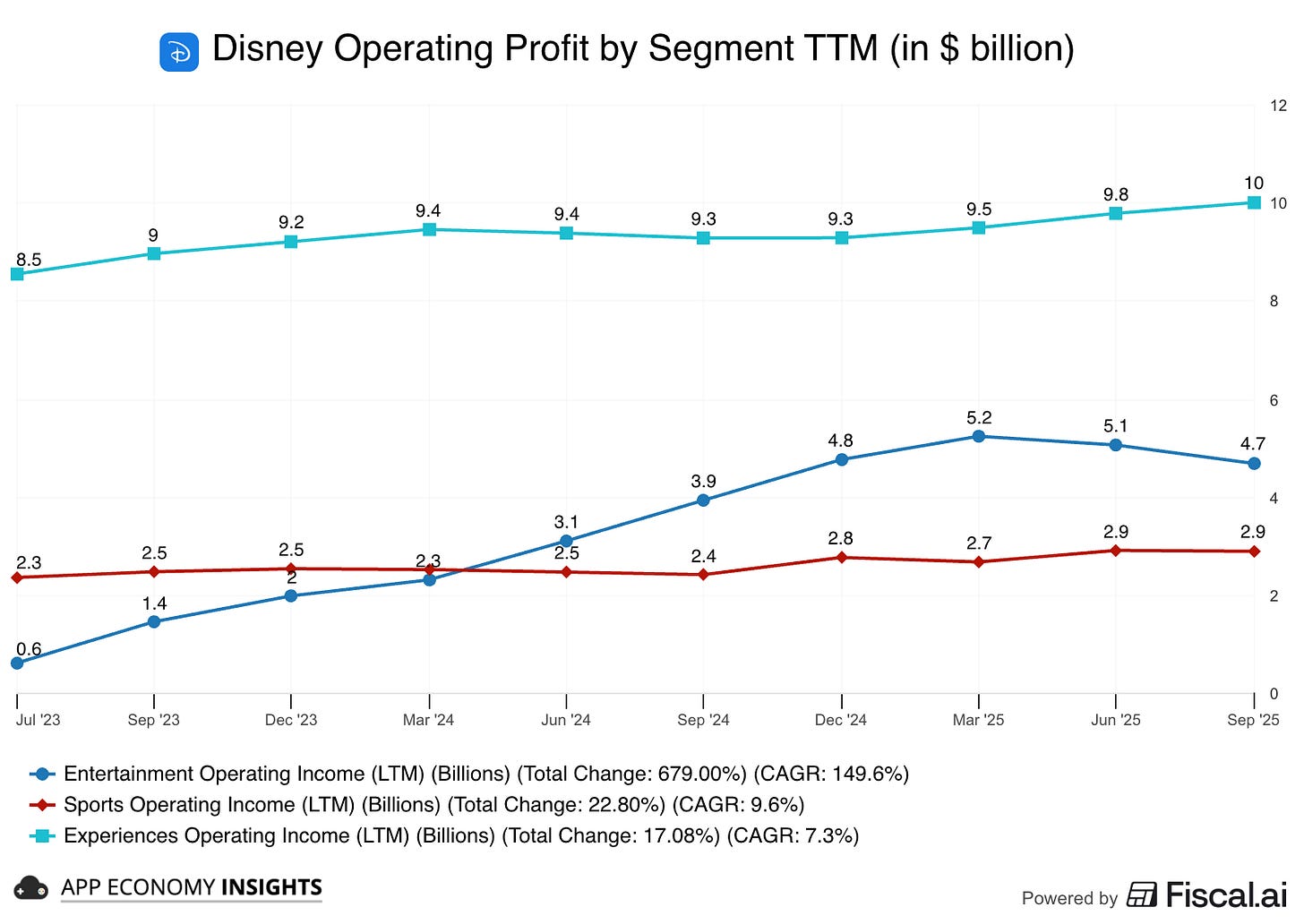

🏰 Disney: Entertainment Slips

Disney’s fiscal year ends in September, so it was Q4 FY25.

📈 Streaming stays profitable: Direct-to-consumer operating income rose 39% Y/Y to $352 million, marking a fifth straight profitable quarter. Disney+ added 4 million subscribers (reaching 132 million). Domestic ARPU was flat as higher ad revenue was offset by mix shifts, while international ARPU increased 4% on currency tailwinds.

📺 Linear remains a problem: Ongoing erosion and lower political advertising continued to weigh on Linear Networks’ profit. ESPN revenue rose 2%, but the YouTube TV blackout will hit the December quarter.

🍿 Content faces tough comps: Content Sales fell 26%, largely because last year included Inside Out 2 and Deadpool & Wolverine. Lilo & Stitch remained the highest-grossing Hollywood film of the year. Q1 FY26 will see a $400 million operating income hit from the theatrical timing of Zootopia 2 and Avatar: Fire and Ash.

🏰 Experiences are the profit and growth driver: Experiences revenue rose 6% to $8.8 billion, with operating income up 13% to $1.9 billion. Disneyland Paris and consumer products licensing stood out, helping offset softer China parks attendance. Cruise demand remained robust, with high utilization and bookings up 3% for the upcoming quarter. Q1 FY26 will face $150 million in pre-opening and dry-dock expenses tied to new ships — a temporary drag on margins.

🔮 Updated guidance: Management reiterated double-digit adjusted EPS growth for FY26 and FY27, with gains weighted toward the back half due to film marketing costs, political ad headwinds, and sports-rights timing. Disney plans to double share repurchases to $7 billion in FY26 and raised its annual dividend 50% to $1.50 per share. Free cash flow is expected to rise meaningfully as investment levels normalize and DTC profitability scales.

What to make of all this?

Disney’s DTC business is now a consistent profit engine, and parks and cruises continue to offset linear pressure. But the Entertainment segment remains challenged, with weaker film output and shrinking TV revenue. With a stronger FY26 slate (The Mandalorian, Toy Story 5, Moana, Avengers: Doomsday), the path forward hinges on stabilizing Entertainment while DTC and Experiences do the heavy lifting.

🦚 Comcast: Broadband Bleed Slows

📸 Big picture: Revenue fell 3% Y/Y to $31.2 billion ($0.5 billion beat), but this was entirely due to a tough comparison with last year’s Paris Olympics. Excluding the Olympics, revenue was up 3%. Adjusted EPS was flat at $1.12 ($0.02 beat), and free cash flow rose 45% Y/Y to $4.9 billion.

📉 Broadband losses improve: This was the main story. Comcast lost only 104,000 broadband customers in Q3, a major improvement from Q2’s 226,000 loss and far better than the ~140,000 analysts had feared. Pay-TV losses also slowed to 257,000 (the smallest loss in several years). Wireless was the star again, adding a new record of 414,000 lines, bringing its total to 8.9 million.

🦚 Peacock growth stalls: Peacock’s paid subscribers were flat sequentially at 41 million (missing estimates). Revenue was $1.4 billion (down Y/Y due to the Olympics comparison, but up excluding it). Adjusted EBITDA losses widened sequentially to $217 million (from $101 million in Q2 and worse than analysts expected), though this was still a large improvement versus the prior year’s $436 million loss.

🎥 Studio boosted by Dinos: Universal Studios revenue rose 6% to $3.0 billion, driven by the strong theatrical run of Jurassic World: Rebirth (which grossed nearly $900 million global box office) and higher content licensing. However, Studio’s EBITDA fell 22% to $365 million due to higher marketing and production costs for its upcoming slate.

🎢 Epic Universe still surging: Theme parks revenue continued its massive run, jumping 19% to $2.7 billion. EBITDA grew 13% to $958 million, fueled by the first full quarter of Epic Universe driving record attendance and per-capita spending.

📺 Versant spinoff & WBD rumors: Comcast confirmed its spinoff of cable channels (USA, CNBC, etc.) into Versant Media Group and will host an Investor Day on December 4, with the separation expected in “early 2026.” On the WBD rumors, co-CEO Mike Cavanagh said the “bar is very high” for M&A but confirmed they would “look at things,” specifically naming “streaming assets and studio assets” as complementary.

