📊 PRO: This Week in Visuals

TSM, ASML, UNH, JNJ, NVS, AXP, ISRG, BLK, UAL, DPZ

Welcome to the Saturday PRO edition of How They Make Money.

Over 130,000 subscribers turn to us for business and investment insights.

In case you missed it:

Our new PRO coverage includes timely updates on the big earnings of the past week.

📧 Free subscribers get our Friday articles and sneak peeks.

💌 Premium subscribers get:

Tuesday articles.

Access to our archive.

Monthly reports with 200+ companies covered.

💼 PRO subscribers get all of the above, plus our Saturday timely coverage.

Today at a glance:

⚙️ TSMC: AI-Driven Outlook

🔬 ASML: Strong Bookings Overshadowed

💼 UnitedHealth: Cyberattack Headwinds

💊 Johnson & Johnson: Pharma Strength

🧬 Novartis: Upgraded Outlook

💳 American Express: Affluent Spending

🦾 Intuitive Surgical: Robotic Precision

📈 Blackrock: Riding the Market Rally

🛩️ United Airlines: Fare Wars

🍕 Domino’s Pizza: International Headwinds

1. ⚙️ TSMC: AI-Driven Outlook

Taiwan Semiconductor Manufacturing (TSM) exceeded Q2 expectations, driven by surging AI demand. High Performance Computing (HPC) grew 28% sequentially and now represents 52% of its net revenue, compared to 44% a year ago. This AI-fueled growth propelled the company's revenue to $20.8 billion, a 40% increase in constant currency, with EPS of $1.48 ($0.06 ahead of consensus).

TSMC's cutting-edge 3nm technology was 15% of overall revenue (up from 9% in Q1), underscoring the growing demand for advanced chips. Despite geopolitical tensions and concerns raised by former President Trump's comments on Taiwan, the company reaffirmed its commitment to global expansion to meet escalating demand for AI and high-end smartphone chips. China represented 16% of TSMC's Q2 revenue, an uptick from 9% in Q1, showcasing the region's increasing impact and associated risks.

TSMC raised its 2024 revenue growth forecast from 'low to mid-20%' to 'slightly above mid-20 %' and narrowed its capital expenditure range to $30-32 billion. CEO C.C. Wei emphasized the growing demand for AI-related chips, stating that all customers want to incorporate AI functionality into their devices.

2. 🔬 ASML: Strong Bookings Overshadowed

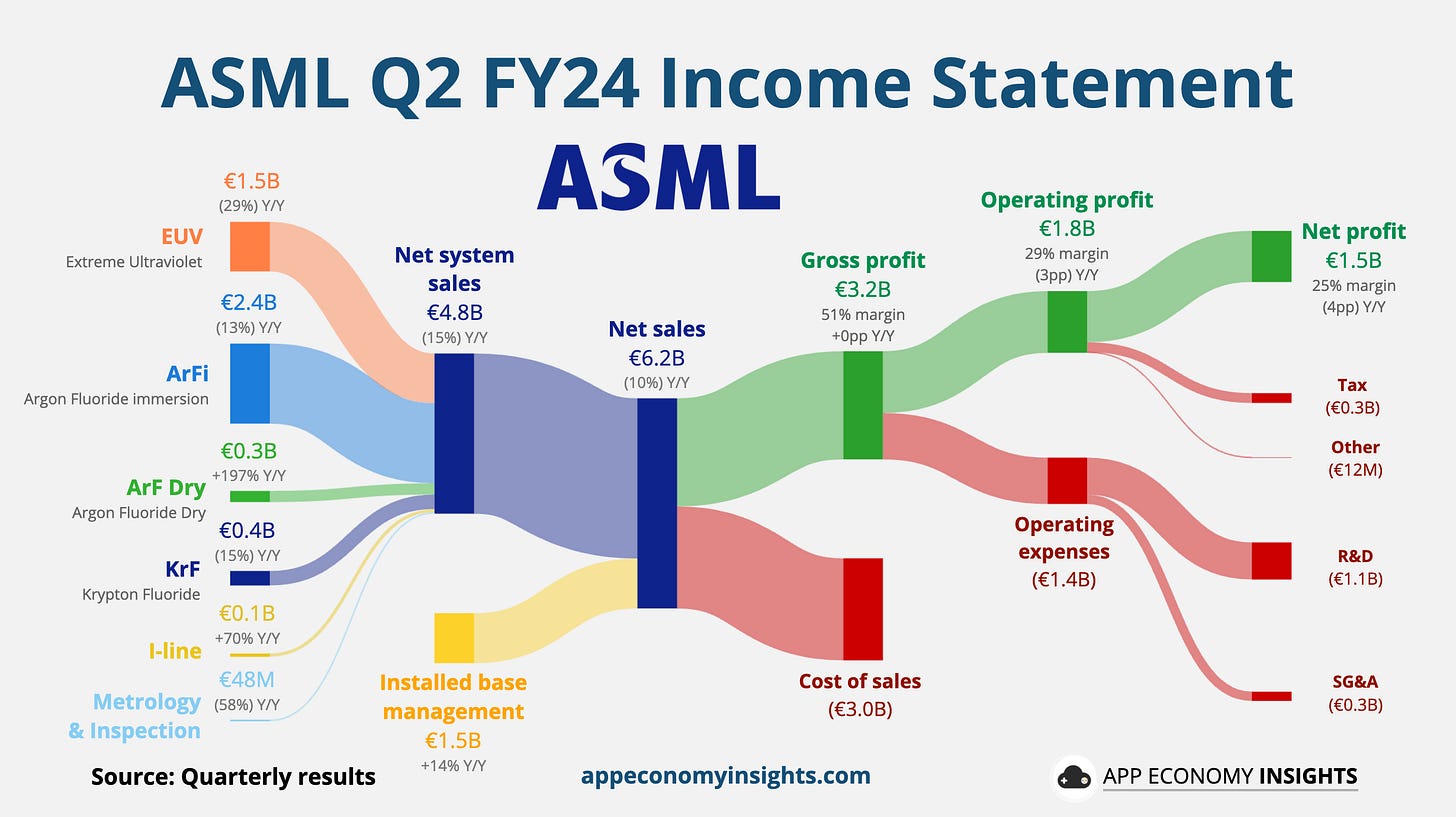

ASML (ASML) reported €5.6 billion in net bookings, a 24% year-over-year increase. It was driven by surging demand for its EUV lithography machines (€2.5 billion), which are crucial for manufacturing advanced chips. Bookings are a leading indicator of net sales growth.

Despite beating Q2 estimates and seeing a significant increase in EUV bookings, ASML's Q3 revenue forecast fell short of expectations. The company expects industry recovery to continue in the second half of the year, driven primarily by strong developments in AI. FY24 guidance remained unchanged (flat revenue year-over-year). Management calls FY24 a “transition year” before returning to growth in FY25.

However, the company's stock fell on fears of tighter US export restrictions to China, which accounted for nearly half of ASML's total net system sales in Q2. The potential impact of stricter export controls is a crucial concern for investors. ASML's future growth prospects are closely tied to its ability to maintain access to the Chinese market.