📊 This Week in Visuals

Because spreadsheets are boring

Welcome to another special Saturday edition of How They Make Money.

Over 100,000 subscribers turn to us for business and investment insights.

In case you missed it:

A picture is worth a thousand words, especially for earnings reports.

Let's visualize the performance of 10 companies that reported their earnings this week. It’s an early sneak peek of the full report that will be released later this month.

Today at a glance:

🛒 Walmart: Advertising Taiwinds

📦 Alibaba: Transformation Phase

🎮 Sony: PS5 Slowdown

🐧 Tencent: Ad Sales Shine

📱 Take-Two: GTA VI Set For Fall 2025

🌐 Cisco: Splunk Boost

☁️ Dynatrace: New Buyback

🌊 Sea Limited: Shopee Rebounds

🔬 Applied Materials: Muted Outlook

🚚 JD.com: Low-Cost Pays Off

1. 🛒 Walmart: Advertising Tailwinds

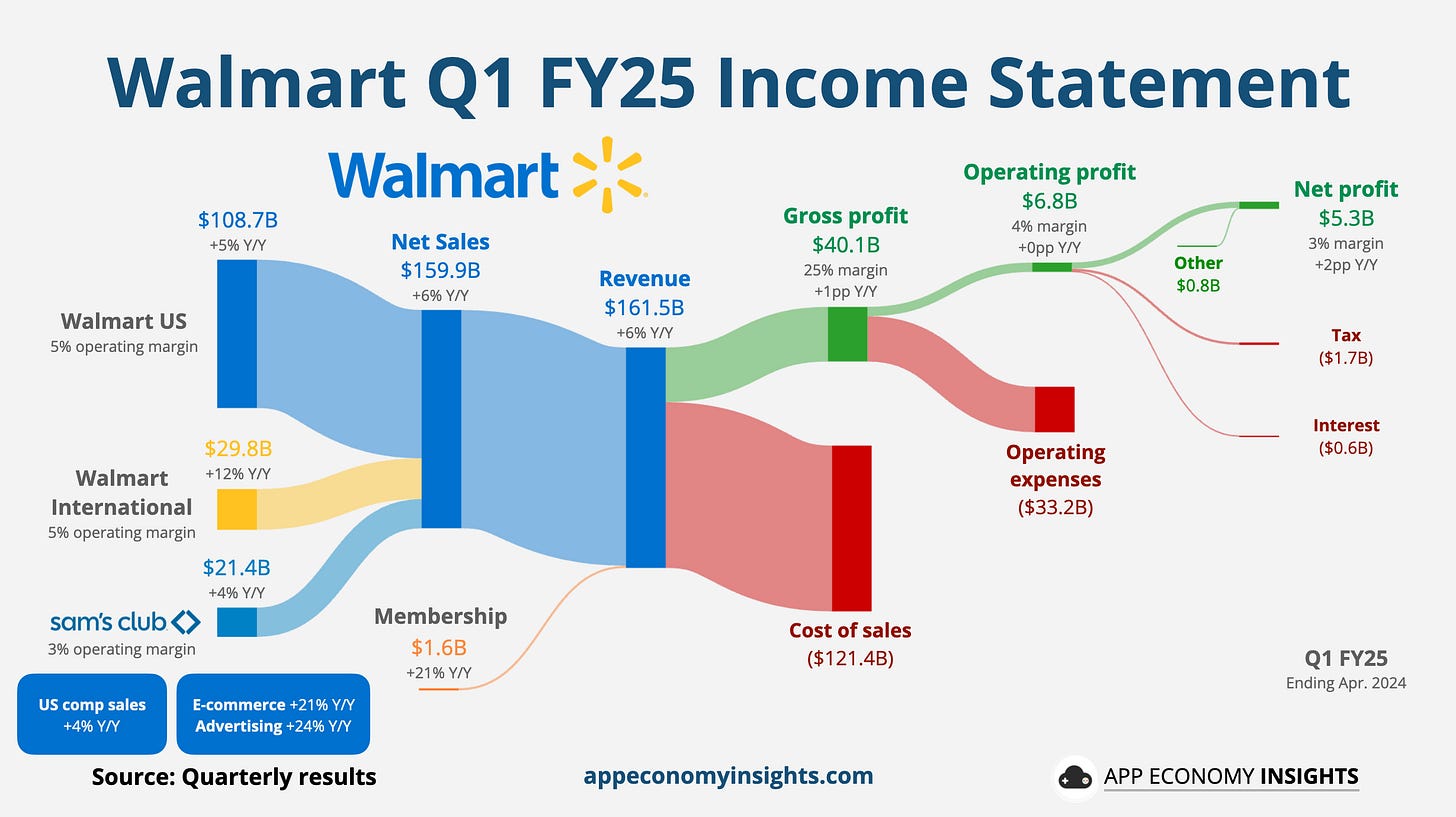

Walmart reported better-than-expected results for its Q1 FY25 (ending in April). The company said it could reach the high end of its previous full-year forecast (3% to 4% year-over-year growth).

Increased online visits by wealthier shoppers helped e-commerce grow 21% year-over-year. Walmart's focus on discounts and competitive pricing has resonated with shoppers across income levels.

The company's strategic investments in advertising (growing 24% year-over-year) and Walmart+ membership boosted the gross margin.

2. 📦 Alibaba: Transformation Phase

Alibaba experienced an 86% plunge in profit in Q4 FY24 (ending in March), primarily due to unrealized losses from equity investments. It’s best to focus on operating profit to gauge the business performance.

Revenue grew 7% year-over-year to 222 billion yuan ($30.7 billion), driven by its focus on low-cost goods. It was an acceleration from 5% in Q3 FY24.

The international digital commerce segment delivered a strong 45% growth, exceeding expectations.

Alibaba's cloud division experienced a modest 3% year-on-year revenue growth, but the company highlighted triple-digit growth in AI-related revenue.

The company plans to upgrade its secondary listing in Hong Kong to a primary listing by August.