What to make of all this?

This quarter was a mixed bag. Broadband subscribers were better than feared, but this stabilization is coming at a high cost. Co-CEO Mike Cavanagh stated the competitive environment “will not change anytime soon” and that investments in pricing will cause more profitability pressure (and a 4% EBITDA decline) on the core connectivity unit in the coming quarters. The growth engines (Wireless/Parks) are on track, but Peacock’s stall is a soft spot. Maybe the NBA coming to Peacock will change that in Q4.

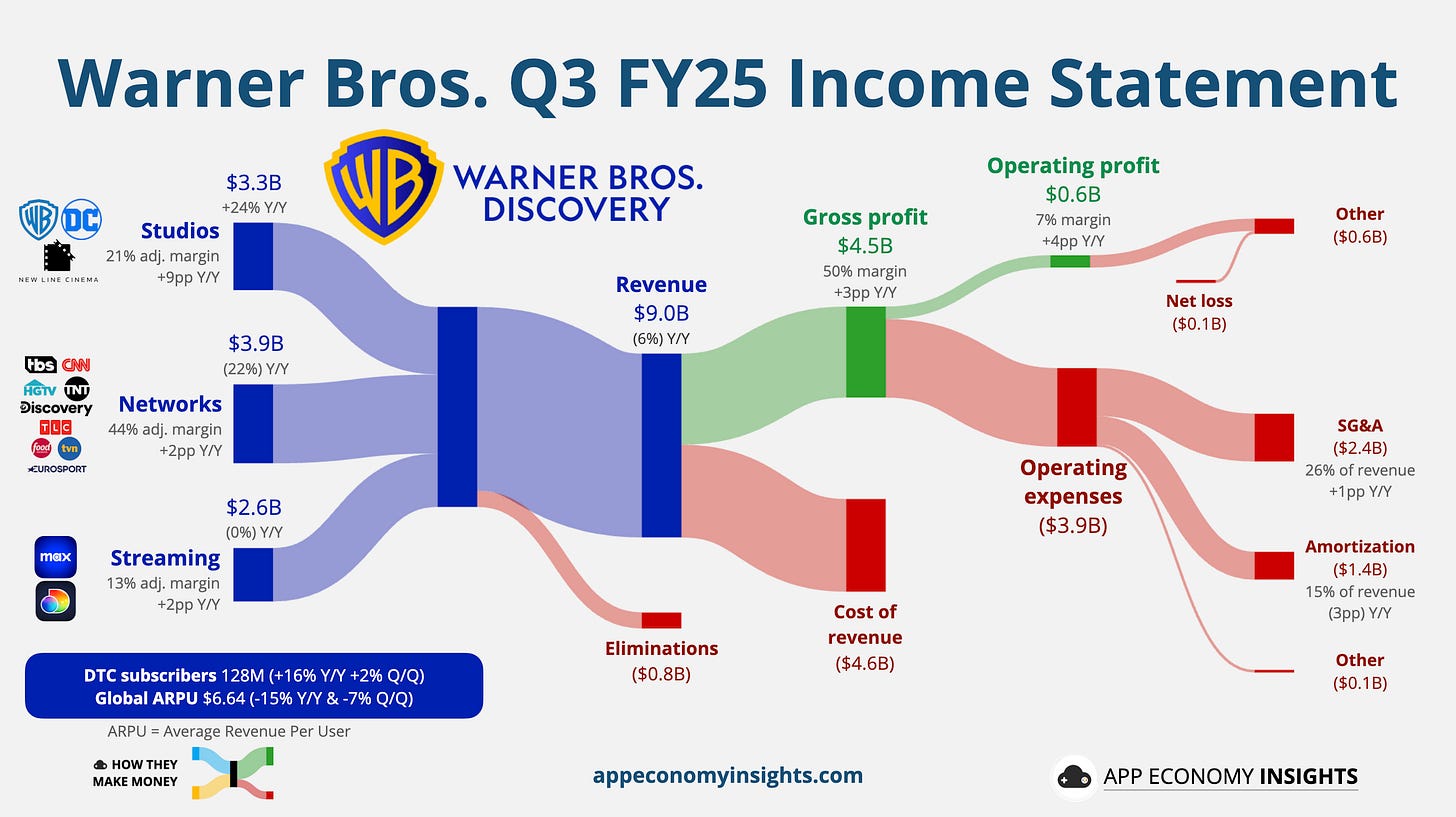

🎥 Warner Bros: Studios & Streaming Shine

🍿 Studios on a roll: Studios revenue soared 24% Y/Y to $3.3 billion ($0.2 billion beat), with adjusted EBITDA more than doubling to $695 million. The segment was powered by hits like Superman, Weapons, and The Conjuring: Last Rites, becoming the first studio to pass $4 billion in global box office for 2025 with only 11 films. Management now expects to “meaningfully exceed” prior guidance, targeting at least $3 billion in Studios EBITDA for 2025.

📺 Linear woes accelerate: Global Networks revenue plummeted 22% Y/Y to $3.9 billion, and EBITDA fell 20% to $1.7 billion. The steep drop was worsened by comparison to last year’s Olympics, but even excluding that, revenue fell 12%. The segment continues to be hit hard by cord-cutting (carriage fees -8%) and a weak ad market (ad sales -20%), with the loss of NBA rights expected to create further headwinds in Q4.

📈 Streaming profits grow, but ARPU dips again: The streaming segment added 2.3 million subscribers (below analyst projections, attributed to a quieter content quarter lacking hits like The White Lotus), reaching 128 million globally (on track for 150 million by 2026). Revenue was flat at $2.6 billion, but adjusted EBITDA grew 19% Y/Y to $345 million. Management remains confident in hitting $1.3 billion in streaming EBITDA for 2025. However, ARPU continues to slide, falling 16% globally to $6.64 due to international expansion and domestic carriage deal renewals. Management signaled that price hikes and a password-sharing crackdown are coming.

💵 Debt down, but net loss recorded: WBD reported total revenue of $9.0 billion ($0.2 billion miss), but its net loss of $148 million or 6 cents/share was ahead of low expectations ($0.01 beat). The loss included $1.3 billion in amortization and restructuring costs. The company paid down another $1.2 billion in debt, bringing gross debt to $34.5 billion and holding net leverage steady at 3.3x.

🪧 “For Sale” sign is up: The biggest news is a formal “strategic review” announced in October after WBD received “unsolicited interest.” CEO David Zaslav confirmed, “It’s fair to say we have an active process underway.” The board is now considering all options: 1) proceeding with the planned mid-2026 split, 2) selling the entire company, or 3) selling off pieces. Suitors reportedly include Comcast, Paramount, Netflix, and Amazon. Paramount has reportedly made three separate offers, all of which were rebuffed. Despite the sale talks, both Zaslav and the company Chairman have indicated they still prefer the planned split.

What to make of all this?

The “Warner Bros.” side (Studios & Streaming) is showing strong profit growth, proving the value of its IP and scale. The “Discovery Global” side (Linear) is declining as expected, but the ad slump is making it worse. The strategic review confirms that the market sees value in the assets (especially Studios), and the company is now officially “in play” even as it continues to execute its planned separation.

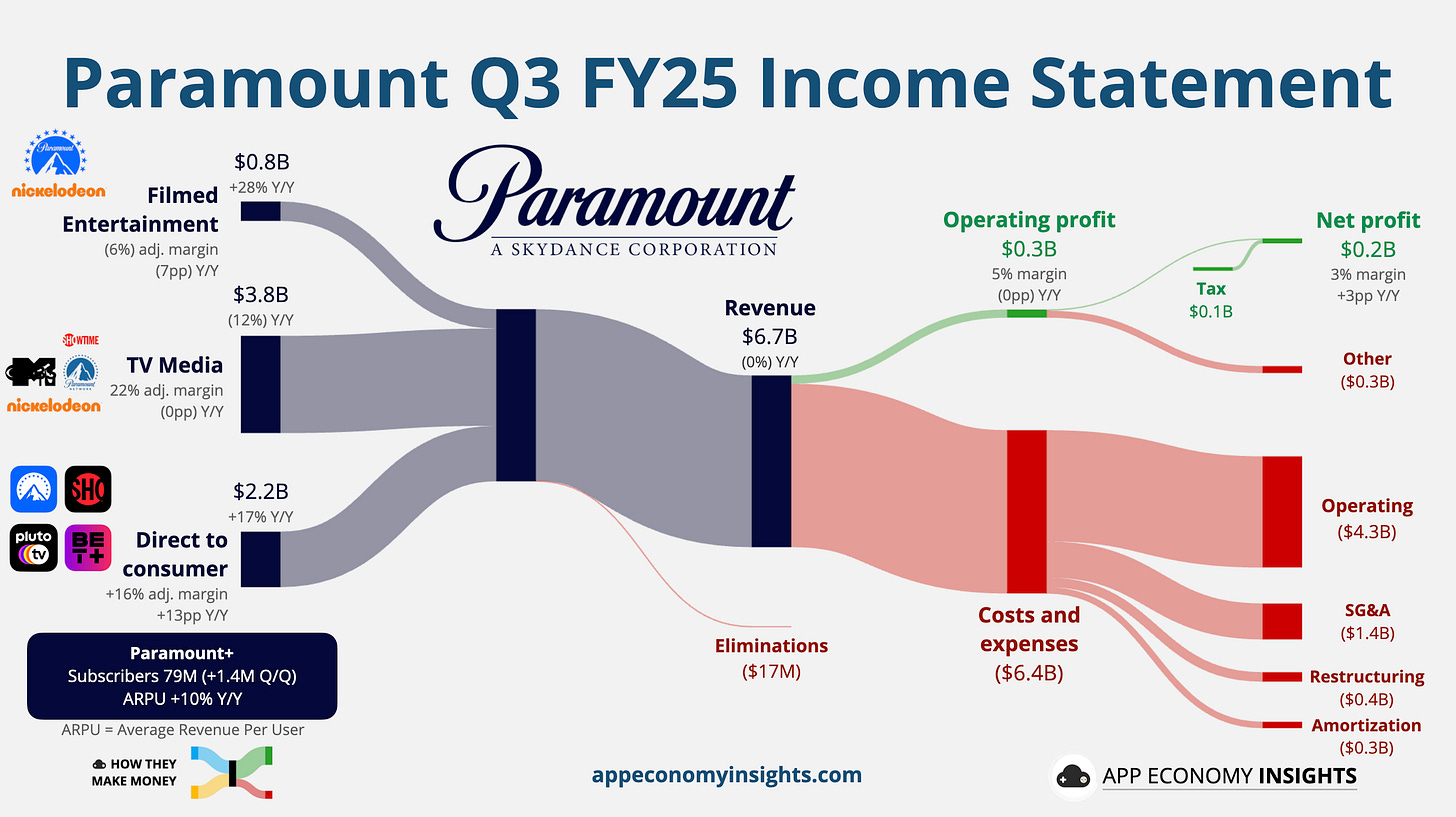

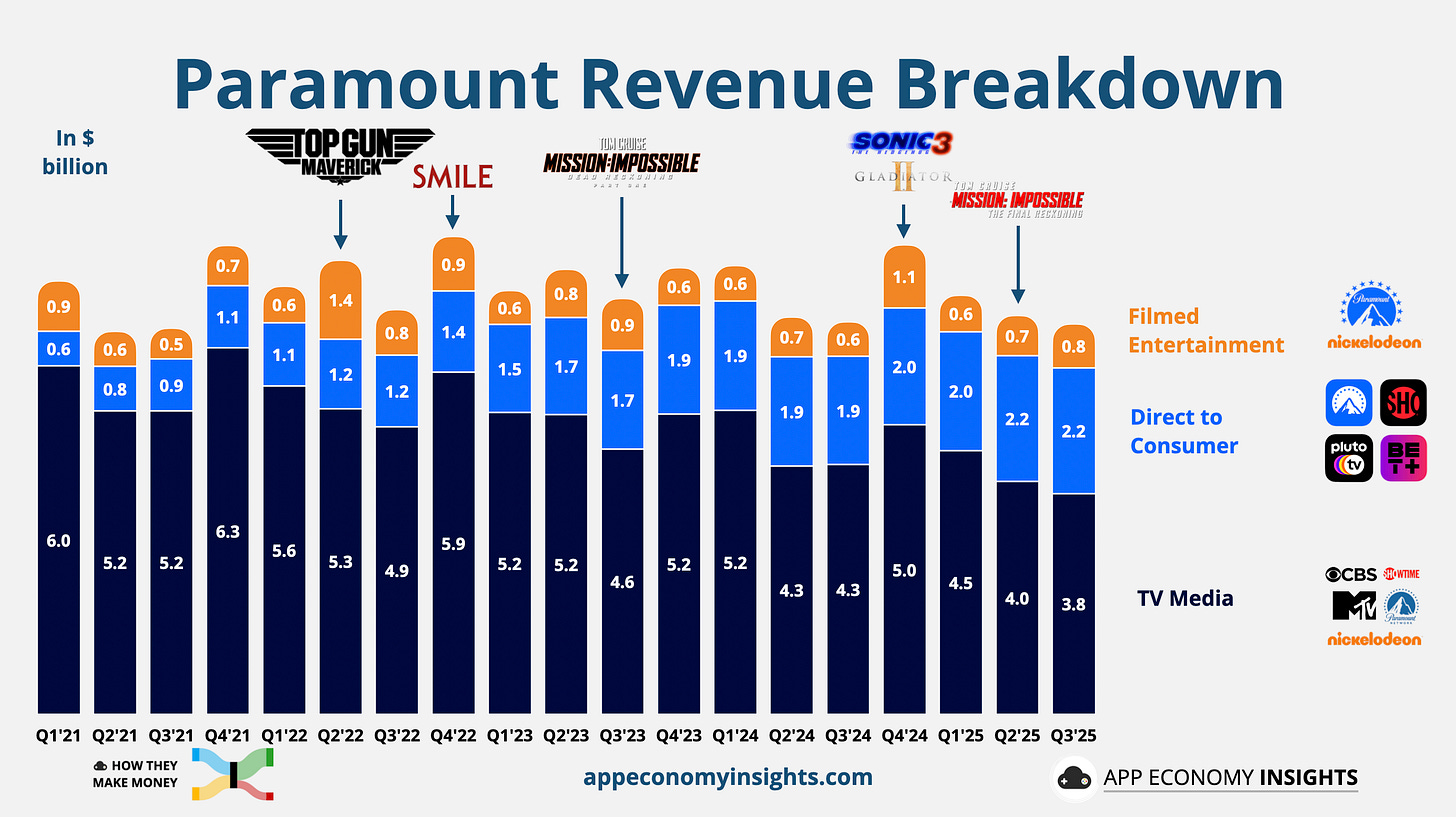

⛰️ Paramount: New Plan & $3 Billion Cuts

📸 Big picture: In its first report as Paramount Skydance, the new company missed Q3 Wall Street expectations. Revenue was flat at $6.7 billion ($0.3 billion miss), and adjusted loss was 12 cents per share (a huge $0.50 miss). However, the stock rallied as investors cheered the new CEO’s aggressive forward-looking plan, which included $30 billion revenue guidance for 2026 ($0.2 billion beat).

📉 TV Media sinks results: The traditional TV segment was the main drag, with revenue plummeting 12% Y/Y to $3.8 billion. Ad revenue fell 12% (blamed on lower political spending), and affiliate revenue fell 7% from cord-cutting. This segment is now the main target for cuts, including the divestiture of TV businesses in Argentina and Chile.

📈 Streaming is the bright spot: The Direct-to-Consumer (DTC) segment revenue grew 17% Y/Y to $2.2 billion, driven by a 24% jump in Paramount+ revenue. Paramount+ added 1.4 million subscribers (reaching 79.1 million total) and grew ARPU by 11%. Management guided for full-year 2025 DTC profitability and “profitability growth in 2026.”

