🔎 Google: "A Positive Moment"

Cloud and YouTube deliver and new AI-Search tests look promising

Welcome to the Premium edition of How They Make Money.

Over 100,000 subscribers turn to us for business and investment insights.

In case you missed it:

Alphabet (GOOG) surged 11% after reporting its Q1 FY24 last week.

The stock hit a new all-time high and crossed a $2 trillion valuation.

CEO Sundar Pichai explained:

“We view this moment as a positive moment for Search.”

Like Microsoft and IBM before it, Alphabet is undergoing a business model shift. While the company must adapt culturally, its core advantage lies in its scale and infrastructure, which are critical to delivering on its new AI ambitions.

Most skeptics focus on the AI disruption to Search. Paradoxically, innovations in the user experience during the shift from desktop to mobile in 2015 opened new opportunities in Seach and became a boon for Google.

Last week, Pichai addressed some of the current objections:

🏷️ Cost: “We are very, very confident. We can manage the cost of how to serve these queries.”

🐌 Latency: “When I look at the progress we have made in latency and efficiency, we feel comfortable.”

💵 Monetization: “Based on our testing so far, I am comfortable and confident that we'll be able to manage the monetization transition.”

So, what spurred the surge post-earnings, and what should you watch out for?

Let’s visualize the insights.

Today at a glance:

Alphabet Q1 FY24.

Cloud & YouTube insights.

Key quotes from the earnings call.

What to watch looking forward.

1. Alphabet Q1 FY24

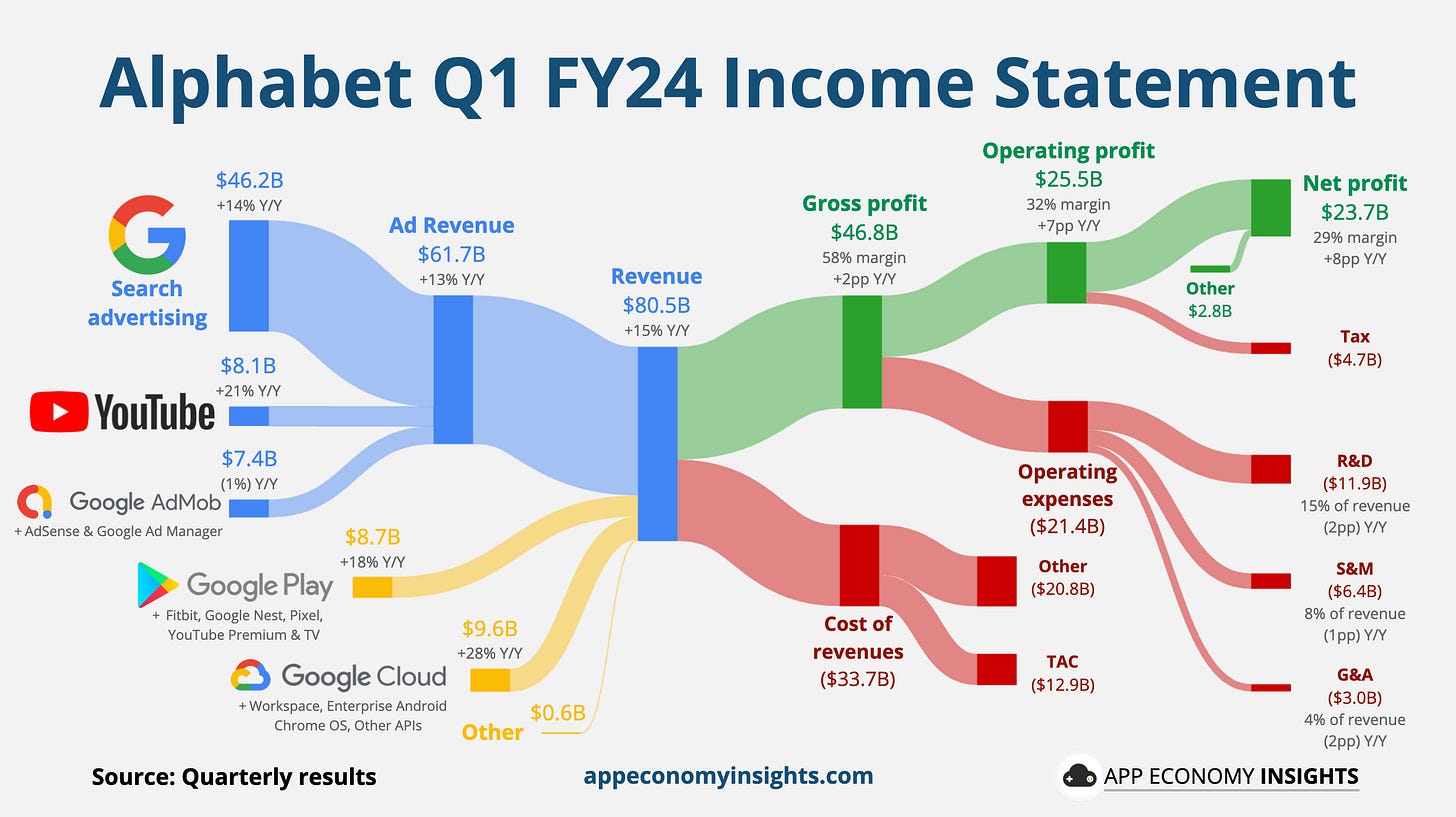

Income statement:

Revenue by segment (growth Y/Y):

🔎 Advertising: $61.7 billion (+13%).

Search: $46.2 billion (+14%).

YouTube ads: $8.1 billion (+21%).

Network: $7.4 billion (-1%).

📱 Subscription, platforms, and devices: $8.7 billion (+18%).

☁️ Cloud: $9.6 billion (+28%, accelerating from +26% Y/Y in Q4).

Main highlights: