🚖 Tesla: Robotaxi Delay

Shareholders will have to be patient (again)

Welcome to the Premium edition of How They Make Money.

Over 130,000 subscribers turn to us for business and investment insights.

In case you missed it:

📉 Tesla missed earnings expectations for the fourth consecutive quarter.

Growth in the automotive segment stalled due to price cuts and increased competition. Investors anxiously awaited updates on future products and autonomy.

Elon Musk pushed the Robotaxi announcement from August 8 to October 10.

From the shareholder letter:

"Though timing of Robotaxi deployment depends on technological advancement and regulatory approval, we are working vigorously on this opportunity given the outsized potential value.”

TSLA shareholders are used to waiting longer than expected for new releases. In the meantime, attention turns to cost reduction and generating sufficient cash flow to invest in future growth.

There was a lot to unpack in the quarter, and we're here to walk you through it with visuals and data-driven insights.

Today at a glance:

Tesla Q2 FY24.

Robotaxi delay and FSD.

Key quotes from the earnings call.

Optimus and competition from BYD.

1. Tesla Q2 FY24

Tesla's revenue comes from three primary sources:

🚗 Automotive: Revenue from selling electric vehicles, including models S, 3, X, and Y (78% of revenue).

🔌 Services and Other: Revenue from vehicle service, Supercharger network, and sales of automotive parts and accessories (12% of revenue).

🌞 Energy Generation and Storage: Revenue from solar products and energy storage solutions, like Solar Roof and Powerwall (10% of revenue).

Q2 FY24 Key metrics:

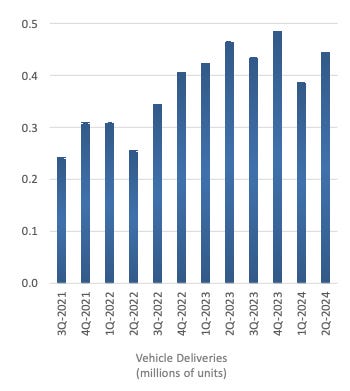

Production: 411K vehicles (-14% Y/Y and -5% Q/Q).

Deliveries: 444K vehicles (-5% Y/Y and +15% Q/Q).

Analysts expected roughly 439K deliveries, making it a slight beat.

Income statement:

Revenue grew 2% Y/Y to $25.5 billion ($0.8 billion beat).

The average price per vehicle continued to decline alongside the deliveries, leading to a 7% year-over-year decline in automotive revenue.

Gross margin was 18% (+1pp Q/Q, flat Y/Y).

Operating margin was 6% (+1pp Q/Q, -3pp Y/Y).

EPS (non-GAAP) was $0.52 ($0.10 miss).

Gross margin trends: