🎬 Streaming Wars Visualized

Unpacking the latest quarter and subscriber trends

Welcome to the Friday edition of How They Make Money.

Over 100,000 subscribers turn to us for business and investment insights.

In case you missed it:

The plot thickens: The streaming wars just got a whole lot messier! Mergers, breakups, surprise hits, and major flops – this quarter's earnings reveal an industry in chaos. Let's unpack the drama and see who's winning (and losing) big.

While everyone else flails, Netflix sits back with a bucket of popcorn. The OG streamer has a plan, and it might involve buying up the leftovers.

CEO Ted Sarandos once said:

“The goal is to become HBO faster than HBO can become us.”

Today at a glance:

Trends and Market Share.

Disney: A Mixed Bag.

Comcast: A Tale of Two Stories.

Warner: Return to Middle Earth.

Paramount: New Leadership and Bids.

Roku: Distribution Advantage.

For a glossary on SVOD, AVOD, OTT, DTC, and more, revisit our Industry Showdown article for an extensive market overview.

1. Trends and Market Share

The chart below shows the current paid subscriber trends in the past four years. Some only started sharing their membership numbers recently. YouTube Premium, Amazon Prime Video, or Apple TV+ don’t share their numbers quarterly.

As a reminder, Disney will merge its Indian assets with Reliance in 2025. So, Disney+ Hotstar is excluded from the Disney+ subscribers below.

The shift from linear TV to streaming has been a high tide lifting all boats. According to Nielsen, streaming accounted for 38.5% of US TV Time in March 2024, representing a 4.5 percentage point increase year-over-year.

As explained previously, the rise of streaming comes at the expense of linear television.

▶️ YouTube dominates the living room: It makes up nearly a quarter of US TV streaming time (excluding YouTube TV). Alphabet’s management has made clear connected TVs are a critical initiative.

🥇 Netflix remains the ‘gold standard:’ Among SVOD in March, Netflix's US market share was more than Hulu, Prime Video, and Disney+ combined.

📺 The platform advantage: Distribution is increasingly crucial. The Roku Channel accounted for 1.3% of US TV Time in March (as much as Peacock), thanks to its 82 million active accounts on their TV OS—Walmart's recent acquisition of VIZIO for $2.3 billion shows they are paying attention.

📉 Churn, baby, churn: Switching between services has become a national sport. Netflix dominates the industry because of its industry-low churn rate. According to Antenna, industry growth slowed down to just 10% year-over-year in 2023, caused by serial churners.

2. Disney: A Mixed Bag

Disney ends its fiscal year in September, so it was Disney’s Q2 FY24.

🍿 Streaming is (finally) profitable: Disney+ and Hulu turned a $47 million profit, a significant improvement from last year's $587 million loss.

📺 Linear TV takes a hit: Revenue of the legacy segment dropped 8%, and profits went down 22% due to fewer ads and cable subscribers.

🏈 ESPN’s DTC transition is coming: A drop in cable subscribers caused Sports profit to decline 9%. Disney will launch a flagship ESPN streaming service next year on top of a skinny sports bundle with Fox and TNT.

🦸🏻 Content & Licensing dropped: There was no significant theatrical release. The company will reduce Marvel content to two TV shows and three movies per year to focus on quality

🏰 The Magic Kingdom remains strong: Parks brought in $1.9 billion in profit, up 13% from last year. Impressive, though slightly below Wall Street's expectations.

What to make of all this?

Disney remains in a major transition. They're pushing hard with streaming while their traditional TV networks slowly decline. It's a bumpy ride, but parks have been resilient.

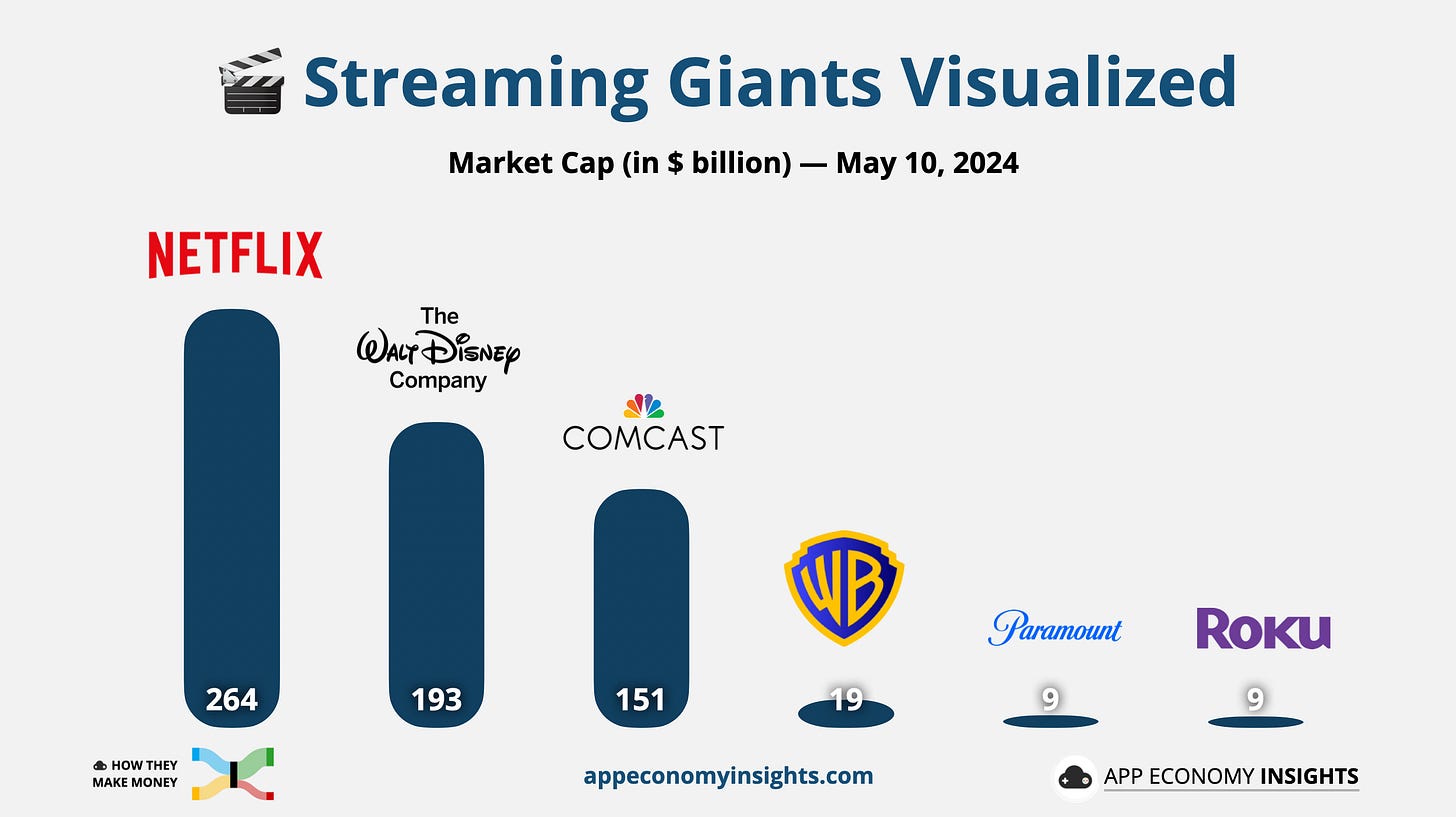

Let’s visualize other key players: Comcast, Warner, Paramount and Roku.