🏈 Sports Betting Economics

Who's winning in this booming sector?

Welcome to the Premium edition of How They Make Money.

Over 150,000 subscribers turn to us for business and investment insights.

In case you missed it:

🏈 Americans wagered a record $120 billion1 on sports in 2023. 👀

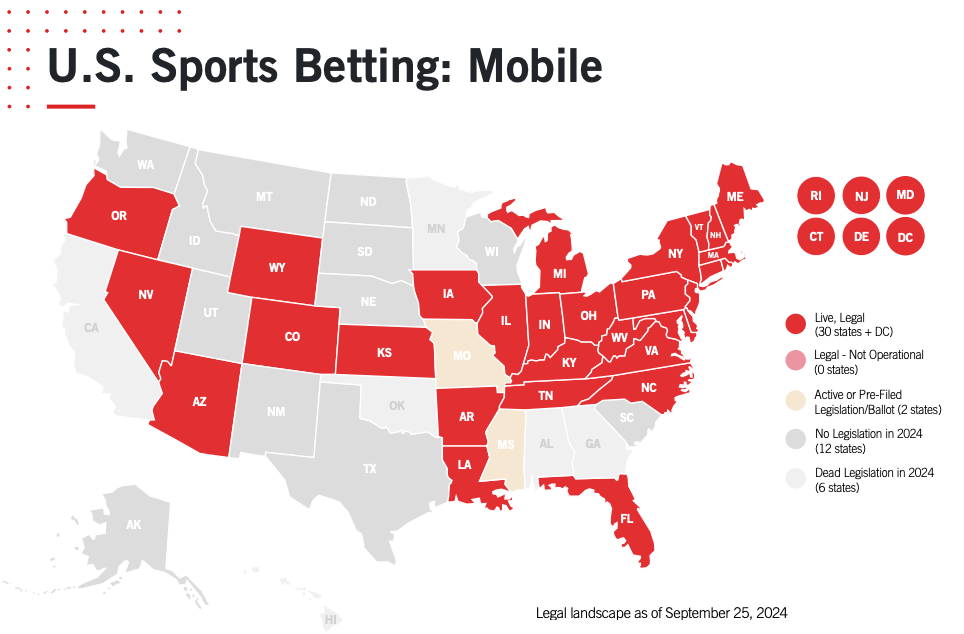

Gone are the days of smoky backrooms and whispered wagers. Today, it's a digital, data-driven industry fueled by the flood of cash unleashed by the legalization of online sports betting in an increasing number of states.

But who's really cashing in on this betting bonanza? And what are the hidden risks and challenges lurking beneath the surface of this booming industry?

Let’s break down the economics behind the biggest names in sports betting and visualize their performance, revealing the secrets behind their success.

Today at a glance:

Flutter.

DraftKings.

Entain (+BetMGM).

Penn Entertainment.

What to watch looking forward.

1. Flutter Entertainment

Flutter wasn't built overnight. It's the result of strategic mergers and acquisitions, culminating in the online gambling powerhouse we see today.

Born from the merger of Paddy Power and Betfair in 2016, Flutter further solidified its position by acquiring The Stars Group (including PokerStars and Sky Bet) in 2020.

Crucially, in 2018, they made a strategic move into the burgeoning US market by acquiring a controlling stake in FanDuel, later increasing their ownership to 95% at a valuation of $11 billion in 2020. This strategic expansion has allowed Flutter to assemble a formidable portfolio of brands, catering to diverse gambling preferences across the globe.

Today, Flutter is dominating the sports betting game with this expansive portfolio. They counted 14.3 million players in Q2 FY24, up 17% year-over-year.

FanDuel is the star of the show in the US. Flutter's not a one-trick pony, though. They have a strong presence in the UK, Ireland, and Australia, thanks to brands like Sky Bet and Sportsbet.

The numbers tell the story:

FanDuel is the growth engine: It was behind the $1.5 billion revenue in the US in Q2 FY24, surging up 38% year-over-year.

Sports betting is where the money's at: Over 58% of Flutter’s revenue comes from Sportsbook, while the rest primarily comes from iGaming (online casino-style games).

High gross margin profile: The cost of sales is the direct cost of running the business. This includes gaming taxes, fees, platform costs, payments to partners, and salaries for the people keeping things running. With a focus on digital, the business delivers an enviable 49% gross margin.

Growth comes at a cost: Running a global gambling operation comes with other costs impacting the bottom line. Over 20% of revenue goes toward sales & marketing, with many promotional offers to acquire new users (paid media, event-driven, affiliate programs).

Flutter's savvy moves, like snapping up FanDuel, have put them in the driver's seat. As the sports betting world keeps evolving, a diverse portfolio across categories and geographies makes Flutter a force to be reckoned with.

Now, let’s look at DraftKings, Entain (+BetMGM), and Penn (ESPN BET).