🎬 Studio stumbles: The Filmed Entertainment segment swung to a loss of $49 million. Revenue grew 30% to $756 million, but this was attributed to consolidating Skydance’s licensing. The theatrical slate underperformed, with films like Smurfs and The Naked Gun cited as disappointments.

♟️ New Strategy: Cut, Spend, and Hunt: The new Skydance-led management team set a bold new course:

Cut: Increased the total cost-savings target from $2 to $3 billion. This includes an additional 1,600 job cuts (tied to asset sales) and ~600 voluntary severances from a new 5-day return-to-office policy.

Spend: Plans to increase content investment by an incremental $1.5 billion in 2026 to “rebuild” the film slate (targeting 15+ movies/year) and bolster streaming.

Talent: Ellison is aggressively re-stacking the creative roster, signing deals with the UFC ($7.7 billion over 7 years), the creators of Stranger Things, and director James Mangold. He also acquired The Free Press for $150 million, installing Bari Weiss as editor-in-chief of CBS News. However, this new direction comes with friction, as Yellowstone creator Taylor Sheridan is reportedly leaving for NBCUniversal.

Hunt: While reportedly submitting three rejected bids for WBD, David Ellison downplayed M&A as a necessity, stating, “there are no must-haves for us. We really look at this as ‘buy versus build’ [...] we absolutely have the ability to build.”

Streamline: Announced plans to unify the tech backend for Paramount+, Pluto TV, and BET+ by mid-2026, and announced another price hike for Paramount+ effective January 2026.

What to make of all this?

This was a messy “kitchen sink” quarter where the (bad) Q3 results were completely overshadowed by the (bold) 2026 plan. Investors cheered the new strategy, sending the stock soaring. Ellison’s plan is now clear: aggressively cut from the declining linear business and plow that money (and more) into “building” the growth engines (UFC and a rebuilt studio). The talent shakeup shows a definitive break from the past.

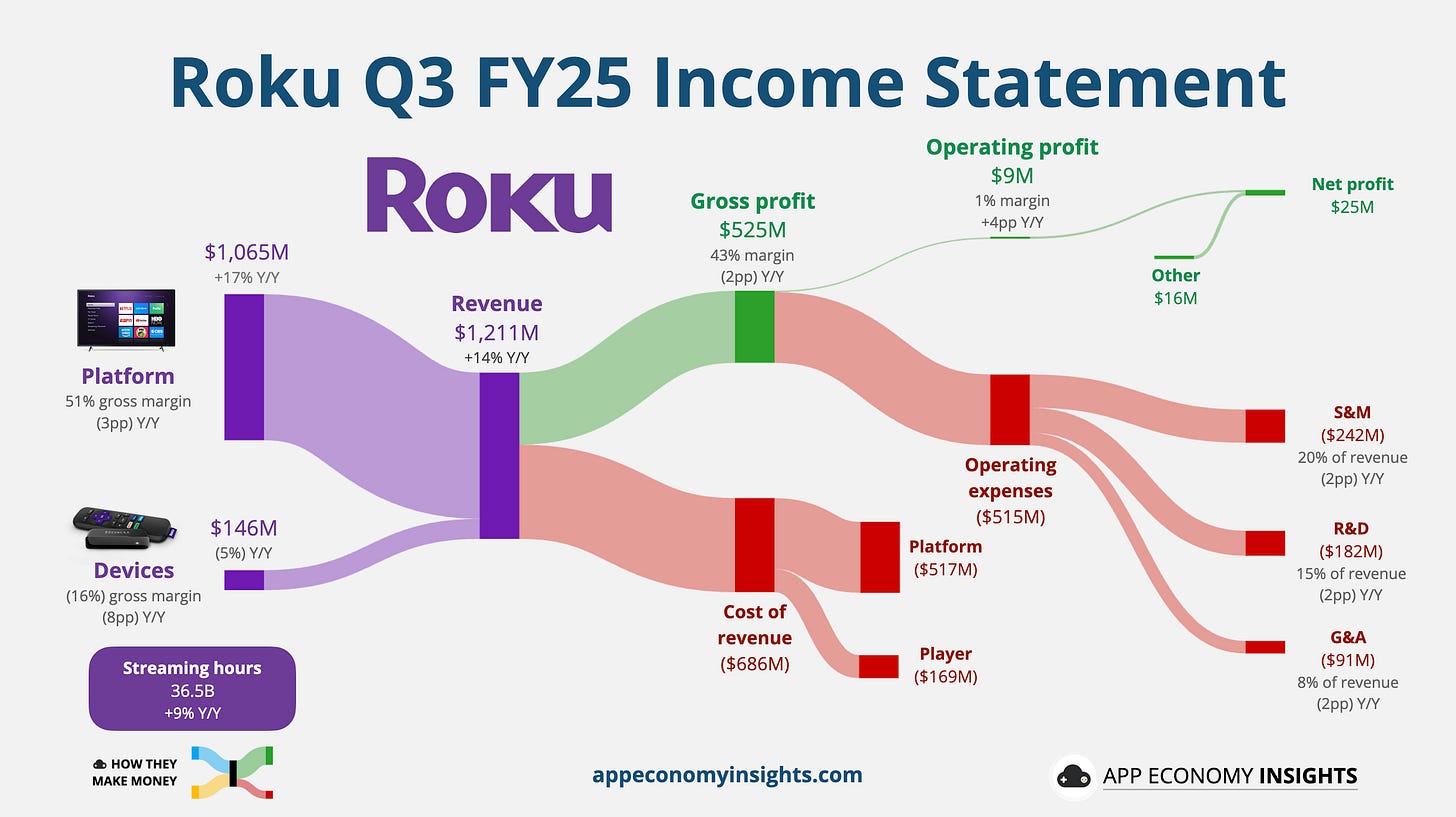

📺 Roku: Strong Guidance Spark Rally

📸 Big picture: Roku reported a massive Q3 earnings beat and strong guidance, causing the stock to rally. Total revenue grew 14% Y/Y to $1.21 billion (in line with estimates), but the company posted a surprise profit of $0.16 per share ($0.07 beat). Roku also achieved its first positive operating income since 2021, generating $25 million in net income (from last year’s $9 million loss).

📈 Platform shines: The high-margin Platform segment continues to drive the business. Revenue grew 17% Y/Y to $1.1 billion, driven by strength in video advertising and streaming service subscriptions. Management noted strong momentum from its self-serve ad platform (Roku Ads Manager) and the new integration with Amazon’s DSP.

📉 Hardware is still a loss-leader: The Devices segment revenue fell 5% Y/Y to $146 million. As expected, the hardware continues to be sold at a loss to grow the user base, posting a negative 16% gross margin ($23 million loss).

📊 Key metrics miss: Roku’s total Active Accounts hit “roughly 90 million.” However, streaming hours of 36.5 billion (+9% Y/Y) came in just below analyst estimates of ~37 billion. Notably, Roku has stopped reporting ARPU (Average Revenue Per User) as it focuses on total profit, following in Netflix’s footsteps.

🔮 Guidance & strategy: The biggest news was the strong forecast. Roku raised its full-year 2025 outlook, lifting revenue guidance to $4.69 billion($40 million raise) and massively increasing its full-year net income target to $50 million (up from a prior $20 million estimate).

What to make of all this?

The unexpected rise in the full-year profit forecast lifted investors’ spirits. Roku is proving its pivot to profitability is working faster than expected, and the market rewarded this new operating leverage, overshadowing the minor engagement miss.

📊 Stay tuned for 15 companies visualized tomorrow in our PRO coverage!

Tencent, Sony, Nu, CoreWeave, Instacart, and more.

That’s it for today!

Stay healthy and invest on!

Want to sponsor this newsletter? Get in touch here.

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Start an account for free and save 15% on paid plans with this link.

Disclosure: I own AAPL, AMZN, GOOG, NFLX, and ROKU in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.